Article content

As Canada’s biggest bookstore-turned-gift-giver’s-paradise edges toward privatization, it’s evident from a stroll around one of its Toronto stores that the retailer knows some things haven’t been working.

Written by Canadian Press on . Posted in Canada. Leave a Comment

Author of the article:

Canadian Press

Tara Deschamps

Published Apr 19, 2024 • 5 minute read

As Canada’s biggest bookstore-turned-gift-giver’s-paradise edges toward privatization, it’s evident from a stroll around one of its Toronto stores that the retailer knows some things haven’t been working.

Advertisement 2

Story continues below

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

or

Article content

Epsom salts and body lotions that previously lined Indigo Books & Music Inc.’s wellness area at the Eaton Centre have been replaced by shelves of books and tchotchkes like cat- and corgi-shaped book lights, magnifying glasses and lap desks.

Article content

In the children’s section, a red velvet curtain and a closed sign hide what was once the American Girl doll emporium. (The pricey playthings and their plethora of accessories were sold off at a discount in March.)

The company has offered few details about these developments, or a transformation plan it launched late last year — around the same time it revealed an almost $50 million net loss in its latest fiscal year — but such is the state of Indigo at a time when shareholders prepare to decide whether the company is better off as a private enterprise owned by a holding company connected to its largest shareholder.

Advertisement 3

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“It’s a pivotal period to strengthen the company financially and then begin to move it forward,” said Joanne McNeish, an associate professor at Toronto Metropolitan University specializing in marketing.

“This won’t be a quick fix.”

She estimates it will take Indigo five years to turn itself around, a process that marketing experts agree could see the retailer put books back in the spotlight and rethink its spaces and even its store count.

“In the case of the Eaton Centre store, do you need two levels?” McNeish questioned.

“Maybe it’s just each square inch of the floor space doing a great job at selling the products they have available.”

Some of this work appears to be underway already, but how much further it will go depends on a May shareholder vote to decide whether to accept the offer of $2.50 per share in cash — up from $2.25 in February — from Trilogy Retail Holdings Inc. and Trilogy Investments L.P.

The Winnipeg Sun’s Daily Headline News

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of The Winnipeg Sun’s Daily Headline News will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 4

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The deal got a green light from the retailer’s board in early April and needs to meet the threshold for shareholder approval before it can go ahead.

Trilogy is owned by Onex Corp. founder and chairman Gerald Schwartz who holds 56 per cent of Indigo’s shares and is the spouse of Indigo founder and CEO Heather Reisman, who holds almost five per cent of the company’s shares.

Should the transaction, which would see Indigo leave the Toronto Stock Exchange, close as expected in June, experts say it will be time for leadership to roll up their sleeves and begin a new chapter.

What they will find is that “it’s a lot of work to make this business profitable,” said Grant Packard, an associate professor of marketing at York University. He previously served as Indigo’s interim chief marketing officer and vice-president of marketing.

Advertisement 5

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Between the low margins linked to books, the dominance of e-commerce giant Amazon and a cyberattack that downed some of the company’s services for weeks, he said, “They’ve been under such turmoil for the last few years.”

Understanding the work Packard and McNeish feel Indigo has to do to rebound from that turmoil also means looking at how it got here.

When Indigo debuted in 1996, it speedily became the country’s go-to bookstore, speckling malls, plazas and eventually, the e-commerce world, under Reisman’s goal to create a mecca for book lovers who scooped up books the founder gave her “Heather’s Pick” stamp of approval.

“If they could, they would spend all day there because it’s the equivalent to them of going on a vacation or going to see a movie,” said Packard in describing the target customer.

Advertisement 6

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“There are a lot of people in Canada that are like that, but there are more people that aren’t like that.”

Coping with such demographics, as well as the rise of Amazon and e-readers, pushed Indigo to branch out.

Some of the products it looked to, such as cozy socks and quirky mugs, made sense as book accompaniments. Others — sex toys, furniture and high-end jam — were a much bigger leap.

“Sauces and that sort of thing, they can go bad and then it begins to be not the quality image that I believe Indigo was going for,” said McNeish. “They were never meant to be a discount bookstore.”

Some of Indigo’s diversification began under Reisman but it gained new momentum under one-time John Lewis and Anthropologie executive Peter Ruis. In 2022, he took the helm of Indigo from Reisman, who was made executive chair before she was due to retire in August 2023.

Advertisement 7

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

As Indigo prepared for her departure last June, four of Indigo’s 10 directors left the board. Chika Stacy Oriuwa attributed her resignation to mistreatment and a “loss of confidence in board leadership.”

Reisman, who returned as Indigo’s CEO last September, has never elaborated on Oriuwa’s allegations. She revealed last year that the company is carrying out a transformation plan meant to “fully re-energize” its connection to customers.

Since then, an unspecified number of staff were laid off in January and Reisman has said Indigo reinvested in books and has been working to “rightsize and rightshape” its general merchandise in an apparent admission there was a mismatch between customer expectations and what the retailer was offering.

Advertisement 8

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Asked about its strategy moving forward, Indigo said in a statement that it is engaging in “meaningful work” to transform the business and update its range of products.

“Books are the heart and soul of Indigo, and we’re excited to expand our assortment of titles online and in stores across the country,” the company said in an email.

“We will also continue to be the booklover’s gift destination with a very carefully curated offering of lifestyle and paper products.”

An April letter Reisman sent to customers teased that the company would also bring back its digital inventory search kiosks, program more events, add seating to more stores and find cafe partners to fill spaces in Indigo shops left vacant by Starbucks.

Advertisement 9

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

At the Eaton Centre location, a Columbus Cafe & Co. has filled the store’s coffee shop void and on a recent Wednesday morning, when the weather was too nice to need refuge indoors, had a hearty line. Employees have also worked to expand and freshen the look of the store’s upscale baby section, where several customers browsed.

McNeish thinks the company now has to build on these wins — a task she still feels Reisman is ideal for.

“You can’t be perfect as a manager all the time, but she just seems to have this instinct for how to do it and a deep understanding, as she is a book person herself,” she said.

The trick, Packard said, will be deciding on the right number of stores, how to utilize them and how to invest in its online channels in a way that delivers the company to stability.

“They’ve just been always very susceptible to a market where the winds blow in different directions very quickly,” he said.

“(They need) to be in a position where market shocks like the pandemic or ransomware attack aren’t as deadly, so they can innovate, they can try new things.”

Article content

Share this article in your social network

This Week in Flyers

Written by Freschia Gonzales on . Posted in Canada. Leave a Comment

Additionally, all affected ETFs will receive new Committee on Uniform Securities Identification Procedures numbers (CUSIP), expected to be effective concurrently with the rebranding.

The BetaPro ETF family, which includes Canada’s only suite of leveraged, inverse, and inverse leveraged ETFs, will not be impacted by these updates and will retain their current names, tickers, and CUSIPs.

A significant update is that the ticker for the Global X Pipelines and Energy Services Index ETF will change from HOG to PPLN, effective on or about May 1. The complete list of ETFs undergoing name changes, along with their new CUSIPs, has been provided to ensure clarity for stakeholders.

Mehta further commented, “As we get ready to expand our product shelf as Global X and embrace new opportunities for investment innovation, Canadians can rest assured that our long-standing offerings will continue to be accessible and deliver effective exposure under their existing tickers.”

The updates are scheduled to take effect on the Toronto Stock Exchange on or about May 1, marking a significant step in the Horizons’ evolution and its commitment to providing innovative investment solutions in Canada.

Written by Freschia Gonzales on . Posted in Canada. Leave a Comment

Desjardins Investments Inc. (DI), serving as the manager for Desjardins Exchange Traded Funds (ETFs), has announced the launch of four new index exchange-traded funds.

These ETFs, having completed their initial offering of units, will begin trading on the Toronto Stock Exchange (TSX) today.

Frédérick Tremblay, managing director and head of Investment Solutions at Desjardins, expressed, “We’re proud to expand our range of Desjardins ETFs and launch these core components, designed to meet investors’ needs for diversification and portfolio construction, and to help empower them financially.”

Written by Reuters Inc. on . Posted in Canada. Leave a Comment

STORY CONTINUES BELOW THESE SALTWIRE VIDEOS

(Reuters) – Futures for Canada’s main stock index tumbled on Friday as investors looked to minimize risk following reports of an escalation in the Middle East conflict, while rising commodity prices contained the decline.

June futures on the S&P/TSX index were down 0.2% at 6:52 a.m. ET (10:52 GMT).

Global stocks eased after reports of Israel’s attack on Iranian soil in the latest exchange of events in the region and pushed investors to safe haven assets.

Across the border, U.S. stock index futures also slipped, and the CBOE Volatility index hit its highest in five months. [.N]

On the commodities front, spot gold prices were poised for a fifth week of gains as investors flocked to the bullion amid the tensions, while copper prices hit their highest in nearly two years. [GOLD/] [MET/L]

Materials shares could outperform their sectoral peers this week on strength from metal miners.

Oil prices steadied after an earlier spike on reports of the attack, as market fears of a major escalation in hostilities in the region appeared to ease and build-up of global oil stocks weighed. [O/R]

The Toronto Stock Exchange’s S&P/TSX composite index ended 0.2% higher on Thursday, as metal prices boosted the materials sector. [.TO]

The TSP, snapped its recent losing streak on Wednesday but is set for a weekly decline.

In corporate news, brokerage Scotia resumed its coverage of construction supplies provider ADENOMA

Earnings in the U.S. are picking up more momentum after streaming giant Netflix gave a revenue forecast below analysts’ estimates, and big tech companies due to report their quarterly figures in the next week.

COMMODITIES AT 6:52 a.m. ET

Gold futures: $2,383; -0.1% [GOLD/]

US crude: $82.28; -0.5% [O/R]

Brent crude: $86.58; -0.6% [O/R]

(Reporting by Purvi Agarwal in Bengaluru; Editing by Ravi Prakash Kumar)

Written by TSX Stocks on . Posted in Canada. Leave a Comment

Trusted News Since 1995

A service for global professionals

·

Friday, April 19, 2024

·

704,963,033

Articles

·

3+ Million Readers

Written by Tara Deschamps The Canadian Press on . Posted in Canada. Leave a Comment

TORONTO — As Canada’s biggest bookstore-turned-gift-giver’s-paradise edges toward privatization, it’s evident from a stroll around one of its Toronto stores that the retailer knows some things haven’t been working.

Epsom salts and body lotions that previously lined Indigo Books & Music Inc.’s wellness area at the Eaton Centre have been replaced by shelves of books and tchotchkes like cat- and corgi-shaped book lights, magnifying glasses and lap desks.

In the children’s section, a red velvet curtain and a closed sign hide what was once the American Girl doll emporium. (The pricey playthings and their plethora of accessories were sold off at a discount in March.)

The company has offered few details about these developments, or a transformation plan it launched late last year — around the same time it revealed an almost $50 million net loss in its latest fiscal year — but such is the state of Indigo at a time when shareholders prepare to decide whether the company is better off as a private enterprise owned by a holding company connected to its largest shareholder.

“It’s a pivotal period to strengthen the company financially and then begin to move it forward,” said Joanne McNeish, an associate professor at Toronto Metropolitan University specializing in marketing.

“This won’t be a quick fix.”

She estimates it will take Indigo five years to turn itself around, a process that marketing experts agree could see the retailer put books back in the spotlight and rethink its spaces and even its store count.

“In the case of the Eaton Centre store, do you need two levels?” McNeish questioned.

“Maybe it’s just each square inch of the floor space doing a great job at selling the products they have available.”

Some of this work appears to be underway already, but how much further it will go depends on a May shareholder vote to decide whether to accept the offer of $2.50 per share in cash — up from $2.25 in February — from Trilogy Retail Holdings Inc. and Trilogy Investments L.P.

The deal got a green light from the retailer’s board in early April and needs to meet the threshold for shareholder approval before it can go ahead.

Trilogy is owned by Onex Corp. founder and chairman Gerald Schwartz who holds 56 per cent of Indigo’s shares and is the spouse of Indigo founder and CEO Heather Reisman, who holds almost five per cent of the company’s shares.

Should the transaction, which would see Indigo leave the Toronto Stock Exchange, close as expected in June, experts say it will be time for leadership to roll up their sleeves and begin a new chapter.

What they will find is that “it’s a lot of work to make this business profitable,” said Grant Packard, an associate professor of marketing at York University. He previously served as Indigo’s interim chief marketing officer and vice-president of marketing.

Between the low margins linked to books, the dominance of e-commerce giant Amazon and a cyberattack that downed some of the company’s services for weeks, he said, “They’ve been under such turmoil for the last few years.”

Understanding the work Packard and McNeish feel Indigo has to do to rebound from that turmoil also means looking at how it got here.

When Indigo debuted in 1996, it speedily became the country’s go-to bookstore, speckling malls, plazas and eventually, the e-commerce world, under Reisman’s goal to create a mecca for book lovers who scooped up books the founder gave her “Heather’s Pick” stamp of approval.

“If they could, they would spend all day there because it’s the equivalent to them of going on a vacation or going to see a movie,” said Packard in describing the target customer.

“There are a lot of people in Canada that are like that, but there are more people that aren’t like that.”

Coping with such demographics, as well as the rise of Amazon and e-readers, pushed Indigo to branch out.

Some of the products it looked to, such as cozy socks and quirky mugs, made sense as book accompaniments. Others — sex toys, furniture and high-end jam — were a much bigger leap.

“Sauces and that sort of thing, they can go bad and then it begins to be not the quality image that I believe Indigo was going for,” said McNeish. “They were never meant to be a discount bookstore.”

Some of Indigo’s diversification began under Reisman but it gained new momentum under one-time John Lewis and Anthropologie executive Peter Ruis. In 2022, he took the helm of Indigo from Reisman, who was made executive chair before she was due to retire in August 2023.

As Indigo prepared for her departure last June, four of Indigo’s 10 directors left the board. Chika Stacy Oriuwa attributed her resignation to mistreatment and a “loss of confidence in board leadership.”

Reisman, who returned as Indigo’s CEO last September, has never elaborated on Oriuwa’s allegations. She revealed last year that the company is carrying out a transformation plan meant to “fully re-energize” its connection to customers.

Since then, an unspecified number of staff were laid off in January and Reisman has said Indigo reinvested in books and has been working to “rightsize and rightshape” its general merchandise in an apparent admission there was a mismatch between customer expectations and what the retailer was offering.

Asked about its strategy moving forward, Indigo said in a statement that it is engaging in “meaningful work” to transform the business and update its range of products.

“Books are the heart and soul of Indigo, and we’re excited to expand our assortment of titles online and in stores across the country,” the company said in an email.

“We will also continue to be the booklover’s gift destination with a very carefully curated offering of lifestyle and paper products.”

An April letter Reisman sent to customers teased that the company would also bring back its digital inventory search kiosks, program more events, add seating to more stores and find café partners to fill spaces in Indigo shops left vacant by Starbucks.

At the Eaton Centre location, a Columbus Café & Co. has filled the store’s coffee shop void and on a recent Wednesday morning, when the weather was too nice to need refuge indoors, had a hearty line. Employees have also worked to expand and freshen the look of the store’s upscale baby section, where several customers browsed.

McNeish thinks the company now has to build on these wins — a task she still feels Reisman is ideal for.

“You can’t be perfect as a manager all the time, but she just seems to have this instinct for how to do it and a deep understanding, as she is a book person herself,” she said.

The trick, Packard said, will be deciding on the right number of stores, how to utilize them and how to invest in its online channels in a way that delivers the company to stability.

“They’ve just been always very susceptible to a market where the winds blow in different directions very quickly,” he said.

“(They need) to be in a position where market shocks like the pandemic or ransomware attack aren’t as deadly, so they can innovate, they can try new things.’

This report by The Canadian Press was first published April 19, 2024.

Companies in this story: (TSX:IDG)

Tara Deschamps, The Canadian Press

Written by TSX Stocks on . Posted in Canada. Leave a Comment

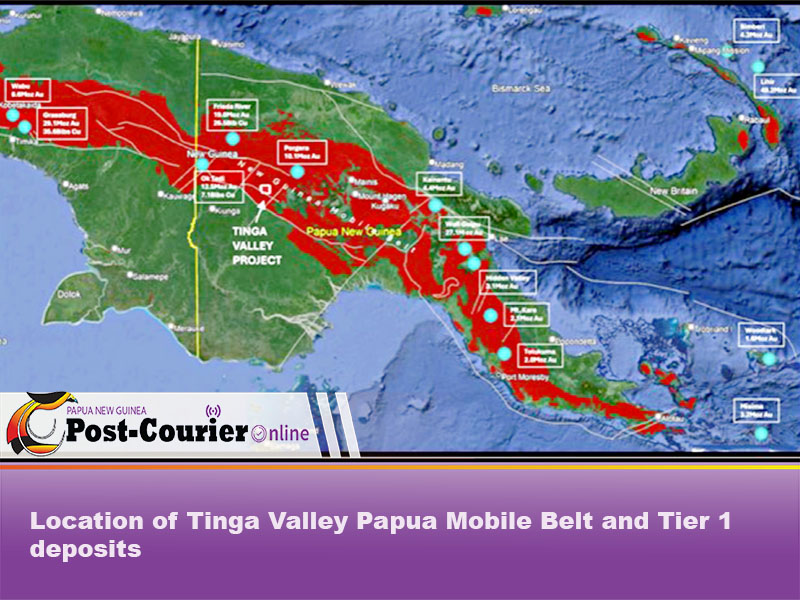

Canadian gold mining company Great Pacific Gold Corp’s plan to acquire Tinga Valley Copper & Gold Corp, will see GPAC take over the highly prospective Tinga Valley Property in Papua New Guinea.

Great Pacific Gold Corp in a market announcement confirmed that it has entered into an amalgamation agreement dated April 12, 2024, with privately held Tinga Valley Copper & Gold Corp to acquire the Tinga Valley Property, a highly prospective Papua New Guinea copper-gold project.

The Tinga Valley Property, spanning 347 sq km, is located 140 km along strike of the world-class Ok Tedi Copper-Gold Mine. The property is highly prospective for large and high-grade porphyry style copper-gold mineralization and associated massive sulphide-magnetite skarn mineralization. Several large high priority drill targets have already been identified over a 2.5km x 1.5km footprint.

This property is expected to complement an extensive copper-gold portfolio in PNG, with

exploration planned to unlock major Copper, Gold Porphyry potential in 2024.

According to Great Pacific Gold, historic surface exploration work has identified extensive Copper and Gold grades across a 2km copper mineralized zone, including grades above 1.97 per cent Cu and 12.7g/t Au.

Great Pacific Gold CEO Bryan Slusarchuk stated, “The Tinga Valley Property is known to host significant size and grade potential for copper and gold and has been subject of a substantial amount of preliminary exploration work that has resulted in excellent drill targets. This acquisition adds to an already large and commanding land position within a country that hosts some of the world’s most important copper and gold deposits. With a strong treasury, in-country expertise, and an excellent technical team, we are well positioned to advance on multiple projects within PNG.”

Tinga CEO Martin Pawlitschek echoed these sentiments, noting that the Tinga Valley Property has the potential to host both large size and high-grade deposits.

He added, “Today’s transaction will benefit local communities, Tinga shareholders and all stakeholders as we combine an excellent project with a well-financed entity consisting of team members having a track record of success advancing projects through large-scale exploration in PNG.”

The acquisition is subject to the approval of the Toronto Stock Exchange (TSX) Venture Exchange acceptance and the satisfaction of other customary conditions.

The shareholders of Tinga will receive 12,500,000 common shares of GPAC, and each Tinga Shareholder will receive one Common Share for every one Tinga Share held. The Common Shares issued to the Tinga Shareholders will be subject to voluntary restrictions on resale.

This acquisition marks a significant milestone for Great Pacific Gold, which already boasts a portfolio of high-grade gold projects in Papua New Guinea and Australia.

Written by TSX Stocks on . Posted in Canada. Leave a Comment

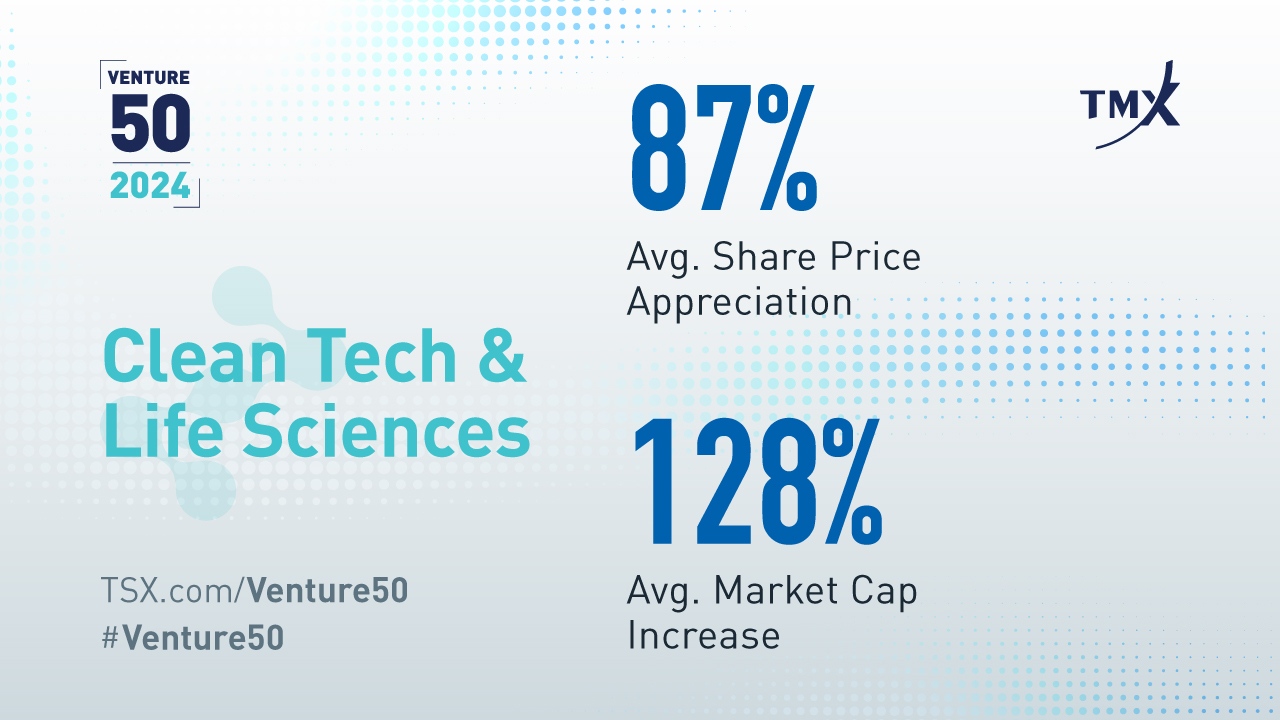

While investors continue to show incredible interest in supporting energy transition, they are also paying close attention to early-stage research and development. TSX Venture Exchange’s (TSXV) 2024 Venture 50™ list highlights this trend, with the top-ranked clean tech and life sciences companies posting an average share price appreciation of 87% and average market capitalization increase of 128% over 2023.

That growing investor interest in research and development for biotech companies is front and centre on this year’s ranking. Despite some of these companies not yet being revenue producing, investors are demonstrating their confidence in the potential of scientific advancements and their transformative impact on society.

Canadian bioscience firm Satellos Bioscience Inc. (TSX: MSCL) is a prime example of this trend. The company’s work in regenerative medicine has captured the attention of investors, who see value in its research to treat degenerative muscle diseases. Although its oral, small molecule drug is still in development, investors have shown interest in its potential to treat Duchenne muscular dystrophy.

That confidence is leading to growth. With nearly $50 million in financing to advance development, Satellos recently graduated from TSXV to Toronto Stock Exchange.

“Research and development-focused companies can represent a riskier asset class, so the interest we are seeing is a testament to well-managed organizations with great potential that investors are willing to support,” said Dani Lipkin, Managing Director, Global Innovation Sector, Toronto Stock Exchange and TSX Venture Exchange. “Investing in R&D indicates a significant evolution in investor confidence and an increased appetite for sectors that are high risk but also potentially high reward.”

It also suggests a more future-looking approach among investors. They are betting on the long-term potential of these companies, recognizing that today’s scientific breakthroughs could become tomorrow’s groundbreaking therapies.

NervGen Pharma Corp. (TSXV: NGEN), another biotech company on the 2024 Venture 50 list, recently finished its phase one clinical trial for a drug intended to enable the nervous system to repair itself after injury. It also received fast-track designation from the U.S. Food and Drug Administration to begin clinical trials for a potentially revolutionary spinal cord injury drug.These advancements have pushed the company closer to getting the treatment onto the market–and investors have taken note. They recently completed a $23 million bought deal, a significant influx of venture capital that can help fuel NervGen’s operations and growth.

“Canadian companies are leading the way on cutting-edge solutions, from developing novel medical treatments to pioneering new clean energy technologies,” Lipkin said. “That makes these companies attractive to investors looking to ensure intellectual property is generated in and remains in Canada to drive economic growth.”

Along with R&D-focused life sciences firms, this year’s clean tech and life sciences ranking also shows a growing interest in companies supporting the energy transition. At the top of the list is Westbridge Renewable Energy Corp. (TSXV: WEB), a solar company at the forefront of this trend. Its work in harnessing utility-scale solar power is contributing to the global shift towards renewable energy sources.

Other notable players in cleantech include GreenPower Motor Company Inc. (TSXV: GPV), which manufactures purpose-built electric cargo vans, shuttles, and school buses, as well as CHAR Technologies Ltd. (TSXV: YES), which transforms woody materials and organic waste into renewable energy.

“There was a strong showing for cleantech companies on the 2024 Venture 50 list, once again highlighting investors’ interest in alternative fuels and energy options,” Lipkin noted. “Investors increasingly acknowledge the importance of decarbonization and the pivotal role of cleantech companies in achieving this goal.”

As the effects of climate change become clearer, these companies are helping the global push towards cleaner, more sustainable energy sources.

The transition to a low-carbon economy also presents significant economic opportunities. The alternative energy sector is expected to experience substantial growth, creating new industries and jobs. Plus, investors are increasingly placing emphasis on environmental, social, and governance (ESG) factors in their investment decisions. Investing in alternative fuels aligns with ESG goals and demonstrates a commitment to sustainable practices.

Overall, this year’s Venture 50 ranking reflects the growing interest in companies that can advance Canada’s innovation agenda.

To learn more about the clean technology and life sciences issuers on the 2024 Venture 50, watch this playlist. You can view the complete list of ranked companies, including those in the diversified industries, energy, mining, and technology sectors on our website.

Copyright © 2024 TSX Inc. All rights reserved. Do not copy, distribute, sell or modify this publication without TSX Inc.’s prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. TMX, the TMX design, TMX Group, The Future is Yours to See., Toronto Stock Exchange, TSX, TSX Venture Exchange, TSX Venture 50, Venture 50, the Venture 50 logo, TSXV, and Voir le futur. Réaliser l’avenir. are the trademarks of TSX Inc.

Written by TSX Stocks on . Posted in Canada. Leave a Comment

Trusted News Since 1995

A service for global professionals

·

Thursday, April 18, 2024

·

704,812,730

Articles

·

3+ Million Readers

Written by TSX Stocks on . Posted in Canada. Leave a Comment

TAMPA, Fla. — The Canadian Space Agency (CSA) has awarded MDA Space a contract extension worth around $182 million to continue supporting robotics operations on the International Space Station until 2030.

The contract now also includes robotics flight controller duties, in addition to the operational readiness support MDA Space has provided for the Mobile Servicing System on the ISS since 2001.

MDA Space has previously only provided training to CSA and NASA staff for operating this system, which includes the space station’s 17-meter Canadarm2 robotic arm, alongside mission planning and engineering support.

The vast majority of ISS robotic operations are conducted by flight controllers on the ground, supporting the berthing of visiting spacecraft, relocation and repair of equipment around the station, monitoring and surveying the station for damage, and assisting astronauts during spacewalks.

From January 2025, MDA Space will control the robotic operations with a team that will initially be based at the CSA mission control centre in Quebec, Canada.

Commercial push

Flight controller support is also part of a new product line of modular robotic technologies and services MDA Space unveiled April 10 called Skymaker, which the company hopes will help it secure emerging commercial opportunities following decades of government work.

The company is offering to operate Skymaker technology on behalf of customers from its recently opened mission control center in Ontario, Canada.

“There’s no need for them to become experts on space robotics and operations,” MDA Space vice president of robotics and space operations Holly Johnson said in an interview, and “try to go through all that scar tissue learning that we had over the past little while.

“We’re going to package that up into a full end-to-end mission services and operations offering.”

Skymaker comprises a kit of parts for robotic arms ranging from one to more than 15 meters in length.

The company is seeing an uptick in demand for space robotics in the commercial market, according to Johnson.

Last year, MDA Space secured contracts to build the grapple fixtures and anchor point interfaces that Axiom’s proposed commercial space station needs to be compatible with robotics.

The company is also providing robotics for one of the commercial teams NASA recently picked to work on concepts for a lunar rover that could be offered as a service.

“We are in discussions with multiple customers that have interest in on-orbit servicing, in-space assembly, and in-space manufacturing,” Johnson told SpaceNews.

MDA Space has historically been known for delivering large-scale and bespoke high-performance robotic systems, such as Canadarm2.

But Johnson said Skymaker addresses demand for a greater variety of needs with robotics covering different lengths and strengths.

“We can reach around the corner or walk around the station,” she added, “and our robotics can be one meter long to more than 15 meters long.”

“Some robotics require dexterous handling, others require crane-like operations, and so with our scalable solution we’re telling our customers: Let us do the heavy or the light lifting.”

According to Johnson, Skymaker is mainly suited for spacecraft that are at least the size of a dishwasher.

Government backing

MDA Space is also currently developing a robotic arm system for the United States-led Gateway space station being planned to orbit the Moon, representing Canada’s contribution to the program.

News of Canada’s ISS robotics extension comes a day after the country’s government proposed the creation of a National Space Council, part of a “new whole-of-government approach to space exploration, technology development, and research.”

The council was announced as part of Canada’s 2024 budget request, which included around $6 million in 2024-25 to Canada’s space agency for the Lunar Exploration Accelerator Program (LEAP), which invests in science and technology activities in lunar orbit, on the Moon’s surface, and beyond.

The Skymaker announcement is also part of a broader transformation for MDA Space, a robotics, satellite systems, and geointelligence provider that listed on the Toronto Stock Exchange after being carved out of Maxar Technologies in 2020.

The company was founded nearly 55 years ago as MacDonald, Dettwiler and Associates.

The company rebranded as MDA Space March 7, and a few weeks later named its software-defined satellite product line Aurora.

Canadian geostationary operator Telesat, Aurora’s anchor customer, has ordered an initial 198 of the satellites for its low Earth orbit broadband network Lightspeed under a contract worth about $1.6 billion. SpaceX is due to start launching the satellites in 2026.

Since separating from Maxar and becoming a public company four years ago, Johnson said MDA Space has been “able to invest heavily in the next generation of products, in roadmaps, and technologies” across all its business areas.

The company’s space robotics competitors include Maxar, U.S.-based Redwire, and GITAI of Japan.

Comments