TSX Stock News

TSX Stock News

Here’s Why Bitfarms CEO Believes The Stock Is Undervalued: ‘Little To No Value Being Associated With Our HPC Potential’

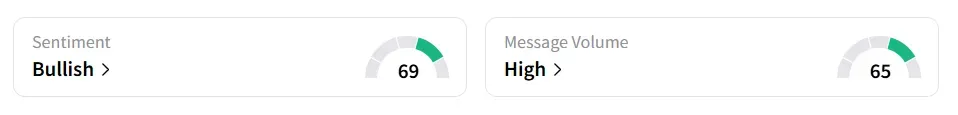

Bitfarms’ board approved a share buyback of up to 49.9 million shares. Bitfarms (BITF) CEO Ben Gagnon believes the company’s stock is trading below its intrinsic value, as the market is overlooking the value of its Bitcoin operations. “We believe that Bitfarms’ shares are currently undervalued because our Bitcoin business is underappreciated by the market, with little to no value being associated with our HPC potential,” said CEO Ben Gagnon. The comment came on Tuesday, after the company’s Board of Directors approved a share repurchase initiative, authorizing a buyback of up to 49.9 million of its common shares, equivalent to roughly 10%

TSX flat as investors await trade updates

Canada’s main stock index was subdued on Tuesday, pressured by technology stocks, as investors awaited potential trade deals between the U.S. and its partners. The Toronto Stock Exchange’s S&P/TSX composite index was down 0.03% at 27,307.73 points. Trade negotiations appeared shaky after EU diplomats said the 27-nation bloc was considering broader counter-measures against Washington. Prospects for an interim trade deal between India and the U.S. have also dimmed, according to Indian government sources. Meanwhile, U.S. Treasury Secretary Scott Bessent announced plans to meet his Chinese counterpart next week, potentially discussing an extension to the August 12 deadline set for tariffs

Revol One Financial® Launches Enduris 10 Income Fixed Index Annuity™

Revol One Financial® Launches Enduris 10 Income Fixed Index Annuity™ – Toronto Stock Exchange News Today – EIN Presswire Trusted News Since 1995 A service for global professionals · Tuesday, July 22, 2025 · 833,000,000 Articles · 3+ Million Readers News Monitoring and Press Release Distribution Tools News Topics Newsletters Press Releases Events & Conferences RSS Feeds Other Services Questions?

XRP Technical Analysis Points to XRP Price Predictions Surpassing $6 in 2025

The cryptocurrency market has witnessed a strong momentum in July 2025, with XRP leading the charge among major digital assets. Why is XRP going up? The answer lies in a perfect storm of regulatory breakthroughs, institutional adoption, and technical breakouts that have propelled XRP to almost all-time highs above $3.60. Moreover, the technical analysis now suggests that XRP’s price may continue to rise, potentially heading toward levels above $6. XRP has established itself as a standout performer in the cryptocurrency space, currently trading at $3.47 with a market capitalization of $204.39 billion. The digital asset has demonstrated exceptional resilience, gaining

Osisko Metals Gaspé Copper Project Intersects 645 Metres Averaging 0.28% Cu

MONTREAL, July 22, 2025 (GLOBE NEWSWIRE) — Osisko Metals Incorporated (the “Company” or “Osisko Metals”) (TSX-V: OM; OTCQX: OMZNF; FRANKFURT: 0B51) is pleased to announce new drill results from the Gaspé Copper Project, located in the Gaspé Peninsula of Eastern Québec. Osisko Metals Chief Executive Officer Robert Wares commented: “These new results underscore the overall large-scale potential of mineralization at Gaspé Copper, with drill hole 1082 cutting 853 metres of continuous mineralization, including the bottom 424 metres being located immediately below and outside the 2024 MRE model. Furthermore, drill hole 1088 intersected new mineralization 80 metres southwest of the 2024

1317234 B.C. Ltd Announces Letter of Intent with Marviken Ontario Inc. for Reverse Takeover Transaction

This section is Partnership Content supplied The content in this section is supplied by Newsfile for the purposes of distributing press releases on behalf of its clients. Postmedia has not reviewed the content. by Newsfile Breadcrumb Trail Links Newsfile Author of the article: Published Jul 21, 2025 • 5 minute read Article content Calgary, Alberta–(Newsfile Corp. – July 21, 2025) – 1317234 B.C. Ltd. (the “Company“) is pleased to announce that it has entered into a non-binding letter of intent (the “LOI“) with Marviken Ontario Inc. (“Marviken“) which outlines the terms and conditions of a proposed business combination of Marviken

Galaxy Digital Stock Is Moving Higher Monday: What’s Going On?

Galaxy Digital Inc GLXY shares are hitting new highs on Monday after the company announced a strategic partnership with K Wave Media KWM to accelerate its Bitcoin BTC/USD treasury strategy. What Happened: Galaxy will serve as an asset manager and strategic advisor to K Wave Media and invest in the company. Galaxy will provide guidance on structuring and making Bitcoin purchase, risk management and long-term institutional-grade infrastructure. The news comes after K Wave recently acquired 88 Bitcoin as part of its Bitcoin treasury strategy. The company is planning to “aggressively” scale its Bitcoin reserves. The company said it now has

Couche-Tard restarts share buybacks after ending Seven & i takeover bid

LAVAL – Alimentation Couche-Tard Inc. says it’s restarting its share buyback program after it announced last week that it had ended its efforts to acquire the owner of the 7-Eleven chain. Laval, Que.-based Couche-Tard says the Toronto Stock Exchange had approved its program to buy back up to 10 per cent of outstanding shares that, based on its current price, represents about $5.8 billion in shares. The company says the potential repurchasing of about 77.1 million shares is an appropriate use of its cash and an efficient way to create long-term shareholder value. Couche-Tard had been keeping funds on-hand as

BSR REIT Unlocks Growth After $618M Apartment Sale

Dan Oberste is the CEO of BSR Real Estate Investment Trust, which is headquartered in Little Rock and trades on the Toronto Stock Exchange. (Steve Lewis) In May 2024, the CEO of a Virginia company that owns more apartments than almost anyone in the United States made a cold call to the front desk of BSR Real Estate Investment Trust, a similar business headquartered in Little Rock’s Union Station. About a year later, that phone call led to a whopping $618 million real estate deal that moved nine high-end apartment complexes in Texas from BSR’s portfolio into the hands of

Inside the death of Hudson’s Bay. Why former senior employees believe leader Richard Baker should take the blame

When Hudson’s Bay employees joined a company-wide Zoom meeting on March 8, 2021, they found their chairman, Richard Baker, wearing a camouflage T-shirt and seated in what appeared to be a boat cabin, accompanied by two tiny dogs. The unmistakable theme from “Game of Thrones” played through the speakers as Baker unmuted himself. “We are at war,” employees recall him saying. “And we are going to win. We will crush the competition.” ARTICLE CONTINUES BELOW