Platinum demand outlook lifted higher by series of new global hydrogen fuel cell buildouts

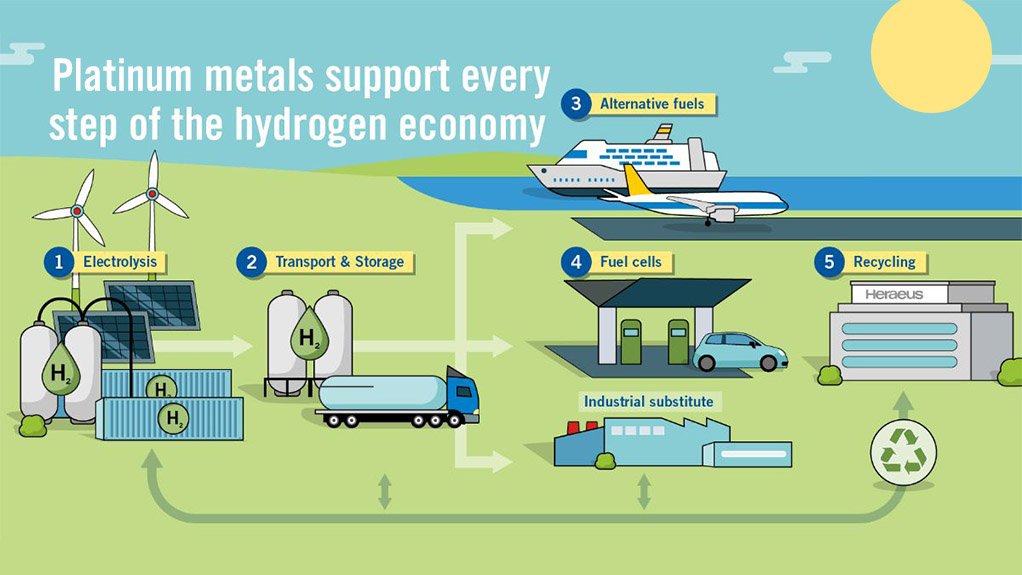

JOHANNESBURG (miningweekly.com) – The outlook for platinum group metals (PGM) demand has been uplifted by a series of new developments in the field of platinum-catalysed green hydrogen generation as well as concomitant fuel cell buildouts that are green-hydrogen fed.

On top of South Korea setting out to construct the world’s largest hydrogen fuel cell power plant in the coastal city of Gyeongju, Sinopec inaugurating Hong Kong’s first public hydrogen refuelling station, and Metrans testing of Slovakia’s first hydrogen truck, Toyota UK has constructed ten quick-filling hydrogen fuel cell Hilux prototypes that have diesel-engine range, Tanaka of Japan has developed the world’s first bulk nano-sized platinum that has ten times more hardness and four times more strength, BMW is introducing hydrogen-powered tugger trains and forklifts at its digital plant in Germany, and a global coalition of industry representatives at COP29 has brightly spotlighted the major benefits of a far larger investment thrust in hydrogen fuel cells than the $75-billion already at final investment decision (FID) stage across 434 projects.

Moreover, the World Platinum Investment Council has drawn attention to:

- Le Havre, in France, being on its way to becoming a central hydrogen hub as part of a French government-backed $1.69-billion initiative involving Air Products and Qair Group.

- Electrical demand for platinum in hard disk drives (HDDs) in a cobalt, chromium and platinum alloy which forms the storage layer in HDD stacks.

- Platinum finding increasing uses in the semiconductor and sensor industries, with applications growing on the back of rising demand for AI, and, in the case of HDDs, the associated need for more data storage capacity. The AI market is projected to grow steeply to around $1.3-trillion over the next decade from a market size of $40-billion in 2022.

The biggest share of end-use platinum demand remains the automotive sector, which has a 40% pull. This is followed by platinum jewellery, which in 2024 absorbed 25% of the eight-million-plus ounces of platinum production. Glass demand takes up 8%, chemical demand 7%, investment demand 6%, medical 4%, petroleum 2%, hydrogen 1% and other 7%.

In South Africa, all speakers at the Mapungubwe Institute for Strategic Reflection’s (Mistra’s) ninth yearly PGM roundtable, on November 27, agreed that South Africa has potential to become a leading player in the hydrogen and fuel cell industry.

By developing capacities, the country can become an indispensable part of the whole hydrogen value chain from mining of minerals and beneficiation, to manufacturing and services, said Mistra executive director Joel Netshitenzhe.

As South Africa progresses its platinum-based hydrogen fuel cell economy, Mistra aims to ensure that the benefits of these emergent industries accrue to all, including youth and communities. Additionally, the institute is focused on securing the global supply of green hydrogen by ensuring PGMs and other critical minerals remain a stable and mutually beneficial source for investment.

Netshitenzhe cited estimates that 35-million tonnes of green hydrogen will be produced by 2035 and form 20% of the EU’s energy mix by 2050, while the world is also moving towards more fuel-cell-powered trains, small vehicles, ships and aircraft.

South African hydrogen projects still awaiting FID include Boegoebaai in the Northern Cape, Coega in the Eastern Cape, Saldanha green steel in the Western Cape, Mitochondria’s Vereeniging project in Gauteng, the Platinum Valley mobility initiative in Gauteng and KwaZulu-Natal, Isondo Fuel Cells project in Gauteng, and Enertrag’s green ammonia project in the Northern Cape.

North America’s only publicly traded pure-play green hydrogen company, the Toronto Stock Exchange-listed Charbone Hydrogen, reported a 23% year-on-year revenue increase in the third quarter of this year, along with progress beginning on green hydrogen production at its Sorel-Tracy facility in Quebec next year. All necessary permits have been secured, and performance testing of electrolyser components has been completed, keeping the prospect of early 2025 production on track at Sorel-Tracy.

Charbone revenue for the nine months ending September 30 of $261 000 was up on the $213 000 for the corresponding period of 2023.

“Ongoing talks with strategic partners are advancing well to support and execute growth potential,” Charbone CFO Benoit Veilleux has told shareholders.

Regarding the world’s largest hydrogen fuel cell power plant in South Korea, the 107.9 MW $550-million project is expected to power 270 000 households once operational from March 2028, Fuel Cell Works stated.

Mining Weekly can report that the project will make use of public-private funding as it goes about augmenting regional clean electricity supply and economic growth, creating 1 200 jobs and revitalising local industrial complexes.

Regarding the hydrogen hub at Le Havre in France, renewable-energy company Qair has been awarded a parcel at Haropa Port to develop an e-methanol production project on 60 ha in Rogerville, in the vicinity of the Grand Canal du Havre and the A29 motorway. It is one of five Haropa Port parcels designated as ‘France 2030 industrial sites’ in May 2024 and thus benefits from government support for the implementation of industrial projects.

Meanwhile, as the world seeks to decarbonise and to combat climate change, the properties of PGMs as powerful catalysts are being applied to technologies for more efficient energy generation and storage.

Although PGMs are not used in the batteries of battery electric vehicles (BEVs) at this point, North America’s Platinum Group Metals Limited, which is developing a PGMs operation in South Africa’s Limpopo province, is at an advanced stage of battery technology research with South Africa’s Anglo American Platinum and Florida International University (FIU) to use PGMs in BEV batteries. The investment in the Lion project creates a potential vertical integration with a broader industrial market development strategy to bring new technologies to market which use palladium and platinum.

The upshot of all this is that the world is not only now earmarking PGMs to catalyse fuel cells that drive its trucks, trains, planes and ships into the new world of clean skies and low-to-no carbon, or to produce its green hydrogen in PGM-catalysed electrolysers, but it is also watching PGMs patenting their way into BEV batteries.

This will mean that BEVs and fuel cell electric vehicles (FCEVs) will both make use of PGMs, with the new generation of lightweight, powerful batteries being seen as having the potential to grow to scale on the back of the attractiveness of BEVs and the use of lithium batteries in other applications beyond mobility. Being in BEVs and FCEVs is a massive potential market advance for PGMs if the FIU research programme becomes a commercial one.

In addition to PGMs, Patent No 10,734,636 B2, entitled ‘Battery Cathodes for Improved Stability’, includes the use of carbon nanotubes and other innovations in a lithium battery. Further patent applications have been filed, Platinum Group Metals has reported as it advances the $617-million, 1 100-employee, 19.5-million-ounce palladium, platinum, rhodium and gold Waterberg project, that lends itself to productive bulk mechanised mining.

At COP29, nearly two dozen industry associations have called for urgent action to scale up the outlook for clean hydrogen and its derivatives.

Accelerating the implementation of the government policies that drive hydrogen deployment can unlock an abatement of 60 to 80 gigatons of CO₂, save $3.7-trillion in capital investments driven by cross-border supply chains for hydrogen and its derivatives, and create 25-million quality jobs worldwide.

Amid all that, worldwide associations have shone a bright spotlight on practical actions that can be taken by governments in the next two years to advance hydrogen’s deployment and save the world from climate chaos.