Copper Price Crash Threatens Zambia’s Economic Stability

Copper Price Crash Threatens Zambia’s Economic Stability

Zambia is bracing for severe economic repercussions following a dramatic fall in global copper prices, with fears mounting over potential job losses, reduced government revenue, and delayed mining investments. The slump was triggered by an escalating global trade war and new U.S. tariffs, which have sent shockwaves through commodity markets.

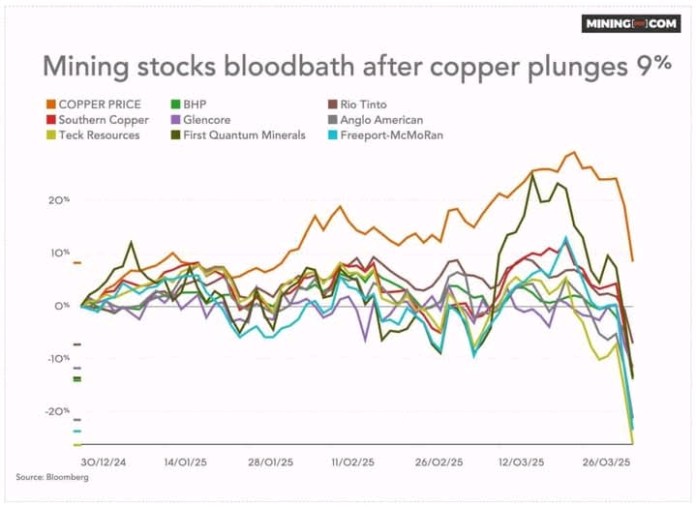

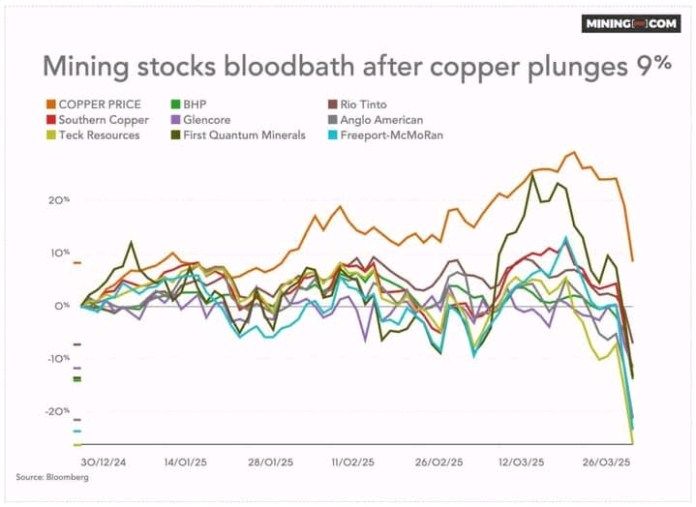

On Friday, copper futures on the Comex market dropped by 9.1% to $4.388 per pound ($9,670 per tonne), while prices in London fell 6.8% to $8,734 per tonne levels last seen during the early stages of the pandemic. The downturn follows warnings from BNP Paribas and Citigroup, both forecasting further declines and a likely global recession if trade tensions persist.

Copper accounts for over 70% of Zambia’s export earnings, making the country especially vulnerable to commodity price shocks. A prolonged dip in copper prices could significantly affect the government’s fiscal projections, especially as it struggles with a growing debt burden and a weakening kwacha. The Ministry of Finance is expected to revise its 2025 budget assumptions if the trend continues.

Mining giants operating in Zambia have already started feeling the pressure. First Quantum Minerals, which owns Kansanshi and Sentinel Mines, saw its shares plunge 12.8% on the Toronto Stock Exchange. The company has warned of possible cuts in capital spending and a review of production targets in light of falling global demand.

Meanwhile, local suppliers and contractors who rely on the mining sector are likely to experience delays in payments or outright cancellations of service contracts. This will have a ripple effect on employment in Copperbelt and North-Western Provinces, where the bulk of mining activity is concentrated.

Economic analysts warn that Zambia could experience a shortfall in foreign exchange inflows, exacerbating pressure on the kwacha and increasing inflationary risks. “The drop in copper prices has the potential to reverse recent gains in macroeconomic stability, and this could lead to more borrowing or austerity measures.”

The situation also places Zambia’s debt restructuring negotiations in a more complicated position. The country recently secured partial relief from international creditors, but continued reliance on copper revenue means any sustained price weakness could erode confidence among lenders and investors.

Small-scale miners, often overlooked in policy circles, are equally exposed. With tighter margins and limited reserves, many could be forced to suspend operations if prices fall below viable thresholds. Calls are growing for the government to consider emergency support or tax relief to cushion vulnerable players in the sector.

As the world’s eighth-largest copper producer, Zambia’s prospects are tightly linked to global economic trends. With copper prices now on a downward spiral, stakeholders are urging diplomatic solutions to the trade standoff, alongside robust domestic strategies to diversify the economy and reduce dependence on a single commodity.

April 9, 2025

By Edwin Daka

©️ KUMWESU