Ottawa Senators owner Michael Andlauer sells his medical logistics company to UPS in deal worth $2.2-billion

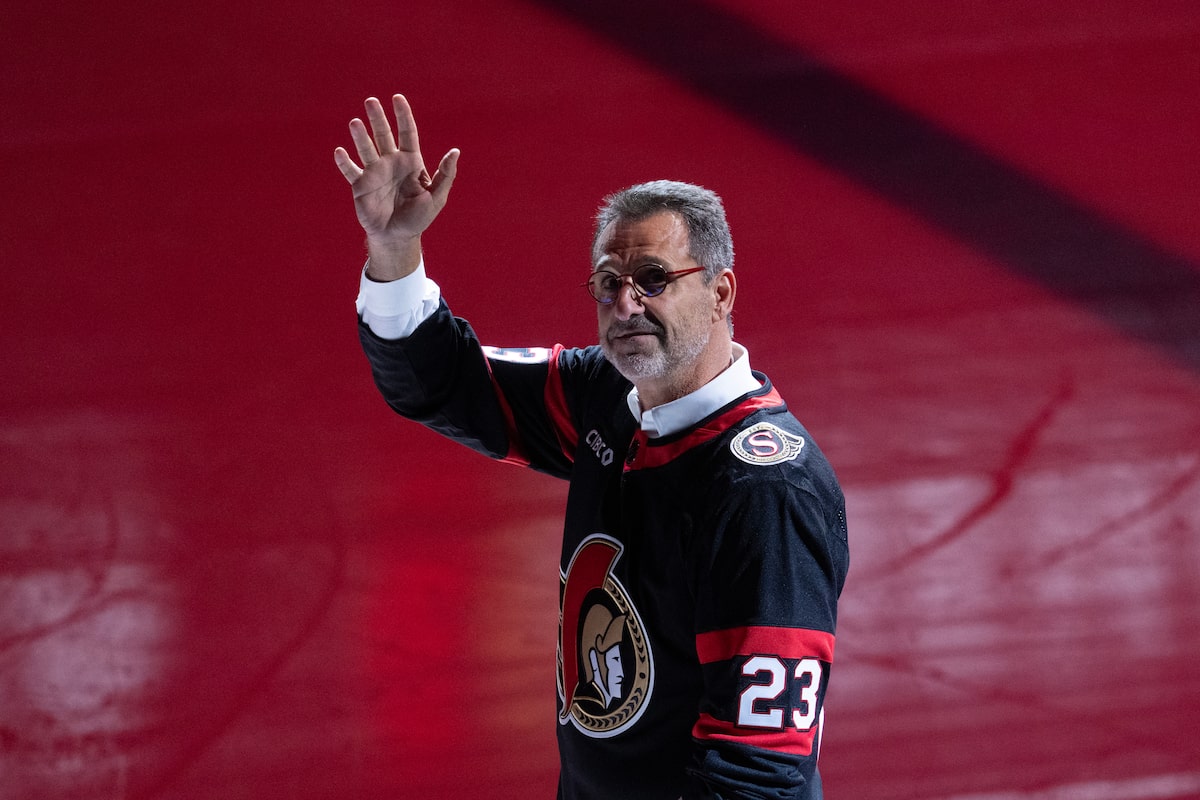

Ottawa Senators owner Michael Andlauer waves to fans as he makes his way to the ceremonial face-off on Oct. 14, 2023 in Ottawa.Adrian Wyld/The Canadian Press

Canadian businessman Michael Andlauer, who recently purchased the Ottawa Senators, is selling his medical logistics business to American shipping giant United Parcel Service Inc., earning him more than $1-billion in cash.

UPS UPS-N is paying $55 per share in cash for Andlauer Healthcare Group (AHG) AND-T, according to an announcement on Thursday, representing a total purchase price of roughly $2.2-billion.

The highest AHG shares have ever traded on the Toronto Stock Exchange was $54.95 in September, 2022. But the stock has struggled of late and closed at $41.96 before the UPS deal was announced – the same price it traded for in September, 2020.

Mr. Andlauer indirectly holds 53.2 per cent of AHG’s shares and 82 per cent of the votes entitled to be cast for the transaction. Once the deal closes, he will remain as chief executive officer of AHG and will also take over leadership of UPS Healthcare Canada.

Born in France in 1966 and raised in a suburb of Montreal, Mr. Andlauer ran the trucking division of McCain Foods Ltd. before starting his own transport business in the early 1990s.

AHG, founded in 1991 and formerly known as Andlauer Transportation Services and ATS Healthcare, is now the dominant player in health care logistics in Canada, offering services that include cold storage, transportation and warehousing. The company went public in 2019, and its success has made Mr. Andlauer a billionaire.

He is also a lifelong hockey fan, and in 2023 a group he assembled purchased 90 per cent of the Ottawa Senators for US$950-million.

While the UPS deal is a friendly transaction, it is the first multibillion-dollar deal to be announced since Ottawa gave itself more power to block foreign investments in Canadian companies.

In March, during the brief two-day period when sweeping U.S. tariffs on goods from Canada were in effect, the federal government updated guidelines that determine when a takeover could face additional regulatory scrutiny to include “the potential of the investment to undermine Canada’s economic security.”

Boxes are moved along a conveyer belt in a UPS Healthcare warehouse in Burlington, Ont., on Nov. 21, 2024.Christopher Katsarov/The Globe and Mail

The update was “a warning to U.S. investors,” Omar Wakil, co-chair of the competition and foreign investment review practice at law firm Torys LLP, told The Globe and Mail at the time.

The AHG-UPS deal includes a $66-million termination fee, which AHG would have to pay UPS if it pulls out of the transaction. A reverse termination fee worth nearly double that amount is also part of the agreement, whereby UPS must pay AHG $110-million if the deal fails to receive required regulatory approvals.

AHG played a key role in the Canadian response to the COVID-19 pandemic, as its refrigerated trucks were used to transport millions of vaccine doses across the country. The company operates out of more than 30 locations in Canada, and also provides health care-related transport services across the U.S.

In 2024, AHG generated a record $650.5-million in revenue, with adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) of $164.6-million.

AHG’s “revenue and earnings remain very resilient due to the company’s exposure to the Canadian healthcare and logistics space, despite the challenging operating environment for the broader freight sector,” CIBC World Markets analyst Kevin Chiang wrote in a note to clients this past February, when AHG last reported earnings.

Mr. Chiang was projecting the company to earn $175.7-million in EBITDA this year and $189.2-million in 2026. He added that AHG “expects to be insulated from the rising risks associated with potential tariffs.”

Mr. Andlauer is also the co-founder of Toronto-based private equity investment company Bulldog Capital Partners. Bulldog CEO Peter Jelley is also chair of the AHG board of directors and a member of the Ottawa Senators board.

Mr. Andlauer’s wife, Lucie Andlauer, worked as vice-president of sales at his medical transport business for 20 years when it was known as ATS Healthcare Canada. She most recently spent six years as CEO of geothermal company Subterra Renewables before retiring in September, 2024.

AHG’s shares closed at $53.32 on Thursday, slightly below the UPS offer price.

Goodmans LLP is serving as legal adviser to AHG, and CIBC Capital Markets is the company’s financial adviser for the transaction. UPS has retained Stikeman Elliot LLP and King & Spalding LLP as legal advisers, and BofA Securities as a financial adviser.