Market Factors: There’s only one thing for investors to do here

With this edition of Market Factors, we discuss why guarding against investment mistakes with domestic stocks should be a top priority and why the U.S. markets may not be all that great either. The diversion features brilliant nature photography and we look ahead to important data releases.

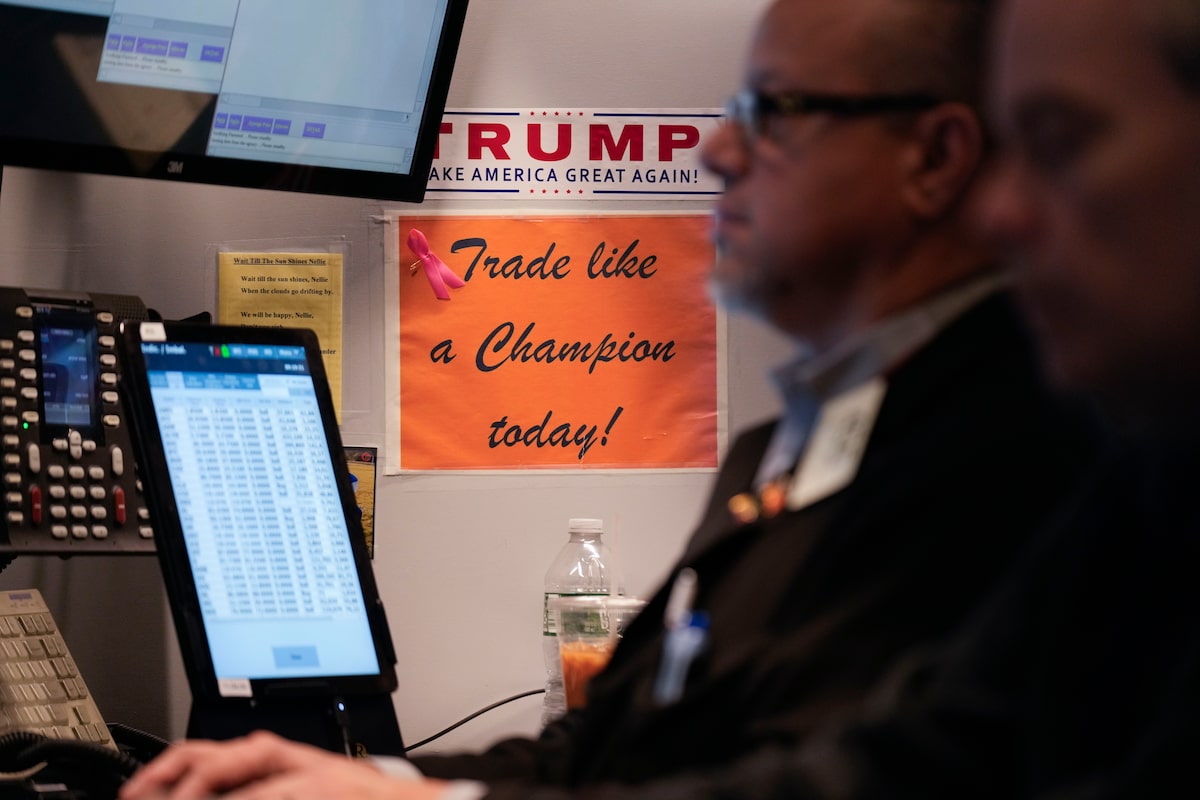

A sticker supporting President Donald Trump is displayed on the floor at the New York Stock Exchange in New York, Monday, Feb. 3, 2025.Seth Wenig/The Associated Press

Tariffs

Do nothing

Things could get really bad for the domestic economy if tariffs remain in place, with all the unemployment-related pain that implies. Or, as in the case of Colombia, the tariffs could be removed inside of a week if adequate forms of obeisance are performed.

The U.S. president could also increase the new duties if he gets annoyed about retaliatory tariffs and Doug Ford’s public defiance. Mr. Trump could also be harbouring anti-Canada vindictiveness about the troubled Trump Hotel deal in Toronto in 2016 (as a real estate banker friend suggested to me). Mr. Trump stated that he wants U.S. banks to be able to operate freely in Canada but we know that’s not going to happen, so maybe this whole process takes longer than expected. Seemingly anything is possible.

The sheer volume of potentialities suggests investors shouldn’t bank on any one of them happening. This, I think, explains the surprisingly muted market reaction to the tariff news on Monday.

The S&P/TSX Composite opened down roughly 2 per cent and the Canadian dollar was lower by seven-tenths of a U.S. penny. I expected worse until I thought about it.

The best thing investors can do here, really the only thing, is nothing. The worst case investment scenario in the short term is to sell everything Monday afternoon, have the tariffs rescinded Thursday, and miss the recovery rally.

Selling everything and having the tariffs remain has a better outcome – it preserves capital when the inevitable domestic growth slowdown hits. The odds are, however, that these investors will miss the bottom of the market and miss a good portion of the recovery whenever it happens.

Staying long, even if it’s an unexciting idea that gets financially painful, is the option with the highest probability of eventual success. There is plenty of time to search for unjustly oversold, high quality domestic stocks but in the next few days the odds of making a mistake are too high.

Winnipeg Jets defenseman Logan Stanley (64) in action during the first period of an NHL hockey game against the Washington Capitals, Saturday, Feb. 1, 2025, in Washington.Nick Wass/The Associated Press

Equities

U.S. markets now dangerously narrow

I’m not bearish but I am becoming more open to bearish arguments as the similarities between markets now and in the late 1990s pile up. The latest salvo comes from RB Advisors’ most recent report, Narrow markets are the exception, not the rule.

The report notes that 2023 and 2024 were the narrowest U.S. markets since 1998/99. Only 30 per cent of S&P 500 constituents beat the benchmark ln 2023 and slightly fewer index stocks outperformed in 2024. This is similar to 1998 and 1999 when roughly 25 per cent and 33 per cent, respectively, beat the S&P 500. The long-term median is 48 per cent of companies outperforming.

Team sports offer a good metaphor for why narrow markets are bad. A team with a number of good players and a deep bench is healthier because if one gets injured, the others can pick up the slack. Another decent payer can come off the bench without a big drop in competitiveness. A team dependent on one player, on the other hand, will slide well down the standings if that player gets hurt or underperforms.

If Nvidia and Meta Platforms are the Lionel Messi and Connor McDavid of today’s market, investors don’t seem overly concerned about the added risk. The monthly Conference Board Consumer Confidence Survey asks Americans whether they believe markets will be higher in 12 months. The RB Advisors report informs that “the past two months’ readings show a level of confidence in the stock market never seen in the survey’s history.”

RB Advisors also highlights recent Goldman Sachs research showing that volatility increases significantly in years after extremely narrow markets. The years 2000-2005 are the poster children for this. Investors kept waiting for technology to retake market leadership only to have energy and consumer staples outperform the S&P 500 Info Tech index by 141 per cent and 120 per cent, respectively.

Diversification away from the popular sectors is the recipe for success according to RB Advisors, protecting against the index’s high weighting in popular sectors while also providing portfolio exposure to industries that assume market leadership.

Diversions

Worth more than 1000 words?

Pictures are worth 1000 words so I don’t have to type much here. The winners of the Canadian Geographic Photos of the Year took some breathtaking shots, as CBC shows here.

The essentials

Looking for our updates on market movers, analyst actions, stock technicals, insider trades and other daily, weekly and monthly insight? Click here to visit our Inside the Market page.

Globe Investor highlights

Darcy Keith on how money markets have shifted their BoC rate cut bets as tariffs become reality, and how economists are reacting to all of the latest mayhem.

Tim Shufelt answers the question, “With Trump’s tariffs, is it unpatriotic to buy U.S. stocks?”

Reuters reports on how investors are betting Musk and Tesla will make a fortune under Trump even as threats mount

What’s up next

The net change in employment for January is the big economic release domestically. That’s out Friday and 22,900 new jobs are expected. The unemployment rate is expected to come in at 6.8 per cent. Before that we have the S&P/Global Canada Composite PMI for January on Wednesday.

A few important earnings reports are also on the calendar. Suncor Energy Inc. is out Wednesday (C$1.166 per share expected). Thursday sees BCE Inc. ($0.718 and maybe guidance about the dividend) and Open Text Corp ($0.932).

The Americans’ ISM Manufacturing for January on Monday came in at 50.9, ahead of the forecast 50.0. Factory orders for December will be announced Tuesday with 0.5 per cent month over month growth expected. ISM Services for January is out Wednesday and an expansionary 54.5 reading is forecast. Unit labour costs for Q4 will be released Thursday and 3.4 per cent annualized is expected. Non-farm payrolls for January is reported Friday – 150,000 new jobs are expected.

U.S. pharma giants Merck & Co. Inc. (US$1.641 per share expected) and Pfizer Inc. (US$0.467) report Tuesday along with Alphabet Inc. (US$2.13). Walt Disney Co releases results Wednesday (US$1.424) and so does QUALCOMM Inc. (US$2.97). Amazon.com Inc. (US$1.475) reports Thursday.

See our full economic and earnings calendar here (You can bookmark the page – it gets updated weekly)