Arizona Metals Announces 2025 Mineral Resource Estimate for Kay Mine Project

Arizona Metals Corp. (TSX:AMC, OTCQX:AZMCF) (the “Company” or “Arizona Metals”) is pleased to announce an initial Mineral Resource Estimate (“MRE”) for its 100% owned Kay Mine Project (the “Kay Project”) located in Yavapai County, Arizona. Highlights of the Kay Project MRE are as follows:

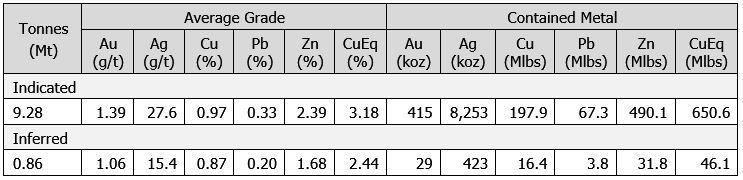

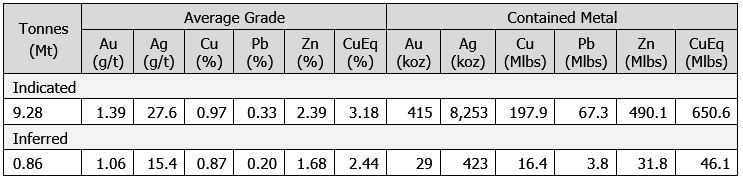

- The underground MRE includes 9.28 million tonnes grading 1.39 g/t Au, 27.6 g/t Ag, 0.97% Cu, 0.33% Pb, and 2.39% Zn in the Indicated category, and 0.86 million tonnes grading 1.06 g/t Au, 15.4 g/t Ag, 0.87% Cu, 0.20% Pb, and 1.68% Zn in the Inferred category, at a base-case cut-off grade of 1.00 % CuEq.

- Copper equivalent MRE grades are 9.28 million tonnes @ 3.18% CuEq in the Indicated category and 0.86 million tonnes @ 2.44% CuEq in the Inferred category.

- Quality Asset: High grade, with good geometry and continuity suitable for bulk underground mining methods.

- Camp Potential: The initial MRE sits within less than 5% of the 10-km long strike of folded prospective host rocks in the Kay Project.

- Infill Potential: This initial MRE has clear potential to expand between existing drill holes within the deposit, and to upgrade Inferred resource

- Expansion Potential: The deposit remains open for expansion beyond this initial MRE both along strike and at depth.

- Continued Advancement: Following the completion of additional metallurgical testwork, a preliminary economic assessment (“PEA”) is planned for release in the second half of 2025.

- The Company is delivering and executing on all of its previously-stated goals for 2025 and looks forward to continuing the development of the Company’s strong assets.

Duncan Middlemiss, President and CEO of Arizona Metals, comments: “The release of our initial Mineral Resource Estimate marks a major milestone for Arizona Metals and validates not only the scale, but more importantly, the quality of the Kay Project. With over 650 million pounds of copper equivalent in the Indicated category alone—and with the deposit remaining open in multiple directions—we see significant opportunity for expansion through continued drilling. We believe this resource represents just the beginning. With a strong treasury and a PEA on track for release later this year, we’re excited to advance the Kay Project toward becoming one of the top undeveloped VMS projects in the U.S.”

Table 1. Kay Mine Property Underground Mineral Resource Estimate at a Base-case Cut-off Grade of 1.00% CuEq, June 17, 2025

Kay Mine Property Mineral Resource Estimate Notes:

- The effective date of the Kay Mine Project Mineral Resource Estimate (MRE) is June 17, 2025. This is the close-out date for the final mineral resource drilling database.

- The mineral resource was estimated by Allan Armitage, Ph.D., P. Geo. of SGS Geological Services, an independent Qualified Person as defined by NI 43-101. Armitage conducted site visits to the Kay Mine property on two occasions, on October 25-26, 2023, and April 7-8, 2024. The mineral resource was peer reviewed by Ben Eggers, MAIG, P.Geo. of SGS Geological Services, an independent Qualified Person as defined by NI 43-101. Eggers conducted a site visit to the Kay Mine property on May 30, 2025.

- The classification of the current MRE into Indicated and Inferred mineral resources is consistent with current 2014 CIM Definition Standards – For Mineral Resources and Mineral Reserves.

- All figures are rounded to reflect the relative accuracy of the estimate and numbers may not add due to rounding.

- All mineral resources are presented undiluted and in situ, constrained by continuous 3D wireframe models (considered mineable shapes), and are considered to have reasonable prospects for eventual economic extraction.

- Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that most Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- The Kay Mine Project MRE is based on a validated drill hole database which includes data from 234 surface diamond drill holes completed between 2020 and May 2025. The drilling totals 133,912 m (including wedge holes). The resource database totals 11,533 assay intervals representing 14,006 m of data.

- Grades for Au, Ag, Cu, Pb and Zn are estimated for each mineralization domain using 1.50 m capped composites assigned to that domain. To generate grade within the blocks, the inverse distance squared (ID2) interpolation method was used for all domains.

- Average density values were assigned to each domain based on a database of 2,307 samples.

- Based on the size, shape, and orientation of the deposit, it is envisioned that the deposits may be mined using underground bulk mining methods such as Longhole Stoping. The MRE is reported at a base case cut-off grade of 1.00 % CuEq. The mineral resource grade blocks are quantified above the base case cut-off grade and within the constraining mineralized wireframes (considered mineable shapes).

- The underground base case cut-off grade of 1.00% CuEq considers metal prices of $4.10/lb Cu, $1.00/lb Pb, $1.35/lb Zn, $2,200/oz Au and $26/oz Ag, metal recoveries of 92% for Cu, 76% for Pb, 85% for Zn, 76% for Au and 75% for Ag, a mining cost of US$49.00/t rock and processing, treatment and refining, transportation and G&A cost of US$29/t mineralized material.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

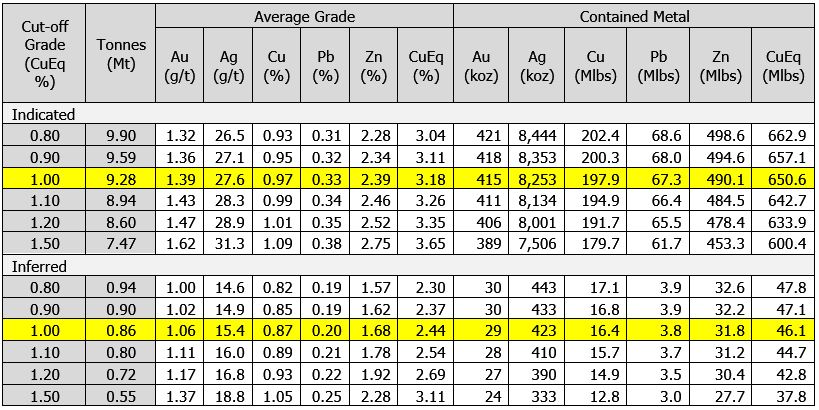

Table 2. Kay Mine Property Underground Mineral Resource Estimate at Various CuEq% Cut-off Grades, June 17, 2025

- Underground mineral resources are reported at a base case cut-off grade of 1.00% CuEq. Values in this table reported above and below the base case cut-off grades should not be misconstrued with a Mineral Resource Statement. The values are only presented to show the sensitivity of the block model estimate to the base case cut-off grade.

- All values are rounded to reflect the relative accuracy of the estimate, and numbers may not add due to rounding.

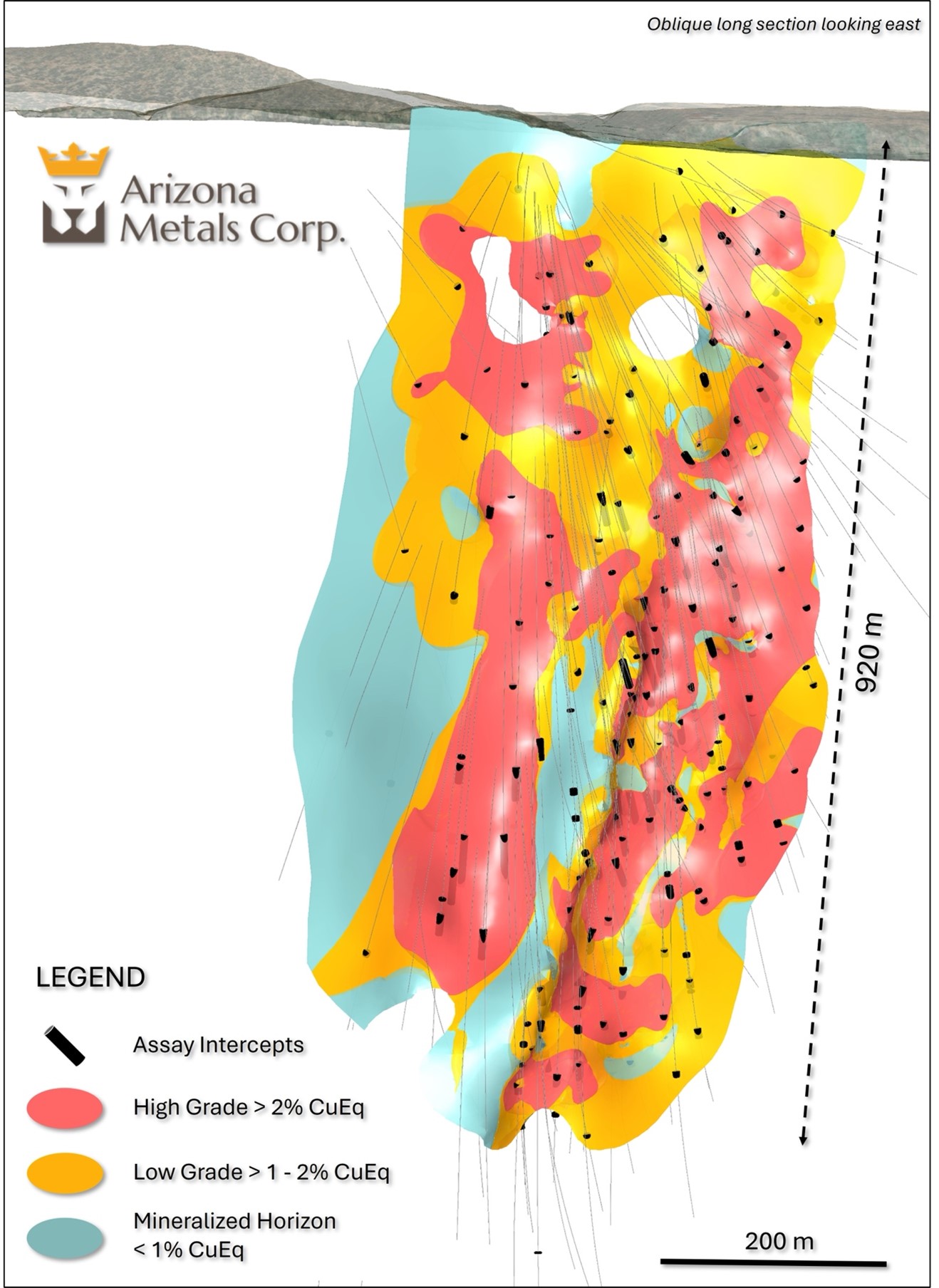

Figure 1. Oblique section looking northeast, showing the MRE and average grade shells of >2% CuEq (orange) and 1-2% CuEq (yellow). See Tables 1 and 2 for constituent metals, contained metals, and cutoff-grade sensitivity.

The Company is fully-funded to complete its planned drilling through the end of 2025 and is on track to deliver a PEA in the second half of 2025, for the Kay Project. G Mining Services Inc. (“G Mining”) has audited the MRE and has been engaged to complete the PEA. The current phase of resource drilling is complete, and the Company has mobilized the two drill rigs to the Kay North Extension target, to be followed by drilling on the North-Central and Western Targets at the Kay Project. These areas will be drilled for the first time from newly-permitted and strategically-positioned drill pads, designed to optimize targeting and access. The Company plans 10,000 m of exploration drilling at these targets with holes ranging from 300 m to 900 m in depth. The Company has chosen these high-priority targets based on analysis of geologic, geochemical, and geophysical exploration data generated to date on the project.

Additionally, 5,000 m of reverse circulation drilling is planned at the Company’s Sugarloaf Peak Gold Project (the “Sugarloaf Peak Project”) in La Paz County, Arizona. Drilling and road-construction contractors have been chosen for the Sugarloaf Peak Project, and the Company is preparing to mobilize crews during Q3.

About Arizona Metals Corp

Arizona Metals Corp owns 100% of the Kay Project in Yavapai County, which is located on 1669 acres of patented and BLM mining claims and 193 acres of private land that are not subject to any royalties. The Kay Project is a steeply dipping VMS deposit that has been defined from a depth of 60 m to at least 900 m. It is open for expansion on strike and at depth.

The Company also owns 100% of the Sugarloaf Peak Project, in La Paz County, which is located on 4,400 acres of BLM claims. The Sugarloaf Peak Project is a heap-leach, open-pit target and has a historic estimate of “100 million tons containing 1.5 million ounces gold” at a grade of 0.5 g/t (Dausinger, N.E., 1983, Phase 1 Drill Program and Evaluation of Gold-Silver Potential, Sugarloaf Peak Project, Quartzsite, Arizona: Report for Westworld Inc.)

The historic estimate at the Sugarloaf Peak Project was reported by Westworld Resources in 1983. The historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

Qualified Person and Quality Assurance/Quality Control

The mineral resource was estimated by Allan Armitage, Ph.D., P. Geo. of SGS Geological Services, an independent Qualified Person as defined by NI 43-101. Armitage conducted site visits to the Kay Mine property on two occasions, on October 25-26, 2023, and April 7-8, 2024. The mineral resource was peer reviewed by Ben Eggers, MAIG, P.Geo. of SGS Geological Services, an independent Qualified Person as defined by NI 43-101. Eggers conducted a site visit to the Kay Mine property on May 30, 2025.

All of Arizona Metals’ drill sample assay results have been independently monitored through a quality assurance/quality control (“QA/QC”) protocol which includes the insertion of blind standard reference materials and blanks at regular intervals. Logging and sampling were completed at Arizona Metals’ core handling facilities located in Phoenix and Black Canyon City, Arizona. Drill core was diamond sawn on site and half drill-core samples were securely transported to ALS Laboratories’ (“ALS”) sample preparation facility in Tucson, Arizona. Sample pulps were sent to ALS’s labs in Vancouver, Canada, and Reno, Nevada, for analysis.

Gold content was determined by fire assay of a 30-gram charge with ICP finish (ALS method

Au-AA23). Silver and 32 other elements were analyzed by ICP methods with four-acid digestion (ALS method ME-ICP61a). Over-limit samples for Au, Ag, Cu, and Zn were determined by ore-grade analyses Au-GRA21, Ag-OG62, Cu-OG62, and Zn-OG62, respectively.

ALS Laboratories is independent of Arizona Metals Corp. and its Vancouver and Reno facilities are ISO 17025 accredited. ALS also performed its own internal QA/QC procedures to assure the accuracy and integrity of results. Parameters for ALS’ internal and Arizona Metals’ external blind quality control samples were acceptable for the samples analyzed. Arizona Metals is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data referred to herein.

The qualified person who devised and monitored the Company’s QA/QC program is David Smith, CPG, a qualified person as defined in National Instrument43-101 – Standards of Disclosure for Mineral Projects. Mr. Smith is the Vice-President, Exploration of the Company. Mr. Smith supervised the drill program and verified the data disclosed, including sampling, analytical, and QA/QC data underlying the technical information in this news release, including reviewing the reports of ALS, methodologies, results, and all procedures undertaken for quality assurance and quality control in a manner consistent with industry practice, and all matters were consistent and accurate according to his professional judgement. There were no limitations on the verification process.

Disclaimer

This press release contains statements that constitute “forward-looking information” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements contained in this press release include, without limitation, statements regarding the expansion potential of the Kay Project, statements regarding drill results and future drilling at the main Kay Project, and at additional targets including the North, North-Central and Western Targets at the Kay Project, and expansion drilling targets on the Kay Project, , statements regarding drilling and other exploration activity on the Sugarloaf Peak Gold Project, statements regarding completion of a PEA in H2 2025 or at all, statements regarding execution of the Company’s plans for 2025 and the achievement of targeted milestones. In making the forward- looking statements contained in this press release, the Company has made certain assumptions. Although the Company believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: availability of the Company to stay well funded; delay or failure to receive required permits or regulatory approvals; and general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward- looking statements or otherwise.

THE TORONTO STOCK EXCHANGE HAS NEITHER REVIEWED NOR ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

Not for distribution to US newswire services or for release, publication, distribution or dissemination directly, or indirectly, in whole or in part, in or into the United States

For further information, please contact:

Morgan Knowles

Vice President of Investor Relations

(647) 202-3904

mknowles@arizonametalscorp.com

or

Duncan Middlemiss

President and CEO

dmiddlemiss@arizonametalscorp.com

https://x.com/ArizonaCorp

Resource World Magazine Inc. has prepared this editorial for general information purposes only and should not be considered a solicitation to buy or sell securities in the companies discussed herein. The information provided has been derived from sources believed to be reliable but cannot be guaranteed. This editorial does not take into account the readers investment criteria, investment expertise, financial condition, or financial goals of individual recipients and other concerns such as jurisdictional and/or legal restrictions that may exist for certain persons. Recipients should rely on their own due diligence and seek their own professional advice before investing.