TSX Stock News

TSX Stock News

GO Residential, a luxury rental REIT in New York, launches rare IPO in Canada

Open this photo in gallery: GO Residential Real Estate Investment Trust owns five rental towers in Manhattan along the East River, including the Copper Buildings.Mike Segar/Reuters An American real estate company that owns luxury rental apartment towers in New York is trying to go public in Canada, with GO Residential Real Estate Investment Trust launching a US$410-million initial public offering on the Toronto Stock Exchange. GO owns five rental towers in Manhattan along the East River, including the Copper Buildings, where the average monthly rent is US$8.05 per square foot. That amounts to US$8,050 per month for a 1,000-square-foot apartment.

Nine high-flying Canadian stocks with strong momentum

What are we screening for? Canadian-listed stocks with strong price momentum. The Screen Tariffs and trade wars have dominated news headlines and kept investors on their toes, and recent comments from President Donald Trump suggesting the United States might impose 30-per-cent tariffs on imports from the EU and Mexico in August could dampen market momentum. While European markets retreated slightly following these comments, the Nasdaq 100 and S&P TSX Composite Index both hit all-times highs, suggesting that investors may have accepted that tariffs will remain in place, and have shifted their focus back to market fundamentals. The S&P TSX Composite

Fiera Sees EMEA as a Key Growth Region

Canadian-headquartered asset manager Fiera Capital is setting the stage for international expansion. Under the leadership of a new global CEO, the company sees the EMEA region as a central pillar of its growth strategy. Zurich serves as one of its key European hubs. Fiera Capital is an independent Global asset management firm with approximately $112.3 billion in assets under management. Maxime Ménard, who served as CEO of Fiera Canada and also led Fiera Global Private Wealth for over a year before recently being appointed Global CEO, aims to strengthen the firm’s global presence. Ménard is supportive of the changes introduced

AvenioGPT Alpha Launch Sparks High Demand Across BioPharma and Research Entities

AvenioGPT Alpha Launch Sparks High Demand Across BioPharma and Research Entities – Toronto Stock Exchange News Today – EIN Presswire Trusted News Since 1995 A service for global professionals · Tuesday, July 15, 2025 · 830,698,633 Articles · 3+ Million Readers News Monitoring and Press Release Distribution Tools News Topics Newsletters Press Releases Events & Conferences RSS Feeds Other Services Questions?

Operational Update

This section is Partnership Content supplied The content in this section is supplied by Newsfile for the purposes of distributing press releases on behalf of its clients. Postmedia has not reviewed the content. by Newsfile Breadcrumb Trail Links Newsfile AB HZ4 and AB HZ5 now on production Author of the article: Published Jul 15, 2025 • 9 minute read Article content Calgary, Alberta–(Newsfile Corp. – July 15, 2025) – Arrow Exploration Corp. (AIM: AXL) (TSXV: AXL) (“Arrow” or the “Company“), the high-growth operator with a portfolio of assets across key Colombian hydrocarbon basins, is pleased to provide an update on

The Billionaires Getting Richest Off Bitcoin’s All-Time High

Bitcoin is soaring to the moon, with the cryptocurrency posting a new all-time high on Monday of $122,838, nearly a 100% increase since July of last year. For a brief time, Bitcoin’s market cap was upwards of $2.4 trillion, surpassing Amazon as the fifth most valuable asset in the world. The frenzy comes as investors eagerly await the outcome of what the U.S. House Committee on Financial Services calls “Crypto Week.” Three bills being considered in the House of Representatives would help establish a regulatory framework and help integrate cryptocurrencies into traditional finance: the CLARITY Act, Anti-CBDC Surveillance State Act

Analyzing the top 10 REITs on the TSX

What are we looking for? Stock markets in Canada and the United States recently hit all-time highs and some investors are asking if there will be a pullback. Along with this, trade policies and challenges to the U.S. Federal Reserve chair are adding to market and interest-rate volatility. Part of an individual’s investing strategy should include dividend-paying stocks, especially for people nearing or in retirement. Real estate investment trusts (REITs) are low-beta (a measure of volatility), interest-rate-sensitive investments and are a good choice for many portfolios. For this Number Cruncher, we look at valuations for the 10 largest publicly traded

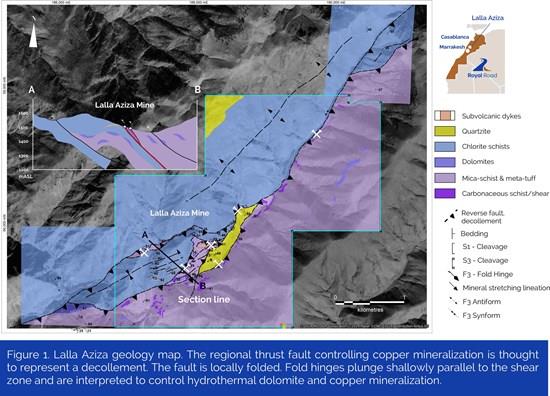

Royal Road Minerals Announces Scout Drilling Results From The Lalla Aziza Copper Project, Kingdom Of Morocco

(MENAFN– Newsfile Corp) Toronto, Ontario–(Newsfile Corp. – July 14, 2025) – Royal Road Minerals Limited ( TSXV: RYR ) (” Royal Road ” or the ” Company “) is pleased to announce results from its initial scout drilling program at the Lalla Aziza copper project in Morocco. Lalla Aziza is an underground copper-mine located in Morocco’s Western High Atlas, approximately 90 kilometers southwest of Marrakesh. Lalla Aziza is owned and operated by Moroccan mining company, Carbomine SARL (“Carbomine” ). In December 2024, Royal Road entered into an Option Agreement (the “Agreement” ) with Carbomine, which provides the Company with an

Cathedra Bitcoin Announces Leadership Transition

(MENAFN– Newsfile Corp) Toronto, Ontario–(Newsfile Corp. – July 11, 2025) – (Block Height: 904,987) – Cathedra Bitcoin Inc. (TSXV: CBIT) (OTCQB: CBTTF) (the ” Company ” or ” Cathedra “), a bitcoin company that develops and operates digital infrastructure assets, is pleased to announce the appointment of Joel Block as Chief Executive Officer. Mr. Block will also be joining as a member and chairman of the Board of Directors (the ” Board “). Concurrently, former Chief Executive Officer, AJ Scalia, and former President and Chief Operating Officer, Drew Armstrong, have resigned from their roles as officers and members of the

CFOs On the Move: Week ending July 11

CFOs On the Move: Week ending July 11 | CFO.com Skip to main content An article from Wendy’s finance chief steps in as interim CEO, OpenText’s CFO exits for banking CEO role and Wolfspeed names a new CFO amid restructuring efforts. Published July 11, 2025 Ken Cook, Wendy’s chief financial officer, will take on the additional role of interim CEO of the fast food chain on July 18. Brandon Bell / Staff via Getty Images Listen to the article 6 min This audio is auto-generated. Please let us know if you have feedback. Ken Cook | Wendy’s Wendy’s chief financial