BSR REIT Unlocks Growth After $618M Apartment Sale

In May 2024, the CEO of a Virginia company that owns more apartments than almost anyone in the United States made a cold call to the front desk of BSR Real Estate Investment Trust, a similar business headquartered in Little Rock’s Union Station.

About a year later, that phone call led to a whopping $618 million real estate deal that moved nine high-end apartment complexes in Texas from BSR’s portfolio into the hands of AvalonBay Communities. Maybe more importantly, the deal sent some of BSR’s early investors — and those investors’ rights to block some of BSR’s moves — to AvalonBay Communities.

BSR walked away from the transaction with a hefty pile of cash — some of which has already been spent to buy up more properties in Texas — as well as the freedom to send the company in a new direction, whatever that might be.

The ingredients are in place for other investors to take an interest in BSR, a company that trades publicly in Canada and owns thousands of high-end apartments in the desirable Texas market.

But BSR CEO Dan Oberste is careful when discussing BSR’s future, saying that selling off the company’s assets or going private are possible but so are boosting the stock price and increasing distributions to shareholders.

“BSR is for sale every day,” Oberste said, noting that any amount from one share in a company to the entire enterprise of a publicly traded company can be purchased at any time.

A Little Rock native, Oberste recalls working for BSR as a kid when it was a private company and painting the office walls for $6 an hour.

Today, Oberste is the CEO with total compensation of $1.7 million last year. While Oberste holds one of seven positions on the board, he describes himself as a professional manager whose objective is to drive shareholder return.

“You see this transition from, historically, a family business that is well-known in Little Rock to an institution run by professional managers,” Oberste said, comparing himself to a bus driver rather than an owner of the bus.

Oberste and the company’s management and board own around 6%-7% of the company. That’s a small amount of the overall pie but an “astronomically high number” compared with the typical percentage, which is less than 1%, BSR CFO Thomas Cirbus said.

BSR is a real estate investment trust, a type of company that owns income-producing real estate — like residential or commercial rental units — and pays dividends to shareholders from the income on those properties. REITS, as they are known, were created by Congress in 1960 as a way to allow retail investors to invest in large-scale real estate developments that might not otherwise be within reach.

Oberste said the management team can drive shareholder return by increasing distributions, which he said have risen by about 11% since the company went public in 2018, or by improving the value of the stock.

“If someone comes along and offers management the ability to maximize the shareholder return while mitigating the risk involved with time and execution, then it’s our job to assess that and advise the board and recommend what the company should do,” he said.

Project Cowboy

Part of BSR’s value in 2025 lies in the deal with AvalonBay Communities, because it gives the company more freedom, which had been limited due to its history as a private company.

In 1956, BSR was founded as a private company known as Bailey Corp., which went on to develop Little Rock neighborhoods such as Foxcroft and St. Charles as well as the Pavilion in the Park shopping center on Cantrell Road.

In the 1990s, John Bailey took over the company, renamed Bailey Properties in 1998, and focused on multifamily apartments with complexes in Little Rock and others in surrounding states.

In 2013, Bailey Properties merged with Summit Housing Partners LLC of Montgomery, Alabama, and changed its name to BSR Trust LLC. The company’s headquarters briefly moved to Montgomery before returning to Little Rock in the Union Station train station.

About seven years ago, BSR wanted to go public, but with about 7,000 units in its portfolio, the company is small by REIT standards. By comparison, AvalonBay Communities has more than 94,000 apartments and is the third-largest owner of apartments in the country.

BSR was too small for the New York Stock Exchange, so the company opted for the Toronto Stock Exchange and went public in May 2018. Oberste, who became the CEO about four years later, said the move made sense as BSR would take the place of another REIT that left the exchange, giving Canadians an opportunity to invest in real estate in the U.S. Sunbelt.

One issue for BSR was that the founding members of the company held certain rights, including the right to block certain major transactions. Known as the Bailey-Hughes affiliates, those investors controlled about 40% of the company when it went public and had the right to appoint up to three board members.

The sale this year, dubbed “Project Cowboy” by BSR, occurred in two transactions. The first sale included 857 units in the Austin area for $187 million. The second included 1,844 units in the Dallas area for $431.5 million.

The transaction also gave the Bailey-Hughes affiliates, as well as other investors who had been with the company since before it went public, an option to move to AvalonBay. After the deal, the Bailey-Hughes affiliates’ portion of BSR fell from 40% to 13%, eliminating their blocking rights. Their board-appointment rights were reduced from three board members to one.

“When you’ve got one hand tied behind your back, it makes it difficult to market that stock, because a lot of stock buyers want to buy a small REIT in hopes that it will privatize,” Oberste said.

The deal, which would have ranked No. 3 on Arkansas Business’ list of the biggest deals involving Arkansas companies in 2024, has also been good for the stock price. As of mid-July, BSR’s stock price had risen about 12.5% since the deal was announced in February.

One market analyst called the deal “transformational” and others have spoken favorably of the transaction. Several analysts noted BSR trades at a “discount” compared with its net asset value, suggesting the stock is more valuable than the company’s stock price suggests.

Lone Star Living

When BSR went public, it began to focus on Texas, a plan that has proved advantageous with the surge in Texas’ population in recent years. Last year, the U.S. Census Bureau estimated that Texas gained 562,941 residents, more than any other state.

As Texas has grown, so has the desirability of BSR’s real estate, putting the company in an enviable spot, Oberste says.

“We’ve got something that a lot of people want,” he said. “And that’s brand-new suburban Class A apartments in Texas — in Dallas, Austin and Houston.”

To understand BSR’s position, it’s important to understand some geographic trends across the Arkansas border. In simplest terms, people keep moving to Texas and BSR owns thousands of high-end apartments in the state’s fastest-growing cities.

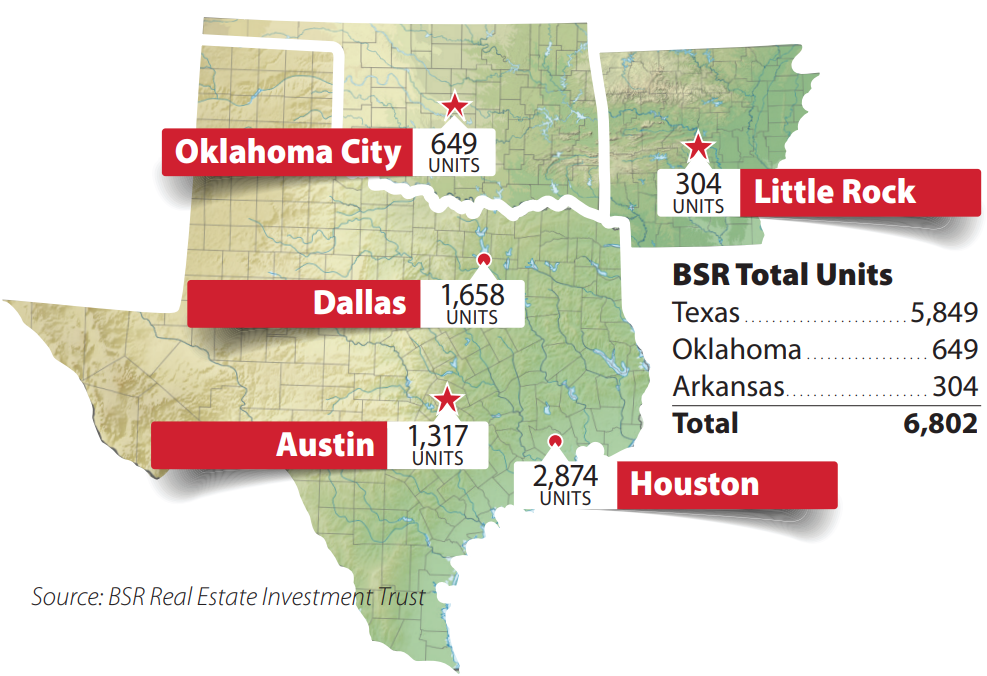

The company also owns 649 similar apartments in Oklahoma City and 304 in Little Rock, although BSR’s three Arkansas properties aren’t indicative of its fancier holdings outside the state.

According to the Texas Demographic Center, the state’s population has grown from about 29 million in 2020 to 31.6 million this year. That’s about a 9% increase in five years, according to the state agency’s most conservative estimate. The population could be as high as 36 million in 10 years and 40.6 million in 20 years, the state estimated.

But most of the growth in Texas has come in the state’s major metropolitan areas, specifically concentrated in the triangle between Dallas, Austin and Houston.

After the sale to AvalonBay, BSR bought two properties in the Houston area. The acquisitions show what type of properties BSR is interested in. Forayna Vintage Park in Houston has 350 apartment suites, and the population in a 3-mile radius has an average household income of $109,262. The company also bought Botanic Luxury, located in the Houston suburb of Spring, which has 288 apartment suites with a surrounding household income of $95,518.

The company would like to buy another property in Dallas in the next three or four months.

In total, BSR owns 6,802 units across 25 properties in Arkansas, Oklahoma and Texas, but the Texas units are the real prize. The company has 2,874 units in the Houston area with an average monthly rent of $1,525, 1,658 units in the Dallas area with an average rent of $1,538 and 1,317 units in the Austin area with an average rent of $1,554. In Texas, BSR had an occupancy rate of 96.1% at the end of the first quarter this year.

The rental units are more valuable in the context of the high hurdles to home ownership. Oberste estimated buying a house in BSR’s core markets in Texas would require an $89,000 down payment and mortgage payments of $2,900 a month.

Apartments are more affordable by comparison, and a slowdown in home construction suggests that dynamic won’t change, Oberste said. A report from the National Association of Homebuilders in June showed housing permits have been down for several months this year both nationally and in Texas, including dips in the Houston, Dallas and Austin areas.

Oberste said the decision to trade publicly in Canada made sense for the company in 2018 and it still has some advantages, noting “political instability” and “tribalism” in the United States. But Oberste added that Canada “doesn’t have to be the permanent domicile for our company.” He said it’s hard for him to see a long-term path for the company on the Toronto exchange.

If the management team thought they could make more money for the shareholders by being traded in the United States, they would consider doing it, he said.