Royal Road Minerals Provides Exploration Update Expands 2025 Drilling Program At Jabal Sahabiyah, Relinquishes Al Miyah Tender, Kingdom Of Saudi Arabia

(MENAFN– Newsfile Corp)

Toronto, Ontario–(Newsfile Corp. – November 5, 2024) – Royal Road Minerals Limited (TSXV: RYR) (” Royal Road ” or the ” Company “) is pleased to provide an update on its exploration work in the Kingdom of Saudi Arabia. The Company carries out its exploration activities in Saudi Arabia through its local subsidiary, Royal Road Arabia Limited (” RRA “). RRA is a Saudi Arabian joint-venture company owned on a 50-50% basis by Royal Road and MIDU Company Limited ( “MIDU”) . MIDU is a Saudi Arabian investment holding company, headquartered in Jeddah, with interests across various sectors including mining, industrial, real estate development and utilities.

RRA was granted Winning Bidder of the Al Miyah tender area and received notification of a 90-day provisional award in July of 2024. However, upon RRA’s request, the Ministry of Industry and Mineral Resources (MIMR) in Saudi Arabia has agreed to allow RRA to relinquish its rights to the Al Miyah tender. This decision enables RRA to concentrate on and expand its planned drilling activities in the Jabal Sahabiyah project area.

Jabal Sahabiyah Project: Saudi Arabia

The Jabal Sahabiyah project consists of three contiguous Exploration Licenses and was awarded to RRA as Preferred Bidder in a competitive Licensing Round in January of this year (see Press Release January 15, 2024). The license areas total approximately 284 square kilometers in areal extent and are located in Asir Province of the Kingdom of Saudi Arabia (see press releases January 15, February 27 and May 29, 2024).

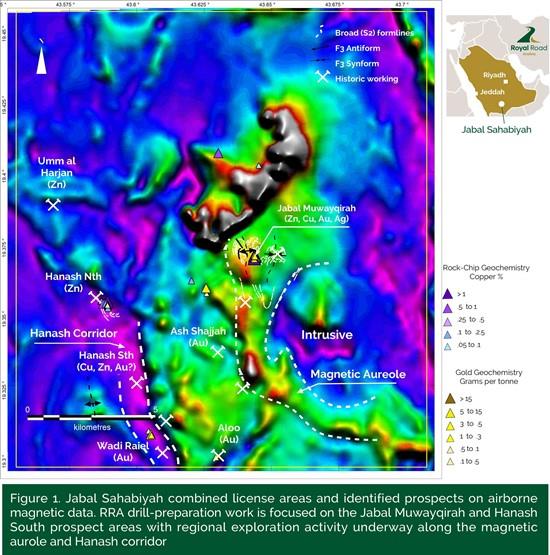

RRA interprets copper, gold and polymetallic mineralization at Jabal Sahabiyah to be controlled broadly by meta-intrusive rocks and associated metasomatism emplaced at or below a mid-crustal detachment (see Figure 1). Previous work at Jabal Sahabiyah included regional and prospect-scale mapping, surface geochemistry, geophysics and scout-drilling conducted by Riofinex in the late 1970s, followed by drill testing of vein gold occurrences by Ma’aden (Saudi-Arabian state-owned mining company) in 2007.

Figure 1

To view an enhanced version of this graphic, please visit:

Riofinex identified a total of 8 individual prospect areas (see Figure 1) represented primarily by exposed or sub cropping remnants of base and precious metals gossans, which demonstrably continue beneath recent alluvium. RRA’s exploration work has focused initially on identifying the concealed extensions of the Jabal Muwayqirah gossan and on advancing it to the point of drill-testing, but the program has now been expanded to include preparation and drill-testing of the Hanash South prospect area and further mapping, geochemical work and drone-borne magnetics at Umm al Harjan, Ash Shajjah and Wadi Raiel.

Jabal Muwayqirah

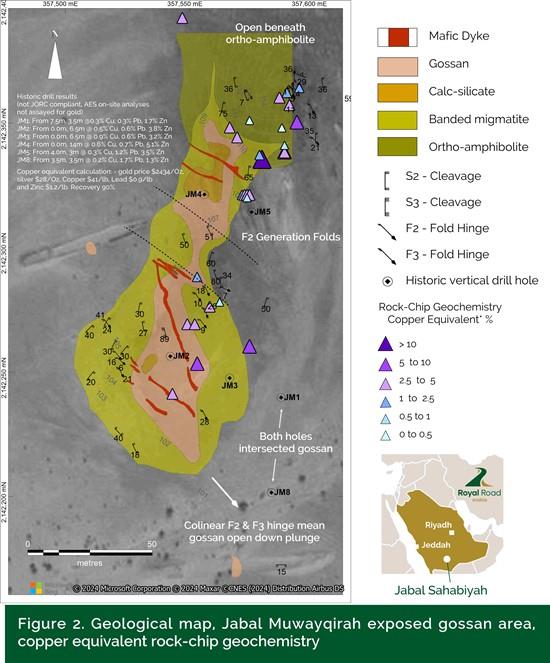

The Jabal Muwayqirah gossan is located at the northern extent of an interpreted magnetic aureole and represents a shallow-dipping oxidized, erosional remnant of zinc, copper, gold and silver mineralization which extends below metamorphosed hangingwall rocks to the north and below alluvial cover to the south (see Figures 1, 2 and 3). Limited shallow open hole drilling conducted by Riofinex intersected zinc, copper and lead mineralization on the gossan and immediately adjacent to it under alluvial cover (Figure 2). Riofinex did not assay for gold. The best intersection was drill hole JM4 which returned 14 meters at 0.6% copper, 5.1% zinc and 0.7% lead (not JORC compliant; from surface). RRA grab rock-chips returned significant gold, silver and base metal grades with gold up to 7.5 grams per tonne (mean 1.6, minimum 0.1 grams per tonne), silver up to 423 ppm (mean 59.5, minimum 1.5 ppm), copper up to 5.0% (mean 0.8%, minimum 0.03%) and zinc up to 30% (mean 3.7%, minimum 0.2%).

Figure 2

To view an enhanced version of this graphic, please visit:

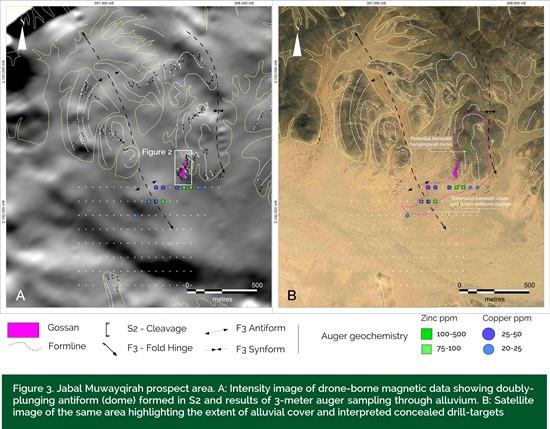

Mapping and new drone-borne magnetic data have revealed that exposed gossan at Jabal Muwayqirah is positioned on the limb of an (F3-generation) antiform (see Figure 3). Auger samples taken from 3 meters below the surface of alluvial sediments have identified subtle zinc and copper anomalism which defines a geochemical trend around the antiform towards its hinge. The geochemistry, structural mapping and magnetic data has highlighted a south-southeast plunging drill-target of approximately 500 meters strike extent and unknown (down-plunge) depth extent (see Figure 3). The gossan also continues beneath overlying metamorphic rocks to the north and may be exposed again around a synform and beneath alluvial cover to the east (see Figure 3). The Company is planning further auger sampling to test this model and has commenced the environmental permitting process for drilling at Jabal Muwayqirah. Drilling is expected to commence in the first quarter of 2025.

Figure 3

To view an enhanced version of this graphic, please visit:

Hanash South

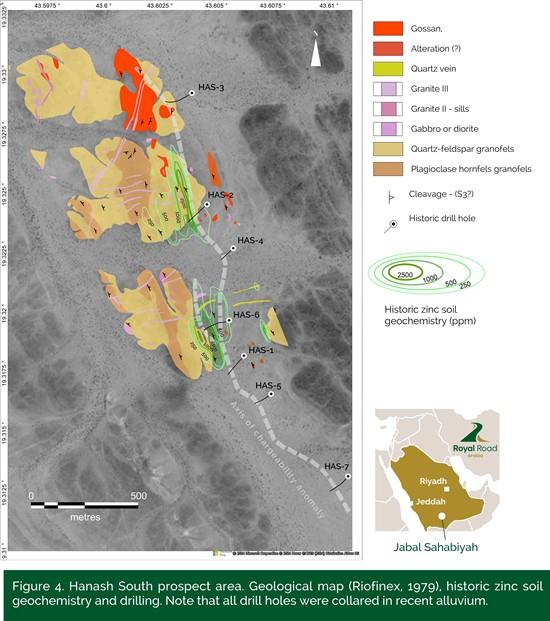

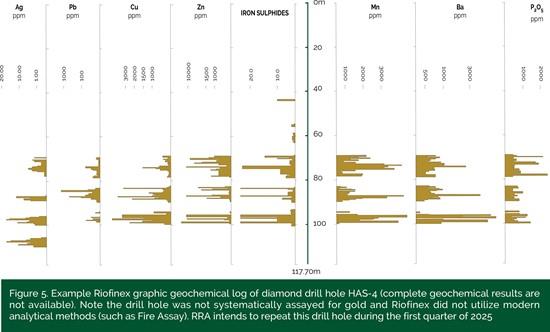

The Hanash South prospect area was discovered by Riofinex in the late 1970’s. Riofinex identified copper, zinc and silver mineralized gossans outcropping and sub-cropping along and within a wadi over a strike distance of approximately 1.6 kilometers (see Figure 4). Riofinex completed ground magnetics, induced polarization (IP) and self-potential (SP) surveys at Hanash South. The IP survey outlined an approximately 2.3-kilometer-long chargeability anomaly located beneath alluvial sediments (see Figure 4). Riofinex drilled seven diamond drill holes along the trend of the IP anomaly. All drill holes except for HAS-3 and 6, intersected (“layer-parallel”) sulphide intervals of from 25 to 90 meters thickness (see example log in Figure 5). The sulphide sections were anomalous in silver, zinc and copper. Some select samples were taken for gold analyses, but results were not reported. Estimated grades assessed from graphic logs (historic results are not available; see Figure 5) can be up to approximately 20 meters at 20ppm silver and 0.3% copper (visual estimate only, not JORC compliant). Highest reported grades over shorter intervals were 12.5% zinc and 0.4% copper over 1.7 meters and 46.4 ppm silver over 2.4 meters (Not JORC compliant).

Figure 4

To view an enhanced version of this graphic, please visit:

Figure 5

To view an enhanced version of this graphic, please visit:

Drilling from Hanash South has identified significant thicknesses of sulphide mineralization over 2.3 kilometers of strike-length and open towards the southeast. Sulphide intersections have not been systematically assayed for gold and where they were sampled, modern fire assay analytical techniques were not utilized, and results have not been reported. RRA is currently completing geological mapping and a drone-borne magnetic survey across Hanash South and has implemented the environmental permitting process with a view to drill testing the prospect in the first quarter of 2025.

Dr Tim Coughlin, Royal Road’s President and CEO stated: “Systematic exploration work at Jabal Sahabiyah is identifying local and district-scale potential at several localities. Key to the polymetallic potential of these localities is repeat geochemical sampling using modern analytical techniques to better assess particularly the gold content of exposed mineralization. This is evident at Jabal Muwayqirah, where the addition of gold from RRA’s grab sampling has elevated copper equivalent grades to a maximum of 16.5% and increased the economic potential of the prospect area. Also important at Jabal Sahabiyah and elsewhere is testing beneath transported cover or wadis. We now have several examples of gossan occurrences occurring as erosional remnants along the immediate banks of wadi’s or as sub crop from within the wadi itself. In the case of Hanash South, Riofinex collared all of their drill holes from within the wadi and at Jabal Muwayqirah our immediate targets are evident as subtle auger anomalies and drone magnetic responses from beneath three meters of transported cover. We look forward to drill-testing our models in the coming year”.

Royal Road Minerals is a mineral exploration and development company with its head office and technical-operations center located in Jersey, Channel Islands. The Company is listed on the TSX Venture Exchange under the ticker RYR and on the Frankfurt Stock Exchange under the ticker RLU. The Company’s mission is to apply expert skills and innovative technologies to the process of discovering and developing copper and gold deposits of a scale large enough to benefit future generations and modern enough to ensure minimum impact on the environment and no net loss of biodiversity. The Company currently explores in the Kingdoms of Saudi Arabia and Morocco. More information can be found on the Company’s website .

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary statement:

This news release contains certain statements that constitute forward-looking information and forward-looking statements within the meaning of applicable securities laws (collectively, “forward-looking statements”) describing the Company’s future plans and the expectations of its management that a stated result or condition will occur. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company, or developments in the Company’s business or in the mineral resources industry, to differ materially from the anticipated results, performance, achievements or developments expressed or implied by such forward-looking statements. Forward-looking statements include all disclosure regarding possible events, conditions or results of operations that is based on assumptions about, among other things, the Alliance, the intention to form a joint venture, enter into a related agreement and establish Newco and, more generally, future economic conditions and courses of action, and assumptions related to government approvals, and anticipated costs and expenditures. The words “plans”, “prospective”, “expect”, “intend”, “intends to” and similar expressions identify forward looking statements, which may also include, without limitation, any statement relating to future events, conditions or circumstances. Forward-looking statements of the Company contained in this news release, which may prove to be incorrect, include, but are not limited to the Company’s exploration plans.

Quality Assurance and Quality Control:

Sample preparation and analyses are conducted according to standard industry procedures at certified laboratories. Analytical performance is monitored by means of certified reference materials (CRMs), coarse blanks, coarse and pulp duplicate samples. Grab rock-chip samples were bagged in the field for a sample size of approximately 2kg and then sent to ALS in Jeddah where gold was analyzed by fire assay with inductively coupled plasma spectrometry (ICP) finish and multielement analyses were conducted by four acid digest with ICP-MS finish (ME-MS61). Soil samples were collected 40-80cm below the surface or in the case of auger samples from up to 3 meters below transported cover to avoid surficial contamination. Approximately 0.5kg was collected for each sample. For each sample, soil or cover thickness, horizon (where present), sample type, sample collection depth, and field sieve-mesh were recorded. QAQC materials included approximately 5% CRMs, 5% blanks, and 8% field duplicates. Soil samples were sent to ALS Jeddah for drying and dry-sieving to -75um/-200 mesh. Gold analysis was completed by 30g fire-assay with an ICP-MS finish. Super trace multi-element analysis was completed using four acid digest with ICP-MS finish (ME-MS61L). All results were analyzed by our in-house Exploration and Database Management team before import into our geochemical database.

The Company cautions you not to place undue reliance upon any such forward-looking statements, which speak only as of the date they are made. There is no guarantee that the anticipated benefits of the Company’s business plans or operations will be achieved. The risks and uncertainties that may affect forward-looking statements include, among others: economic market conditions, anticipated costs and expenditures, government approvals, and other risks detailed from time to time in the Company’s filings with Canadian provincial securities regulators or other applicable regulatory authorities. Forward-looking statements included herein are based on the current plans, estimates, projections, beliefs and opinions of the Company management and the Company does not undertake any obligation to update forward-looking statements should assumptions related to these plans, estimates, projections, beliefs and opinions change.

MENAFN05112024004218003983ID1108853019