Article content

The pinnacle of bicycle racing, the Tour de France, gets under way this weekend and it is a gruelling competition: 23 days, 184 racers and 3,320 kilometres.

Written by Special to Financial Post on . Posted in Canada. Leave a Comment

Bert Clark: Three traits common to Tour winners are also often shared by many successful long-term investors

Published Jun 23, 2025 • Last updated 1 hour ago • 3 minute read

The pinnacle of bicycle racing, the Tour de France, gets under way this weekend and it is a gruelling competition: 23 days, 184 racers and 3,320 kilometres.

Advertisement 2

Story continues below

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS

Subscribe now to read the latest news in your community.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your community.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to keep reading.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

Success requires incredible fitness, mental strength and teamwork. These three traits common to Tour winners are also often shared by many successful long-term investors. They leverage comparative advantages to selectively outperform the market, target being consistently good (but not always the best) in the short term and they mitigate risks to stay in the race.

Article content

Article content

A good example of the first two traits in action is provided by Jonas Vingegaard, one of this year’s favourites and the winner of the 2022 and 2023 races. He won just two of the stages in 2022 and only one in 2023. Those stages all involved tough climbs — his forte. But in both years, he consistently finished well in each stage, even when he didn’t win. Being consistently good and selectively outperforming were part of his winning formula.

The Kingston Whig-Standard’s Noon News Roundup

Your weekday lunchtime roundup of curated links, news highlights, analysis and features.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of The Kingston Whig-Standard’s Noon News Roundup will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Likewise, investors should pick their spots and not try to outperform everywhere.

For example, about 50 per cent of the funds we manage are invested in passive or factor strategies where we expect cost-effective market, or close to market, returns. The other 50 per cent is invested in market segments or strategies where we believe we have an advantage. Those advantages include our tolerance for illiquidity, longer investment time horizon and ability to partner with operational experts on a cost-effective basis.

Investors should also avoid “big bets.” Because surprises are all too common in the investment world, big bets are likely to lead to inconsistent results.

The Japanese equity market peaked in 1989, then dropped and took 34 years to recover. The Nasdaq peaked in 2000 and then took 15 years to once again reach its dot-com peak. Nortel Networks Corp. hit a high of $124.50 in July 2000, making it the largest company on the Toronto Stock Exchange at the time, representing more than a third of the entire index. By January 2009, it was insolvent.

Advertisement 4

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Big bets on any of these things would have led to big highs, big lows and then big regrets. Diversification helps prevent inconsistent results.

To win the Tour de France, racers also need to take precautions to avoid having to withdraw from the race. Risks abound. Crowded packs of racers travelling over cobblestones, narrow roads and mountains is a recipe for trouble. In 2024, 42 racers had to withdraw.

This is why Tour teams protect team leaders like Vingegaard with “domestiques” biking in front to allow them to stay out of the peloton and stay in the race.

Like racing, investment success is impossible if you don’t stay in the race. One of the keys to doing that is never having to sell investments in down markets. This locks in losses and prevents you from participating in the recovery.

Advertisement 5

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

To stay in the race and avoid crystallizing temporary losses, investors should ensure they have adequate and reliable liquidity — in our case, mostly real and nominal bonds of different durations — to meet ongoing liquidity needs and avoid the need to sell higher-returning, but more volatile investments if they fall in value.

Read More

The Tour de France is a unique sporting event. Success is the product of many things, but much like investing, it’s as much about what you do as what you don’t do.

Bert Clark is chief executive of Investment Management Corp. of Ontario.

Article content

Share this article in your social network

Featured Local Savings

Written by TSX Stocks on . Posted in Canada. Leave a Comment

↵

Image Source: Pixabay

The goal of rational investors is to maximize total return.

Total return is the complete return of an investment over a given time period. It includes all capital gains and any dividends or interest paid.

The 3 aspects of total return for stocks are:

We calculate expected total returns using the 3 aspects of total return for more than 600 securities in The Sure Analysis Research Database.

While we currently rate many of the stocks we cover as buys, due to expected annual returns above 10%, many are rated as holds due to mediocre returns.

Additionally, there are also plenty of stocks we currently rate as sells.

Typically, low (or negative) projected total return is due to overvaluation. Put simply, many of the stocks we rate as sells are overvalued, due to their high current valuations.

Buying overvalued stocks can result in low, or negative, future returns, even with a high dividend yield.

With that in mind, this article will cover 10 high dividend stocks we currently rate as sells according to their low projected total returns.

The list is sorted by annual expected returns over the next five years, from lowest to highest.

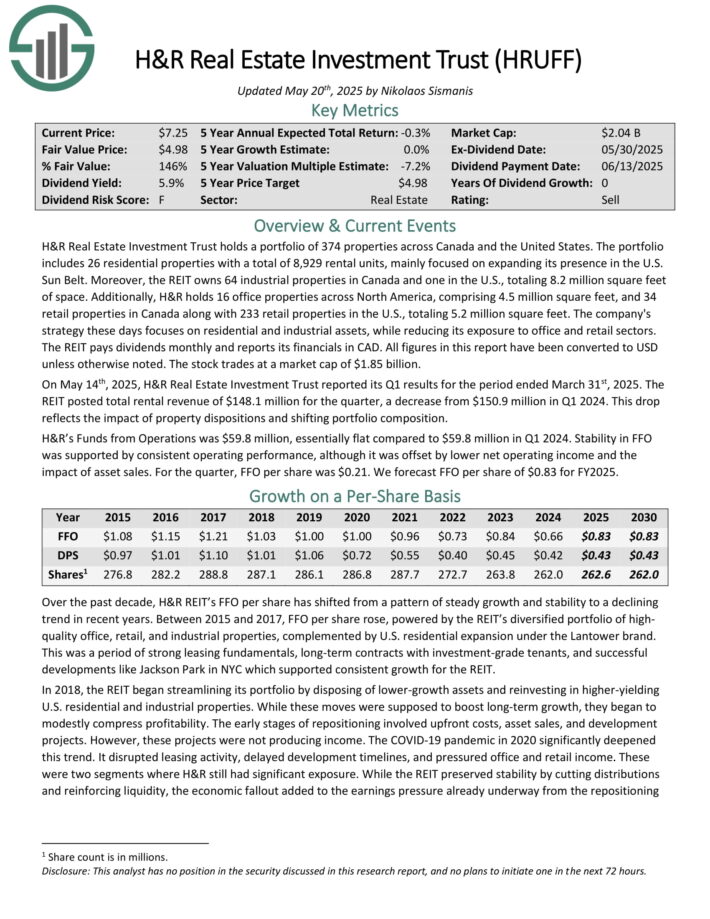

H&R Real Estate Investment Trust holds a portfolio of 374 properties across Canada and the United States. The portfolio includes 26 residential properties with a total of 8,929 rental units, mainly focused on expanding its presence in the U.S. Sun Belt.

Moreover, the REIT owns 64 industrial properties in Canada and one in the U.S., totaling 8.2 million square feet of space. Additionally, H&R holds 16 office properties across North America, comprising 4.5 million square feet, and 34 retail properties in Canada along with 233 retail properties in the U.S., totaling 5.2 million square feet.

The company’s strategy these days focuses on residential and industrial assets, while reducing its exposure to office and retail sectors.

The REIT pays dividends monthly and reports its financials in CAD. All figures in this report have been converted to USD unless otherwise noted.

On May 14th, 2025, H&R Real Estate Investment Trust reported its Q1 results. The REIT posted total rental revenue of $148.1 million for the quarter, a decrease from $150.9 million in Q1 2024.

This drop reflects the impact of property dispositions and shifting portfolio composition. H&R’s Funds from Operations was $59.8 million, essentially flat compared to $59.8 million in Q1 2024.

Click here to download our most recent Sure Analysis report on HRUFF (preview of page 1 of 3 shown below):

Sabine Royalty Trust is an oil and gas trust set up in 1983 by Sabine Corporation. At initiation, the trust initially had an expected reserve life of 9 to 10 years but it has surpassed expectations by an impressive margin.

The trust consists of royalty and mineral interests in producing properties and proved oil and gas properties in Florida, Louisiana, Mississippi, New Mexico, Oklahoma, and Texas. It is roughly 2/3 oil and 1/3 gas in terms of revenues.

The trust’s assets are static in that no further properties can be added. The trust has no operations but is merely a pass-through vehicle for royalties. SBR had royalty income of $82.6 million in 2024.

In early May, SBR reported (5/9/25) financial results for the first quarter of fiscal 2025. Production of oil grew 22% but production of gas dipped -1% over the prior year’s quarter. In addition, the average realized prices of oil and gas decreased -26% and -7%, respectively. As a result, distributable cash flow per unit declined -6%, from $1.27 to $1.19.

The outlook for this year is negative, as OPEC has begun to unwind its production cuts and intends to boost its output by 2.0 million barrels per day until the end of 2026.

Click here to download our most recent Sure Analysis report on SBR (preview of page 1 of 3 shown below):

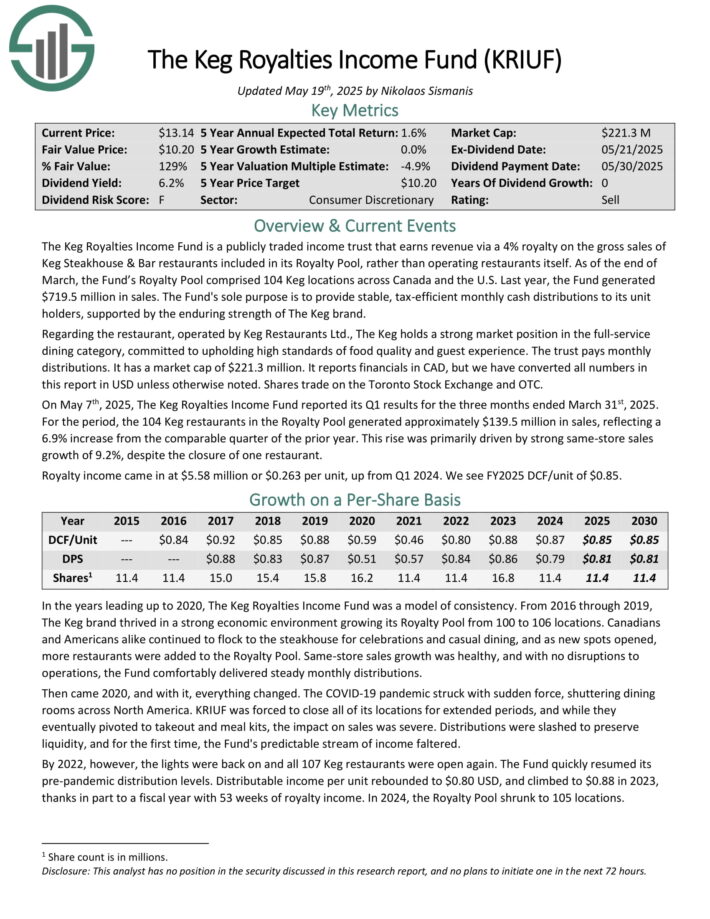

The Keg Royalties Income Fund is a publicly traded income trust that earns revenue via a 4% royalty on the gross sales of Keg Steakhouse & Bar restaurants included in its Royalty Pool, rather than operating restaurants itself.

As of the end of March, the Fund’s Royalty Pool comprised 104 Keg locations across Canada and the U.S. Last year, the Fund generated $719.5 million in sales.

The Keg holds a strong market position in the full-service dining category, committed to upholding high standards of food quality and guest experience.

It reports financials in CAD, but we have converted all numbers in this report in USD unless otherwise noted. Shares trade on the Toronto Stock Exchange and OTC.

On May 7th, 2025, The Keg Royalties Income Fund reported its Q1 results for the three months ended March 31st, 2025. For the period, the 104 Keg restaurants in the Royalty Pool generated approximately $139.5 million in sales, reflecting a 6.9% increase from the comparable quarter of the prior year.

This rise was primarily driven by strong same-store sales growth of 9.2%, despite the closure of one restaurant.

Click here to download our most recent Sure Analysis report on KRIUF (preview of page 1 of 3 shown below):

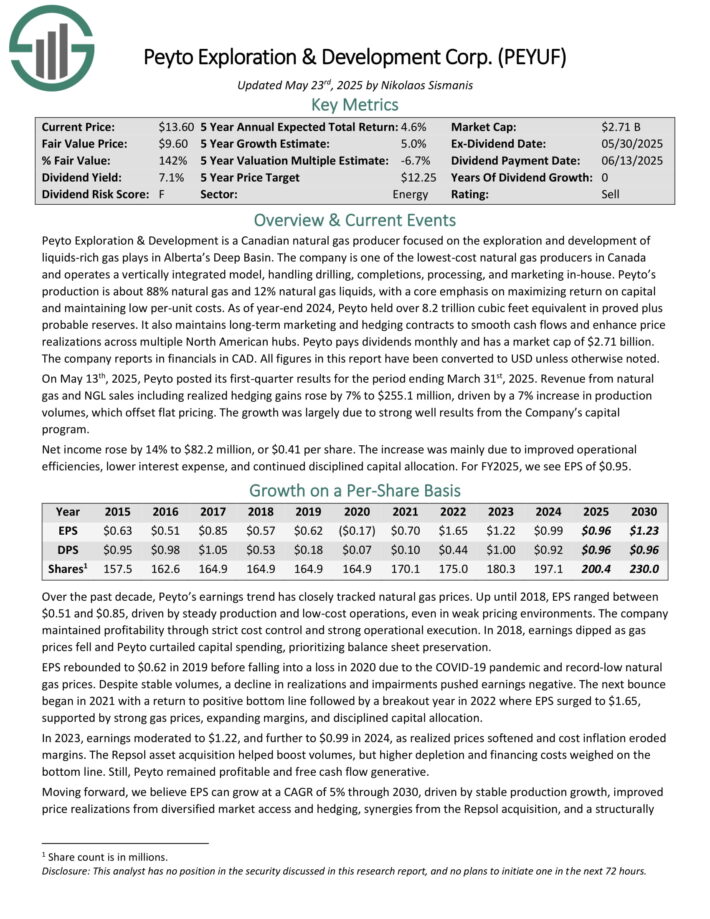

Peyto Exploration & Development is a Canadian natural gas producer focused on the exploration and development of liquids-rich gas plays in Alberta’s Deep Basin.

The company is one of the lowest-cost natural gas producers in Canada and operates a vertically integrated model, handling drilling, completions, processing, and marketing in-house.

Peyto’s production is about 88% natural gas and 12% natural gas liquids, with a core emphasis on maximizing return on capital and maintaining low per-unit costs.

As of year-end 2024, Peyto held over 8.2 trillion cubic feet equivalent in proved plus probable reserves. It also maintains long-term marketing and hedging contracts to smooth cash flows and enhance price realizations across multiple North American hubs.

The company reports in financials in CAD. All figures in this report have been converted to USD unless otherwise noted.

On May 13th, 2025, Peyto posted its first-quarter results for the period ending March 31st, 2025. Revenue from natural gas and NGL sales including realized hedging gains rose by 7% to $255.1 million, driven by a 7% increase in production volumes, which offset flat pricing. The growth was largely due to strong well results from the Company’s capital program.

Click here to download our most recent Sure Analysis report on PEYUF (preview of page 1 of 3 shown below):

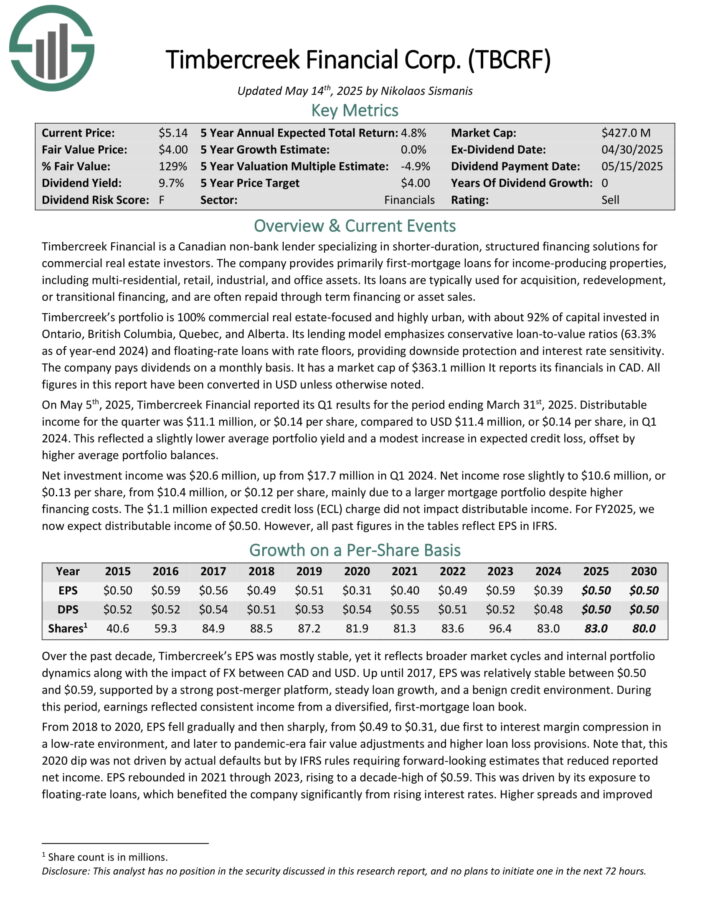

Timbercreek Financial is a Canadian non-bank lender specializing in shorter-duration, structured financing solutions for commercial real estate investors.

The company provides primarily first-mortgage loans for income-producing properties, including multi-residential, retail, industrial, and office assets.

Its loans are typically used for acquisition, redevelopment, or transitional financing, and are often repaid through term financing or asset sales.

Timbercreek’s portfolio is 100% commercial real estate-focused and highly urban, with about 92% of capital invested in Ontario, British Columbia, Quebec, and Alberta. Its lending model emphasizes conservative loan-to-value ratios (63.3% as of year-end 2024) and floating-rate loans with rate floors, providing downside protection and interest rate sensitivity.

All figures in this report have been converted in USD unless otherwise noted.

On May 5th, 2025, Timbercreek Financial reported its Q1 results for the period ending March 31st, 2025. Distributable income for the quarter was $11.1 million, or $0.14 per share, compared to USD $11.4 million, or $0.14 per share, in Q1 2024.

This reflected a slightly lower average portfolio yield and a modest increase in expected credit loss, offset by higher average portfolio balances.

Click here to download our most recent Sure Analysis report on TBCRF (preview of page 1 of 3 shown below):

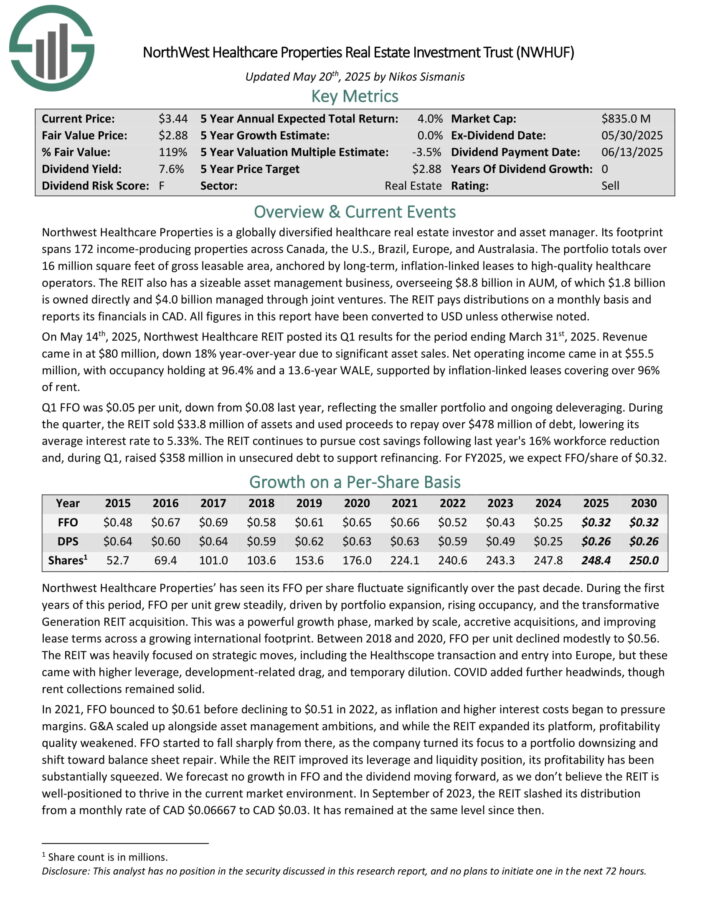

Northwest Healthcare Properties is a globally diversified healthcare real estate investor and asset manager. Its footprint spans 172 income-producing properties across Canada, the U.S., Brazil, Europe, and Australasia.

The portfolio totals over 16 million square feet of gross leasable area, anchored by long-term, inflation-linked leases to high-quality healthcare operators.

The REIT also has a sizeable asset management business, overseeing $8.8 billion in AUM, of which $1.8 billion is owned directly and $4.0 billion managed through joint ventures. The REIT pays distributions on a monthly basis and reports its financials in CAD. All figures in this report have been converted to USD unless otherwise noted.

On May 14th, 2025, Northwest Healthcare REIT posted its Q1 results for the period ending March 31st, 2025. Revenue came in at $80 million, down 18% year-over-year due to significant asset sales.

Net operating income came in at $55.5 million, with occupancy holding at 96.4% and a 13.6-year WALE, supported by inflation-linked leases covering over 96% of rent.

Q1 FFO was $0.05 per unit, down from $0.08 last year, reflecting the smaller portfolio and ongoing deleveraging. During the quarter, the REIT sold $33.8 million of assets and used proceeds to repay over $478 million of debt, lowering its average interest rate to 5.33%.

Click here to download our most recent Sure Analysis report on NWHUF (preview of page 1 of 3 shown below):

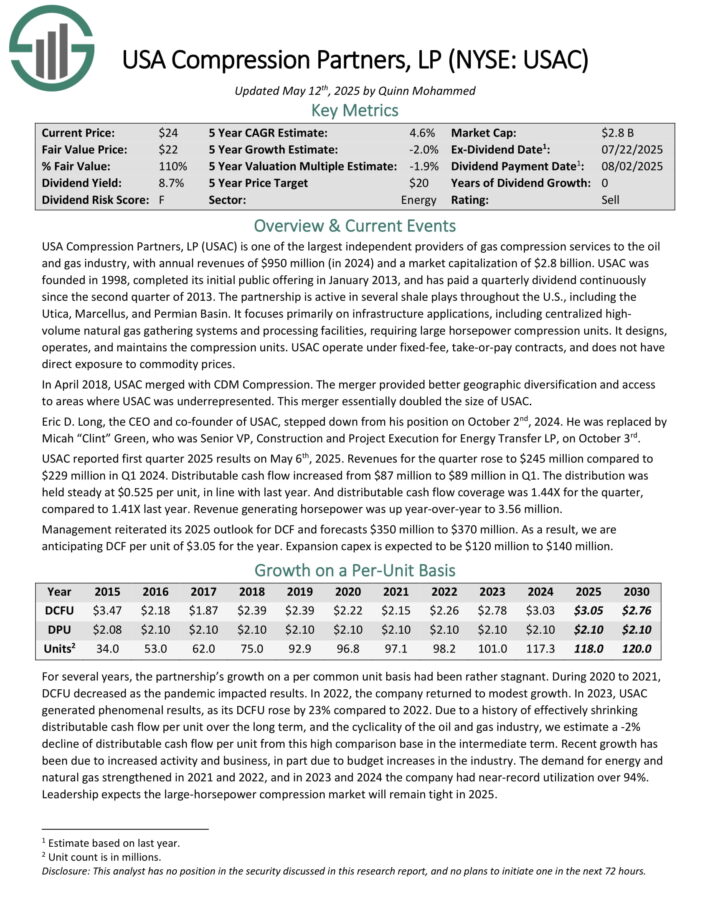

USA Compression Partners, LP is one of the largest independent providers of gas compression services to the oil and gas industry, with annual revenues of $950 million in 2024.

The partnership is active in several shale plays throughout the U.S., including the Utica, Marcellus, and Permian Basin. It focuses primarily on infrastructure applications, including centralized high-volume natural gas gathering systems and processing facilities, requiring large horsepower compression units.

It designs, operates, and maintains the compression units. USAC operate under fixed-fee, take-or-pay contracts, and does not have direct exposure to commodity prices.

USAC reported first quarter 2025 results on May 6th, 2025. Revenues for the quarter rose to $245 million compared to $229 million in Q1 2024. Distributable cash flow increased from $87 million to $89 million in Q1. The distribution was held steady at $0.525 per unit, in line with last year.

Distributable cash flow coverage was 1.44X for the quarter, compared to 1.41X last year. Revenue generating horsepower was up year-over-year to 3.56 million. Management reiterated its 2025 outlook for DCF and forecasts $350 million to $370 million.

Click here to download our most recent Sure Analysis report on USAC (preview of page 1 of 3 shown below):

Pizza Pizza Royalty Corp. is a Canadian entity which collects and distributes a dividend stream based on royalties earned from the Pizza Pizza and Pizza 73 restaurant chains.

The company’s base reporting currency is Canadian Dollars, but this report will use U.S. Dollar figures except when otherwise noted.

Pizza Pizza Royalty Corp. receives income from 797 combined total restaurant locations across Canada under its two brands. More than 150 of these are non-traditional locations sited in public places such as universities and hospitals.

Pizza Pizza has outsized exposure to the province of Alberta thanks to its ownership of Pizza 73 which is centered in that province.

Pizza Pizza reported its Q1 2025 results on May 7th, 2025. Same store sales grew 1.2% in Q1 versus the prior year. While nothing extraordinary, this was a sequential improvement as Pizza Pizza had reported negative same store sales throughout 2024.

While revenues ticked up, so did expenses, leading to flattish results. EPS of 17 cents fell by 1% from the same period of the prior year.

Click here to download our most recent Sure Analysis report on PZRIF (preview of page 1 of 3 shown below):

Northland Power develops, builds, owns, and operates power generation assets, including offshore and onshore wind, solar, natural gas, and battery energy storage systems.

It also supplies energy through a regulated utility in Colombia. Northland manages 3.2 GW of gross operating capacity and has 2.4 GW in active construction across three projects: Hai Long (Taiwan), Baltic Power (Poland), and Oneida (Canada), with a broader development pipeline totaling about 10 GW.

Northland reports in CAD. All figures have been converted to USD unless otherwise noted. On May 13th, 2025, Northland Power reported its Q1 results for the period ending March 31st, 2025. Revenue declined 14% year-over-year to about $467 million, primarily due to exceptionally low wind conditions in Europe and a strong wind quarter the year prior, partially offset by higher contributions from North American onshore wind and natural gas assets.

Adjusted EBITDA fell 20% to approximately $260 million, reflecting weaker offshore wind production despite continued operational discipline. Net income fell to $80 million from $107 million a year earlier, driven by the same headwinds in offshore generation and derivative fair value changes.

Click here to download our most recent Sure Analysis report on NPIFF (preview of page 1 of 3 shown below):

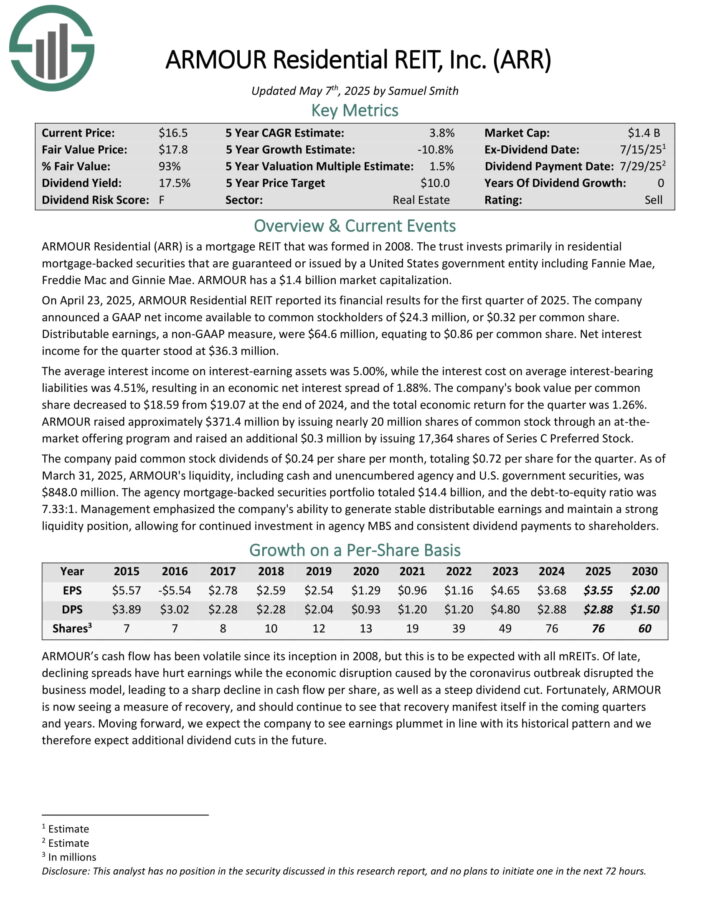

ARMOUR Residential invests in residential mortgage-backed securities that include U.S. Government-sponsored entities (GSE) such as Fannie Mae and Freddie Mac.

It also includes Ginnie Mae, the Government National Mortgage Administration’s issued or guaranteed securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate home loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, money market instruments, and non-GSE or government agency-backed securities are examples of other types of investments.

On April 23, 2025, ARMOUR Residential REIT reported its financial results for the first quarter of 2025. The company announced a GAAP net income available to common stockholders of $24.3 million, or $0.32 per common share.

Distributable earnings, a non-GAAP measure, were $64.6 million, equating to $0.86 per common share. Net interest income for the quarter stood at $36.3 million.

The average interest income on interest-earning assets was 5.00%, while the interest cost on average interest-bearing liabilities was 4.51%, resulting in an economic net interest spread of 1.88%. The company’s book value per common share decreased to $18.59 from $19.07 at the end of 2024, and the total economic return for the quarter was 1.26%.

Click here to download our most recent Sure Analysis report on ARMOUR Residential REIT Inc (ARR) (preview of page 1 of 3 shown below):

High dividend stocks are naturally appealing on the surface, due to their high dividend yields.

But income investors need to make sure they do not fall into a dividend ‘trap’, meaning purchasing an overvalued stock solely due to its high yield.

There are other important factors when buying stocks, specifically the total return potential. Stocks with negative or low future returns should be sold, even when they offer a high dividend yield.

More By This Author:

The 10 Highest Yielding Dividend Champions

3 High Yielding Dividend Champions Yielding Over 5%

15 Highest Yielding Utility Stocks

Written by Aaron Walker on . Posted in Canada. Leave a Comment

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Elon Musk is reportedly planning to launch a decentralized exchange (DEX) on X (formerly Twitter).

Crypto researcher Atlas took to X to break the news, pointing out that this move could result in the introduction of hundreds of millions of users to crypto.

Keep reading to learn more about Musk’s DEX plans, what it means for crypto, and how investing in the best altcoins could help you make the most of it.

A native DEX on Twitter will transform the platform into an ‘everything app,’ which Elon Musk has gone on record to say was his goal.

Another reason to believe that we could soon see X turning into a full-blown financial ecosystem is Linda Yaccarino, CEO of X, who recently confirmed that in-app tipping, payments, and investing are already in the pipeline.

For X users, this could mean enhanced financial privacy, total control over their funds, and lower transaction fees, as well as the ability to trade stablecoins, $BTC, $ETH, and other tokenized assets directly from within the X app.

Although Musk hasn’t officially confirmed the decentralized exchange, users have spotted a GitHub code snippet on X that suggests a DEX is already in the works.

Integrating a DEX into X (a platform with 650M active monthly users) will crank up crypto’s visibility and mainstream adoption.

Also, let’s not forget Musk’s crypto effect. Just a couple of weeks back, he uploaded a clip from a video game where his character was named Kekius Maximus. As a result, $KEKIUS tokens soared almost instantly.

So, if Musk’s DEX supports or even mentions specific tokens, those could very easily emerge as the top trending cryptos.

With that in mind, here are the best cryptos to buy now to benefit from the hype around a revolutionary X DEX.

Snorter Token ($SNORT) could be the next crypto to explode thanks to its one-of-a-kind Telegram trading bot that comes with advanced tools, tight security, and a top-notch user experience.

Snorter’s biggest selling point is its ability to swipe liquidity in new meme coins.

In our experience, doing so manually, i.e., without Snorter Bot, would be nearly impossible because institutional crypto investors eat up all the liquidity in new tokens using advanced tools.

By allowing you to buy meme cryptos as soon as they’re listed, Snorter gives you the opportunity to make huge gains that are generally associated with price jumps in freshly listed altcoins.

Additionally, $SNORT token holders will benefit from reduced trading fees: just 0.85%, which is noticeably lower than the industry standard of 1%.

Snorter Bot is a force to reckon with in terms of security, too.

From routing your swaps through a private Solana RPC infrastructure to using MEV-resistant relays and other techniques to protect you against sandwich attacks, honeypots, and scams, it’s a complete package.

Buy Snorter Token now for just $0.0961 each. The project is currently in presale, and it has raised over $1.16M.

Speaking of crypto apps that could revolutionize the DeFi space, Best Wallet is a free crypto wallet offering a secure and seamless user experience, as well as the ability to buy new meme coins on presale directly from within the app.

Powered by the Best Wallet Token ($BEST), Best Wallet is self-custodial. This simply means that it doesn’t belong to any company or crypto exchange, so no one has access to your crypto except you.

Other security measures include advanced cryptographic techniques (Fireblock’s MPC-CMP wallet technology) and two-factor authentication/biometrics for app login.

You can make the most of Best Wallet’s growth trajectory by buying $BEST, the token that powers its ecosystem. It’s currently available for just $0.025215, with the presale having raised over $13.4M so far.

XRP, the fourth biggest crypto in terms of market capitalization, has been in a massive consolidation zone for the past few months.

Expert traders (such as Crypto Beast on X) believe that a breakout of this zone could see the token explode 300% and reach $8. $XRP is currently trading around $2.11.

A huge reason for this bullish bias is the recent approval of a spot XRP ETF by Canada’s Ontario Securities Commission (OSC). It will soon be launched on the Toronto Stock Exchange (TSX).

Also, approximately 2,700 whales now hold more than 1M $XRP, which is the highest ever. And XRP’s active addresses have also increased to 295K per day, as compared to 35K-40K in the previous few months.

With Elon Musk planning to blur the lines between finance and communication by building a decentralized exchange (DEX) on X, we could see an unprecedented number of users entering Web3 and decentralized finance.

That said, bear in mind that crypto investments are risky because of the market’s volatility and uncertainty. This article isn’t financial advice, and you must always do your own research before investing.

Written by Paul L. on . Posted in Canada. Leave a Comment

Canada’s first spot XRP exchange-traded fund (ETF), launched by Purpose Investments under the ticker XRPP.U, has had a tough start since debuting on the Toronto Stock Exchange (TSX) on June 18.

This product is the world’s second spot XRP ETF, following Brazil’s Hashdex offering.

Notably, the Purpose XRP ETF closed 1.63% lower at $9.68 on Friday, June 20, 2024, extending its post-launch decline as light trading kept it near its session low.

Since its launch, the new fund, also available in CAD-hedged (XRPP) and CAD non-hedged (XRPP.B) versions, has mostly trended lower, reflecting XRP’s overall market performance.

This aligns with the performance of the Brazilian ETF, which has fallen about 7.50% since its debut, partly due to weaknesses in the underlying XRP token.

Purpose’s new ETFs have a management fee of 0.69%, capped at 0.89%, with any savings passed on to investors. For Canadians, the funds can also be held in tax-friendly accounts like TFSAs and RRSPs, giving investors easy crypto exposure within traditional portfolios.

These new products have had little effect on XRP’s price so far, likely because Canada and Brazil have much smaller financial markets than the United States.

Looking ahead, U.S. regulators are paying more attention to launching their spot XRP ETFs, with several applications under consideration.

To this end, the Securities Exchange Commission (SEC) recently invited public comments on Franklin Templeton’s and WisdomTree XRP Trust’s proposed XRP and Solana ETFs. If approved, these ETFs would trade on Cboe’s BZX Exchange.

Meanwhile, both existing XRP ETFs continue to trade in sync with XRP, which is under bearish pressure. At press time, the asset was valued at $2.13, down nearly 1%, and over the past week, it has lost about 1.7%.

From a technical perspective, XRP is trading below its 50-day simple moving average (SMA) of $2.30. This shows short-term weakness and sustained downward pressure. However, it is still well above its 200-day SMA of $1.85, indicating that its long-term uptrend remains intact and the broader outlook is still positive.

Additionally, the 14-day Relative Strength Index (RSI) is at 45.07, a neutral level that suggests XRP is neither overbought nor oversold.

Featured image via Shutterstock

Written by Date on . Posted in Canada. Leave a Comment

Cannot view this video? Visit:

Morguard, a fully integrated real estate company with $18.7 billion in assets under management and 1,100 professionals, owns, manages, develops, and provides advisory services to high-quality, well-located assets across North America. Morguard also currently owns a 67.0% interest in Morguard Real Estate Investment Trust and a 47.9% effective interest in Morguard North American Residential Real Estate Investment Trust. For half a century, Morguard has dedicated themselves to creating value, fostering partnerships, and delivering excellence across North America.

MEDIA CONTACT:

Susanne DesRochers

Head of Marketing and Communications

…

416-312-4670

To view the source version of this press release, please visit

SOURCE: Toronto Stock Exchange

MENAFN20062025004218003983ID1109702610

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Written by Florence Muchai on . Posted in Canada. Leave a Comment

Bloomberg analysts James Seyffart and EricBalchunas have raised the odds for altcoin exchange-traded funds (ETFs) approval to 90% following recent engagement with the US Securities and Exchange Commission (SEC). The analysts are confident in spot XRP, Dogecoin, and Cardano ETFs.

“Eric Balchunas and I are raising our odds for the vast majority of the spot crypto ETF filings to 90% or higher,” Bloomberg ETF Analyst James Seyffart said on X. “Engagement from the SEC is a very positive sign in our opinion.”

NEW: @EricBalchunas & I are raising our odds for the vast majority of the spot crypto ETF filings to 90% or higher. Engagement from the SEC is a very positive sign in our opinion pic.twitter.com/5dh8G8rK6Y

— James Seyffart (@JSeyff) June 20, 2025

It all began with the approval of spot BTEC ETFs, which received a green light in 2024 after years of deliberation. It allowed investors to own BTC in traditional financial products directly. With the growing interest in crypto investments, the potential approval of spot altcoin ETFs could further expand the market.

Several spot crypto ETF filings are now awaiting approval from the pro-crypto SEC. Others are LEFT, Cardano, Polkadot, HBAR, Avalanche, and SUI—Paul Atkins, who became the agency’s new chairman in April. Since taking over, Atkins has promised a friendlier approach to digital assets.

The analysts noted that the SEC has already acknowledged the 19b-4 forms for these applications and likely views the underlying altcoins as commodities. They also pointed to Commodity Futures Trading Commission-regulated futures markets that already exist for many assets.

On the Polymarket, a prediction site, users are now betting that the Ripple ETF will be approved by the end of the year. The odds are also at 90%. This is a 19% surge from the previous odds, which suggests that buyers are becoming more confident.

Currently, Bitcoin and Ethereum-based ETFs are a big part of the market. However, XRP’s progress toward becoming an ETF could provide good competition.

If the ETF is approved, XRP would be bought and sold on traditional stock exchanges like any other security. Holders would not have to handle their crypto wallets directly. This makes it easier for small investors to enter and lets institutional capital come in without directly investing in crypto.

The next few months could be very important for getting ready for what could be the biggest crypto event of the year. As for timing, analysts say approvals could arrive within weeks or closer to final deadlines later this year. Most applications have their final SEC decision dates in October and November.

However, earlier this week, the US SEC said it would take an extra 35 days to decide whether to accept or reject Franklin Templeton’s spot XRP filing. Instead, it opened a comment period for the ETF and proposed a spot Solana ETF from the same firm.

While there’s still a delay in approving the spot XRP ETF in the US, the 3iQ XRP ETF was launched on the Toronto Stock Exchange on Wednesday. As reported by Cryptopolitan, XRPQ started without a management fee for the first six months.

This made it one of the most affordable digital asset exchange-traded funds (ETFs). It will only put money into long-term holdings of XRP bought from trustworthy over-the-counter (OTC) counterparties and digital asset trading sites.

Seyffart and Balchunas also assigned a 95% probability of approval to crypto basket or index ETF filings within the next six months by Grayscale, Hashdex, Bitwise, and Franklin Templeton. Several of these applications are approaching their final SEC deadlines in early July.

KEY Difference Wire helps crypto brands break through and dominate headlines fast

Written by Murtuza J Merchant on . Posted in Canada. Leave a Comment

Investor optimism surrounding a potential XRP XRP/USD exchange-traded fund (ETF) has reached new heights.

What Happened: Bettors on the Polymarket prediction platform are assigning an 89% chance of U.S. approval for XRP ETF by the end of 2025.

This surge in confidence, up from 70% earlier this year, reflects growing expectations that XRP could soon join Bitcoin BTC/USD and Ethereum ETH/USD in the ETF arena, potentially reshaping the altcoin market.

Trading activity on Polymarket has also intensified, with volumes exceeding $95,000, signaling strong market interest driven by regulatory developments and insider sentiment.

An XRP ETF would allow investors to gain exposure to the cryptocurrency through traditional stock exchanges, eliminating the need for managing digital wallets.

Why It Matters: If approved, an XRP ETF could serve as a pivotal moment for Ripple — the company that created it — and pave the way for greater institutional adoption.

For traders, anticipating ETF approval will likely fuel volatility, creating opportunities for significant price movements as the decision deadline nears.

However, the U.S. Securities and Exchange Commission (SEC) delayed its decision on Franklin Templeton‘s proposed spot XRP ETF by 35 days. Instead, it opted to open a public comment period.

This delay also affects Franklin Templeton’s proposed spot Solana ETF.

Despite the postponement, 3iQ XRP ETF was launched on the Toronto Stock Exchange on June 18 this year.

The rising odds of U.S. approval highlight a broader trend of cryptocurrencies transitioning into regulated investment vehicles.

Bitwise and Grayscale have also filed for XRP-related investment products. No approvals have been granted in the U.S. as yet.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Written by Shanny Basar on . Posted in Canada. Leave a Comment

A landmark rollout further reinforces 3iQ’s track record as a trusted innovator in delivering regulated, first-to-market digital asset investment solutions.

Ripple, the leader in enterprise blockchain and crypto solutions, is an early investor in the fund.

The 3iQ XRP ETF (TSX: XRPQ, XRPQ.U), which launches with a 0% management fee for the first six months, provides exposure to a digital asset that has grown by 10,800% since January 2015.

3iQ rang the closing bell at the Toronto Stock Exchange to mark XRPQ’s first day of trading.

3iQ Corp., a global pioneer in digital asset investment solutions, is pleased to announce the launch of the 3iQ XRP ETF (TSX: XRPQ, XRPQ.U), which began trading on the Toronto Stock Exchange (TSX). The 3iQ team rang the closing bell on 18 June on the TSX floor to commemorate this historic launch. XRPQ is one of the first exchange-traded fund (ETF) in North America to provide investors with exposure to XRP, the third-largest digital asset by market capitalization.

Ripple, the leader in enterprise blockchain and crypto solutions, is an early investor in the fund. 3iQ’s new ETF enables investors to gain long-term exposure to XRP in a transparent and cost-effective way.

XRPQ debuts with a 0% management fee for the first six months, placing it among the most competitively priced digital asset ETFs. It will invest only in long-term holdings of XRP purchased from reputable digital asset trading platforms and over-the-counter (OTC) counterparties. The underlying assets will be fully secured in standalone cold storage. XRPQ is available for investment through registered accounts in Canada, and its TSX listing enables access for qualified investors globally, subject to local regulations.

“The launch of XRPQ marks another milestone in our mission to provide investors with convenient, cost-effective access to digital assets within a regulated framework,” said Pascal St-Jean, President and CEO of 3iQ. “XRP has demonstrated significant growth potential over the past decade, and this groundbreaking strategy offers Canadian and qualified global investors a transparent, low-cost and tax-efficient way to securely access that opportunity. Ripple Labs’ investment support reflects our shared leadership in advancing the digital asset space.”

XRP is the native digital asset of the XRP Ledger, an open-source blockchain designed for high-speed, low-cost payments across borders. The XRPL consistently settles transactions in three to five seconds, with fees often less than a fraction of a cent. Since January 2015, XRP’s price has climbed from $0.02 to over $2.19, an increase of more than 10,800%. Ongoing regulatory clarity and growing institutional interest have positioned the XRPL to solve real-world use cases such as global remittances, liquidity management, and broader blockchain applications.

Earlier this year, 3iQ launched the 3iQ Solana Staking ETF (TSX: SOLQ), which invests in long-term Solana (SOL) holdings while delivering staking rewards. SOLQ quickly became the largest Solana ETF following its launch and as of June 12, 2025 has over $120 million USD in assets under management.

Source: 3iQ

A reminder as Canadians begin trading the 3iQ XRP ETF today: regulatory clarity drives innovation. Canada had the world’s first Bitcoin ETF in 2021. Now it beat the US with an XRP ETF. It’s way past time for the US to catch up and get crypto market structure legislation done.

— paulgrewal.eth (@iampaulgrewal) June 18, 2025

And receive exclusive articles on securities markets

Written by TSX Stocks on . Posted in Canada. Leave a Comment

DeLisle Worrell.

IN the Barbados Daily Nation newspaper of May 12, 2025, there is the headline “Top Sagicor execs paid $13.9m”. A visitor to Barbados might wonder why this would be of interest to Barbadian readers, because Sagicor is a wholly-owned Canadian insurance company; 50 per cent of its assets are in Canada, another quarter in the USA, and of the remainder, the largest share is in Jamaica, not in Barbados. None of the “top execs” referred to in the headline is Barbadian. Barbadians, however, will know that this modest-sized Canadian company is the modern incarnation of the Barbados Mutual Life Assurance Society, born in Bridgetown in 1840. By 1997 when the company’s history entitled The Rise of the Phoenix was published, it stood at the pinnacle of the Barbadian financial system.

In its heyday in the 1960s and 1970s, the managing directors of the Barbados Mutual were among the leading bankers and captains of industry and commerce whose remit covered all areas of finance and trade, not only in Barbados but throughout the Caribbean. Daily at lunchtime, these business leaders walked from their offices on Broad St to the Mutual’s distinctive cast iron headquarters building at the west end of the street, entering through an unobtrusive side door and heading upstairs to the Bridgetown Club. There they could enjoy a lunch that regularly featured the club’s famous fried melts and Bajan soup with sweet dumplings and breadkind, and take a sip or two of corn ‘n’ oil, as they discussed the region’s economic fortunes. In those days banks’ Eastern Caribbean offices located in Barbados had a wide scope of authority for the management of their local portfolios, and there were a sizeable number of Barbadian and regional companies with networks across the Caribbean, whose presence marked Bridgetown as a thriving financial and commercial centre.

Over the course of the 21st century much has changed. The Barbados Mutual’s directors and membership made the change from a mutual society to a corporation whose shares were traded on the regional securities exchanges. Over time, with different exchange rates and low trading volumes, especially on the Barbados exchange, it became more efficient to trade on a single larger securities exchange outside the Caribbean. This prompted the move to the Toronto exchange. Other Barbadian multinational firms and insurance companies have also made the decision to sell to Canadian interests. Yet others have failed or have been bought by regional or foreign interests.

The transformation of Sagicor has arguably made it a stronger company, by virtue of the extraordinary growth which the listing in Toronto has made possible. When the company was first listed on the Toronto Stock Exchange just six years ago its assets were a little short of US$9 billion; today it has grown to two and a half times that size. Backed by assets and reserves in the Canadian financial market, its capacity to cover risks may be even higher than the growth in its assets suggests. In addition, operating under the surveillance of the highly-regarded Canadian Office for Supervision of Financial Institutions lends Sagicor a degree of credibility beyond what Barbados and the rest of the Caribbean can offer. It was from that Canadian institution that the region learned supervisory skills.

Although the number of Barbadian-owned multinationals has dwindled, the services they once provided are still available. The Barbados Mutual Life Assurance Society is no more, but Sagicor Life provides Jamaicans, Barbadians and others in the Caribbean with the full range of insurance products available in the North American market. Commercial banks have curtailed personal banking services in favour of online banking and credit and debit cards, leaving credit unions and other non-banks as the main providers of face-to-face services. A wide variety of new trade and distributional channels are replacing the Caribbean’s traditional trading, wholesale and retailing businesses.

It may be that not much has been lost with the demise of the household names of the twentieth century, except the pride of local ownership.

DeLisle Worrell is a former governor of the Central Bank of Barbados. His Economic Letters may be found under “Commentary” at DeLisleWorrell.com.

Written by Date on . Posted in Canada. Leave a Comment

Cannot view this video? Visit:

CIRI’s Annual Conference is the second-largest gathering of IR practitioners in the world. Over two days of programming, the conference will bring together industry leaders and IR experts that offer their views and advice during numerous breakout sessions, panel discussions and presentations.

CIRI is a professional, not-for-profit association of executives responsible for communication between public corporations, investors and the financial community. With four Chapters and close to 400 members across Canada, CIRI is the world’s third-largest society of investor relations professionals.

MEDIA CONTACT:

Nathalie Megann, CPIR

President & Chief Executive Officer

CIRI

416.364.8200 x101

…

To view the source version of this press release, please visit

SOURCE: Toronto Stock Exchange

MENAFN19062025004218003983ID1109698457

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments