VANCOUVER, BC / ACCESS Newswire / July 16, 2025 / Star Copper Corp. (CSE:STCU)(OTCQX:STCUF)(FWB:SOP) (“Star Copper” or the “Company”), a critical mineral exploration and development company, is pleasedto announce that it has entered into a definitive agreement (the “Agreement”) to acquire (the “Acquisition”) a 100% interest in the Copperline Property (“Copperline”, the “Property” or the “CopperlineProperty”), located in north-central British Columbia.

“The Copperline Property is an exciting addition to our growing portfolio of high-grade copper assets in British Columbia,” stated Darryl Jones, CEO of Star Copper Corp. “With its compelling geology, strong infrastructure access, and historical grades, Copperline represents an exceptional grassroots copper-silver opportunity in a proven metallogenic belt.”

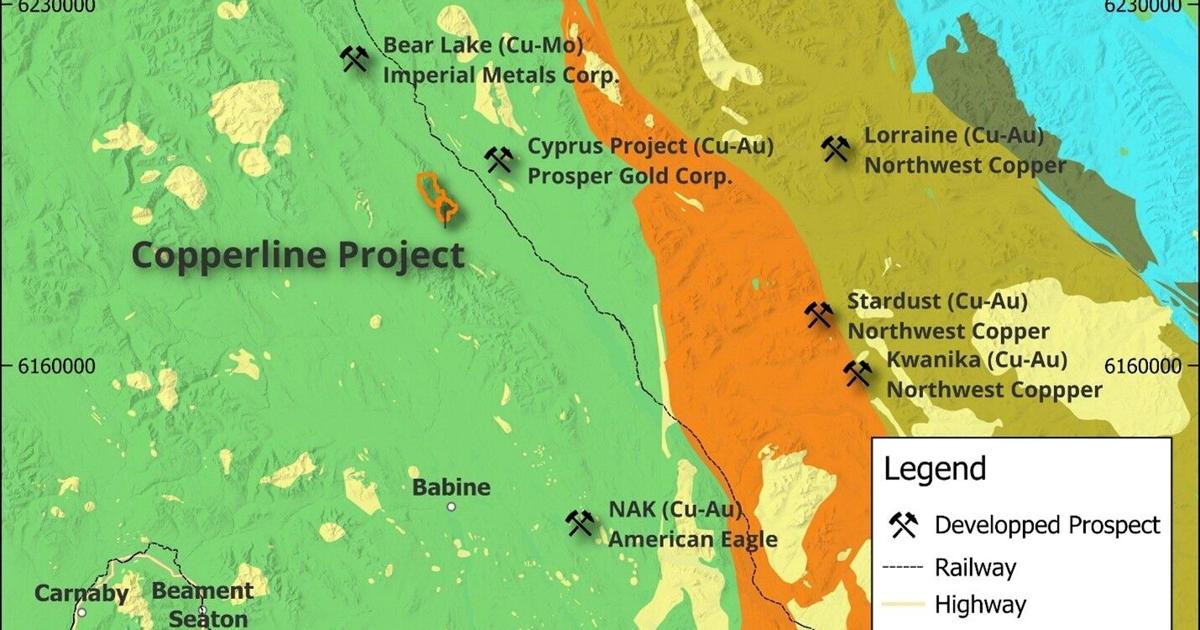

The Copperline Property consists of eight mineral claims totaling approximately 4,502 hectares, situated near Skutsil Knob at the south end of the Driftwood Range, approximately 120 km north-northeast of Smithers, British Columbia (Figure 1).

Under the Agreement, the Company has agreed to acquire Copperline in exchange for (i) cash, (ii) common shares of the Company (“Common Shares”), (iii) the grant of the Net Smelter Royalty (as defined below), and (iv) a Bonus payment (as defined below), subject to certain conditions.

Highlights

-

High-Grade Copper-Silver Showings: Drilling, and surface sampling have returned intervals including 25.0 m of 2.54% Cu, 50.4 g/t Ag (DR-9)2, 3.7 m of 2.5% Cu, 76.6 g/t Ag (CL-16)3, and grab samples up to 8.51% Cu and 200 g/t Ag5.

-

Favourable Geology: Mineralization comprises fine-grained bornite, chalcocite, tetrahedrite, and chalcopyrite within subaerial Telkwa volcanics, consistent with volcanic redbed copper deposit models4.

-

Strong Infrastructure & Access: Located within 5 km of logging roads and 11 km from the BC Rail Dease Lake extension5(Figure 1).

-

Exploration Upside: In 2003 several new zones of mineralization were discovered, including the West Zone and Dave’s Zone. Grab samples from the West Zone averaged 2.8% Cu and 71 g/t Ag, while a sample from Dave’s Zone returned 0.17% Cu and 229 g/t Ag3. Mineralized zones and interpreted structural controls suggest the potential for stacked lenses. Multiple “rusty zones” were identified during prospecting northeast of the “main zone” offering potential for new mineralized zones to be discovered.

-

The Company plans to compile data and create the first 3D model of the Copperline system to plan for the first exploration program.

Figure 1: Map illustrating the regional location of the Copperline Project (After Prosper Gold).

Property Overview

The Copperline Property consists of eight mineral claims totaling approximately 4,502 hectares, located in north-central British Columbia near Skutsil Knob at the southern end of the Driftwood Range. The Property lies roughly 120 km north-northeast of Smithers and benefits from excellent regional infrastructure, including proximity to logging roads (within 5 km), the BC Rail Dease Lake extension (11 km), and hydroelectric potential via the nearby Kotsine River. The Property is accessible by road to within 5 km of the main mineralized zone, allowing for efficient mobilization of exploration crews and equipment.

Geologically, the Copperline Property is underlain by subaerial volcanic rocks of the Lower Jurassic Telkwa Formation, part of the Hazelton Group. These rocks include andesitic to basaltic flows, breccias, and volcaniclastics, locally interbedded with sedimentary units such as redbeds and siltstones. The stratigraphy dips gently to the east and is structurally disrupted by north-northwest trending fault zones and fracture corridors, which are interpreted to control copper-silver mineralization.

Copper-silver mineralization on the Property is characteristic of volcanic redbed copper systems and consists of disseminated and vein-controlled sulphides, including bornite, chalcocite, chalcopyrite, and tetrahedrite. Mineralization is typically hosted within massive volcanic units and associated with secondary structures such as shears, fractures, and bedding-parallel veins. Key alteration assemblages include epidote, chlorite, calcite, hematite, and silica, with “rusty zones” and green alteration halos acting as reliable visual pathfinders in outcrop and float.

Historical exploration dates back to the 1930s, with trenching by Cominco followed by diamond drilling in the 1970s by Craigmont Mines Ltd., and further work by Kit Resources Ltd. in the early 2000s.

Key Historical Drilling Results include:

Craigmont Mines Ltd. (1973-1974)*

|

DR-9:

-

25.0 m @ 2.54% Cu, 50.4 g/t Ag

-

Including: 38.7 m @ 1.82% Cu, 37.7 g/t Ag

-

Also: 7.7 m @ 1.80% Cu, 37.7 g/t Ag

|

|

DR-11:

-

9.1 m @ 2.94% Cu, 83.3 g/t Ag

-

6.1 m @ 1.24% Cu, 68.9 g/t Ag

-

8.5 m @ 0.61% Cu, 11.0 g/t Ag

|

|

DR-12:

-

3.0 m @ 3.05% Cu, 78.9 g/t Ag

-

9.7 m @ 1.01% Cu, 37.4 g/t Ag

-

2.4 m @ 2.00% Cu, 41.1 g/t Ag

|

|

DR-1:

-

12.2 m @ 1.62% Cu, 35.0 g/t Ag

-

12.2 m @ 1.25% Cu, 27.4 g/t Ag

-

4.9 m @ 0.90% Cu, 23.0 g/t Ag

|

*Drilling data compiled from Craigmont Mines in ARIS 27276

Kit Resources Ltd. (2003)

|

CL-16:

-

14.3 m @ 0.812% Cu, 25.843 g/t Ag

-

Including:

-

3.7 m @ 2.512% Cu, 76.667 g/t Ag

-

7.6 m @ 0.301% Cu, 10.887 g/t Ag

-

21.0 m @ 0.385% Cu, 13.261 g/t Ag

-

Including:

-

6.7 m @ 0.471% Cu, 21.285 g/t Ag

-

7.8 m @ 0.605% Cu, 16.463 g/t Ag

|

|

CL-14 :

|

In 2003, Kit Resources also discovered additional zones of mineralization northeast of the Main Zone, including the West Zone and Dave’s Zone. The West Zone returned average grab values of 2.82% Cu and 71.44 g/t Ag, while Dave’s Zone produced a grab sample grading 0.17% Cu and 229 g/t Ag, highlighting the potential for multiple stacked lenses or structurally controlled zones across the broader Property area3.

Star Copper plans to compile legacy data, create a 3D geological model, and execute a staged exploration program that includes surface mapping, geophysics (IP and magnetics), and diamond drilling focused on both Main Zone extensions and new target areas.

National Instrument 43-101 Disclosure

Nicholas Rodway, P.Geo., (EGBC Licence# 46541) (Permit to Practice# 100359), is an independent contractor to the Company and a Qualified Person as defined by NI 43-101. Mr. Rodway has reviewed and approved the technical content in this release.

Acquisition Terms

The Company entered into the Agreement with Zimtu Capital Corp. (TSXV: ZC) (the “Vendor”) on July 14, 2025; Zimtu is not a “Related Person” of the Company, as that term is defined in the policies of the Canadian Securities Exchange (“CSE”). Pursuant to the Agreement, the Company has agreed to acquire Copperline from the Vendor in consideration for:

-

cash payments in the aggregate amount of $350,000, consisting of (i) a payment of $100,000 on the date the Acquisition is completed (the “Closing Date”), and (ii) a payment of $250,000 on the first business day that is six (6) months after the Closing Date (the “Completion Date”);

-

the issuance of 500,000 Common Shares (the “Consideration Shares”), with (i) 200,000 Consideration Shares to be issued on the Closing Date, and (ii) 300,000 Consideration Shares to be issued on the Completion Date; and

-

the grant by the Company to the Vendor of a 2% net smelter returns royalty, payable on all production from the Copperline Property, of which 1% will be eligible for repurchase by the Company at any time within five (5) years of the Closing Date for a one-time payment of $1,000,000 (the “Net Smelter Royalty”).

In addition to the foregoing, if the Company publishes a mineral resource estimate prepared in accordance with Form 43-101F1 of NI 43-101 in respect of the Copperline Property (the “Resource Estimate”) disclosing any combination of measured, indicated or inferred mineral resources in excess of either (i) 500,000,000 pounds of copper, or (ii) 15,000,000 ounces of silver, then the Company will pay the Vendor an additional amount of $1,500,000 (the “Bonus”), consisting of:

-

a cash payment in the amount of $750,000; and

-

the issuance of that number of Common Shares having an aggregate value equal to $750,000 (the “Bonus Shares”), at a deemed issue price per Bonus Share equal to the ten (10) day volume weighted average of the Common Shares on the CSE, or such other stock exchange on which the Common Shares may be listed from time to time immediately prior to the publication of the Resource Estimate.

The Consideration Shares and the Bonus Share (if any), when issued, will be subject to a statutory hold period of four months and one day from the date of issuance of such Common Shares.

Closing of the Acquisition is subject to certain conditions and approvals, including (i) the execution of a royalty agreement for the Net Smelter Royalty in accordance with the terms set forth in the Agreement, (ii) the receipt of all required consents and regulatory approvals, including without limitation the acceptance of the TSX Venture Exchange (“TSXV”) and the consent of the CSE, and (iii) such other customary conditions for a transaction such as the Acquisition. The Acquisition is not conditional in any way upon the completion, partial or otherwise, of the LIFE Offering (as defined below).

LIFE Flow Through Offering

The Company is pleased to announce that it intends to complete a non-brokered private placement for gross proceeds of up to C$2,500,000.50 from the sale of up to 1,666,667 “flow-through” units of the Company (each, a “FT Unit”, and collectively, the “FT Units”) at a price of C$1.50 per FT Unit (the “LIFE Offering”) under the Listed Issuer Financing Exemption (as defined below).

Each FT Unit will consist of one “flow-through” Common Share (each, a “FT Share” and collectively, “FT Shares”) and one “flow-through” Common Share purchase warrant (each a “FT Warrant” and collectively, “FT Warrants”), issued as “flow-through shares”, as defined in subsection 66(15) of the Income Tax Act (Canada) (the “Tax Act”). Each FT Warrant will be exercisable to acquire one Common Share (each a “Warrant Share”, and collectively, “Warrant Shares”) at a price of $1.60 per Warrant Share for a period of 24 months from the LIFE Closing Date (as defined below). The Warrant Shares underlying the FT Units will not qualify as “flow-through shares” under the Tax Act. The FT Warrants to be issued pursuant to the LIFE Offering will not be listed for trading on any stock exchange. The LIFE Offering is expected to close on or about July 23, 2025 (the “LIFE Closing Date”), or such other date as determined by the Company, such date being no later than 45 days from the date the Company issues a press release announcing the LIFE Offering.

Subject to compliance with applicable regulatory requirements and in accordance with National Instrument 45-106 – Prospectus Exemptions (“NI 45-106”), the LIFE Offering is being made to purchasers resident in all provinces of Canada, except Quebec, pursuant to the listed issuer financing exemption under Part 5A of NI 45-106 (the “Listed Issuer Financing Exemption”). The securities offered under the Listed Issuer Financing Exemption will not be subject to a hold period in accordance with applicable Canadian securities laws.

The gross proceeds of the LIFE Offering will be used to incur “Canadian exploration expenses” that are “flow-through critical mineral mining expenditures”, within the meaning of the Tax Act, on the Company’s flagship Star Project.

There is an offering document (the “Offering Document”) related to the LIFE Offering that can be accessed under the Company’s issuer profile on SEDAR+ at www.sedarplus.ca and on the Company’s website at: www.starcopper.com. Prospective investors should read this Offering Document before making an investment decision.

The Company may pay finder’s fees in connection with the LIFE Offering in accordance with applicable securities laws and the policies of the CSE. Completion of the LIFE Offering is subject to customary conditions and the receipt of all necessary approvals.

This news release does not constitute an offer to sell or a solicitation of an offer to sell any of securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

References

1Borovic, I. (1990). Geophysical Survey of the Driftwood Property. ARIS Report 19978.

2Craigmont Mines Ltd. (1974). Diamond Drilling Report – Driftwood River Area. ARIS Report 4967.

3Houle, J. (2003). Kit Resources Ltd. Drilling & Geochemical Report on the Copperline Property. ARIS Report 27276.

4Rodway, N. (2023). Copperline Property Technical Assessment Report. Prepared for Zimtu Capital Corp.

5Weicker, R. (2001). Geological and Prospecting Report on the Copperline Property. ARIS Report 26667.

6British Columbia Minfile Detail Report (2024) (Minfile umber 093M 117) or NMIN 09M15Cu1.

On Behalf of the Board of Directors

~Darryl Jones~

Darryl Jones

CEO, President & Director

Star Copper Corp.

About Star Copper Corp. (CSE:STCU)(OTCQX:STCUF)(FWB:SOP / WKN A416ME)

Star Copper Corp. is an exploration and development company focused on developing high-potential copper projects in mining-friendly jurisdictions. The Company aims to advance its British Columbian Star Project where significant exploration work including historical drilling has confirmed open mineralization at depth and in all directions. Star Copper’s strategic plans include geological mapping and geophysical surveys to refine existing targets, diamond drilling programs to test high-priority zones, environmental baseline studies and permitting groundwork alongside data analysis and resource modeling to support a future resource estimate prepared in accordance with NI 43-101. The Company further plans to advance its Indata Project with follow-up drilling to expand on previous high-grade copper and gold intercepts, trenching and surface sampling to delineate mineralized zones, and infrastructure improvements for site accessibility and operations. With a commitment to sustainable development and value creation, Star Copper aims to position itself to support surging industrial demand to meet growing global electrification needs.

For more information visit: www.starcopper.com and to sign up for free news alerts please go to https://starcopper.com/news/news-alerts/, or follow us on X (formerly Twitter),Facebook or LinkedIn. More information in respect of the project, including historical drilling, is available under the Company’s profile at www.sedarplus.ca and/or in the Company’s February 26, 2025 technical report.

Investor Relations Star Copper Corp.

Email: info@starcopper.com

Web: https://starcopper.com/

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and other statements that are not historical facts. Forward-looking statements are often identified by terms such as “will”, “may”, “should”, “anticipate”, “expects” and similar expressions. All statements other than statements of historical fact, included in this news release are forward-looking statements that involve risks and uncertainties. Forward-looking statements in this press release include, but are not limited to, statements regarding the the Company’s exploration and development plans with respect its projects, statements regarding the LIFE Offering including, without limitation, statements regarding the completion or the expected LIFE Closing Date, the payment of finder’s fees, the receipt of regulatory approvals, and the use of gross proceeds, and statements regarding the Acquisition, including the completion or the anticipated benefits thereof, the receipt of acceptance and consent from the TSXV and the CSE, the prospects of the mineral claims forming the Copperline Property, which is not at an advanced stage of development, the Company’s anticipated business and operational activities, and the Company’s plans with respect to the exploration of the Company’s flagship Star Project, the Indata Project or the Copperline Property. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations include, but are not limited to, the inherently unpredictable nature of resource exploration, market conditions and the risks detailed from time to time in the filings made by the Company with securities regulators. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect, and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and the Company will update or revise publicly any of the included forward- looking statements as expressly required by applicable law.

SOURCE: Star Copper Corp.

View the original

press release

on ACCESS Newswire