(MENAFN– Newsfile Corp)

Toronto, Ontario–(Newsfile Corp. – July 14, 2025) – Royal Road Minerals Limited ( TSXV: RYR ) (” Royal Road ” or the ” Company “) is pleased to announce results from its initial scout drilling program at the Lalla Aziza copper project in Morocco.

Lalla Aziza is an underground copper-mine located in Morocco’s Western High Atlas, approximately 90 kilometers southwest of Marrakesh. Lalla Aziza is owned and operated by Moroccan mining company, Carbomine SARL (“Carbomine” ). In December 2024, Royal Road entered into an Option Agreement (the “Agreement” ) with Carbomine, which provides the Company with an option to acquire 100% of the Lalla Aziza Mining License. Summary terms of the Agreement are provided below.

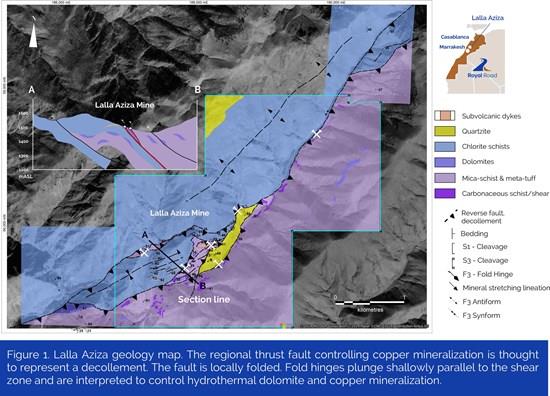

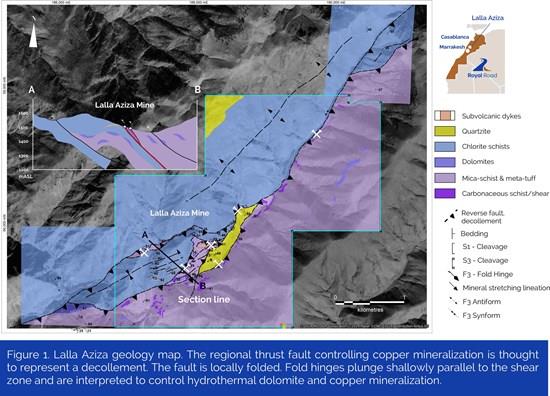

The Lalla Aziza mine area is located close to the southwestern extent of Carbomine’s license area, along a regionally extensive, southeast-dipping shear zone which continues for a distance of 4 kilometers diagonally across the license area (see Figure 1). Copper at Lalla Aziza is mined from chalcopyrite ore, hosted in dolomite vein-stockworks and hydrothermal breccia. Dolomite and copper mineralization is emplaced proximal to and within fault-related fold-hinges which plunge shallowly along and in the hanging-wall to the shear zone towards the northeast. Where mapped, mineralized structures can exceed 20 meters in thickness, but underground mining is limited to locally higher-grade intervals, where hand-picked ore averages in excess of 3% copper.

To view an enhanced version of this graphic, please visit:

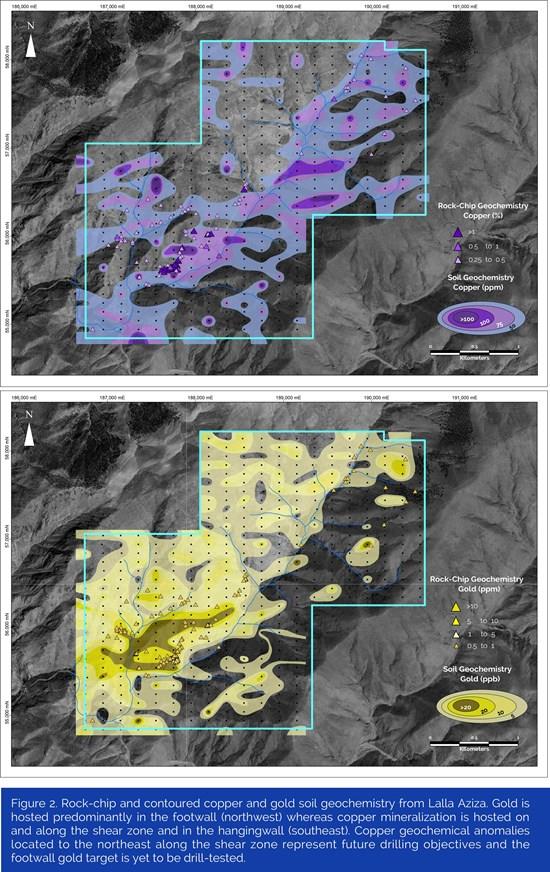

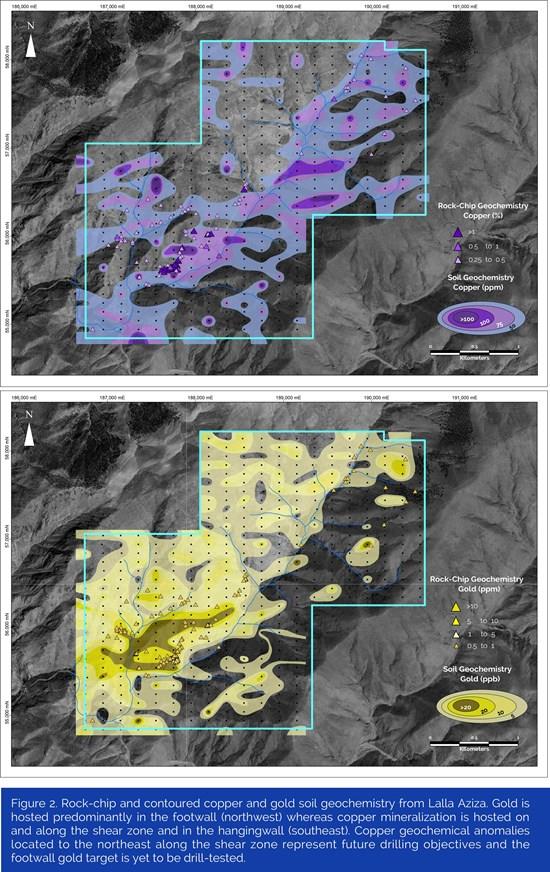

Royal Road has completed geological mapping, underground and surface rock-chip, channel and soil geochemical sampling across the Lalla Aziza license area (see Figures 1 and 2 and press release April 2, 2025). The Company has now completed a 15-hole, 1000-meter reverse circulation scout-drilling campaign at the project. This is the first exploration drilling to be conducted at Lalla Aziza. Drilling is aimed principally at testing bulk copper grades across the extent of the shear/fold zone, including the higher-grade underground intervals, in order to;

Assess potential for a “starter”-style open-pit mine; and

Test for the along-strike, down-plunge continuity of copper mineralization

Significant drilling results include the following (see Table 1):

| RC25LA002 |

From 32 to 51 meters |

19 meters at 1.1% copper |

| RC25LA004 |

From 12 to 17 meters |

17 meters at 1.3% copper |

| RC25LA005 |

From 18 to 35 meters |

17 meters at 1.1% copper (EOH) |

| RC25LA007 |

From 0 to 31 meters |

31 meters at 0.7% copper |

| RC25LA009 |

From 18 to 37 meters |

19 meters at 1.0% copper |

| RC25LA010 |

From 26 to 47 meters |

21 meters at 1.0% copper |

| RC25LA012 |

From 51 to 63 meters |

12 meters at 0.7% copper |

| |

| (Not true width and the company does not have sufficient information to determine the true widths of the drill hole intersections) |

To view an enhanced version of this graphic, please visit:

| TABLE 1: DRILL RESULTS LALLA AZIZA |

|

COPPER |

GOLD |

| HOLE ID |

E |

N |

Z(m) |

DIP |

AZIM |

DEPTH |

FROM |

TO |

LENGTH (m)* |

% |

(g/t) |

| RC25LA001 |

531667 |

3434774 |

1506 |

-50 |

330 |

57 |

22 |

38 |

16 |

0.6 |

|

| RC25LA002 |

531667 |

3434773 |

1506 |

-90 |

330 |

64 |

32 |

51 |

19 |

1.1 |

|

| RC25LA003 |

531607 |

3434732 |

1495 |

-50 |

335 |

25 |

19 |

25 |

6 |

0.8 |

|

| RC25LA004 |

531607 |

3434731 |

1495 |

-70 |

335 |

88 |

25 |

42 |

17 |

1.3 |

|

| RC25LA005 |

531583 |

3434710 |

1489 |

-50 |

335 |

35 |

18 |

35 |

17 |

1.1 |

|

| RC25LA006 |

531583 |

3434709 |

1489 |

-90 |

335 |

67 |

35 |

38 |

3 |

0.4 |

|

| RC25LA007 |

531533 |

3434693 |

1487 |

-50 |

335 |

49 |

0 |

31 |

31 |

0.7 |

|

| RC25LA008 |

531533 |

3434692 |

1487 |

-90 |

335 |

79 |

0 |

2 |

2 |

0.3 |

|

| 19 |

33 |

14 |

0.4 |

|

| 41 |

44 |

3 |

0.4 |

|

| 50 |

52 |

2 |

0.6 |

|

| 70 |

74 |

4 |

0.2 |

|

| RC25LA009 |

531636 |

3434751 |

1492 |

-50 |

335 |

67 |

18 |

37 |

19 |

1.0 |

|

| RC25LA010 |

531636 |

3434750 |

1492 |

-90 |

335 |

67 |

26 |

47 |

21 |

1.0 |

|

| RC25LA011 |

531656 |

3434714 |

1489 |

-50 |

335 |

73 |

11 |

16 |

5 |

0.3 |

0.3 |

| 33 |

39 |

6 |

0.5 |

|

| 55 |

57 |

2 |

0.2 |

|

| RC25LA012 |

531692 |

3434719 |

1488 |

-50 |

335 |

85 |

51 |

63 |

12 |

0.7 |

|

| RC25LA013 |

531609 |

3434679 |

1484 |

-65 |

335 |

79 |

47 |

53 |

6 |

0.4 |

|

| RC25LA014 |

531546 |

3434677 |

1485 |

-50 |

335 |

73 |

25 |

47 |

22 |

0.2 |

|

| RC25LA015 |

531453 |

3434589 |

1470 |

-50 |

335 |

88 |

NO SIGNIFICANT INTERSECTIONS |

| *NOT TRUE WIDTH |

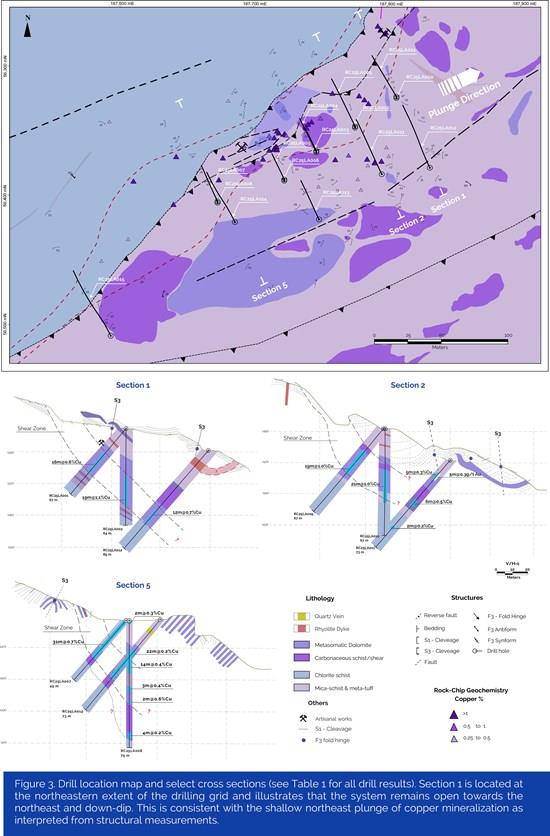

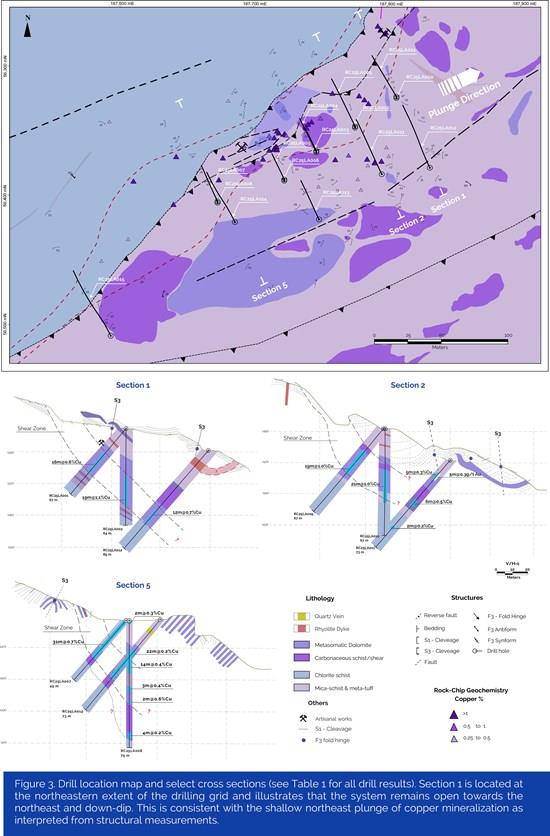

These initial scout drilling results at Lalla Aziza have confirmed that economically significant copper grades continue across the width of the shear/fold zone and that the mineralized structure is likely to plunge and continue below-surface towards the northeast (see Figure 3). Grades and thicknesses are considered significant enough to support potential for an open-pit starter at Lalla Aziza, assuming additional recoverable resources exist along and adjacent to the shear zone. Further work at Lalla Aziza will be focused on mapping and geophysics in order to define drill objectives at depth and to the northeast of the current drill grid. The gold potential of the footwall will also be better constrained.

To view an enhanced version of this graphic, please visit:

Royal Road has notified Carbomine of its intention to exercise its option to acquire the Lalla Aziza Mining License subject to the terms of the Agreement as summarized below.

“Initial results at Lalla Aziza are encouraging, with strong indications that copper mineralization extends at depth to the northeast. We look forward to commencing detailed mapping, geophysics and targeting to define the project’s full potential and optimize future drilling,” said Tim Coughlin, President and CEO of Royal Road. “Morocco continues to stand out as a geologically prospective and politically supportive jurisdiction-critically positioned to contribute to the world’s growing demand for secure and sustainable supplies of copper and other strategic metals.”

Summary terms of the Agreement are as follows:

Royal Road have paid to Carbomine the sum of USD$50,000 upon execution of an initial Letter of Intent (superseded by the Agreement)

Royal Road have paid to Carbomine the sum of USD$200,000 upon execution of the Agreement

Royal Road has notified Carbomine of its intention to exercise the option to acquire 100% legal and beneficial ownership of the Carbomine mining licence. Subject to completion of the exercise of the option, to receipt of all relevant regulatory approvals in respect of the assignment or transfer of the Mining Licence to Royal Road and the confirmation from the relevant regulatory authorities in the form acceptable to Royal Road that it is the legal owner of the Mining Licence free from all encumbrances Royal Road shall pay the sum of US$1,500,000 to Carbomine

Upon the anniversary of the date on which Royal Road is registered as the legal and beneficial owner of the mining licence, RRM shall pay an annual fee of US$300,000 to Carbomine until the drawdown of project finance for a Bankable Feasibility Study

Upon the completion of the first Bankable Feasibility Study on the mining license and the drawdown of project finance for the purpose of such Bankable Feasibility Study, Royal Road shall pay Carbomine the sum of USD$2,500,000

Upon commencement of commercial production from the mining license, Carbomine shall be granted a net smelter return royalty of 2.5% in total (applicable to all mineral or metallic product extracted and recovered from the mining license) in respect of production from the license

About Royal Road Minerals:

Royal Road Minerals is a mineral exploration and development company with its head office and technical-operations center located in Jersey, Channel Islands. The Company is listed on the TSX Venture Exchange under the ticker RYR, on the OTCQB under the ticker RRDMF and on the Frankfurt Stock Exchange under the ticker RLU. The Company’s mission is to apply expert skills and innovative technologies to the process of discovering and developing copper and gold deposits of a scale large enough to benefit future generations and modern enough to ensure minimum impact on the environment and no net loss of biodiversity. The Company currently explores in the Kingdoms of Saudi Arabia, Morocco and in Colombia. More information can be found on the Company’s website .

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The information in this news release was compiled, reviewed and verified by Dr. Tim Coughlin, BSc (Geology), MSc (Exploration and Mining), PhD (Structural Geology), FAusIMM, President and CEO of Royal Road Minerals Ltd and a qualified person as defined by National Instrument 43-101

Cautionary statement:

This news release contains certain statements that constitute forward-looking information and forward-looking statements within the meaning of applicable securities laws (collectively, “forward-looking statements”) describing the Company’s future plans and the expectations of its management that a stated result or condition will occur. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company, or developments in the Company’s business or in the mineral resources industry, to differ materially from the anticipated results, performance, achievements or developments expressed or implied by such forward-looking statements. Forward-looking statements include all disclosure regarding possible events, conditions or results of operations that is based on assumptions about, among other things, future economic conditions and courses of action, and assumptions related to government approvals, and anticipated costs and expenditures. The words “plans”, “prospective”, “expect”, “intend”, “intends to” and similar expressions identify forward looking statements, which may also include, without limitation, any statement relating to future events, conditions or circumstances. Forward-looking statements of the Company contained in this news release, which may prove to be incorrect, include, but are not limited to the Company’s exploration plans.

The Company cautions you not to place undue reliance upon any such forward-looking statements, which speak only on the date they are made. There is no guarantee that the anticipated benefits of the Company’s business plans or operations will be achieved. The risks and uncertainties that may affect forward-looking statements include, among others: economic market conditions, anticipated costs and expenditures, government approvals, and other risks detailed from time to time in the Company’s filings with Canadian provincial securities regulators or other applicable regulatory authorities. Forward-looking statements included herein are based on the current plans, estimates, projections, beliefs and opinions of the Company management and the Company does not undertake any obligation to update forward-looking statements should assumptions related to these plans, estimates, projections, beliefs and opinions change.

Quality Assurance and Quality Control:

Sample preparation and analyses are conducted according to standard industry procedures at certified laboratories. Percussion-chip samples were sampled on 1m downhole intervals and passed through a 75-25% drill-rig mounted splitter. The 75% sample was placed in rows and analyzed for guidance on-site using a Vanta pXRF tool. The 25% sample was split 50-50% to produce analytical and retention samples of between 1 to 3kg. Samples for analysis were bagged in the field and sent to ALS Seville for analysis of gold by fire assay with an ICP-AES finish (method Au-ICP22) and multielements by four acid digest ICP-MS (method ME-MS61). QAQC materials included CRMs, blanks and duplicates inserted into sample batches on a ration of 1:10. Soil samples were collected 30-60cm below the surface to avoid surficial contamination. Approximately 0.5kg was collected for each sample. For each sample, soil thickness, horizon, surface type, sample collection depth, & field sieve-mesh was recorded. QAQC materials included approximately 5% CRMs, 1% blanks and 1% field duplicates. Infill soil samples were sent to ALS in Sevilla for drying, disaggregation and dry-sieving to -180um. Samples were analyzed using the super-trace low level gold and multi-element package (AuME-St43) with a 25g charge weight. Gold and multielement concentrations are determined from the same solution via a combination of ICP-MS and ICP-AES

MENAFN14072025004218003983ID1109797352

Comments