‘Govt. can’t prevent companies from flipping mining projects’

‘Govt. can’t prevent companies from flipping mining projects’

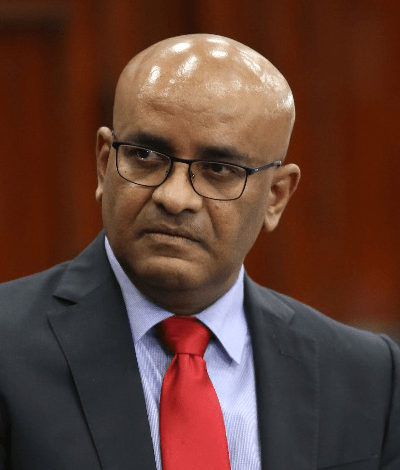

… VP Jagdeo in response to Canadian firm selling 57% shares in gold project for US$638M

Kaieteur News – Responding to concerns raised in relation to Canadian mining company, Reunion Gold Corporation selling 57% of its shares of its gold project for some US$638 million, days after disclosing the signing of a US$1 million Mineral Agreement with the Government of Guyana (GoG) – Vice President (VP), Bharrat Jagdeo, has stated that ‘flipping’ is not unusual particularly in the mining industry and it is something the Government of Guyana (GoG) cannot prevent.

When asked last Thursday about the announcement made by Reunion selling majority shares of its Oko West gold project located in Region Seven (Cuyuni-Mazaruni), to fellow Canadian company, G Mining Ventures Corporation (GMIN), Jagdeo first noted that is he not aware of such a development. He continued, “I don’t know who is walking away with six-something but…remember we dealt with the issue of flipping…” the Vice President added, “I pointed out that this is not unusual in many parts of the world so I have no doubt that a company may be selling a project here…I doubt the figure.”

Jagdeo said too, “I’m saying, I’m not aware of any flipping but flipping is not something you have to consult the government of Guyana on, and I am saying that I doubt Kaieteur News have the story accurate, I’m prepared to put my head on the block that Kaieteur has it inaccurate.”

It should be noted that on April 22, Reunion itself announced that it entered into a definitive agreement with GMIN, through which a company (New GMIN) will be created for the Oko West project. Upon completion of the transaction, GMIN will hold the majority stake in a new combined entity, with a 57% ownership, while Reunion shareholders will retain a 43% stake. Reunion said that the deal is valued C$875 million, which is equivalent to about US$638 million.

Meanwhile, what Guyana receives from the deal with Reunion is US$1 million for signing the Mineral Agreement with the company; the state receives tax and a royalty of 5% if the gold price is below US$1,000 per ounce and 8% if the gold price is above US$1,000 per ounce. Under the terms of the agreement, Reunion is granted stable fiscal and operational conditions throughout the project’s lifespan. Jagdeo said, “Kaieteur News argued every time that the big mining contracts be put up on the website. I asked (Senior Minister) Ashni Singh to put up everyone…” It should be noted that the Mineral Agreement with Reunion Gold is not available on the website.

According to the Vice President, Reunion will have a similar contract to other large-scale mining contracts which he said is a standard agreement in Guyana. In fact, he said the terms for Reunion mirrors the terms of the contract the government signed with Troy Resources, the Australian company that abandoned its mining project in Guyana.

“But let me tell you what the key elements are if you just examine them (mining contacts) they deal with the tax concessions that they get, so they do get tax concessions for the development of the mine and the tax obligation to the state. So the tax obligation to the state is clearly outlined in the document…so as per the agreement, anything that is in the agreement we will get…” Jagdeo stated.

Moreover, he went on to explain past instances of flipping in the oil and gas sector. In relation to that sector, Jagdeo underscored that a signing bonus is attached to the exploration licenses of US$10 million and US$20 million. “Just to explore you have to pay a signing bonus now so we put in a big signing bonus there, because you can’t prevent people from going for partnerships…even if they flip, the state earns (from the signing bonus) because you can’t prevent that from happening,” he added.

Kaieteur News had reported that Reunion Gold is actively considering both open-pit and underground mining. The company aims to reach a construction decision by 2025, marking another crucial milestone in its journey toward operational readiness in Guyana’s gold industry. The Canadian mining company has firmly set its eyes on reaching gold production at its Oko West Gold Project by 2027. The company has an estimated 4.2 million ounces of gold. In February 2024, Reunion announced an updated Mineral Resource Estimate (MRE) containing a total of 4.3 M oz. of gold in Indicated Resources grading 2.05 g/t and 1.6 M oz. of gold in Inferred Resources grading 2.59 g/t. The February 2024 MRE includes an underground Resource containing 1.1 M oz. of gold at a grade of 3.12 g/t Au in the Inferred category.

GMIN & Reunion Agreement

With hopes of establishing its presence in South America, GMIN is set to acquire the majority share of Reunion’s Gold Oko West project by Q3 2024, subject to the receipt of required security holder, court and Toronto Stock Exchange (TSX) approvals and other closing conditions customary in transactions of this nature. Also, the agreement includes reciprocal deal protections and a reciprocal C$31.2 million termination fee payable under certain circumstances.

The Canadian companies entered into the agreement to combine the two companies, with hopes of setting the stage for the creation of a leading intermediate gold producer, particularly in the Guiana Shield region.

GMIN team including through the Gignac Family-owned G Mining Services (GMS), which has an impressive track-record of executing world-class projects in the Guiana Shield region to generate industry leading returns for its stakeholders. GMIN says it plans to move Oko West quickly through technical studies to a construction decision, leveraging the considerable amount of exploration, development, and permitting work that has already been completed by Reunion, supported by the expected free cash flow from the Tocantinzinho Gold Project in Para state, Brazil which is on schedule and on budget for commercial production in the second half of 2024.

In addition, Reunion shareholders will receive common shares in a newly created gold explorer (SpinCo) that will hold all of Reunion’s assets other than Oko West. Notably GMIN has agreed to fund SpinCo with C$15 million.

Louis-Pierre Gignac, Chief Executive Officer (CEO), President of GMIN, speaking on the deal with Reunion said, “Oko West has all the key attributes GMIN is looking for in its next leg of growth. We are well-positioned to accelerate value creation at Oko West leveraging our unique expertise in building and operating mines on schedule and on budget in the Guiana Shield, deep knowledge of and network in the region, and over US$480M anticipated near-term free cash flow from Tocantinzinho. The acquisition of Oko West is the second step towards our vision of becoming a leading intermediate gold producer, building on the team’s success at Tocantinzinho. We look forward to continuing to advance our Buy. Build. Operate strategy to create and unlock further value for GMIN shareholders.”

For his part, Rick Howes, Chief Executive Officer (CEO) and President of Reunion said: “We are very pleased to announce this Transaction today, which we believe is a testament to the outstanding work our team has done rapidly discovering and advancing Oko West over the last few years. We believe that this Transaction not only delivers our shareholders an attractive upfront premium, but also the ability to participate with significant ongoing ownership in the combined company, having the opportunity to participate in an expected future re-rating as Oko West is advanced towards production.”

He continued, “The transaction significantly de-risks the advancement of Oko West given the financial strength, free cash flow, and development capabilities that GMIN brings to the table. Importantly, we believe this is a great outcome for the country of Guyana, with Oko West being taken forward by a company that will be a great steward of the asset for the benefit of the country and its communities.”

Another Deal

China’s Zijin Mining recently said it would acquire Guyana Goldfields for C$323 million ($238 million), bringing an end to a protracted takeover battle for the Canada-listed gold miner.

Toronto-based Guyana Goldfields announced on June 3 that it had received a binding proposal from an unnamed overseas-based miner to acquire the company, valuing it around 35% higher than a previously accepted offer from Silvercorp Metals.