FireFly Metals focused on growing copper-gold resource at Green…

A highly productive December quarter at the Green Bay Copper-Gold Project in Newfoundland, Canada, has put FireFly Metals Ltd in a strong position to drive further value “by demonstrating the immense production upside”, according to managing director Steve Parsons.

A key milestone during the quarter was a substantial increase in the Green Bay measured and indicated resource to 24.4 million tonnes at 1.9% for 460,000 tonnes copper equivalent while the inferred resource grew to 34.5 million tonnes at 2% for 690,000 tonnes.

This reflected the results of a highly successful 2023-2024 underground drilling campaign but FireFly is not resting on its laurels with four rigs continuing to drill underground in a fully-funded 130,000-metre drill campaign focused on growing and upgrading the resource.

World-scale nature

Parsons said: “Our exploration program has been highly successful, delivering a big increase in the resource base while highlighting the world-scale nature of the Green Bay Project.

“We now have four rigs working with the twin aims of growing and upgrading the resource. These goals are part of our overall strategy to drive value by demonstrating the immense production upside at Green Bay.”

READ: FireFly Metals begins trading on Toronto Stock Exchange main board

Another milestone passed in the quarter was FireFly beginning trading on the Toronto Stock Exchange (TSX) under the symbol FFM, in addition to its primary ASX listing, with the aim of increasing its profile in the North American investment community and attracting local exploration and development talent.

Additional ground

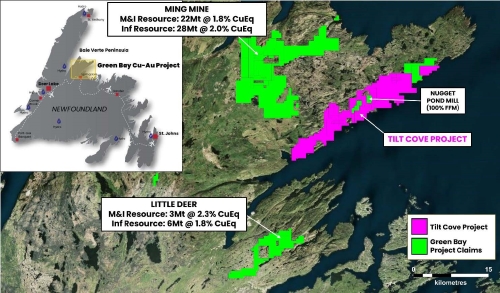

The company also completed the transaction to acquire the 115-square-kilometre, Tilt Cove copper-gold regional exploration project in Newfoundland.

READ: FireFly Metals snaps up second copper-gold project near Green Bay ahead of major exploration push

The transaction strengthens the company’s regional land holding by adding further exploration tenure continuous to the emerging world-class Green Bay Copper-Gold Project.

The 54% increase in land holding sees the Green Bay Project grow to a total area of ~326 square kilometres.

Tilt Cove is highly prospective for volcanogenic massive sulphide (VMS) deposits similar to FireFly’s rapidly growing Ming Mine. The project also contains high-grade orogenic-style gold mineralisation.

FireFly’s tenure in Newfoundland, Canada including the acquired Tilt Cove Project.

READ: Firefly Metals expands SPP to $8 million after receiving $27.7 million in subscriptions

Well-funded

After raising A$8 million in a significantly oversubscribed share purchase plan following a $65 million placement in September 2025, FireFly is well funded for its accelerated growth strategy in 2025 with ~A$84.1 million in cash, receivables and liquid investments at December 31, 2024.

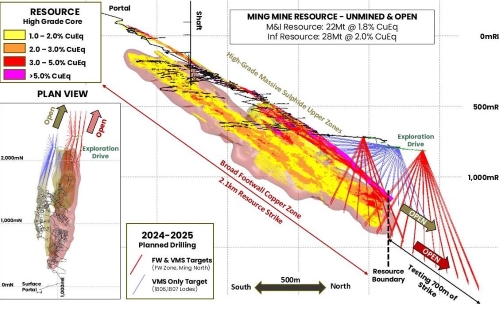

Green Bay Project hosts two distinct styles of copper mineralisation: one contains high-grade copper-gold massive sulphide zones (VMS) and the other is a large-scale, copper-rich stringer sulphides Footwall Zone (FWZ).

The resource increase was driven mainly by mineralisation from the large-scale FWZ copper zone directly below the high-grade VMS due to the Phase 1 drill platform locations.

Best assays yet

Continuous copper-gold intersections (copper-equivalent – CuEq) which are wide (~true thickness) and high-grade were returned, including FireFly’s best assays yet at Green Bay:

- 86.3 metres at 3.7% CuEq (3.1% copper & 0.6 g/t gold) in hole MUG24-079. This includes two distinct VMS lodes grading 15.5 metres at 4.6% CuEq and 9.9 metres at 5.8% CuEq above a broad copper FWZ intersection with a high-grade core of 27.6 metres at 5.3% CuEq; and

- 76.3 metres at 2.9% CuEq (2.4% copper & 0.5 g/t gold) in hole MUG24-073. This includes an upper VMS lode grading 20.1 metres at 6.1% CuEq above multiple FWZ intersections including 24.0 metres at 2.6% CuEq and 11.0 metres at 2.4% CuEq.

The resource consists of two components – Ming Mine containing 21.5 million tonnes at 1.8% for 393,000 tonnes CuEq of measured and indicated resources and 28.4 million tonnes at 2.0% for 576,000 tonnes CuEq of inferred resources and Little Deer deposit with 2.9 million tonnes of measured and indicated resources at 2.3% for 65,000 tonnes CuEq and 6.2 million tonnes of inferred resources at 1.8% for 114,000 tonnes CuEq.

All resource growth was attributable to the Ming Mine, with no additional resource growth drilling at Little Deer.

Zones remain open

Exploration drilling has demonstrated that the Ming Mine resource extends over considerable distances, now reaching a strike length of about 2 kilometres.

Both the high-grade massive sulphide zones and broad footwall stringer zones remain open, with downhole geophysical surveys indicating probable extensions to the mineralisation.

Phase 2 drilling is well underway with drilling targeting the high-grade copper-gold VMS zones which are expected to underpin the next round of resource growth.

Four drill rigs are operating underground, with the focus split between extension/exploration (two rigs) and resource conversion drilling (two rigs).

Key 2024-2025 milestones for the Green Bay Copper-Gold Project. Timelines are indicative and may be subject to change.

Regional exploration

At a regional level, exploration will accelerate in the current quarter with surface drilling to begin imminently.

Drilling will initially focus on the historical mines within 5 kilometres of the Ming deposit that contain unmined intersections such as 25 metres at 4.1% CuEq (4.7 g/t gold and 0.23% copper).

Data compilation for the newly acquired Tilt Cove property is also in progress with numerous copper and gold targets for exploration.

“There is a huge opportunity for FireFly to show that Green Bay is perfectly placed to fill the void between the numerous smaller copper producers and the limited number of major mines around the world,” Parsons added.

“This pathway will see us generate substantial shareholder value as we continue to grow and upgrade the resource and test compelling regional targets. This work will underpin a growing realisation of the size of the prize at Green Bay in a global context.”

Planned 2024-2025 resource extension drilling at the Ming Mine.

Project development

Work on engineering studies continues to evaluate various scenarios for an up-scaled restart to operations, which will incorporate the expected 2025 resource updates once finalised.

Following the success of the drilling programs to date, the company intends to complete the next phase of growth drilling before delineating the size of any future potentially upscaled mining operation, to avoid unduly limiting the scale of such operations.