↵

Image Source: Pixabay

The goal of rational investors is to maximize total return.

Total return is the complete return of an investment over a given time period. It includes all capital gains and any dividends or interest paid.

The 3 aspects of total return for stocks are:

- Dividends

- Change in earnings-per-share

- Change in the price-to-earnings multiple

We calculate expected total returns using the 3 aspects of total return for more than 600 securities in The Sure Analysis Research Database.

While we currently rate many of the stocks we cover as buys, due to expected annual returns above 10%, many are rated as holds due to mediocre returns.

Additionally, there are also plenty of stocks we currently rate as sells.

Typically, low (or negative) projected total return is due to overvaluation. Put simply, many of the stocks we rate as sells are overvalued, due to their high current valuations.

Buying overvalued stocks can result in low, or negative, future returns, even with a high dividend yield.

With that in mind, this article will cover 10 high dividend stocks we currently rate as sells according to their low projected total returns.

The list is sorted by annual expected returns over the next five years, from lowest to highest.

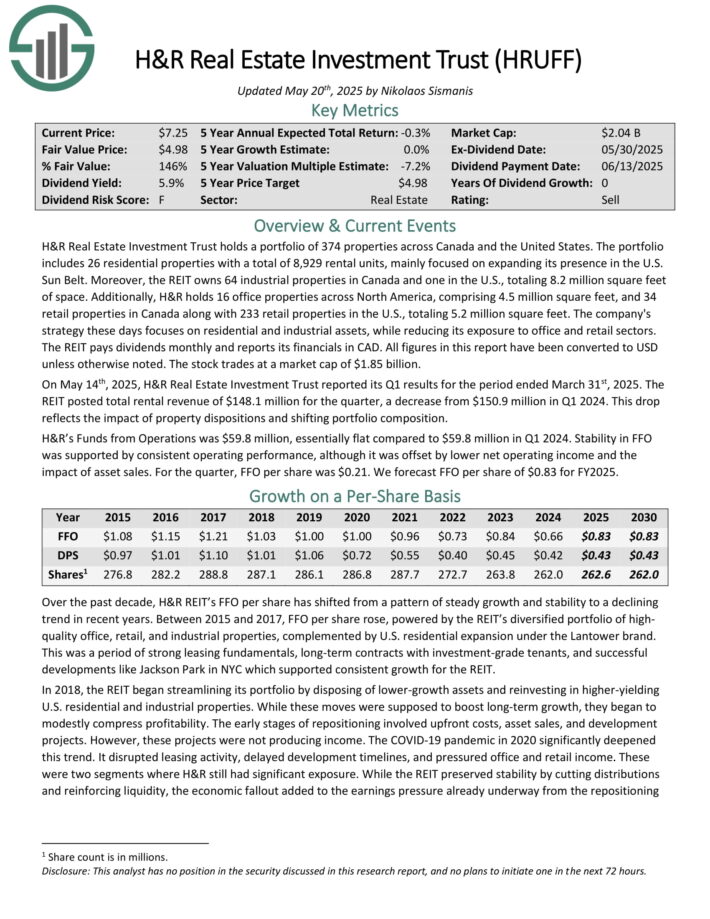

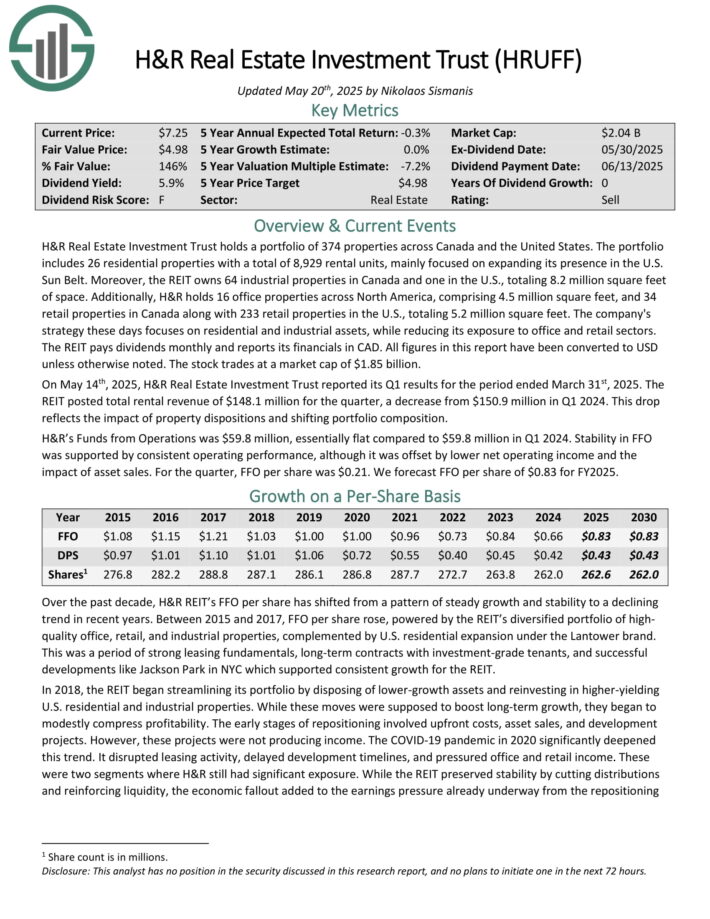

High Dividend Stock To Sell #10: H&R Real Estate Investment Trust (HRUFF)

- Annual Expected Return: -2.1%

H&R Real Estate Investment Trust holds a portfolio of 374 properties across Canada and the United States. The portfolio includes 26 residential properties with a total of 8,929 rental units, mainly focused on expanding its presence in the U.S. Sun Belt.

Moreover, the REIT owns 64 industrial properties in Canada and one in the U.S., totaling 8.2 million square feet of space. Additionally, H&R holds 16 office properties across North America, comprising 4.5 million square feet, and 34 retail properties in Canada along with 233 retail properties in the U.S., totaling 5.2 million square feet.

The company’s strategy these days focuses on residential and industrial assets, while reducing its exposure to office and retail sectors.

The REIT pays dividends monthly and reports its financials in CAD. All figures in this report have been converted to USD unless otherwise noted.

On May 14th, 2025, H&R Real Estate Investment Trust reported its Q1 results. The REIT posted total rental revenue of $148.1 million for the quarter, a decrease from $150.9 million in Q1 2024.

This drop reflects the impact of property dispositions and shifting portfolio composition. H&R’s Funds from Operations was $59.8 million, essentially flat compared to $59.8 million in Q1 2024.

Click here to download our most recent Sure Analysis report on HRUFF (preview of page 1 of 3 shown below):

High Dividend Stock To Sell #9: Sabine Royalty Trust (SBR)

- Annual Expected Return: -0.5%

Sabine Royalty Trust is an oil and gas trust set up in 1983 by Sabine Corporation. At initiation, the trust initially had an expected reserve life of 9 to 10 years but it has surpassed expectations by an impressive margin.

The trust consists of royalty and mineral interests in producing properties and proved oil and gas properties in Florida, Louisiana, Mississippi, New Mexico, Oklahoma, and Texas. It is roughly 2/3 oil and 1/3 gas in terms of revenues.

The trust’s assets are static in that no further properties can be added. The trust has no operations but is merely a pass-through vehicle for royalties. SBR had royalty income of $82.6 million in 2024.

In early May, SBR reported (5/9/25) financial results for the first quarter of fiscal 2025. Production of oil grew 22% but production of gas dipped -1% over the prior year’s quarter. In addition, the average realized prices of oil and gas decreased -26% and -7%, respectively. As a result, distributable cash flow per unit declined -6%, from $1.27 to $1.19.

The outlook for this year is negative, as OPEC has begun to unwind its production cuts and intends to boost its output by 2.0 million barrels per day until the end of 2026.

Click here to download our most recent Sure Analysis report on SBR (preview of page 1 of 3 shown below):

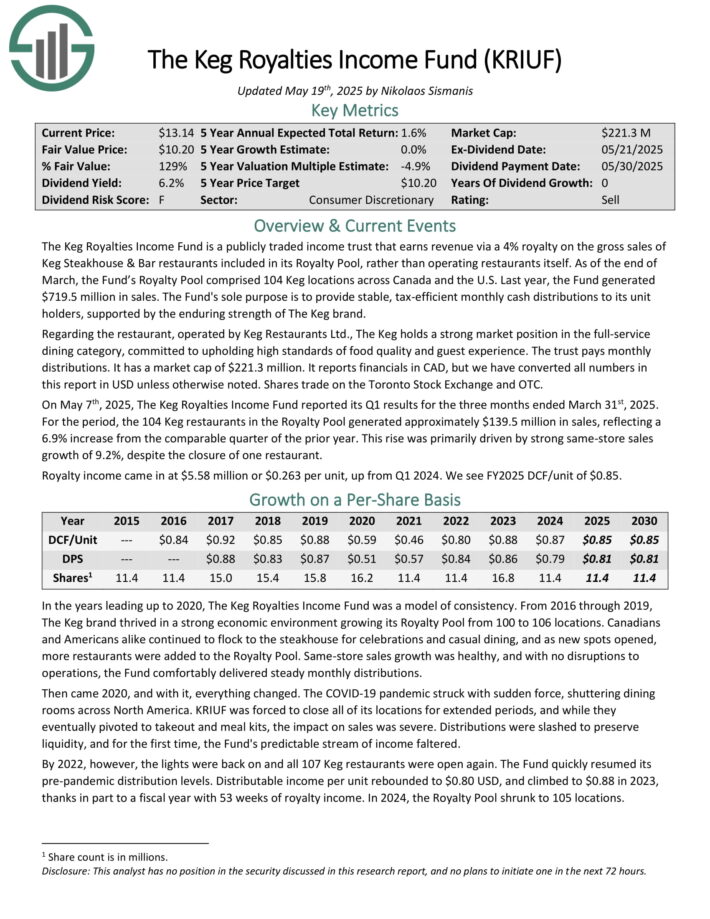

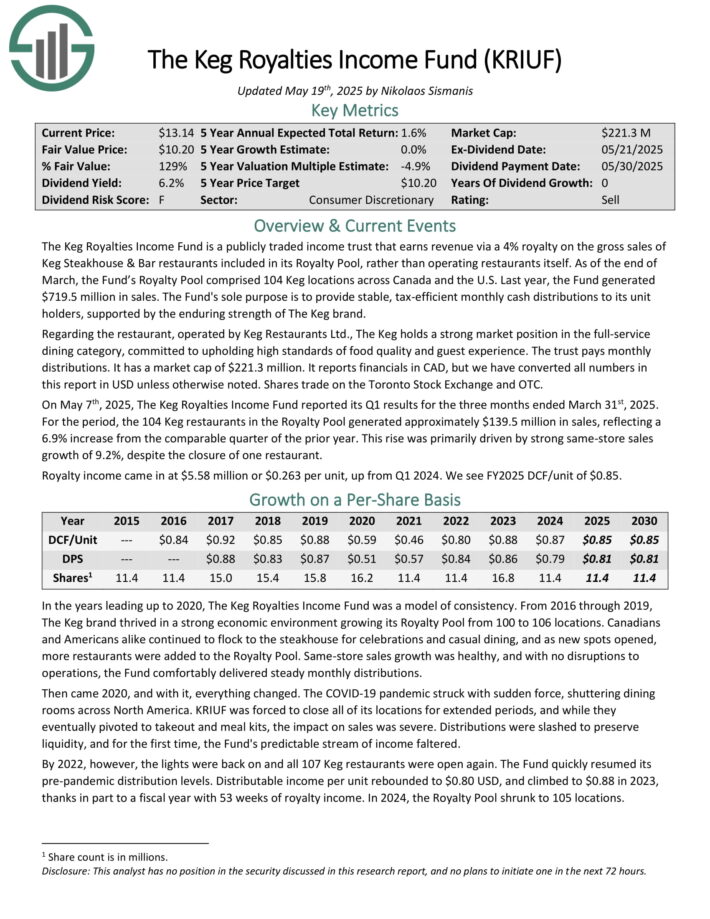

High Dividend Stock To Sell #8: The Keg Royalties Income Fund (KRIUF)

- Annual Expected Return: 1.2%

The Keg Royalties Income Fund is a publicly traded income trust that earns revenue via a 4% royalty on the gross sales of Keg Steakhouse & Bar restaurants included in its Royalty Pool, rather than operating restaurants itself.

As of the end of March, the Fund’s Royalty Pool comprised 104 Keg locations across Canada and the U.S. Last year, the Fund generated $719.5 million in sales.

The Keg holds a strong market position in the full-service dining category, committed to upholding high standards of food quality and guest experience.

It reports financials in CAD, but we have converted all numbers in this report in USD unless otherwise noted. Shares trade on the Toronto Stock Exchange and OTC.

On May 7th, 2025, The Keg Royalties Income Fund reported its Q1 results for the three months ended March 31st, 2025. For the period, the 104 Keg restaurants in the Royalty Pool generated approximately $139.5 million in sales, reflecting a 6.9% increase from the comparable quarter of the prior year.

This rise was primarily driven by strong same-store sales growth of 9.2%, despite the closure of one restaurant.

Click here to download our most recent Sure Analysis report on KRIUF (preview of page 1 of 3 shown below):

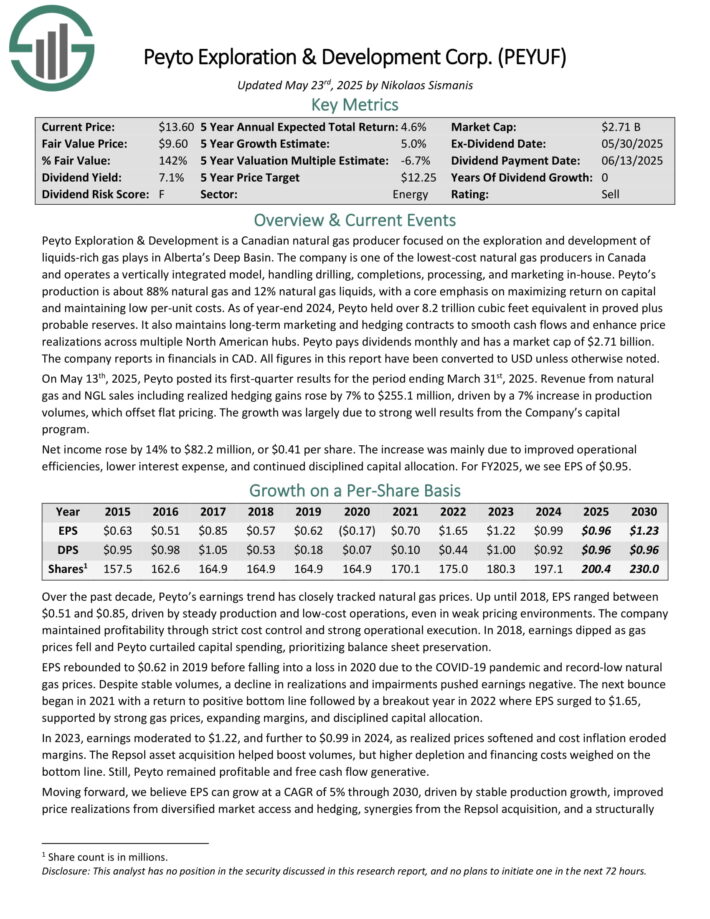

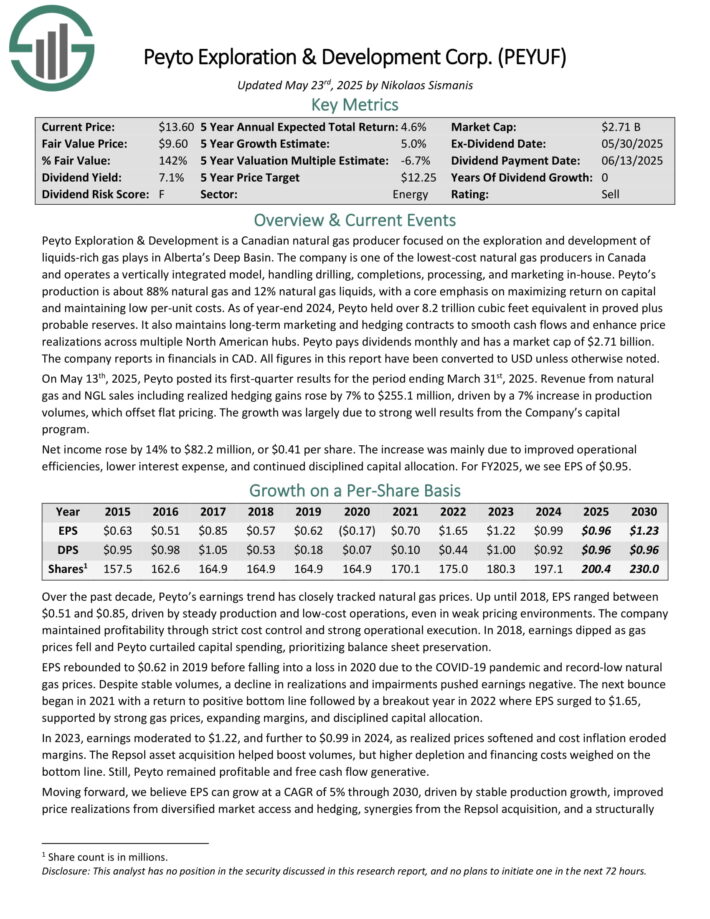

High Dividend Stock To Sell #7: Peyto Exploration & Development (PEYUF)

- Annual Expected Return: 2.4%

Peyto Exploration & Development is a Canadian natural gas producer focused on the exploration and development of liquids-rich gas plays in Alberta’s Deep Basin.

The company is one of the lowest-cost natural gas producers in Canada and operates a vertically integrated model, handling drilling, completions, processing, and marketing in-house.

Peyto’s production is about 88% natural gas and 12% natural gas liquids, with a core emphasis on maximizing return on capital and maintaining low per-unit costs.

As of year-end 2024, Peyto held over 8.2 trillion cubic feet equivalent in proved plus probable reserves. It also maintains long-term marketing and hedging contracts to smooth cash flows and enhance price realizations across multiple North American hubs.

The company reports in financials in CAD. All figures in this report have been converted to USD unless otherwise noted.

On May 13th, 2025, Peyto posted its first-quarter results for the period ending March 31st, 2025. Revenue from natural gas and NGL sales including realized hedging gains rose by 7% to $255.1 million, driven by a 7% increase in production volumes, which offset flat pricing. The growth was largely due to strong well results from the Company’s capital program.

Click here to download our most recent Sure Analysis report on PEYUF (preview of page 1 of 3 shown below):

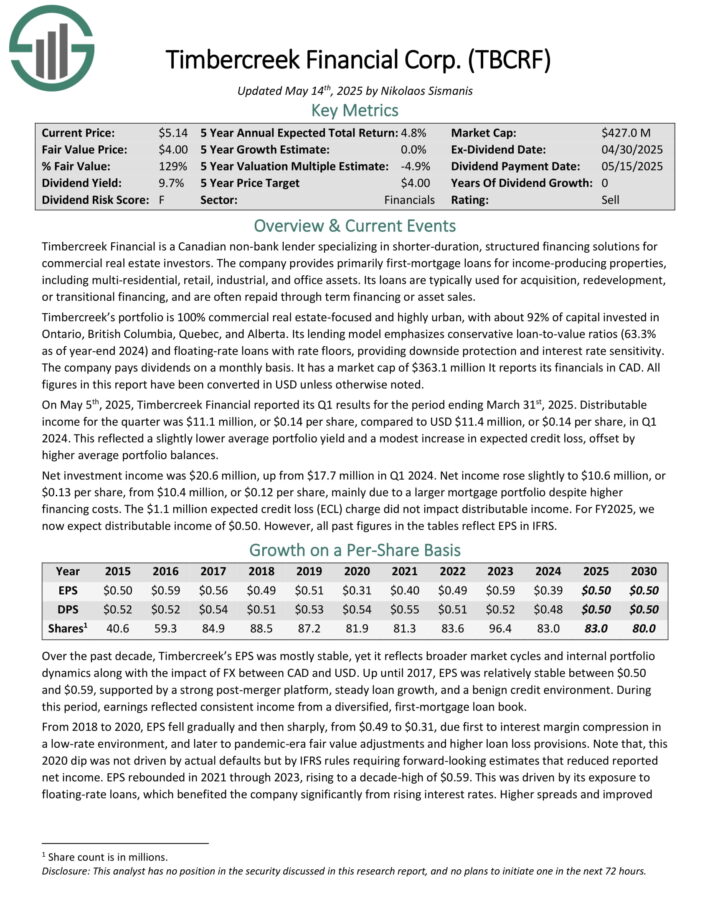

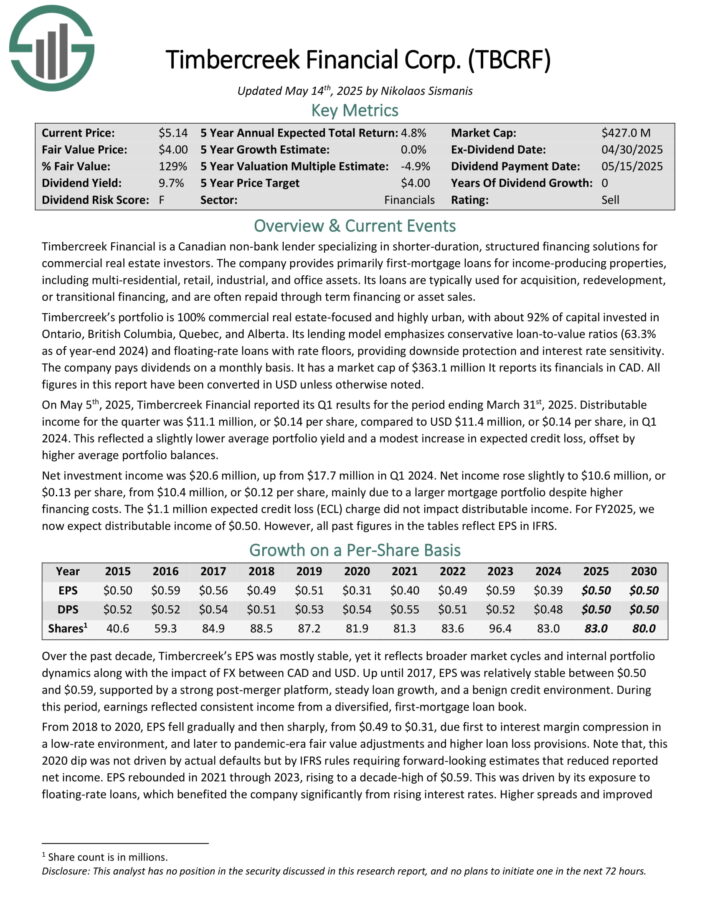

High Dividend Stock To Sell #6: Timbercreek Financial Corp. (TBCRF)

- Annual Expected Return: 3.1%

Timbercreek Financial is a Canadian non-bank lender specializing in shorter-duration, structured financing solutions for commercial real estate investors.

The company provides primarily first-mortgage loans for income-producing properties, including multi-residential, retail, industrial, and office assets.

Its loans are typically used for acquisition, redevelopment, or transitional financing, and are often repaid through term financing or asset sales.

Timbercreek’s portfolio is 100% commercial real estate-focused and highly urban, with about 92% of capital invested in Ontario, British Columbia, Quebec, and Alberta. Its lending model emphasizes conservative loan-to-value ratios (63.3% as of year-end 2024) and floating-rate loans with rate floors, providing downside protection and interest rate sensitivity.

All figures in this report have been converted in USD unless otherwise noted.

On May 5th, 2025, Timbercreek Financial reported its Q1 results for the period ending March 31st, 2025. Distributable income for the quarter was $11.1 million, or $0.14 per share, compared to USD $11.4 million, or $0.14 per share, in Q1 2024.

This reflected a slightly lower average portfolio yield and a modest increase in expected credit loss, offset by higher average portfolio balances.

Click here to download our most recent Sure Analysis report on TBCRF (preview of page 1 of 3 shown below):

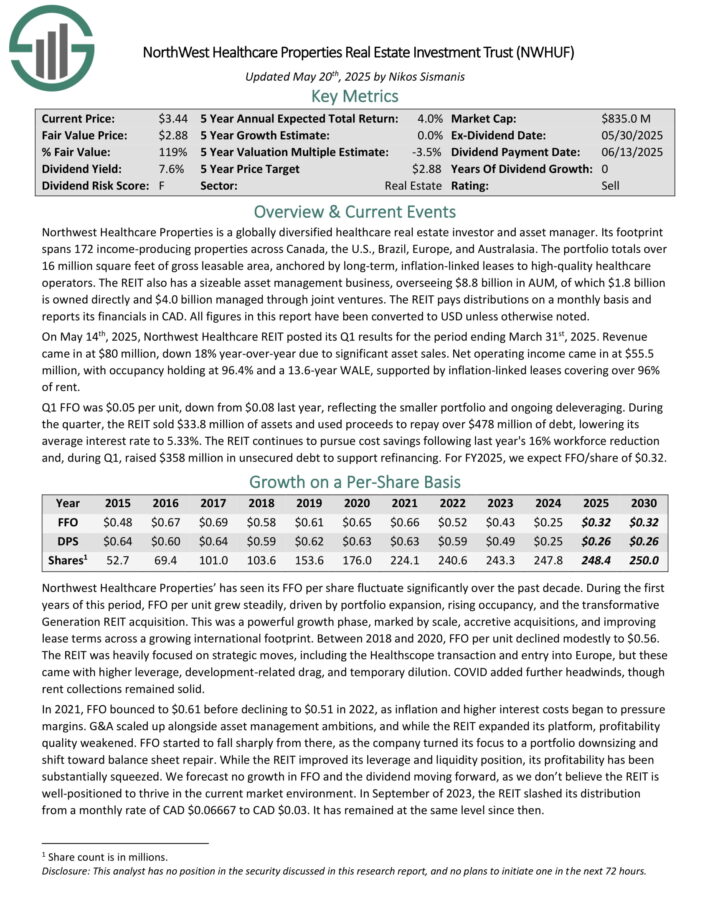

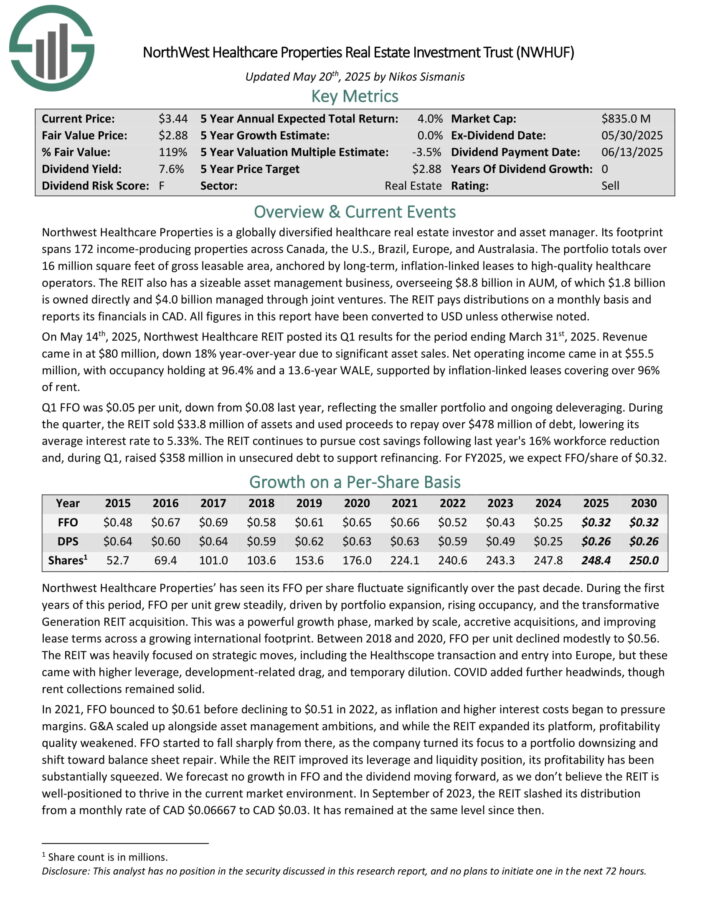

High Dividend Stock To Sell #5: NorthWest Healthcare Properties (NWHUF)

- Annual Expected Return: 3.7%

Northwest Healthcare Properties is a globally diversified healthcare real estate investor and asset manager. Its footprint spans 172 income-producing properties across Canada, the U.S., Brazil, Europe, and Australasia.

The portfolio totals over 16 million square feet of gross leasable area, anchored by long-term, inflation-linked leases to high-quality healthcare operators.

The REIT also has a sizeable asset management business, overseeing $8.8 billion in AUM, of which $1.8 billion is owned directly and $4.0 billion managed through joint ventures. The REIT pays distributions on a monthly basis and reports its financials in CAD. All figures in this report have been converted to USD unless otherwise noted.

On May 14th, 2025, Northwest Healthcare REIT posted its Q1 results for the period ending March 31st, 2025. Revenue came in at $80 million, down 18% year-over-year due to significant asset sales.

Net operating income came in at $55.5 million, with occupancy holding at 96.4% and a 13.6-year WALE, supported by inflation-linked leases covering over 96% of rent.

Q1 FFO was $0.05 per unit, down from $0.08 last year, reflecting the smaller portfolio and ongoing deleveraging. During the quarter, the REIT sold $33.8 million of assets and used proceeds to repay over $478 million of debt, lowering its average interest rate to 5.33%.

Click here to download our most recent Sure Analysis report on NWHUF (preview of page 1 of 3 shown below):

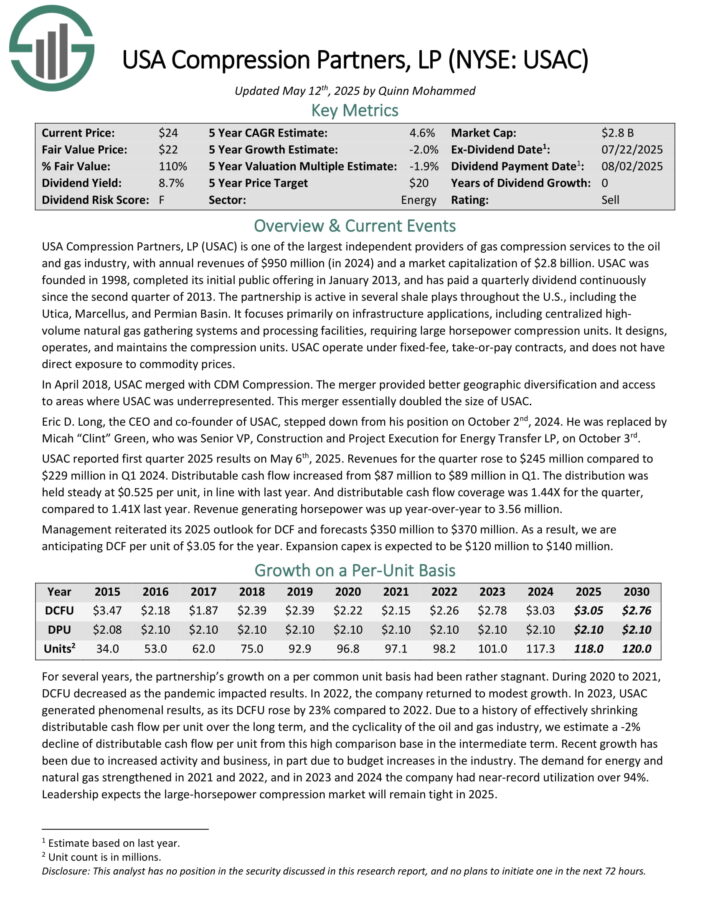

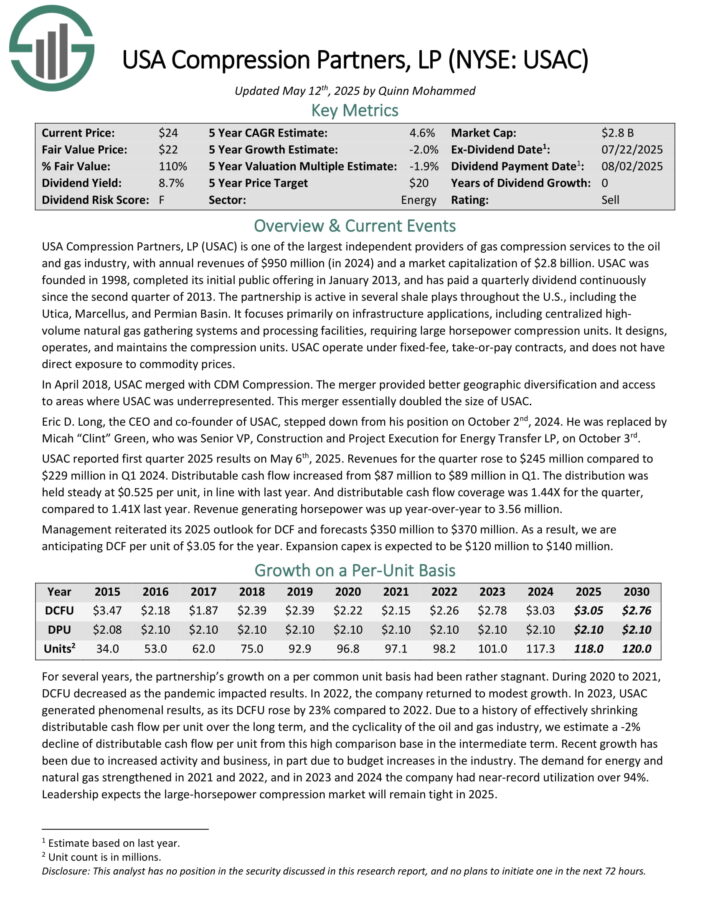

High Dividend Stock To Sell #4: USA Compression Partners LP (USAC)

- Annual Expected Return: 4.0%

USA Compression Partners, LP is one of the largest independent providers of gas compression services to the oil and gas industry, with annual revenues of $950 million in 2024.

The partnership is active in several shale plays throughout the U.S., including the Utica, Marcellus, and Permian Basin. It focuses primarily on infrastructure applications, including centralized high-volume natural gas gathering systems and processing facilities, requiring large horsepower compression units.

It designs, operates, and maintains the compression units. USAC operate under fixed-fee, take-or-pay contracts, and does not have direct exposure to commodity prices.

USAC reported first quarter 2025 results on May 6th, 2025. Revenues for the quarter rose to $245 million compared to $229 million in Q1 2024. Distributable cash flow increased from $87 million to $89 million in Q1. The distribution was held steady at $0.525 per unit, in line with last year.

Distributable cash flow coverage was 1.44X for the quarter, compared to 1.41X last year. Revenue generating horsepower was up year-over-year to 3.56 million. Management reiterated its 2025 outlook for DCF and forecasts $350 million to $370 million.

Click here to download our most recent Sure Analysis report on USAC (preview of page 1 of 3 shown below):

High Dividend Stock To Sell #3: Pizza Pizza Royalty Corp. (PZRIF)

- Annual Expected Return: 4.0%

Pizza Pizza Royalty Corp. is a Canadian entity which collects and distributes a dividend stream based on royalties earned from the Pizza Pizza and Pizza 73 restaurant chains.

The company’s base reporting currency is Canadian Dollars, but this report will use U.S. Dollar figures except when otherwise noted.

Pizza Pizza Royalty Corp. receives income from 797 combined total restaurant locations across Canada under its two brands. More than 150 of these are non-traditional locations sited in public places such as universities and hospitals.

Pizza Pizza has outsized exposure to the province of Alberta thanks to its ownership of Pizza 73 which is centered in that province.

Pizza Pizza reported its Q1 2025 results on May 7th, 2025. Same store sales grew 1.2% in Q1 versus the prior year. While nothing extraordinary, this was a sequential improvement as Pizza Pizza had reported negative same store sales throughout 2024.

While revenues ticked up, so did expenses, leading to flattish results. EPS of 17 cents fell by 1% from the same period of the prior year.

Click here to download our most recent Sure Analysis report on PZRIF (preview of page 1 of 3 shown below):

High Dividend Stock To Sell #2: Northland Power (NPIFF)

- Annual Expected Return: 4.1%

Northland Power develops, builds, owns, and operates power generation assets, including offshore and onshore wind, solar, natural gas, and battery energy storage systems.

It also supplies energy through a regulated utility in Colombia. Northland manages 3.2 GW of gross operating capacity and has 2.4 GW in active construction across three projects: Hai Long (Taiwan), Baltic Power (Poland), and Oneida (Canada), with a broader development pipeline totaling about 10 GW.

Northland reports in CAD. All figures have been converted to USD unless otherwise noted. On May 13th, 2025, Northland Power reported its Q1 results for the period ending March 31st, 2025. Revenue declined 14% year-over-year to about $467 million, primarily due to exceptionally low wind conditions in Europe and a strong wind quarter the year prior, partially offset by higher contributions from North American onshore wind and natural gas assets.

Adjusted EBITDA fell 20% to approximately $260 million, reflecting weaker offshore wind production despite continued operational discipline. Net income fell to $80 million from $107 million a year earlier, driven by the same headwinds in offshore generation and derivative fair value changes.

Click here to download our most recent Sure Analysis report on NPIFF (preview of page 1 of 3 shown below):

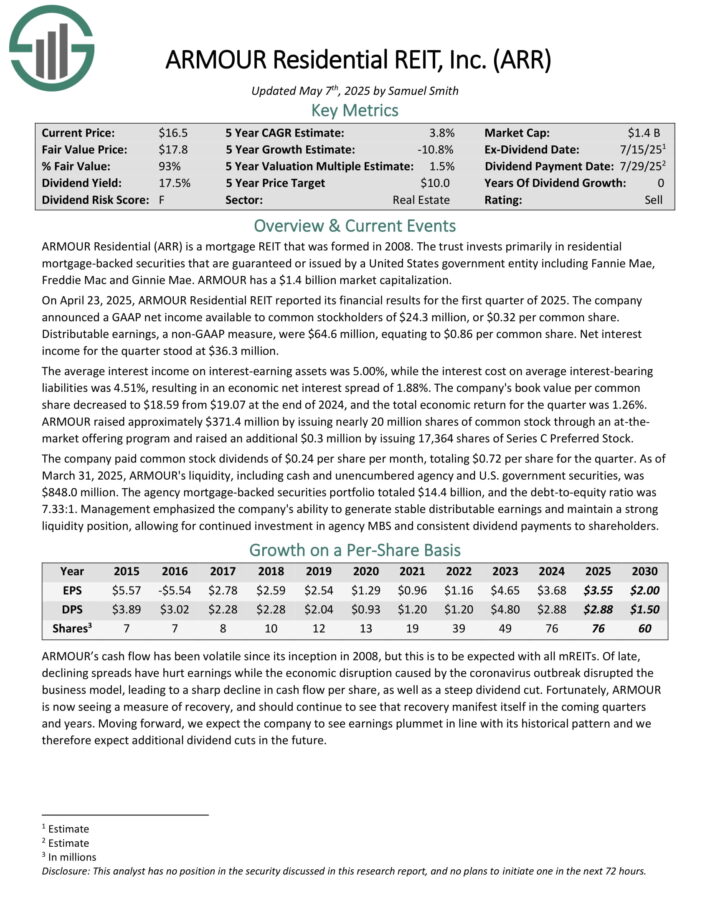

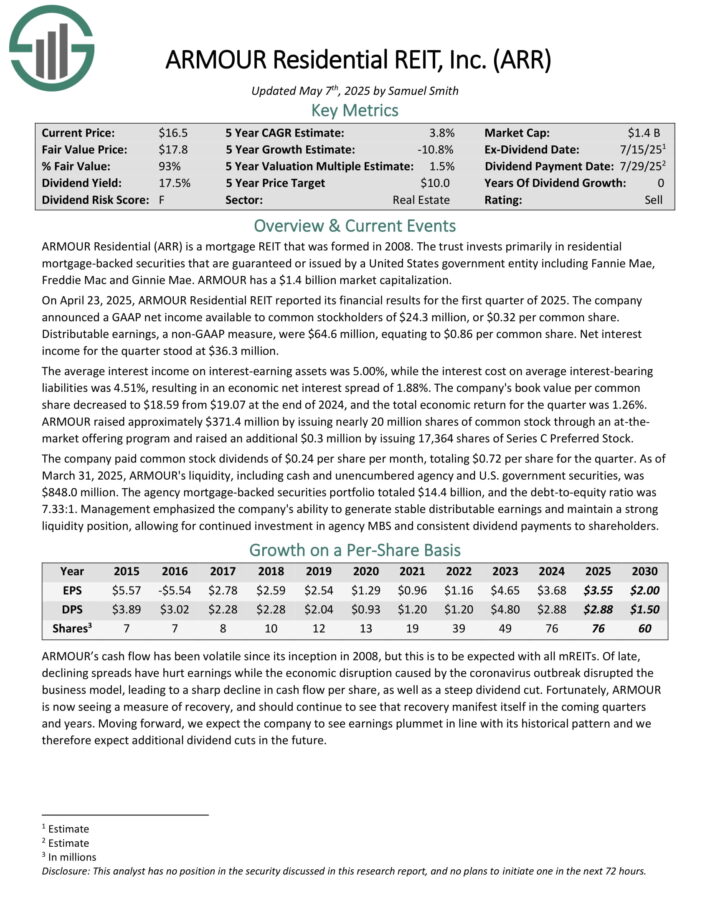

High Dividend Stock To Sell #1: ARMOUR Residential REIT (ARR)

- Annual Expected Return: 4.3%

ARMOUR Residential invests in residential mortgage-backed securities that include U.S. Government-sponsored entities (GSE) such as Fannie Mae and Freddie Mac.

It also includes Ginnie Mae, the Government National Mortgage Administration’s issued or guaranteed securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate home loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, money market instruments, and non-GSE or government agency-backed securities are examples of other types of investments.

On April 23, 2025, ARMOUR Residential REIT reported its financial results for the first quarter of 2025. The company announced a GAAP net income available to common stockholders of $24.3 million, or $0.32 per common share.

Distributable earnings, a non-GAAP measure, were $64.6 million, equating to $0.86 per common share. Net interest income for the quarter stood at $36.3 million.

The average interest income on interest-earning assets was 5.00%, while the interest cost on average interest-bearing liabilities was 4.51%, resulting in an economic net interest spread of 1.88%. The company’s book value per common share decreased to $18.59 from $19.07 at the end of 2024, and the total economic return for the quarter was 1.26%.

Click here to download our most recent Sure Analysis report on ARMOUR Residential REIT Inc (ARR) (preview of page 1 of 3 shown below):

Final Thoughts & Additional Reading

High dividend stocks are naturally appealing on the surface, due to their high dividend yields.

But income investors need to make sure they do not fall into a dividend ‘trap’, meaning purchasing an overvalued stock solely due to its high yield.

There are other important factors when buying stocks, specifically the total return potential. Stocks with negative or low future returns should be sold, even when they offer a high dividend yield.

More By This Author:

The 10 Highest Yielding Dividend Champions

3 High Yielding Dividend Champions Yielding Over 5%

15 Highest Yielding Utility Stocks