TSX Stock News

TSX Stock News

Post From Community: Molson Coors and Light the Hoan announce 2025 Shine a Lite grant recipients

Editor’s note: Post From Community is the place for community announcements and event postings. If you have a community-oriented event you feel our readers would be interested in, please submit here. By Molson Coors Beverage Company Advertisement MILWAUKEE – July 1, 2025 – In celebration of Miller Lite’s 50th anniversary, five Milwaukee nonprofits have been selected as 2025 Shine a Lite grant recipients by Molson Coors Beverage Company and Light the Hoan. Now in its fifth year, the Shine a Lite program honors local organizations that are making a lasting difference in the community. Each selected nonprofit willreceive a $10,000 grant

Eagle Royalties and Summit Royalty Execute Definitive Agreement for Reverse Takeover of Eagle Royalties

TORONTO, ON / ACCESS Newswire / July 2, 2025 / Summit Royalty Corp. (“Summit”) and Eagle Royalties Ltd. (CSE:ER.CN) (“Eagle”) are pleased to announce that they have entered into a definitive amalgamation agreement (the “Amalgamation Agreement”) in respect of a reverse takeover transaction (the “RTO”), pursuant to which Summit will “go-public” by way of a reverse takeover of Eagle. In this news release, references to the “Resulting Issuer” are to Eagle after the closing of the RTO. Transaction Particulars and the Definitive Agreement On June 30, 2025 Eagle, Summit and a newly-formed subsidiary of Eagle (“Eagle Subco”) incorporated under the

Canadian company acquires Cosgroves

A Canadian company with an international reach in sustainable engineering and environmental consulting has bought Christchurch-headquartered engineering firm Cosgroves. The Toronto Stock Exchange and New York Stock Exchange-listed Stantec paid an undisclosed sum for its latest acquisition. Cosgroves has more than 90 staff across New Zealand and works with clients, architects, project managers and other professionals in consulting engineering on private and public building projects such as the redevelopment of the Christchurch Town Hall. Stantec said the addition of Cosgroves would expand its buildings engineering capabilities in New Zealand, particularly in fire engineering, electrical, mechanical, hydraulics, buildings sustainability, and civil

Ethereum Hits $2,600 Wall, XRP Awaits Court Ruling, BlockDAG’s GLOBAL LAUNCH Release Offers BDAG at $0.0016

Price trends often go beyond charts. They’re shaped by timing, decisions, and real utility. Ethereum is testing major resistance at $2,600, and analysts are watching to see if strong institutional inflows can push it higher. At the same time, the XRP price outlook hinges on both legal outcomes and ETF momentum that could change its path dramatically. Meanwhile, BlockDAG is gaining traction for how it’s rewarding its early community. With its mainnet on the way, the project is engaging users across different roles, testers, referrers, buyers, and promoters, to fuel ecosystem growth. Through the BlockDAG GLOBAL LAUNCH release, users can

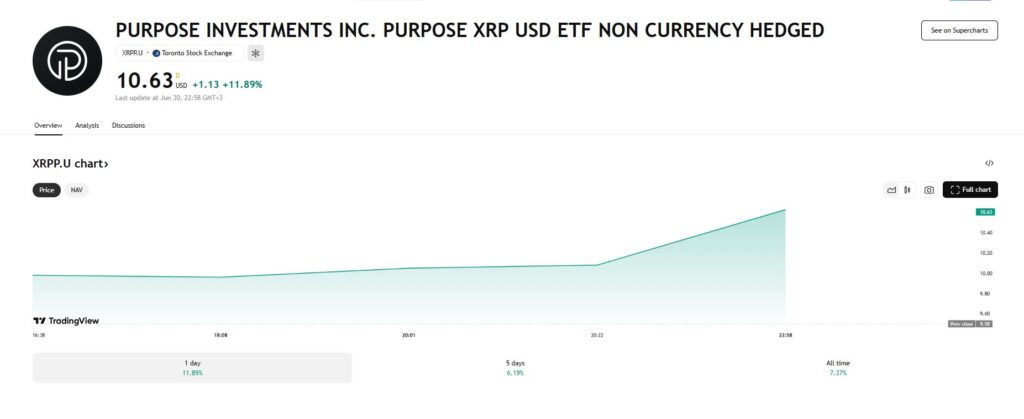

North America’s first spot XRP ETF is breaking out

Canada and North America’s first spot XRP exchange-traded fund (ETF), launched by Purpose Investments, is showing signs of strength following a choppy debut. Trading on the Toronto Stock Exchange (TSX), the fund surged 11.89% on June 30, closing at $10.63. Over the past five days, the ETF has gained 6.19%, and since its inception on June 18, it is up 7.37%. XRPP ETF all-time price chart. Source: TradingView This resurgence comes despite the underlying XRP cryptocurrency struggling to break through key resistance levels. The ETF had initially mirrored the broader weakness in XRP, but appears to be decoupling somewhat in

TSX Venture Exchange Updates Escrow Policy for New Listings

The TSX Venture Exchange (TSXV) has announced updates to its policy on escrow and resale restrictions. The immediately effective updates amended and renamed Policy 5.4 – Capital Structure, Escrow and Resale Restrictions (New Policy 5.4), which applies to new listings on the TSXV (New Listings), which include initial public offerings (IPOs), reverse takeovers (RTOs), changes of business (COBs) and qualifying transactions (QTs). Significant updates include: Expanding ways to demonstrate acceptable capital structure: The New Policy 5.4 provides more ways for an issuer to demonstrate acceptable capital structure when seeking approval for a New Listing. Eliminating the delayed escrow release schedule

Engineering firm sold to Canadian company

A Canadian company with an international reach in sustainable engineering and environmental consulting has bought Christchurch-headquartered engineering firm Cosgroves. The Toronto Stock Exchange and New York Stock Exchange-listed Stantec paid an undisclosed sum for its latest acquisition. Cosgroves has more than 90 staff across New Zealand and works with clients, architects, project managers and other professionals in consulting engineering on private and public building projects such as the redevelopment of the Christchurch Town Hall. Stantec said the addition of Cosgroves would expand its buildings’ engineering capabilities in New Zealand, particularly in fire engineering, electrical, mechanical, hydraulics, buildings’ sustainability, and civil

Clean Air Metals Files Interim Financial Statements for the Three Months Ended April 30, 2025

THUNDER BAY, ON / ACCESS Newswire / June 30, 2025 / Clean Air Metals Inc. (“Clean Air Metals” or the “Company”) (TSXV:AIR)(FRA:CKU)(OTCQB:CLRMF) announces that it has filed its unaudited consolidated interim financial statements and management’s discussion and analysis for the three-month period ended April 30, 2025, available for viewing on www.sedarplus.ca. Financial Highlights Total assets as at April 30, 2025 of $37,507,184 Total cash as at April 30, 2025 of $2,475,945 Working capital deficiency as at April 30, 2025 of $527,130 Shareholder’s equity as at April 30, 2025 of $33,668,042 During the quarter, the Company incurred $584,284 in cost for

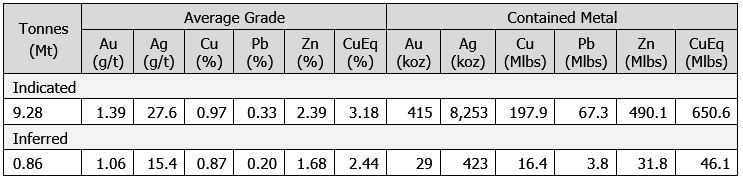

Arizona Metals Announces 2025 Mineral Resource Estimate for Kay Mine Project

Share this article Arizona Metals Corp. (TSX:AMC, OTCQX:AZMCF) (the “Company” or “Arizona Metals”) is pleased to announce an initial Mineral Resource Estimate (“MRE”) for its 100% owned Kay Mine Project (the “Kay Project”) located in Yavapai County, Arizona. Highlights of the Kay Project MRE are as follows: The underground MRE includes 9.28 million tonnes grading 1.39 g/t Au, 27.6 g/t Ag, 0.97% Cu, 0.33% Pb, and 2.39% Zn in the Indicated category, and 0.86 million tonnes grading 1.06 g/t Au, 15.4 g/t Ag, 0.87% Cu, 0.20% Pb, and 1.68% Zn in the Inferred category, at a base-case cut-off grade of

Ur-Energy Announces Appointment of Matthew Gili as President as Ur-Energy Advances Wyoming Uranium Production

LITTLETON, CO / ACCESS Newswire / June 30, 2025 / Ur-Energy Inc. (NYSE American:URG)(TSX:URE) (the “Company” or “Ur-Energy”) is pleased to announce the appointment of Matthew D. Gili as Ur-Energy’s President as a part of the Company’s succession planning and plans for strategic growth. Ur-Energy is progressing toward full production levels at Lost Creek and quickly moving toward production operations at its second mine at Shirley Basin. At full production, the Company expects to mine up to 2.2 million pounds of uranium annually. The addition of Mr. Gili strengthens the Company’s experienced management team to support the drive toward full-scale