AGRIWEEK – February 14, 2025

February 14, 2025

U.S. Inflation is heating up again, putting pressure on Trump to cool it on tariffs

Inflation figures released on Feb. 12, 2025, will come as a disappointment to Americans who hoped President Donald Trump would be true to his word on bringing down prices “on Day One.” It will also put pressure on the new administration to be wary of policies that may heat up inflation – and that includes tariffs.

The consumer price index, which measures the change in prices paid by consumers for a representative basket of goods and services, rose unexpectedly from December to January by 0.5 per cent. It means consumers are paying around 3 per cent more on item prices than they were a year ago.

Economists had been expecting the pace of inflation to slow in January.

The news isn’t good for anyone concerned. It means inflation remains above the Federal Reserve’s long-run target of 2 per cent – making it harder for the central bank to cut rates at its next meeting on March 19. At its last meeting, the rate-setting Federal Open Market Committee kept its benchmark federal funds rate unchanged at a range of 4.25-4.50 per cent.

Following the release of the latest inflation data, markets have a stronger conviction that the Fed will again hold rates steady when it meets in March.

It also means more pain for consumers. Higher interest rates set by the Fed play a large role in determining rates for mortgages, credit cards and auto loans. If January’s rate of inflation were to continue throughout 2025, consumers would see a painful 6.2 per cent annualized inflation rate.

And although it would be churlish to link the latest jump in inflation to an administration just weeks old, it does put into focus the current slate of Trump economic policies. Economists have long warned that imposing tariffs on imports and cutting taxes does little to curb inflation – rather, they may contribute to faster price increases.

Already, China has been hit by a 10 per cent tariff on all products. Trump has also proposed a 25 per cent tariff on all steel and aluminum imports, and he mulled imposing new tariffs on Canada and Mexico – two of the United States’ largest trading partners.

I believe that if these wide-ranging tariffs come into effect, the Federal Reserve will have no choice but to keep rates elevated for the remainder of 2025.

One of the largest drivers of inflation in January was rent increases, which accounted for nearly 30% of all items increase. Rents jumped 4.6 per cent from a year earlier.

If Trump’s tariffs on Canadian imports, like lumber, take effect, Americans can expect continued price increases in the homebuilding sector. Supply and demand imbalances remain a key driver for higher prices, so fewer houses being built due to higher materials cost will likely lead to higher rents.

Consumers saw better news on new vehicle prices, which remained flat over the month and showed slight declines from a year ago.

This is even as demand for new cars increased 2.5 per cent over 2024. In January 2025, the number of new vehicles sold topped the same month a year earlier for the fifth month in a row.

But as with homebuilding, any tariffs on the import of car parts or materials will impact the auto industry. Carmakers may have breathed an immediate breath of relief when Trump delayed new tariffs on Canada and Mexico. But if deals aren’t reached by the March 1 deadline, industry analysts expect immediate impacts on top sellers.

And any higher cost of new cars will have a knock-on effect on used cars, which saw prices jump 2.2 per cent in January – it’s largest increase since May 2023.

Of course, not all inflationary pressures are in the purview of government.

The transportation sector, which includes insurance and parking fees, increased by 8% over the year. Insurance prices soared almost 12 per cent, on the back of last year’s 20.6 per cent increase in prices, while parking fees increased by almost 5 per cent as a result of more expensive repairs and more dangerous driving behaviors.

Meanwhile, with bird flu continuing to spread, egg prices rose a shocking 15.2 per cent in January, and are 53 per cent more expensive than at this time last year.

All in all, voters who cited inflation as the main reason they were backing Trump may be feeling a little uneasy – the administration is only a few weeks old, but for one reason or other, Americans are experiencing ever higher prices with little relief in sight.

The U.S. inflation rate in January came was a surprise to the market and indicates that the Federal Reserve will now be on pause for at least the next few months. This means that the spread between Canada and the U.S. interest rates is likely to widen this year. Canadian CPI data for January will be released next week.

One would have expected the Canadian dollar to circle the drain after the release of the U.S. CPI this week, but the value of the loonie has rallied to the 70 U.S. cent level. This is likely an indication that markets are not paying close attention to the interest rate spreads between Canada and the U.S. but are speculating on the endgame of the tariff situation. The market is clearly indicating that they feel that tariffs are a negotiating ploy and not an endgame for the U.S. administration.

The market may or may not be right, but there is no question that inflation trajectories for the U.S. and Canada are completely in opposite direction. Canadian inflation rates continue to drop and are on a downward trajectory, especially as interest rates decline. On the other hand, inflation in the U.S., even without tariffs, is still climbing.

Look for the loonie to drop in the coming months on the fundamentals of the economies on both sides of the border will drive the currency lower. The installation of tariffs on Canada would only accelerate the decline in the loonie. All of the rest of the drama is just noise.

Buhler Industries going private

Buhler Industries intends to go private.

The publicly-traded Winnipeg firm, founded by the late John Buhler, will be absorbed entirely by the Turkish firm ASKO under a proposed deal.

Buhler Industries was established in 1969 when John Buhler purchased the Standard Gas Engine Works. The company produced the Farm King line of grain augers, snowblowers, mowers and other small implements. In 1982 Buhler purchased the Allied line of front-end loaders. In 2000 it purchased the Versatile tractor line from New Holland Ag, as part of the Case-New Holland merger and subsequent divestiture required by competition regulators. It operates eight manufacturing plants throughout North America.

The purchaser, ASKO, is wholly-owned by the Konukoğlu family. ASKO owns the firm Basak Traktor, which purchased 80 per cent of Buhler Industries from Russian combine manufacturer Rostselmach. Currently ASKO owns 96.7 per cent of the firm’s shares.

Following the completion of the amalgamation, the shares will be de-listed from the Toronto Stock Exchange and the company will apply to cease to be a reporting issuer under applicable Canadian securities laws.

ASKO owns firms worldwide that manufacture construction equipment, energy and technology equipment, and agricultural equipment including tractors. As well as building and marketing its own equipment, it also manufactures tractors for the German firm CLAAS.

India’s retail inflation eases to 5-month low, boosting rate cut hopes

India’s retail inflation slowed to a five-month low in January as food price inflation eased, boosting the odds of another rate cut in the South Asian economy where growth is slowing amid the escalating threat of a global trade war.

Annual retail inflation in January was at 4.31 per cent, lower than economists’ estimate of 4.6 per cent and 5.22 per cent in the previous month. Retail inflation was at 3.65 per cent in August 2024.

Food inflation eased to 6.02 per cent from 8.39 per cent in December.

Cooling inflation boosts chances of further policy easing by India’s central bank, which cut its key policy rate for the first time in nearly five years in February in a bid to boost an economy that is expected to grow at its slowest pace in four years.

The Reserve Bank of India sees inflation averaging 4.8 per cent in the current financial year that ends on March 31 and expects it to fall to 4.2 per cent next year, it said last week.

“The sharp fall in Indian headline consumer price inflation in January reinforces that the RBI will continue to loosen monetary policy over the coming months to support the economy,” said Harry Chambers, an economist at Capital Economics.

The central bank targets inflation at 4 per cent within a tolerance band of 2 percentage points on either side.

In January, vegetable prices rose 11.35 per cent year-on-year, compared with a 26.60 per cent increase in the previous month.

Prices of cereals rose 6.24 per cent against a 6.50 per cent gain in December, while those of pulses gained 2.59 per cent against 3.80 per cent. Prices of vegetables and pulses fell from the previous month.

Winter harvests have helped moderate food prices, but warmer-than-usual temperatures in March could pose risks to crops like wheat.

Core inflation, which excludes volatile items such as food and energy and is seen as a better gauge of domestic demand, quickened to 3.7 per cent in January from 3.6 per cent in the previous month, according to two economists.

Last week, RBI Governor Sanjay Malhotra said the central bank is alert to all pressures on inflation and will be watchful of the impact of rupee depreciation on local prices.

A 5 per cent depreciation in the rupee impacts domestic inflation to the extent of 30 basis points to 35 basis points, he said.

A potential trade war dragged the rupee to its lifetime low of 87.95 per U.S. dollar in February, boosting worries about higher inflation on imported goods.

U.S. President Donald Trump’s trade advisers were finalising plans on Wednesday for the reciprocal tariffs the president has vowed to impose on every country that charges duties on U.S. imports, ratcheting up fears of a widening global trade war.

Indian Prime Minister Narendra Modi is expected to propose increased energy and defence imports during a two-day U.S. visit from Wednesday.

France raises soft wheat area estimate

France raises soft wheat area estimate but cautious on harvest outlook

France’s farm ministry on Tuesday increased its estimate of the winter soft wheat area for this year’s harvest, confirming a rebound from last year’s rain-hit planting while warning that soggy conditions could also hurt the 2025 crop.

Last year France, the European Union’s biggest grain grower, gathered its smallest soft wheat crop since the 1980s after months of heavy rain, contributing to a slump in exports.

A dry end to last autumn let growers complete most sowing for 2025, but downpours in January have kept some fields drenched.

For winter soft wheat, France’s main cereal crop, the ministry raised its area estimate for 2025 to 4.57 million hectares from 4.51 million in its initial projection in December.

The revised estimate was up 10 per cent compared with the area harvested in 2024 and 0.4 per cent above the average area of the past five years, the ministry said in a report.

For other crops, the estimated winter barley area was trimmed to 1.21 million hectares from 1.23 million projected in December, now down 2.1 per cent from 2024 and 3.5 per cent below the five-year average, with the ministry noting some sowing was postponed in favour of spring crops.

For winter rapeseed, the expected area was lowered to 1.27 million hectares from 1.34 million, now down 4.1 per cent from last year though 6.2 per cent above the five-year average.

For durum wheat, the variety used in pasta, the area sown with winter crop was pegged at 198,000 hectares, down from 206,000 hectares forecast in December and a new 30-year low.

Wheat and rapeseed are almost exclusively winter crops in France while barley production also includes a significant portion of spring crop.

Kazakhstan says grain transit issues with Russia resolved

Kazakhstan has resolved most of its grain transit and transhipment issues with Russia, allowing grain exports to Europe and North Africa through Russia’s Baltic ports to flow unhindered, the country’s agriculture minister said on Tuesday.

Ex-Soviet neighbours Russia and Kazakhstan, both members of the Eurasian Economic Union, have been in a grain trade dispute since last year with both countries banning each other’s grain from their domestic markets.

Kazakhstan, which only has access to the inland Caspian Sea and relies on Russian ports for exports, had a record grain harvest of 26.7 million tonnes in 2024 and plans to export 6.5 million tonnes with 1.5 million tonnes going to Europe and North Africa.

Russia allowed transit of Kazakh grain through its ports last November, but on condition the grain was loaded directly from railcars into vessels without going into temporary storage, creating logistical problems for Kazakh exporters.

“Issues with grain, legumes, and oilseed crops have been resolved. The rail cars are no longer standing idle at the transshipment points as they used to. We have resolved this promptly, and exports are being shipped,” said Agriculture Minister Aidarbek Saparov.

Egypt imported 6.3 million tonnes of Russian wheat in 2024/25

Egypt, the biggest buyer of Russian wheat, imported 6.3 metric tonnes from July 2024 to January 2025, a 70 per cent increase compared to last year, analysts from rail carrier Rusagrotrans said in a report published on Monday.

Rusagrotrans said wheat exports from Russia continued at a record pace so far this season with the country, the world’s top wheat exporter, shipping 32.2 million tonnes, 1.3 per cent more than in the same period of the last season.

The acceleration precedes new export quotas on February 15 that will slow shipments. In line with the new quotas Russia can export 10.6 million tonnes of wheat before July 1, 2025.

Bangladesh, which bought 2.3 million tonnes, emerged as the second-largest buyer in the 2024/25 season, while Turkey, which introduced an import ban to protect its domestic market, slipped to third place with a 47 per cent drop in Russian wheat imports.

Algeria, which bought 1.7 million tonnes of Russian wheat, and Kenya, which bought 1.4 million tonnes, were the fourth and the fifth largest importers.

WK Kellogg forecasts upbeat 2025 profit on cost cut efforts

WK Kellogg forecast annual profit above expectations on Tuesday and reported better-than-expected earnings as the breakfast cereal maker’s efforts to clamp down on costs boosted its margins.

Battle Creek, Michigan-based WK Kellogg had announced a reorganization plan in August involving plant closures, workforce reduction and plans to streamline its supply chain by investing in modernizing its equipment and infrastructure.

The cost-cutting effort helped the company post an adjusted profit of 42 cents per share for the fourth quarter ended December 28, and beat analysts’ estimates of 26 cents per share, according to data compiled by LSEG.

The company expects full-year net adjusted earnings before interest, tax, depreciation and amortization (EBITDA) between $286 million and $292 million, compared with analysts’ estimate of $283.2 million.

The company has also had to raise prices to offset higher raw material costs, which have in turn led to budget-strained customers cutting back spending on packaged food such as cereal.

The cereal maker’s product pricing rose 3.8 per cent in the quarter, while volume slumped 5.6 per cent. The higher prices helped the company’s margins rise to 8.9 per cent.

WK Kellogg’s net sales fell 1.8 per cent to $640 million in the quarter, compared with analysts’ average expectation of $641.7 million.

WHO says communication with US authorities on H5N1 bird flu a ‘challenge’

A World Health Organization spokesperson said on Tuesday that communication on bird flu had become challenging since President Donald Trump announced a U.S. withdrawal from the United Nations health agency.

Asked about communication received by the WHO from Washington on the H5N1 outbreak, Christian Lindmeier told a press briefing in Geneva: “Communication is a challenge indeed. The traditional ways of contact have been cut.”

He declined to elaborate.

A U.S. outbreak of the H5N1 virus has infected nearly 70 people, mostly farm workers, since April 2024. The U.S. Department of Agriculture reported for the first time last week that a second strain of bird flu was found in dairy cattle in Nevada, a discovery that ramped up concerns about the U.S. outbreak.

Under WHO rules known as the International Health Regulations (IHR), countries have binding obligations to communicate on public health events that have the potential to cross borders. These include advising the WHO immediately of a health emergency and measures on trade and travel.

Other countries have privately voiced concern at the idea that the United States would stop communicating about emerging viruses that could become the next pandemic. “If such a big country does not report anymore, what message does it send?” said a Western diplomat in Geneva.

Argentina has also said it plans to withdraw from the WHO, citing “deep differences” regarding the agency’s management of health issues, notably the COVID-19 pandemic.

Canadian pulse exports slow down in December

Canadian pea and lentil exports slowed down in December compared to the previous month, although year-to-date movement remains solid as India remains in the market for the time being.

Canada exported 171,007 tonnes of peas in December, which was down 15 per cent from the previous month, according to Statistics Canada trade data. However, year-to-date pea exports of 1.438 million tonnes were running about 200,000 tonnes ahead of the year-ago pace.

India was the top buyer through five months, accounting for nearly half of the total pea exports at 694,391 tonnes. China, Bangladesh and the United States were also large export destinations for Canadian peas.

Canadian pea sales to India have picked up considerably over the past year after India lifted import tariffs on yellow peas in December 2023. The duty-free period has been extended several times over the past year but is set to expire once again on Feb. 28. The last extension at the end of December was made just a week ahead of expiry, although market participants are uncertain what will happen this month.

A similar Indian policy on duty-free imports of pigeon peas, a type of yellow lentil also called tur in India, was recently extended for another year to March 31, 2026. Canada does not grow pigeon peas, but yellow peas can be used as substitute.

The duty-free pea movement has cut into domestic prices in India. While that benefits consumers, farmers in the country have expressed concern and have called on the government to raise duties once again.

Canadian lentil exports were down five per cent in December compared to November, with about 253,000 tonnes moved out of the country. Crop-year-to-date exports of 1.083 million tonnes were up 27 per cent.

India was also the largest buyer of lentils so far this marketing year, accounting for 38 per cent of the total.

Canada exported about 20,000 tonnes of chickpeas in December, which was in line with the 20,400 tonnes moved the previous month. Year-to-date chickpea exports at 73,236 tonnes are running 26 per cent behind the 2023-24 pace.

Turkey and Pakistan are the top destinations for Canadian chickpeas in 2024-25, each importing around 12,600 tonnes during the first five months of the marketing year. The U.S., Italy and India round out the top five export destinations.

Early flooding has little effect on soybean oil, protein composition U.S. study suggests

While flooding substantially decreases soybean yields, it needn’t impact seed composition, including protein and oil content, a recent University of Arkansas study found.

The two-year study looked at 31 different soybean varieties, including some bred to be flood tolerant or moderately flood tolerant, and more susceptible varieties. Researchers examined the effects of four days of partial submergence on soybeans in the R1 or early flowering stage.

“Flooding research has focused on the early reproductive stage simply because it is when the stress is most pronounced and causes the greatest yield loss,” said researcher Caio Vieira in a Feb. 3 news release.

The most flood-tolerant varieties lost about 33 per cent of yield after being flooded, while the most susceptible plants lost just over half of their yield potential. However, no significant impacts on seed protein or oil content were observed across the different varieties.

Viera said temperature changes in the U.S. have allowed earlier soybean planting, while shifting rain patterns have put additional stress on soy plants.

“We’re pretty much getting the potential for flooding throughout the season. It’s been tougher,” he said.

Arkansas farmers typically plant soy from early April to mid-Mary, putting the R1 stage in late June or early July.

“It can be hit or miss,” Vieira said. “You can get a year where that period is a full-on drought, or you can get a year where that typical R1 period is completely wet with intensive rains. It’s hard, hard to predict.”

Arkansas can also see the remnants of hurricanes roll through. This happened twice in September, the news release noted.

Vieira said the study will help his team identify and incorporate flood-tolerant characteristics into future soybean genetics.

USDA trims Argentina corn, soy harvest estimates after dry weather

Argentina, a major grain supplier, will harvest less corn and soy than previously expected after hot, dry weather hurt crops, the U.S. Department of Agriculture said on Tuesday.

Grain traders have been closely monitoring dryness in Argentina because it is the world’s top exporter of soyoil and meal, the No. 3 exporter of corn, and competes with the U.S. for global grain and soy sales.

Corn production is particularly important because world inventories for 2024-25 are projected to drop to their lowest level in a decade due to robust demand and a smaller than anticipated U.S. harvest last year.

Corn and soy futures prices turned lower at the Chicago Board of Trade after USDA updated its crop estimates, as traders anticipated lower production in Argentina.

USDA pegged Argentina’s corn crop at 50 million tonnes in a monthly report, down from 51 million in January. The agency pegged soybean production at 49 million tonnes, down from 52 million last month.

Analysts surveyed by Reuters were expecting 49.5 million tonnes of corn and 50.49 million tonnes of soybeans.

“This is a valid, light cut,” said Rich Nelson, chief strategist at brokerage Allendale.

Rains benefited Argentina’s crops recently but did not reach all growing areas, and some damage was already done, analysts said. Farmers have found smaller than usual corn cobs and yellowing crop leaves in their fields at a time when they should be green.

USDA also lowered its estimate for Brazil’s corn crop to 126 million tonnes from 127 million in January.

In the U.S., estimates for corn and soy inventories were left unchanged from January.

Brazil beef, chicken exports set record for January

Beef shipments totaled 209,192 tons in January, with more than $1 billion in revenue, said beef lobby Abiec.

Chicken meat exports totaled 443,000 tons in January, an increase of 9.4% compared to the same period last year, and generated $826.4 million in revenue, according to pork and chicken lobby ABPA.

The increase (in beef volume and value of exports) occurred in practically all the main destination markets, reaching the best average since June 2023,” said Abiec.

“China, the Philippines, and other markets have maintained a significant positive flow of imports of Brazilian (chicken) products, reinforcing the positive outlook regarding the behavior of these markets throughout the year,” ABPA president Ricardo Santin said in a note.

Brazil is the world’s largest exporter of beef and chicken and home to some of the industry’s largest players.

Brazil is expected to see positive results for chicken exports in February, Santin said, with demand from Mexico expected to continue to generate business for Brazil.

Former Saskatchewan farm leader, Todd Lewis, appointed to Senate

Todd Lewis, the former president of the Agricultural Producers Association of Saskatchewan and vice president of the Canadian Federation of Agriculture was appointed to the Canadian Senate on Feb. 7. Lewis, a fourth-generation farmer, said he was encouraged to apply by the increasing role the Senate has had in the parliamentary process the last few years, particularly since the minority government was elected in 2021. Lewis is also heavily involved with his local community as municipal councillor, volunteer firefighter and board member on numerous committees.

“Ag in general, especially western Canadian ag, has been under-represented in the chamber,” said Lewis after his appointment.

Trump readies reciprocal tariffs as trade war fears mount

Donald Trump’s on-again/off-again trade threats continued during the week, as he announced he would impose tariffs on all steel and aluminum imports entering the U.S. beginning March 12. The move, coming less than a week after he announced a month-long delay to broad tariffs on Canada and Mexico, drew condemnation from most U.S. trade partners.

With many, including Canada, vowing retaliation, Trump’s advisors were reportedly finalizing plans of their own reciprocal tariffs — ratcheting up fears of a widening global trade war and threatening to add to already-sticky U.S. inflation.

Feeder market stalls; cold temperatures, tariff threat limit sales

The Western Canadian feeder cattle market was hard to define during the first week of February, with prices softer earlier in the week, but creeping higher by Friday, Feb. 7. Volumes were limited, as frigid temperatures in Alberta made it too cold to market cattle or operate sales barns. In addition, the threat of U.S. tariffs caused producers to hold back on sales. Although the implementation of U.S. tariffs and Canadian retaliatory measures were delayed for 30 days, it was too late to plan for the week.

Durum yields falling behind spring wheat

Average durum yields in Saskatchewan have behind spring wheat over the past decade, according to research from the University of Saskatchewan. Prior to 2015, spring wheat and durum yields in the province were relatively similar, but data over the past 10 years has seen spring wheat yields climb higher while durum held steady, with a yield gap of seven to 15 bushels per acre.

Curtis Pozniak, a University of Saskatchewan wheat breeder, believes the yield gap between Canadian Western Red Spring (CWRS) wheat and Canadian Western Amber Durum (CWAD) can be partly explained by the varieties that are used. “Farmers are adopting CWRS varieties more quickly than they are with durum,” said Pozniak, who spoke at the 2025 Durum Summit held Jan. 30 in Swift Current. “Growers that are focusing on CWRS wheat, their on-farm yield potential is increasing at a faster rate than what we see in durum wheat…. Growers of CWRS wheat are adopting the latest genetics a lot sooner than they are for durum wheat,” he added.

Canada seeks stronger EU trade ties as both regions threatened by Trump tariffs

Canada wants to deepen its economic ties with the European Union and uphold global trading rules in the face of threatened U.S. tariffs, trade minister Mary Ng told Reuters on Feb. 8 after meeting with European leaders.

The EU and Canada have benefited from a free trade agreement since 2017, which has boosted bilateral trade by 65 per cent, and set up a raw materials partnership in 2021.

“Trade agreements are one thing, and we have seen really great numbers, but what more can we be doing to help Canadian businesses enter into any of the 27 member states…and what more can we do to the same in Canada” Ng said. She said critical minerals and smaller businesses would be among the focus areas with the EU. Canada is also pushing to diversify its exports and set itself a target in 2018 of increasing non-U.S. exports by 50 per cent by 2025. Ng said the country was on track to meet or exceed the target.

Canadian premiers in Washington, D.C.

Canada’s 13 provincial and territorial premiers went to Washington, D.C. on February 12 to meet with United States lawmakers and special interest groups. Led by Ontario Premier Doug Ford, the current chair of the Council of the Federation, the premiers will try to drum up support against the tariffs President Donald Trump plans to impose on Canada.

Brazil’s Conab raises grain output forecast on bigger corn crop

Crop agency Conab on Thursday raised its forecast for total Brazilian grain supplies in the 2024/25 season to 325.71 million tonnes from 322.25 million tonnes based on expectations of a bigger corn crop.

Conab said Brazil’s total corn crop will reach 122.01 million tonnes, up almost 2.5 million tonnes from a January forecast. The revision reflected mainly better prospects for the country’s second corn crop, which is planted after soybeans are harvested in the same areas and represents about three quarters of supplies in a given year.

To date, conditions for planting of Brazil’s second corn crop are favourable, but February “will be a decisive” month for the sowing within the ideal climate window, Conab said.

Second corn sowing reached 5.3 per cent of the expected planted area in the country, way below the 19.3 per cent at this time last year, Conab said.

Overall, the agency expects Brazilian farmers to plant 16.8 million hectares (41.513 million acres) with second corn this year, an area 2.4 per cent larger than last season’s.

Conab slightly lowered Brazil’s soybean supply forecast to 166.01 million tons in the same report, citing “irreversible crop losses” in the south of the country caused by dry weather.

“Soybean cultivation has faced serious difficulties due to drought,” Conab said referring to Brazil’s southernmost state of Rio Grande do Sul, one of the country’s biggest suppliers.

Conab said some places there have benefited from occasional rains while in others rains have been scarce or irregular, damaging plants. The same goes for Mato Grosso do Sul state, according to Conab.

Strategie Grains lifts EU 2025/26 wheat output forecast

French consultancy Strategie Grains has slightly increased its wheat production forecast for the European Union in the 2025/26 season due to a larger than expected planted area in France.

The EU’s soft wheat output is now expected to reach 127.7 million tonnes, up from 127.2 million tonnes forecast last month and significantly higher than the 113.7 million tonnes projected for 2024/25.

This adjustment reflects improved planting conditions and a response to competitive market dynamics.

“As winter draws to a close, growing conditions for soft wheat and winter barley remain better than last year across the EU,” Strategie Grains said in a report.

“However, the threat of yield losses persists due to excess moisture in west Europe and lack of rain in southeast Europe,” it added.

European cereal production in 2025/26 is under close scrutiny after smaller harvests in 2024 led to tight balance sheets and reduced exports.

In another update, Strategie Grains slightly lowered its forecast for maize production in the EU for the 2025/26 season.

Maize production is now projected at 59.9 million tonnes, down from 60.3 million tonnes forecast last month but up from 58.1 million tonnes in 2024/25. The decrease is attributed to a reduction in maize acreage due to increased winter crop planting.

Strategie Grains raised its forecast for EU soft wheat shipments outside the bloc in 2024/25, mainly due to larger exports from the northeast EU countries, which supply high-quality wheat, but total exports would remain about 10 million tonnes below last season.

For 2025/26, wheat and barley shipments would rebound against the backdrop of larger harvests and reduced availability in other exporting countries.

EU maize imports in 2025/26 would remain above the 20 million tonnes threshold projected for the current season, as production is set to rise only very moderately.

Strategie Grains sees a potential small increase in EU grain prices for the remainder of 2024/25. In 2025/26, the price average for maize is forecast lower than its 2024/25 level, whilst that of soft wheat and barley would be higher.

Canadian dollar futures posted gains as they ended the week at 69.95 U.S. cents. The initial tariff threats on Monday pushed the dollar down close to the 68 U.S. cent level before rallying later in the week.

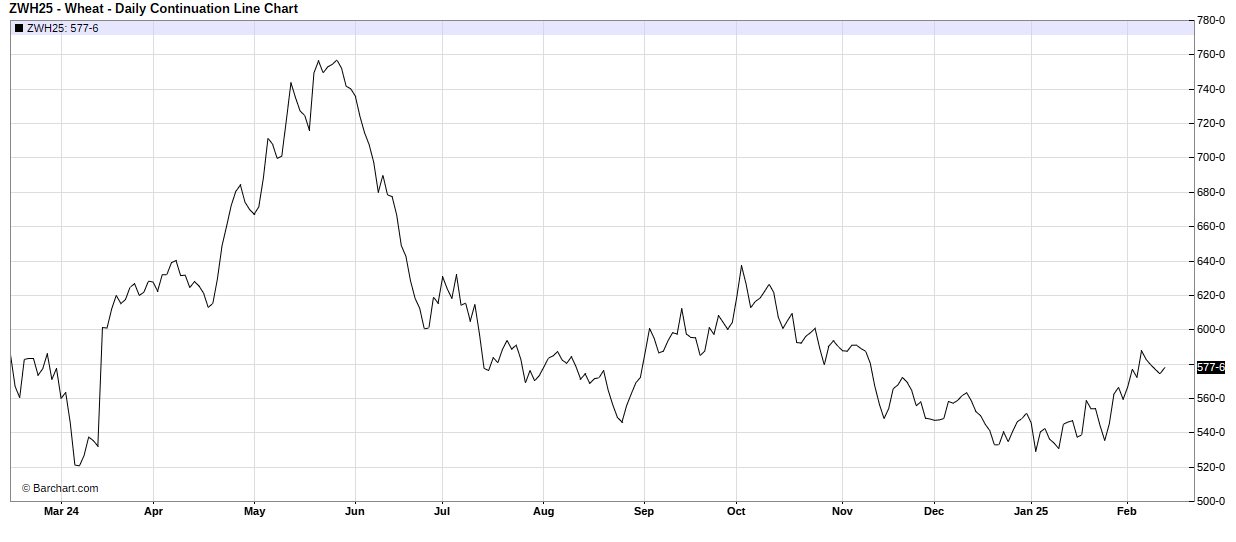

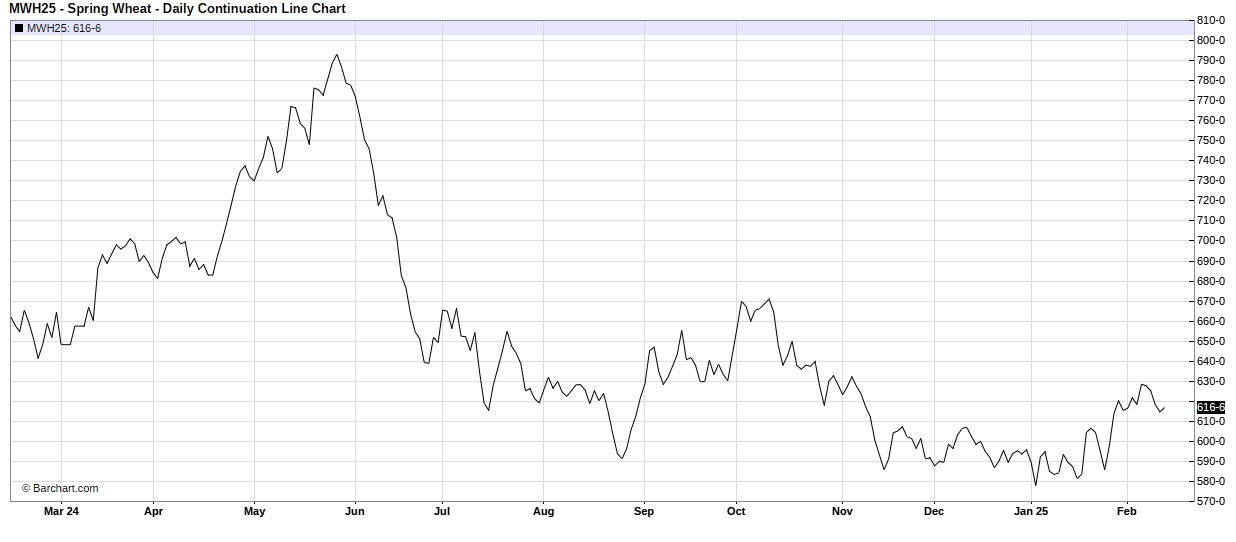

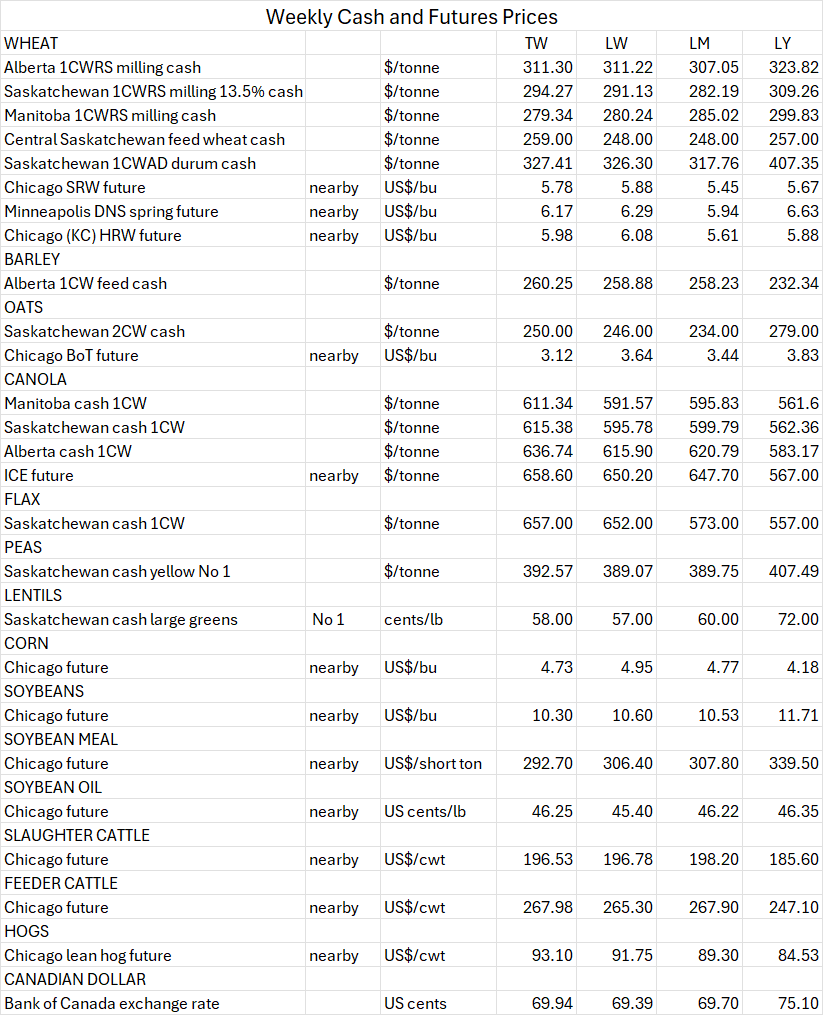

Wheat futures pushed higher during the past week with the nearby Chicago contract up by 21 cents per bushel while Kansas City and Minneapolis futures closed the week up by 20 and nine cents per bushel, respectively. Spring wheat cash prices in Western Canada, conversely moved lower with cash prices dropping by C$2.18 per tonne to C$8.92 per tonne. Strength in the Canadian dollar did pressure cash wheat prices during the past week. Wheat prices were also hurt by the threat of U.S. tariffs at the beginning of March.

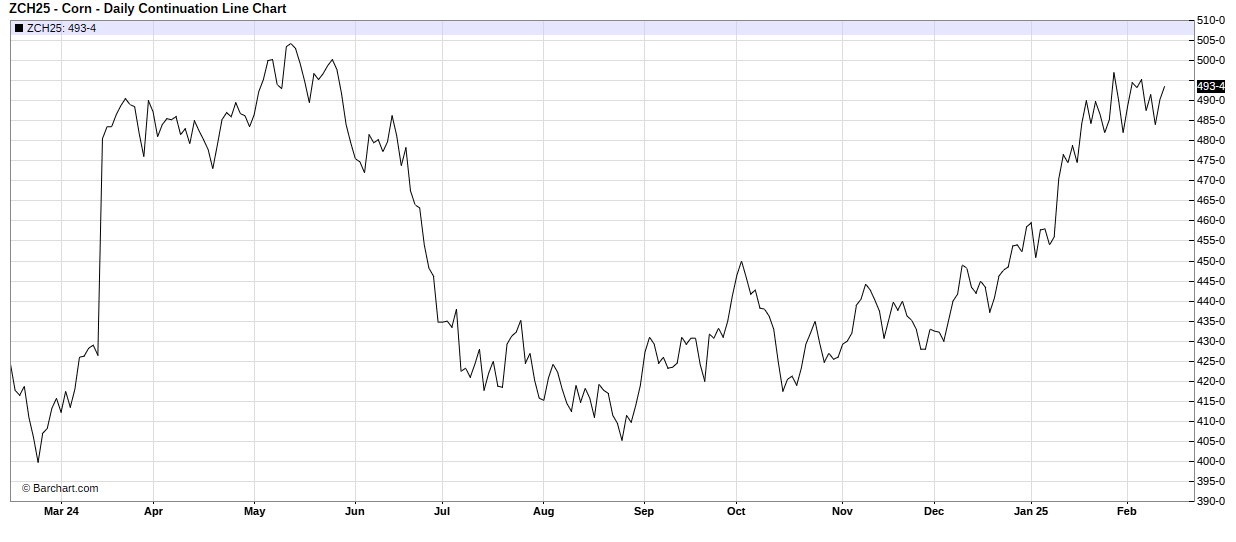

Corn futures were up slightly this past week by posting gains of five cents per bushel. Oat futures also posted strong gains of 15 cents per bushel during the past seven days. Cash oat prices in central Saskatchewan moved up by C$10 per tonne during the past week.

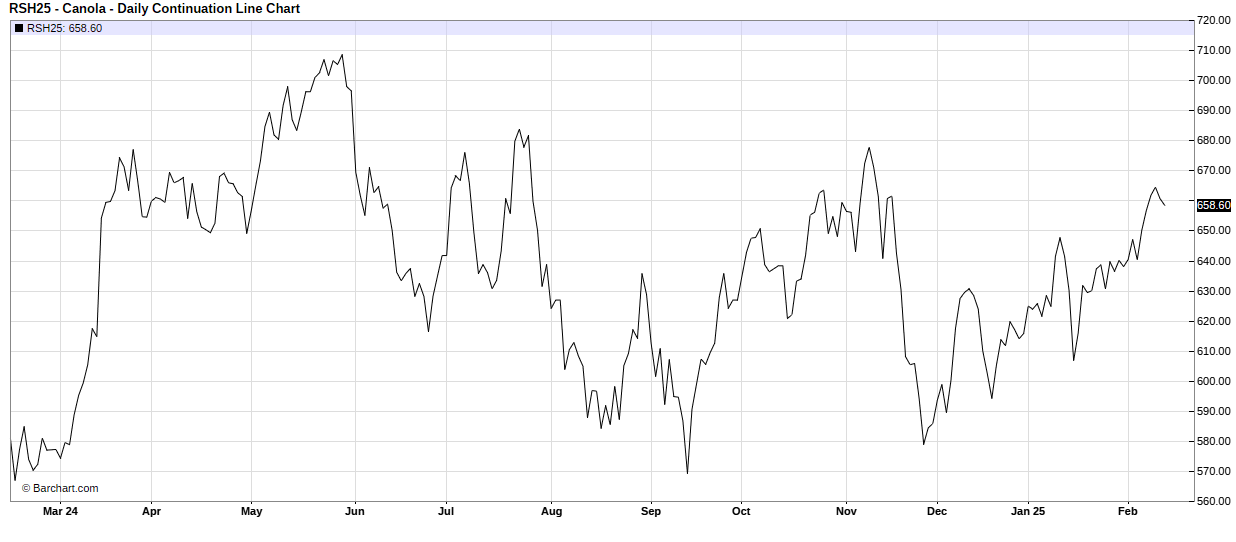

Canola futures were modestly higher this week, with the nearby futures contracts gaining C$2.80 per tonne. Cash prices for canola were mixed and ranged from down 0.70 cents per tonne to up by C$1.15 per tonne during the week.

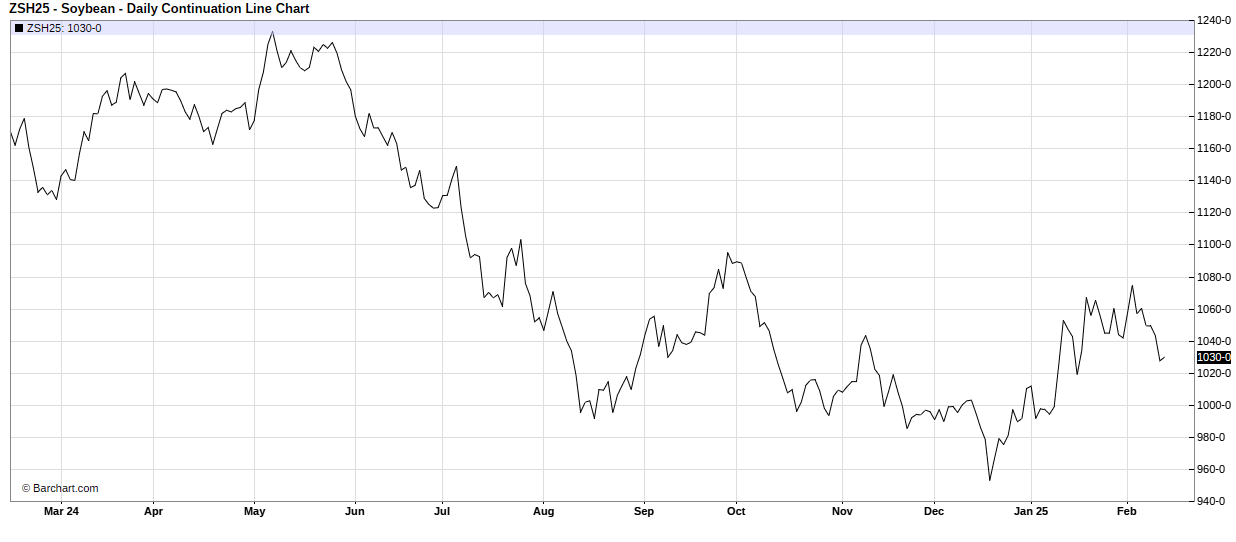

Nearby soybean futures were modestly higher and increased by 16 cents per bushel. Soybean oil futures were stronger during the past week with the nearby contract up by 0.42 cents per pound. Soybean meal futures were slightly stronger during the past week, with the nearby contract up by US$1.70 per short ton.

Cattle futures prices were moved lower last week with slaughter cattle dropping by US$4.72 per hundredweight. Feeder cattle contracts were also lower with the nearby contracts down by US$7.90 per cwt. Nearby hog futures were close to unchanged this past week with the nearby contract down by only 17 cents per cwt.

Weekly Chicago March Corn Futures

Weekly Chicago March Wheat Futures

Weekly Minneapolis March Wheat Futures

Weekly Kansas City March Wheat Futures

Weekly Chicago Soybeans March Futures

Weekly ICE Canola March Futures

Ukraine sold down the river

The recent pronouncements from the U.S. administration indicate that Ukraine has been thrown under the bus. It seems that the quick peace deal that the U.S. has promised involves giving Putin most of wheat he wants. The U.S. administration has indicated that they are willing to cede Ukrainian territory to Russia, limit the size and capabilities of the Ukrainian military and make sure that Ukraine never joins the NATO alliance. Ukraine has pushed back on the U.S. plan and indicates that it will continue to fight Russian aggression. The problem is that without U.S. backing, Ukraine will have great difficulty in sustaining the war even with European and Canadian support.

This is a horrible outcome for democracy and indicates that the U.S. is actively extricating itself from the international world order. By giving into Putin, it signals that larger countries can invade smaller ones without any consequence.

A resolution to the conflict, as unfair as it would be, would likely “normalize” the flow of grains and oilseeds from the Black Sea region. The resumption of “normal” exports would likely pressure global commodity prices, especially for wheat. This will increase the competitiveness of the Black Sea region as exports restrictions are lifted in the region. Keep this in mind as the situation evolves.

The real tragedy is not economic, but the loss of Ukraine’s dream of independence. Even if a peace agreement is reached, there will be no guarantee that the country won’t return to the Russian sphere of influence. Since the independence of Ukraine, meddling in Ukrainian politics has been a constant. The end game will likely be Russia conquering Ukraine by force or by installing their own puppet government. This is a sad reality for Ukraine and diaspora located in Canada and around the world.