(MENAFN– Newsfile Corp)

Toronto, Ontario–(Newsfile Corp. – May 30, 2025) – Cathedra Bitcoin Inc. (TSXV: CBIT) (OTCQB: CBTTF) (” Cathedra, ” the ” Company ,” or ” we “), a bitcoin company that develops and operates digital infrastructure assets with the goal of maximizing its per-share bitcoin holdings, today announces our first quarter (” Q1 “) financial results for 2025:

Q1 2025 Financial Highlights

Total revenues for the three months ended March 31, 2025, of C$6.5 million, compared to C$5.9 million during the three months ended March 31, 2024, an increase of 11%.

In March, we prepaid the outstanding C$5.7 million of principal on our 3.5% senior secured convertible debentures due November 11, 2025 (the ” Debentures “), for C$4.6 million of cash, representing a 20% discount to par (plus accrued interest). Additionally, the creditor surrendered for cancellation 10.9 million warrants to purchase subordinate voting shares at a price of C$0.12 per share until November 11, 2026.

To partially fund the repayment of the Debentures, we entered into a new loan for US$2.5 million, which is secured by approximately 50 of our bitcoin; carries interest at a rate of 13.0% per annum, payable monthly; and is interest-only until maturity on March 18, 2026.

Subsequent to quarter end, we repurchased and cancelled an additional 14,205,000 subordinate voting share purchase warrants for total cash consideration of US$75,002. These warrants also had an exercise price of C$0.12 and were set to expire in 2026 and 2027.

As of May 30, 2025, we hold approximately C$0.5 million of cash and C$7.6 million of bitcoin (52.5 bitcoin) for total liquidity of C$8.1 million. Our 52.46 bitcoin translates to approximately 6 satoshis (or “sats”) per share.

Q1 2025 Operating Highlights

In January, we announced a new 10-megawatt power purchase agreement in connection with a potential greenfield bitcoin mining data center development in Tennessee. This would mark our second site in Tennessee and is expected to achieve a cost of power of approximately US$30 per megawatt-hour. Upon final regulatory approvals, we intend to begin construction on the new site, which could be fully operational in as little as three months thereafter.

Also in January, we announced a new partnership with Synota Inc. (” Synota “), a software company that provides automated payments for C&I energy and hosting contracts to reduce financial risk and deliver consistent cash flow. Under the partnership, we utilize Synota’s tools to facilitate daily or weekly settlement of hosting bills, thereby improving cash flow cycles, reducing risk and simplifying back-office processes. This partnership has also added flexibility for Cathedra to accumulate bitcoin, by providing us the option to receive daily hosting payments in the form of U.S. dollars or bitcoin.

In March, we announced that Tirpitz Technology Holdco LLC (the ” JV “), a joint venture that owns and operates a 60-megawatt bitcoin mining data center in North Dakota (the ” North Dakota Facility “) and in which Cathedra holds a minority interest, entered into a binding agreement to sell 100% of the membership units in the JV to a third-party bitcoin miner for total cash consideration of approximately US$21.0 million. The agreement was contingent upon the completion of several performance milestones which were recently achieved, and we expect the transaction to close in the coming weeks (subject to closing conditions and customary regulatory approvals).

Management Commentary

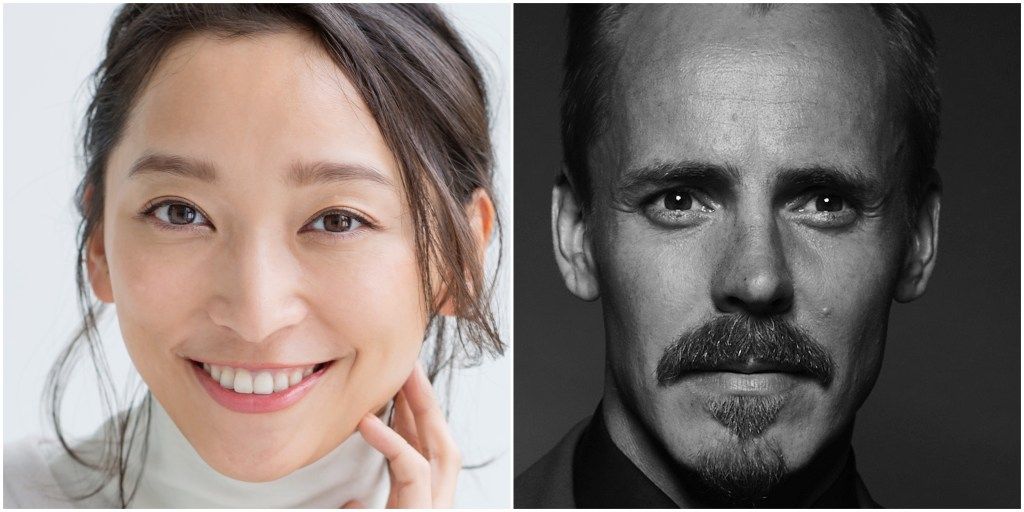

“The first several months of 2025 have affirmed our all-weather strategy, under which we offer hosting services to third-party bitcoin miners while maintaining exposure to mining upside through our own fleet of machines and opportunistic profit-sharing arrangement with certain hosting clients,” remarked AJ Scalia, CEO of Cathedra. “During April, daily hash price hit lows of roughly US$40/PH, during which time the stability of our hosting business allowed us to continue operating without selling down our existing bitcoin strategy. In the weeks since, hash price has rallied nearly 50% as bitcoin has surged to new all-time highs, and we have benefited through our direct exposure to hash rate.

“We took important steps to optimize our capital structure, prepaying our outstanding convertible debt at a significant discount to its par value and cancelling a total of nearly 25 million warrants.

“Looking toward the future, we have contracted another 10 megawatts of power capacity at a new site in Tennessee, which would expand our data center portfolio by 33%. We continue work to expand this growth pipeline further.

“Finally, we recognize that obtaining a listing on a major U.S. stock exchange will meaningfully improve our liquidity, access to capital, and public profile, and continue to work toward bringing Cathedra’s shares to the deepest capital market in the world.”

About Cathedra Bitcoin Inc.

Cathedra Bitcoin Inc. develops and operates digital infrastructure assets across North America with the goal of maximizing its per-share bitcoin holdings. The Company hosts bitcoin mining clients across its portfolio of three data centers (30 megawatts total) in Tennessee and Kentucky and recently developed and sold a 60-megawatt data center in North Dakota, a joint venture in which Cathedra held a minority interest, closing of which is anticipated to occur in the second quarter of 2025. Cathedra also operates a fleet of proprietary bitcoin mining machines at its own and third-party data centers, producing approximately 400 PH/s of hash rate. Cathedra is headquartered in Vancouver and its shares trade on the TSX Venture Exchange under the symbol CBIT and in the OTC market under the symbol CBTTF.

At time of publishing, the Company holds approximately 52.5 bitcoin worth approximately US$5.5 million and amounting to approximately 6 satoshis (or “sats”) per share.

For more information about Cathedra, visit cathedra or follow Company news on Twitter at @CathedraBitcoin or on Telegram at @CathedraBitcoin .

Media and Investor Relations Inquiries

Please contact:

Antonin Scalia

Chief Executive Officer

+1 (604) 259-0607

…

Forward-Looking Statements

This news release contains certain “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian securities laws that are based on expectations, estimates and projections as at the date of this news release. The information in this release about future plans and objectives of the Company, are forward-looking information. Forward-looking information contained in this news release includes but is not limited to information concerning: the potential for and merits of the Kungsleden acquisition; the benefits of the strategy to become a developer and operator of high-density compute infrastructure for bitcoin mining and/or other potential end markets; and other statements regarding future plans and objectives of the Company. Any statements that involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This forward-looking information is based on reasonable assumptions and estimates of management of the Company at the time it was made. The Company has also assumed that no significant events occur outside of its normal course of business.

Additionally, these forward-looking statements may be affected by risks and uncertainties in the business of Cathedra and general market conditions. Investors are cautioned that forward-looking statements are not based on historical facts but instead reflect Cathedra’s management’s expectations, estimates or projections concerning future results or events based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made. Although Cathedra believes that the expectations reflected in such forward-looking statements are reasonable, such statements involve risks and uncertainties, and undue reliance should not be placed thereon, as unknown or unpredictable factors could have material adverse effects on future results, performance or achievements of the Company. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are the following: an inability successfully integrate the Kungsleden business on terms which are economic or at all; a failure to realize the expected benefits of the business plan to develop and operate high-density compute infrastructure for bitcoin mining and/or other potential end markets; the risks of an increase in the Company’s electricity costs, cost of natural gas, changes in currency exchange rates, energy curtailment or regulatory changes in the energy regimes in the jurisdictions in which the Company operates and the potential adverse impact on the Company’s profitability; revenue may not increase as currently anticipated, or at all; it may not be possible to profitably liquidate the current digital currency inventory, or at all; a decline in digital currency prices may have a significant negative impact on operations; an increase in network difficulty may have a significant negative impact on operations; the volatility of digital currency prices; future capital needs and the ability to complete current and future financings, as well as capital market conditions in general; volatile securities markets impacting security pricing unrelated to operating performance; historical prices of digital currencies and the ability to mine digital currencies that will be consistent with historical prices; changes in general economic, business and political conditions, including changes in the financial markets; changes in applicable laws and regulations both locally and in foreign jurisdictions; compliance with extensive government regulation and the costs associated with compliance; unanticipated costs; changes in market conditions impacting the average revenue per MWh; and the risks and uncertainties associated with foreign markets. Additionally, the forward-looking statements contained herein may be affected by risks and uncertainties in the business of Cathedra and general market conditions. Please see the Company’s management information circular dated June 18, 2024 which is available for view the Company’s SEDAR+ profile on . Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended and such changes could be material. Readers should not place undue reliance on forward-looking information. The Company undertakes no obligation to revise or update any forward-looking information other than as required by law.

To view the source version of this press release, please visit

SOURCE: Cathedra Bitcoin Inc.

MENAFN30052025004218003983ID1109615450

Comments