Great Quest Gold Enters Into Arrangement Agreement With Lotus Gold

VANCOUVER, British Columbia–(BUSINESS WIRE)–Jun 27, 2025–

Great Quest Gold Ltd. (“ Great Quest ” or the “ Company ”) (TSX-V: GQ) is pleased to announce that further to its news release dated May 14, 2025, it has entered into a definitive arrangement agreement dated June 26, 2025 (the “ Arrangement Agreement ”) with Lotus Gold Corporation (“ Lotus ”), pursuant to which Great Quest intends to acquire all of the issued and outstanding common shares of Lotus (the “ Lotus Shares ”) in exchange for newly issued common shares in the capital of Great Quest (“ GQ Shares ”) as an arm’s length transaction to be completed by way of a court-approved plan of arranged under the Business Corporations Act (British Columbia) (the “ BCBCA ”) (the “ Arrangement ”). Pursuant to the policies of the TSX Venture Exchange (the “ TSXV ”), the Arrangement will be considered a reverse takeover (the “ RTO ”) of the Company by Lotus, which will become a wholly-owned subsidiary of the resulting issuer (the “ Resulting Issuer ”) following completion of the Arrangement.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250626431996/en/

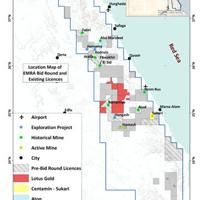

The Wadi Zeidun, Umm Samra, Siqdid, and Umm Salim mineral properties form the Eastern Desert Gold Project and are located at 600 km south-southeast of Cairo, Egypt.

Transaction Details

Pursuant to the Arrangement Agreement, the shareholders of Lotus will receive such number of common shares of the Resulting Issuer (the “ RI Shares ”) such that the former Lotus shareholders will own 63.3% of the issued and outstanding RI Shares and the number of RI Shares held by the former shareholders of Great Quest will equal 36.7%. The number of RI Shares issued as consideration shares to former holders of Lotus Shares will be determined following completion of the Bridge Financing (as defined below) and announced in a subsequent news release accordingly.

In accordance with the terms of the Arrangement Agreement, all outstanding warrants of Lotus will be exercisable to acquire RI Shares, in amounts and at exercise prices adjusted in accordance with the Arrangement Agreement. A subsequent news release will describe the valuation of Lotus.

Arrangement Agreement

The Arrangement will be subject to the following approvals:

- approval by the Supreme Court of British Columbia,

- requisite regulatory approval, including the approval of the TSXV; and

- the approval of the directors and the shareholders of each of Great Quest and Lotus.

Among other terms customary for a transaction of this nature, the Arrangement Agreement includes the following terms and conditions:

- A change of name of the Company to such name as is mutually agreed between Great Quest and Lotus and acceptable to the TSXV effective upon closing of the Arrangement (the “ Closing ”);

- a share consolidation of Great Quest on the basis of one post-consolidation GQ Share for every 30 pre-consolidation GQ Shares;

- completion of a bridge financing (the “ Bridge Financing ”) by Great Quest for gross aggregate proceeds of up to CAD$500,000, through the issuance of GQ Shares at a pre-Consolidation price of $0.025 per share, as further described in the Company’s news release dated June 16, 2025;

- directors and officers of Lotus and shareholders of Lotus holding 5% or more entering into support and voting agreements pursuant to which they have agreed to vote their Lotus Shares in favour of the Arrangement;

- each of Great Quest and Lotus will have a working capital deficit and long term debt (excluding non-cash liabilities) of no more than CAD$110,000 unless agreed otherwise by Lotus and Great Quest respectively in writing;

- Lotus will receive a title opinion regarding Great Quest’s Namibian mineral project; and

- Great Quest will receive a technical report in compliance with National Instrument 43-103 – Standards of Disclosure for Mineral Projects and a title opinion regarding Lotus’ Eastern Desert Gold Project in Eastern Egypt.

Trading in the GQ Shares has been halted since May 8, 2025 in accordance with the policies of the TSXV and will remain halted until such time as all required documentation in connection with the Arrangement has been filed with and accepted by, and permission to resume trading has been obtained from, the TSXV. There can be no assurance that trading of GQ Shares will resume prior to the completion of the Arrangement.

Shareholder Approvals

At a special meeting of the shareholders of Great Quest the (the “ GQ Meeting ”) to be held in accordance with the BCBCA, Great Quest will seek the approval of the RTO pursuant to the policies of the TSXV by an ordinary resolution passed by shareholders of Great Quest holding at least 51% of the issued and outstanding GQ Shares present in person or represented by proxy at the GQ Meeting.

At a special meeting of the shareholders of Lotus (the “ Lotus Meeting ”) to be held in accordance with the BCBCA, Lotus will seek the approval of the Arrangement by a special resolution passed by the shareholders of Lotus holding at least 66 2 / 3 % of the issued and outstanding Lotus Shares present in person or represented by proxy at the Lotus Meeting.

Lotus Advance

In connection with the Arrangement, Lotus will enter into a secured loan agreement with Great Quest for the loan amount of $300,000 (the “ Loan ”) bearing interest at 10% per annum, subject to conversion into GQ Shares at a pre-Consolidation price of $0.025 per share should the Arrangement not close by the November 30, 2025 deadline. Great Quest intends to use the funds from the Loan for its working capital requirements.

Bridge Financing

Further to Great Quest’s news release dated June 16, 2025, the Company intends to complete the Bridge Financing prior to the Closing. The Bridge Financing is subject to approval by the TSXV.

Resulting Issuer Board of Directors

Upon completion of the Arrangement, it is anticipated that the board of directors of the Resulting Issuer shall consist of the following persons:

Jed Richardson, Director

Jed Richardson brings a wealth of experience spanning a 25-year career in the mining and financial sectors. He has worked as a Research Associate at RBC Capital Markets and as a Research Analyst at Cormark/Sprott Securities, in addition to serving as a Mining Engineer for Alcan Aluminum. Jed has also served as Vice-President of Corporate Development for Verde Potash, Principal Consultant of Javelin Corporate Development Partners, and President and CEO of Trigon Metals. Joining Great Quest’s Board in 2010, he was appointed President & CEO in 2013, transitioning to the role of Executive Chairman in 2024. Jed holds a B.A.Sc. in Mineral and Geological Engineering from the University of Toronto.

Heye Daun, Director

Heye Daun is the co-founder and former President & CEO of Osino Resources. He is also the co-founder of the former Auryx Gold Corp. which advanced the Otjikoto gold project in Namibia until sale to B2Gold Corp for US$160m in 2011. As the former President & CEO of Ecuador Gold & Copper Corp. (“ EGX ”), Heye was instrumental in the formation of Lumina Gold Corp. through the C$200m merger of EGX with Odin Mining, before founding Osino Resources in 2015 with Alan Friedman. Heye is a mining engineer and MBA and has extensive experience in mining operations, working for Rio Tinto, AngloGold-Ashanti and Gold Fields, and stints in mining finance with South Africa’s Nedbank Capital and Old Mutual Investment Group. For the last 12 years Heye has been a successful public markets mining entrepreneur. Heye is a Director and also co-founder of Lotus.

Alan Friedman, Director

Alan Friedman is a South African-trained lawyer and public markets entrepreneur with significant success in a range of sectors such as mining, oil & gas, cannabis, e-gaming and others. As a result of being involved with North American public markets for over 20 years, his little black book is brimming with the Who-is-Who in Finance and Acquisitions and he has played an integral role in the financings and go-public transactions for many resource companies onto Toronto Stock Exchange and AIM. He is also a director of the Canada-Africa Chamber of Business. Alan is a Co-founder and Director of TSXV-listed Eco (Atlantic) Oil and Gas Ltd., and co-founder of Auryx Gold Corp and Osino Resources. Alan is a Director and also co-founder of Lotus.

Sponsorship

The Arrangement may require sponsorship under the policies of the TSXV unless a waiver from sponsorship is granted. Great Quest intends to apply for a waiver from sponsorship requirements of the TSXV in connection with the Arrangement. There can be no assurance that such waiver will ultimately be granted.

Eastern Gold Desert Project Descriptions

In two competitive international bid rounds, Lotus secured ten exploration sectors (blocks or licenses) across the Egyptian Eastern Desert. Subsequent renewal and relinquishment of blocks, as well as the addition of 5.5 blocks acquired from B2Gold brings the total land position to ±1,930 km 2 (roughly the equivalent of 11 blocks), as summarised below:

|

Exploration Agreement |

Project Area |

# of Exploration Sectors |

Area (km 2 ) |

|

BR1 – Zeidun |

Wadi Zeidun |

±1.4 (after renewal) |

253 |

|

BR1 – Umm Samra |

Umm Samra |

±1.3 (after renewal) |

230 |

|

BR2 — Siqdid |

Siqdid |

3 |

483 |

|

(BR-1) Umm Salim |

Umm Salim |

5.5 |

963 |

|

Total |

± 11 |

±1,930 |

Qualified Person (QP) Statements

Qualified Person David Underwood, BSc. (Hons) is Vice President Exploration of Lotus Gold Corporation and has reviewed and approved the scientific and technical information in this news release as it pertains to Lotus, and is a registered Professional Natural Scientist with the South African Council for Natural Scientific Professions (Pr. Sci. Nat. No.400323/11) and a Qualified Person for the purposes of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (” NI 43-101 “).

On behalf of the board of directors of Great Quest Gold Ltd.:

“Jed Richardson”

Chief Executive Officer and Executive Chairman

Further Information and Disclaimer

All information contained in this news release with respect to Great Quest and Lotus was supplied by the parties respectively, for inclusion herein, and each party and its directors and officers have relied on the other party for any information concerning the other party.

Completion of the Arrangement is subject to a number of conditions, including but not limited to, TSXV acceptance and, if applicable, pursuant to the requirements of the TSXV, disinterested shareholder approval. Where applicable, the Arrangement cannot close until any required shareholder approvals are obtained. There can be no assurance that the transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the Arrangement, any information released or received with respect to the transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative.

The TSX Venture Exchange Inc. has in no way passed upon the merits of the Arrangement and has neither approved nor disapproved the contents of this press release.

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward Looking Information

This news release contains “forward-looking information” within the meaning of applicable securities laws relating to the proposal to complete the Arrangement and associated transactions. Any such forward-looking statements may be identified by words such as “expects”, “anticipates”, “believes”, “projects”, “plans” and similar expressions. Readers are cautioned not to place undue reliance on forward-looking statements. Statements about, among other things, the completion and expected terms of the Arrangement, the Loan, the number of securities of the Company that may be issued in connection with the Arrangement and Bridge Financing, obtaining the requisite shareholder approval, Lotus’ strategic plans and the parties’ ability to satisfy closing conditions and receive necessary approvals, are all forward-looking information. These statements should not be read as guarantees of future performance or results. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those implied by such statements. Although such statements are based on management’s reasonable assumptions, there can be no assurance that the Arrangement (including the name change and consolidation), the Loan, or the Financings will occur or that, if the Arrangement, and the Financings do occur, they will be completed on the terms described above. Great Quest and Lotus assume no responsibility to update or revise forward-looking information to reflect new events or circumstances unless required by applicable law.

View source version on businesswire.com:https://www.businesswire.com/news/home/20250626431996/en/

CONTACT: For more information, please contact:Great Quest Gold Ltd.

Jed Richardson, Executive Chairman

Email:IR@greatquest.com

(647)276-6002Lotus Gold Corporation

Mike Silver, Interim CEO

Email:msilver@lotusgold.ca

KEYWORD: NORTH AMERICA CANADA

INDUSTRY KEYWORD: MINING/MINERALS NATURAL RESOURCES

SOURCE: Great Quest Gold Ltd.

Copyright Business Wire 2025.

PUB: 06/27/2025 07:30 AM/DISC: 06/27/2025 07:30 AM