Article content

ENDEAVOUR ANNOUNCES INDEPENDENT NON-EXECUTIVE

DIRECTOR NOMINATION

Written by John Smith on . Posted in Canada. Leave a Comment

Trusted News Since 1995

A service for global professionals

·

Monday, April 22, 2024

·

705,539,601

Articles

·

3+ Million Readers

Written by Sergio Pani on . Posted in Canada. Leave a Comment

Trusted News Since 1995

A service for global professionals

·

Monday, April 22, 2024

·

705,554,507

Articles

·

3+ Million Readers

Written by GlobeNewswire on . Posted in Canada. Leave a Comment

The content in this section is supplied by GlobeNewswire for the purposes of distributing press releases on behalf of its clients. Postmedia has not reviewed the content.

Author of the article:

GlobeNewswire

Published Apr 22, 2024 • 3 minute read

ENDEAVOUR ANNOUNCES INDEPENDENT NON-EXECUTIVE

DIRECTOR NOMINATION

Article content

London, 22 April 2024 – Endeavour Mining plc (LSE:EDV, TSX:EDV, OTCQX:EDVMF) (“Endeavour” or the “Company”) is pleased to announce that the Board has nominated John Munro as an Independent Non-Executive Director of the Company. His appointment will be voted on by shareholders at the Annual General Meeting (“AGM”) to be held on 30 May 2024. If elected at the AGM, John Munro will chair the Technical, Health and Safety Committee of the Board and join the Remuneration Committee.

Advertisement 2

Story continues below

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

or

Article content

Srinivasan Venkatakrishnan, Chair of the Board, said: “I am delighted to welcome John Munro to the Endeavour Board. He brings considerable mining, operational and project development experience in Africa, as well as strategy and mining finance expertise globally. We look forward to welcoming him as a valuable addition to the Board, where he will continue to help Endeavour reinforce its operational excellence, as the business continues to grow.”

Tertius Zongo, an Independent Non-Executive Director has notified the Board that he will not seek re-election as a Director of the Company at the forthcoming AGM, in order to focus on his personal interests. He has been an important member of the Semafo and Endeavour Boards for the past 12 years. He will continue to assist the Company as a consultant on West African matters.

Srinivasan Venkatakrishnan, Chair of the Board, said: “On behalf of the Board, I would like to thank Tertius for his significant contribution to the business over the years and we wish him well and every success for the future. I am pleased that we can continue to benefit from his wisdom and experience in his new role.”

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

John Munro brings over 30 years of experience in mining, having held a number of senior executive roles in the industry, leading mining operations and businesses in Africa and around the world, in a range of commodities. He holds a BSc Chemical Engineering from the University of Cape Town and a postgraduate Advanced Management Programme qualification from Harvard Business School.

There is no additional information requiring disclosure under LR 9.6.13 of the Listing Rules of the Financial Conduct Authority in relation to the appointment of John Munro.

CONTACT INFORMATION

| Jack Garman Vice President, Investor Relations +442030112723 jackgarman@endeavourmining.com |

Brunswick Group LLP in London Carole Cable, Partner +442074045959 ccable@brunswickgroup.com |

ABOUT ENDEAVOUR MINING PLC

Endeavour Mining is one of the world’s senior gold producers and the largest in West Africa, with operating assets across Senegal, Cote d’Ivoire and Burkina Faso and a strong portfolio of advanced development projects and exploration assets in the highly prospective Birimian Greenstone Belt across West Africa.

Advertisement 4

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

A member of the World Gold Council, Endeavour is committed to the principles of responsible mining and delivering sustainable value to its employees, stakeholders and the communities where it operates. Endeavour is admitted to listing and to trading on the London Stock Exchange and the Toronto Stock Exchange, under the symbol EDV.

For more information, please visit www.endeavourmining.com.

ABOUT JOHN MUNRO

John Munro has over 30 years’ experience in the international mining industry, with the last 20 years in senior executive roles, leading mining operations and businesses in Africa and around the world, in a range of commodities. In the early 2000s John was an executive of Gold Fields Limited, variously leading that company’s international operations, project development and strategy. In 2008 he was appointed CEO of Rand Uranium, a uranium and gold start up. Thereafter, John moved to London working initially in First Reserve Corporation’s mining acquisitions team before joining Cupric Canyon Capital in 2014. John held various executive roles at Cupric, including 2 years as CEO, leading the financing and development of that company, culminating in the sale to MMG Limited in 2024.

John was previously a non-executive director of Nordgold SE and is currently a non-executive director of Manuli Hydraulics, a private company.

Attachment

Article content

Share this article in your social network

This Week in Flyers

Written by TSX Stocks on . Posted in Canada. Leave a Comment

Kurmuk Gold Mining Plc says its operations in the gold-rich Benishangul-Gumuz Regional State are being hindered by regional authorities, whom it accuses of refusing the company access to mining sites.

“[The company] will be forced to close its exploration camp and send all its employees home until a solution to these problems is achieved,” reads a letter from Kurmuk Gold Mining (KGM) to the Ministry of Mines on February 27, 2024.

The firm holds three gold exploration licenses in Benishangul, located near the border with Sudan.

Kurmuk was formerly under ASCOM, an Egyptian mining company, before it was re-established as KGM following the political changes of 2018. It was awarded a license to look for gold in Dul Ashashire that year, while the Mestefinfine and Abestelo exploration licenses were issued in 2021.

“Local authorities have denied access to the Dul Ashashire exploration area. KGM has repeatedly requested a support letter from Kurmuk Woreda to access the Dul exploration target for core drilling but the requests have not been accepted,” reads the letter to the Ministry. “KGM is not currently conducting any exploration under this license.”

– Advertisement –

The firm goes on to accuse the Benishangul-Gumuz Water, Mine, and Energy Resource Development Bureau of refusing to endorse the exploration licenses granted to it by the Ministry

“KGM could not get access to the exploration license areas,” reads the letter signed by Brox Work, general manager at the firm. “Due to the problems created by regional authorities, it is impossible to implement the approved work program under the three exploration licenses as planned.”

Brox responded to inquiries from The Reporter by saying the problems are “currently being resolved” but declined to comment further. Officials from Benishangul-Gumuz declined requests for comment.

“The problem is KGM license areas are occupied by artisanal miners,” Awoke Tesfaye, communications director at the Ministry of Mines, told The Reporter. “The problem is directly linked to the regional government. We are trying to solve it together.”

KGM secured its licenses during Takele Uma’s tenure as minister of Mines.

Sources at the Benishangul Mine Resource Development Bureau told The Reporter there are two major concerns surrounding KGM’s projects.

“The regional government has questions about the legitimacy of the licensing process. The federal authority did not consult the regional government before taking the license from Ascom and awarding it to Kurmuk,” said the source, who spoke anonymously. “The second major issue is that the federal government reserved 100 hectares of gold-rich land for KGM. This land is the livelihood for a large number of people. Because the population of Benishangul has no culture of farming and livestock, their livelihood depends on artisanal mining. It’s difficult for the regional government to displace the artisanal miners from the land earmarked for the investment.”

KGM is a subsidiary of Allied Gold Corp, a mining company based in Canada, according to its website.

Kurmuk’s license to explore for gold in what is thought to be the area holding largest gold reserves in the country previously belonged to ASCOM Mining Ethiopia Plc, which acquired the license during the EPRDF regime.

ASCOM, a leading Egyptian state-owned mining firm, transferred its shares in Kurmuk to Allied Gold following the political transition of 2018. KGM holds a 20-year concession for gold mining in a 100 square kilometer plot covering the Dish Mountain and Ashashire deposits, with gold exploration licenses covering an additional 1,450 square kilometers in Benishangul, according to a prospectus presented to investors in September 2023.

Experts in the field say Ethiopian officials overestimated the company’s capacity when they awarded a concession covering 100 square kilometers of land in September 2021. The Ethiopian government holds a seven percent stake in the Kurmuk project, according to the document from September 2023.

KGM initially planned to start early works in the final quarter of 2023, with its eye on commercial production in 2026, according to company documents. It was looking to produce close to seven tons of gold annually over the first years of production with a total investment capital requirement of half a billion USD, according to the document.

However, Allied Gold’s financial statements reveal that Kurmuk’s total assets stood at less than USD 200,000 as of September 30, 2023.

The disagreements with regional authorities and security issues mean that it will take a longer time before any gold is pulled out of the ground at Kurmuk, according to sources close to the issue.

However, these sources also claim that KGM is intentionally delaying its operations using various issues as pretext because the company lacks the financing to start its work. According to these sources, the company is using the licenses to boost Allied Gold (AAUC) share value on the Toronto Stock Exchange.

Some insiders claim illicit gold mining is already underway in Kurmuk with the full knowledge of KPM management.

Work, the general manager, denied the allegations.

He told The Reporter that the company has been unable to import mining machinery and equipment because federal authorities failed to approve its requests.

However, officials at the Ministry of Mines told The Reporter they have no records of such requests or denials.

Written by Umesh Ellichipuram on . Posted in Canada. Leave a Comment

Lithium Americas has announced an underwritten public offering to raise $275m, earmarked for the construction and development of the Thacker Pass lithium project in Humboldt County, Nevada.

The company is looking to sell 55 million shares at $5 each.

This public offering is being facilitated by a syndicate of underwriters, with Evercore ISI, Goldman Sachs & Co and BMO Capital Markets acting as the co-lead book-running managers.

In addition to the initial offering, Lithium Americas has granted the underwriters an option to buy up to another 8.25 million common shares at the issue price, which can be exercised within 30 days post-closing.

The closing of the offering is anticipated on 22 April 2024, subject to the satisfaction of customary closing conditions, including approval from the Toronto Stock Exchange and the New York Stock Exchange.

Last month, Lithium Americas secured a conditional commitment for a $2.26bn loan from the US Department of Energy to construct processing facilities at the Thacker Pass mine.

Access the most comprehensive Company Profiles

on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Company Profile – free

sample

Your download email will arrive shortly

We are confident about the

unique

quality of our Company Profiles. However, we want you to make the most

beneficial

decision for your business, so we offer a free sample that you can download by

submitting the below form

By GlobalData

This loan, part of the Advanced Technology Vehicles Manufacturing Loan Programme, is intended to support the initial annual production of 40,000 tonnes (t) of battery-grade lithium carbonate.

The Thacker Pass project is expected to generate approximately 1,800 direct jobs during its three-year construction period and 360 jobs after becoming operational, over its projected 40-year lifespan.

The mine will be developed in two phases, with a total anticipated production capacity of 80,000t of battery-quality lithium carbonate per year.

The commencement of Phase 1 production is targeted by 2027, with the lithium produced expected to qualify electric vehicles for consumer incentives under the US clean energy tax credits programme.

Give your business an edge with our leading industry insights.

Written by Cision PR Newswire on . Posted in Canada. Leave a Comment

TORONTO, April 19, 2024 /PRNewswire/ – Paul Raymond, Alithya Group Inc. (TSX: ALYA) (“Alithya”), shares his Company’s story in an interview with TMX Group.

The View From The C-Suite video interview series highlights the unique perspectives of listed companies on Toronto Stock Exchange and TSX Venture Exchange. Videos provide insight into how company executives think in the current business environment. To see the latest View From The C-Suite visit https://www.tsx.com/c-suite.

About Alithya Group Inc. (TSX: ALYA)

Empowered by the passion and enthusiasm of a talented global workforce, Alithya is an advisor in strategy and digital technology services. Transforming the world one digital step at a time, Alithya leverages collective intelligence and expertise to develop practical IT solutions tailored to complex business challenges.

CNW sponsored announcement. To learn more visit www.newswire.ca.

![]()

View original content to download multimedia:https://www.prnewswire.com/news-releases/toronto-stock-exchange-alithya-group-inc-the-view-from-the-c-suite-302122516.html

SOURCE Toronto Stock Exchange

0

0

votes

Article Rating

Written by Nelson Smith on . Posted in Canada. Leave a Comment

wellesenterprises

Emboldened by higher interest rates, high capex expenses, and weak share prices, many critics say Canada’s telecom stocks – and their generous dividends – are at risk. I examine TELUS Corporation (TSX:T:CA) (NYSE:TU) and its succulent 6.9% dividend to see if the payout can weather today’s storm.

TELUS Corporation can trace its history way back to 1906. Its predecessor company, Alberta Government Telephones (AGT) was formed after the Alberta government acquired various telephone assets in the province. AGT grew to eventually serve virtually all citizens of Alberta outside of the Edmonton area, where telephone service was provided by an arm of the municipal government.

AGT continued to provide telephone service to Albertans until 1990, when the ruling Progressive Conservative government decided to privatize the government entity. It formed TELUS Corporation as a vehicle to facilitate the transfer. By 1991, the province sold its remaining stake to TELUS, and it was officially a standalone company without any government backing.

TELUS then acquired Edmonton’s telephone operations in 1995, paying $467M for Edmonton Telephones (ED TEL). With this acquisition, TELUS now had a virtual monopoly in telephone operations in the province.

TELUS continued to grow in 1999. Dubbed as a “merger of equals”, TELUS merged with BC Tel in 1999, a privately-held telecom which held a virtual monopoly on the British Columbia market. TELUS moved its headquarters from Edmonton to Burnaby, and BC Tel’s operations were quickly rebranded under the TELUS name.

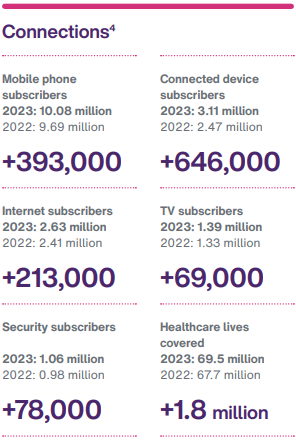

After a series of smaller acquisitions and billions invested in building a wireless network across Canada, today TELUS is firmly entrenched as one of Canada’s top telecoms. As of December 31st, 2023, it boasted more than 10M mobile phone subscribers, 2.6M internet subscribers, 1.39M television subscribers, as well as robust security, agricultural, health, and technology subsidiaries. Its wireline assets are still clustered in Canada’s two westernmost provinces, but its wireless network spans all the way across Canada.

TELUS 2023 Annual Report

Unlike its competitors, BCE (BCE) and Rogers Communications (RCI) – which own substantial stakes in media assets like television channels and professional sports franchises – TELUS diversified into other areas that leverage its existing networks.

For instance, TELUS Health is a global health and wellbeing provider dedicated to solving pressing issues facing citizens, healthcare professionals, employers, and employees, around the world. It provides various technological solutions to healthcare providers, including virtual care platforms. TELUS Health generated $1.7B in revenue in 2023.

TELUS also has a robust Agriculture and Consumer Goods division, which is focused on improving food management solutions and outcomes. Products from this division include tools to make farms both more efficient and safer, as well as inventory management software for both food producers and retailers. This part of the company generated $347M in revenue in 2023, which was slightly lower than 2022.

The company also owns a majority stake of TELUS International (TIXT) (TIXT:CA), which was partially spun off in 2021. TELUS International provides digitally-led customer experiences like AI services and content moderation. It has struggled since its IPO and the stock has fallen nearly 80% since its peak in 2022 as growth expectations have slowed.

Put it all together, and TELUS generated $20B in revenues in 2023, an increase of 9.4% compared to 2022. Adjusted EBITDA came in at $7.1B, a 7.6% improvement versus 2022. Higher interest costs hurt the bottom line in 2023, with adjusted earnings falling 20% from $1.18 to $0.95 per share. Free cash flow increased from $1.3B in 2022 to $1.8B in 2023, mostly due to lower capital expenditures.

After years of solid returns and steadily increasing dividends, TELUS shares have stumbled over the last 52 weeks. The stock is down more than 23% on the Toronto Stock Exchange, falling from a high of more than $28 per share to today’s level of $21.72.

That’s close to a 52-week and a five-year low. The stock hasn’t traded below $20 since the market chaos of March 2020. It traded as high as $34 per share in 2022.

There are a few reasons the stock is struggling so much. The big one is the state of the Canadian wireless industry today. After years of enjoying a comfortable oligarchy, TELUS and its two main competitors BCE and Rogers are facing more serious competition.

It started when Rogers acquired Shaw Communications, which was first announced in 2021. The Canadian government took a hard look at the proposed transaction and approved it – with one important caveat. Shaw owned Freedom Mobile, an upstart wireless provider with some 2M subscribers. Rogers would need to sell Freedom before it could go ahead and acquire the rest of Shaw.

There was really only one serious potential buyer, and that was Quebecor (OTCPK:QBCRF), a regional telecom with assets in Quebec. Quebecor paid $2.85B for Freedom and quickly got to work expanding its new asset the same way it gained market share against the incumbents in its home province – it undercut the competition. This created a price war across Canada as TELUS and its peers largely matched these aggressive prices to minimize the damage.

To demonstrate the impact of this price war, let’s take a closer look at Canadian inflation data. According to a Statistics Canada analysis, the price of wireless service fell by 26.5% year-over-year in February, although some of that decline can be attributed to faster service for the same price as telecoms roll out recently upgraded 5G networks.

Still, that’s not pretty.

Like any telecom, TELUS has to borrow aggressively to fund expensive investments in both its wireless and wireline networks. This leaves it vulnerable to higher interest rates, like we saw in 2023. TELUS spent $1.27B in net interest costs last year, up some 50% compared to the $847M it spent in 2022.

TELUS shares rallied earlier this year as investors expected aggressive rate cuts in 2024. Heavily indebted telecoms like TELUS would especially welcome any help on this front. Unfortunately, sticky inflation data has tempered any rate-cut expectations. According to CME’s FedWatch Tool, the chances of a June rate cut are now just 18.9% in the United States.

Chances are higher in Canada, with the market predicting an 80% chance of a 25 basis point rate cut in June and a 58% chance of an additional 25 basis point rate cut in September. So relief might be coming, but judging by the price action, investors seem skeptical.

Combine higher interest rates and the overall weak telecom market, and it’s not surprising TELUS shares have been weak. In fact, some investors have even taken this a step further and predicted that TELUS will soon be forced to cut its dividend.

Let’s take a closer look at the viability of that dividend, starting with why it could be in danger.

TELUS has been aggressively hiking its dividend for years now, maintaining its original target of 7-10% annual dividend growth first announced in 2011. It extended that guidance in 2013, 2016, 2019, and 2022.

Dig a little further, and there’s a problem. TELUS has a history of not earning enough free cash flow to cover that dividend.

For example, in 2021, TELUS earned $777M in free cash flow. That same year it paid just over $1B in dividends.

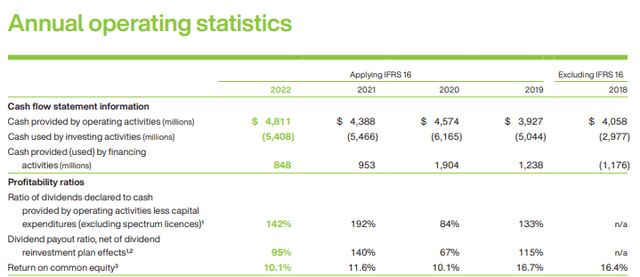

The story got a little better in 2022, but it still wasn’t great. Free cash flow improved to $1.27B while the company paid $1.18B in dividends. It covered the dividend, but the payout ratio was 95% of free cash flow once we factor in the impact of dividend reinvestment effects. That’s well above the company’s target payout ratio of 60-75% of free cash flow.

Unfortunately, from 2019 to 2022 the company’s payout ratio was only in the desired range once, with a payout ratio in 2020 of 67% of free cash flow.

TELUS 2022 Annual Report

It’s easy to argue TELUS’ outlook has gotten worse since 2022, too. Interest rates are far higher, which has had a significant impact on profitability. Combine that with a price war in the wireless sector in Canada, and it’s little wonder why investors are bearish.

In addition, TELUS currently has a debt-to-EBITDA ratio of greater than 4x. That’s a lot of debt, especially considering the uncertainty of future rate cuts.

Despite what you read above, this analyst isn’t nearly as bearish as the rest of the market. I believe that TELUS has a sustainable dividend that it can grow in 2024 and beyond.

First, 2023 saw the company make substantial progress on its dividend payout ratio. It earned $1.759B in free cash flow, a 38% improvement versus 2022. This improvement was largely driven by an 18.7% decline in capital expenditures.

Most importantly, this improved the payout ratio to 77% of free cash flow. That’s a little above the company’s desired payout range, but not hugely so.

Free cash flow is expected to improve in 2024 as well. TELUS released 2024’s guidance in February, when it reported 2023’s full-year earnings. It told investors to expect $2.3B in free cash flow in 2024, a 30% improvement compared to 2023.

Seeking Alpha doesn’t track analyst estimates for 2025’s free cash flow. However, analysts do expect earnings per share to grow by 16% in 2025 and an additional 15% in 2026. Based on the earnings increase, expected lower interest rates, and continued discipline on the capital expenditure side, and it isn’t hard to envision even higher free cash flow in 2025.

There are a couple of other bullish factors working for TELUS going forward. Firstly, there’s still robust immigration into Canada. The country’s population increased by 1.27M people in 2023, a pretty large number for a nation with just over 40M people. Most of these people will end up getting wireless packages, with many of them choosing TELUS.

I’ll also argue the price war isn’t quite as bad as it appears at first glance. Many wireless customers are happy to pay the same amount each month in exchange for more data or faster download speeds. Since the incumbent telecoms have already invested in their networks, this extra service costs them virtually zero in continued operating costs while keeping a customer away from the competition.

This phenomenon is further proven by TELUS’ average revenue per user (ARPU), which stayed largely unchanged in 2023 despite the price war. APRU was $58.50 in the fourth quarter of 2023, down ever so slightly from $58.69 in the same quarter of 2022.

I can understand why investors are worried about Canada’s telecoms. There are some significant headwinds impacting the sector.

I recently wrote about BCE’s dividend safety, and it’s much murkier than TELUS’ I ultimately believe BCE will make it through this rough patch with the dividend intact; however, I’m the first to admit naysayers who say the dividend might not survive have a point.

TELUS’ dividend, meanwhile, is in much better shape. Free cash flow is expected to grow by 30% in 2024, hitting $2.3B. Even if we assume a 10% dividend raise, TELUS would still see its payout ratio fall to the 65% range. That’s comfortably in line with the company’s targets.

As I write this, TELUS has a generous 6.9% dividend yield. Combine that with its strong predicted earnings growth, a reasonable valuation of under 14x forward free cash flow, and its position as part of Canada’s dominant telecom oligarchy, and it combines to make an interesting investment opportunity. This analyst is long.

Written by Solomon Israel on . Posted in Canada. Leave a Comment

Beverage alcohol company Constellation Brands has converted its shares in Canadian cannabis company Canopy Growth Corp. into new exchangeable shares.

Constellation’s exchangeable shares may be converted back into Canopy common shares on a one-to-one basis, the companies announced Friday.

ADVERTISEMENT

However, the two Constellation subsidiaries that now own the exchangeable shares don’t plan to convert them “until such time as the U.S. domestic sale of marijuana could not reasonably be expected to violate the Controlled Substances Act, the Civil Asset Forfeiture Reform Act (as it relates to violation of the Controlled Substances Act), and all related applicable anti-money laundering laws,” Constellation said in a news release.

The three remaining Constellation nominees to Canopy’s board have all resigned as part of the deal, and Constellation “no longer holds any governance rights in relation to Canopy Growth,” Canopy noted in its release.

Constellation subsidiary Greenstar Canada Investment Limited Partnership has also canceled and forgiven a promissory note to Canopy with principal worth 100 million Canadian dollars ($72.8 million), converting CA$81.2 million of the principal into shares and forgiving the remaining principal and interest.

Smiths Falls, Ontario-based Canopy said it now has CA$100 million less debt on its balance sheet.

“While we remain supportive of Canopy’s strategy, this transaction is expected to eliminate the impact to our equity in earnings and is aligned to our intent to not deploy additional investment in Canopy,” Constellation President and CEO Bill Newlands said in a statement.

ADVERTISEMENT

Constellation’s move comes days after Canopy shareholders approved the creation of the exchangeable shares as part of a plan to create the company’s U.S.-domiciled holding company Canopy USA, which is meant to acquire Canopy’s existing U.S. cannabis assets.

“We look forward to maintaining an enduring positive relationship with (Constellation) as our largest shareholder, and to the further advancement of the Canopy USA strategy that this change enables as Canopy USA moves forward with the acquisitions of Wana, Jetty and Acreage,” Canopy CEO David Klein, a former Constellation executive, said in a statement.

Constellation originally invested in Canopy in 2017, taking a 9.9% stake.

The Victor, New York-based alcohol company poured an unprecedented CA$5 billion into Canopy in 2018, acquiring more shares in a deal in which Constellation received board seats and warrants that could have boosted its stake in Canopy to more than 50%.

Constellation exercised some of those warrants in 2020.

By 2022, however, Constellation said it did not plan to invest any more capital in the Canadian cannabis operator.

Constellation allowed its warrants to purchase additional Canopy shares to expire last November.

Canopy’s latest quarterly net loss was CA$216.7 million, with net revenue of CA$78.5 million.

Shares of Canopy trade on the Nasdaq as CGC and on the Toronto Stock Exchange as WEED.

Constellation trades as STZ on the New York Stock Exchange.

Written by Canadian Press on . Posted in Canada. Leave a Comment

Author of the article:

Canadian Press

Tara Deschamps

Published Apr 19, 2024 • 5 minute read

As Canada’s biggest bookstore-turned-gift-giver’s-paradise edges toward privatization, it’s evident from a stroll around one of its Toronto stores that the retailer knows some things haven’t been working.

Advertisement 2

Story continues below

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

or

Article content

Epsom salts and body lotions that previously lined Indigo Books & Music Inc.’s wellness area at the Eaton Centre have been replaced by shelves of books and tchotchkes like cat- and corgi-shaped book lights, magnifying glasses and lap desks.

Article content

In the children’s section, a red velvet curtain and a closed sign hide what was once the American Girl doll emporium. (The pricey playthings and their plethora of accessories were sold off at a discount in March.)

The company has offered few details about these developments, or a transformation plan it launched late last year — around the same time it revealed an almost $50 million net loss in its latest fiscal year — but such is the state of Indigo at a time when shareholders prepare to decide whether the company is better off as a private enterprise owned by a holding company connected to its largest shareholder.

Advertisement 3

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“It’s a pivotal period to strengthen the company financially and then begin to move it forward,” said Joanne McNeish, an associate professor at Toronto Metropolitan University specializing in marketing.

“This won’t be a quick fix.”

She estimates it will take Indigo five years to turn itself around, a process that marketing experts agree could see the retailer put books back in the spotlight and rethink its spaces and even its store count.

“In the case of the Eaton Centre store, do you need two levels?” McNeish questioned.

“Maybe it’s just each square inch of the floor space doing a great job at selling the products they have available.”

Some of this work appears to be underway already, but how much further it will go depends on a May shareholder vote to decide whether to accept the offer of $2.50 per share in cash — up from $2.25 in February — from Trilogy Retail Holdings Inc. and Trilogy Investments L.P.

The Winnipeg Sun’s Daily Headline News

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of The Winnipeg Sun’s Daily Headline News will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 4

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The deal got a green light from the retailer’s board in early April and needs to meet the threshold for shareholder approval before it can go ahead.

Trilogy is owned by Onex Corp. founder and chairman Gerald Schwartz who holds 56 per cent of Indigo’s shares and is the spouse of Indigo founder and CEO Heather Reisman, who holds almost five per cent of the company’s shares.

Should the transaction, which would see Indigo leave the Toronto Stock Exchange, close as expected in June, experts say it will be time for leadership to roll up their sleeves and begin a new chapter.

What they will find is that “it’s a lot of work to make this business profitable,” said Grant Packard, an associate professor of marketing at York University. He previously served as Indigo’s interim chief marketing officer and vice-president of marketing.

Advertisement 5

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Between the low margins linked to books, the dominance of e-commerce giant Amazon and a cyberattack that downed some of the company’s services for weeks, he said, “They’ve been under such turmoil for the last few years.”

Understanding the work Packard and McNeish feel Indigo has to do to rebound from that turmoil also means looking at how it got here.

When Indigo debuted in 1996, it speedily became the country’s go-to bookstore, speckling malls, plazas and eventually, the e-commerce world, under Reisman’s goal to create a mecca for book lovers who scooped up books the founder gave her “Heather’s Pick” stamp of approval.

“If they could, they would spend all day there because it’s the equivalent to them of going on a vacation or going to see a movie,” said Packard in describing the target customer.

Advertisement 6

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“There are a lot of people in Canada that are like that, but there are more people that aren’t like that.”

Coping with such demographics, as well as the rise of Amazon and e-readers, pushed Indigo to branch out.

Some of the products it looked to, such as cozy socks and quirky mugs, made sense as book accompaniments. Others — sex toys, furniture and high-end jam — were a much bigger leap.

“Sauces and that sort of thing, they can go bad and then it begins to be not the quality image that I believe Indigo was going for,” said McNeish. “They were never meant to be a discount bookstore.”

Some of Indigo’s diversification began under Reisman but it gained new momentum under one-time John Lewis and Anthropologie executive Peter Ruis. In 2022, he took the helm of Indigo from Reisman, who was made executive chair before she was due to retire in August 2023.

Advertisement 7

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

As Indigo prepared for her departure last June, four of Indigo’s 10 directors left the board. Chika Stacy Oriuwa attributed her resignation to mistreatment and a “loss of confidence in board leadership.”

Reisman, who returned as Indigo’s CEO last September, has never elaborated on Oriuwa’s allegations. She revealed last year that the company is carrying out a transformation plan meant to “fully re-energize” its connection to customers.

Since then, an unspecified number of staff were laid off in January and Reisman has said Indigo reinvested in books and has been working to “rightsize and rightshape” its general merchandise in an apparent admission there was a mismatch between customer expectations and what the retailer was offering.

Advertisement 8

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Asked about its strategy moving forward, Indigo said in a statement that it is engaging in “meaningful work” to transform the business and update its range of products.

“Books are the heart and soul of Indigo, and we’re excited to expand our assortment of titles online and in stores across the country,” the company said in an email.

“We will also continue to be the booklover’s gift destination with a very carefully curated offering of lifestyle and paper products.”

An April letter Reisman sent to customers teased that the company would also bring back its digital inventory search kiosks, program more events, add seating to more stores and find cafe partners to fill spaces in Indigo shops left vacant by Starbucks.

Advertisement 9

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

At the Eaton Centre location, a Columbus Cafe & Co. has filled the store’s coffee shop void and on a recent Wednesday morning, when the weather was too nice to need refuge indoors, had a hearty line. Employees have also worked to expand and freshen the look of the store’s upscale baby section, where several customers browsed.

McNeish thinks the company now has to build on these wins — a task she still feels Reisman is ideal for.

“You can’t be perfect as a manager all the time, but she just seems to have this instinct for how to do it and a deep understanding, as she is a book person herself,” she said.

The trick, Packard said, will be deciding on the right number of stores, how to utilize them and how to invest in its online channels in a way that delivers the company to stability.

“They’ve just been always very susceptible to a market where the winds blow in different directions very quickly,” he said.

“(They need) to be in a position where market shocks like the pandemic or ransomware attack aren’t as deadly, so they can innovate, they can try new things.”

Article content

Share this article in your social network

Comments

This Week in Flyers

Written by Freschia Gonzales on . Posted in Canada. Leave a Comment

Additionally, all affected ETFs will receive new Committee on Uniform Securities Identification Procedures numbers (CUSIP), expected to be effective concurrently with the rebranding.

The BetaPro ETF family, which includes Canada’s only suite of leveraged, inverse, and inverse leveraged ETFs, will not be impacted by these updates and will retain their current names, tickers, and CUSIPs.

A significant update is that the ticker for the Global X Pipelines and Energy Services Index ETF will change from HOG to PPLN, effective on or about May 1. The complete list of ETFs undergoing name changes, along with their new CUSIPs, has been provided to ensure clarity for stakeholders.

Mehta further commented, “As we get ready to expand our product shelf as Global X and embrace new opportunities for investment innovation, Canadians can rest assured that our long-standing offerings will continue to be accessible and deliver effective exposure under their existing tickers.”

The updates are scheduled to take effect on the Toronto Stock Exchange on or about May 1, marking a significant step in the Horizons’ evolution and its commitment to providing innovative investment solutions in Canada.

Comments