Alkane Resources has received a key regulatory approval in Sweden for its proposed merger of equals with Mandalay Resources.

Alkane confirmed that Sweden’s Inspectorate of Strategic Products had approved the deal under the Swedish Foreign Direct Investment (FDI) Act.

The proposed merger, announced in April, will see Alkane acquire all issued and outstanding shares of Mandalay under a court-approved plan of arrangement under British Columbia law. Mandalay shareholders will receive 7.875 Alkane shares for each Mandalay share held.

Once complete, the merged entity will become an emerging mid-tier gold and antimony producer valued at around $1 billion.

Former Mandalay shareholders will own approximately 55 per cent of the company and Alkane shareholders will hold the balance on an undiluted basis.

“The transaction will take Alkane to a new level, bringing together two companies with complementary assets and a shared vision for growth,” Alkane managing director Nic Earner said in April.

“The combination of assets, leadership, and supportive long-term shareholders enhances our scale and financial strength and positions us well to continue to pursue additional growth opportunities.”

The proposed merger has been unanimously approved by the Alkane and Mandalay boards, with directors from both companies recommending that shareholders vote in favour of the transaction.

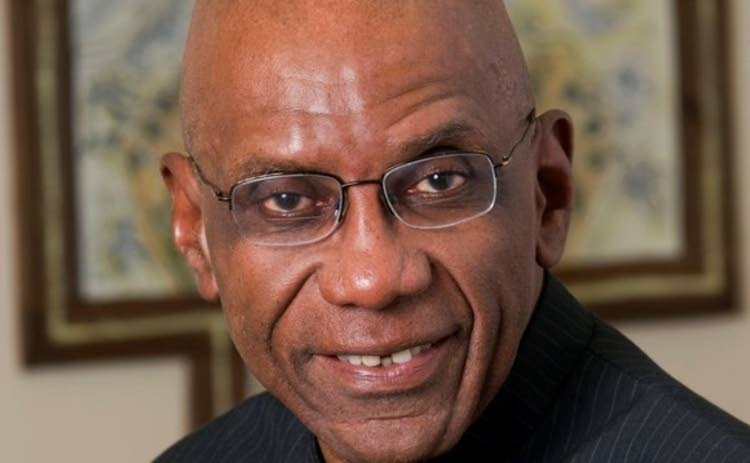

“The transaction presents a compelling opportunity for Mandalay shareholders to accelerate value creation through increased capital markets scale, liquidity and a growing diversified asset base,” Mandalay president and chief executive officer Frazer Bourchier said in April.

“We are excited to have found a like-minded partner committed to the same principles. The transaction aligns with our vision to create a mid-tier gold and antimony producer with mines in premier operating jurisdictions and with our strategy for continued growth.”

Once the transaction is completed, the merged entity will operate as ‘Alkane Resources’ on the ASX and the Toronto Stock Exchange exchange, the latter of which Mandalay is currently trading.

The transaction still requires approval from the British Columbian Supreme Court, the Foreign Investment Review Board of Australia and shareholders from both companies.

Subscribe to Australian Mining and receive the latest news on product announcements, industry developments, commodities and more.