Article content

Groupe Dynamite Inc. is poised to awaken Canada’s long-dormant initial public offering market after an 18-month dry spell, in what bankers are calling a cunningly timed offering that is expected to be the country’s biggest debut in nearly three years.

Dynamite, a retailer of women’s clothing, aims to raise $300 million in a deal that would value the company — majority owned by chief executive Andrew Lutfy — at $2.3 billion.

Article content

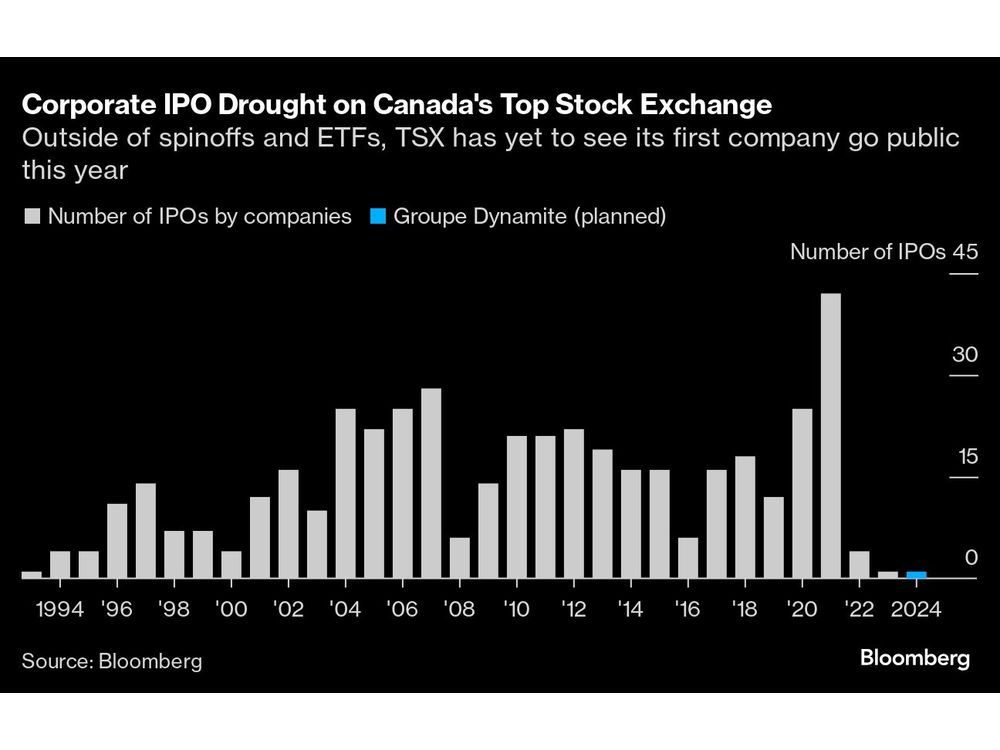

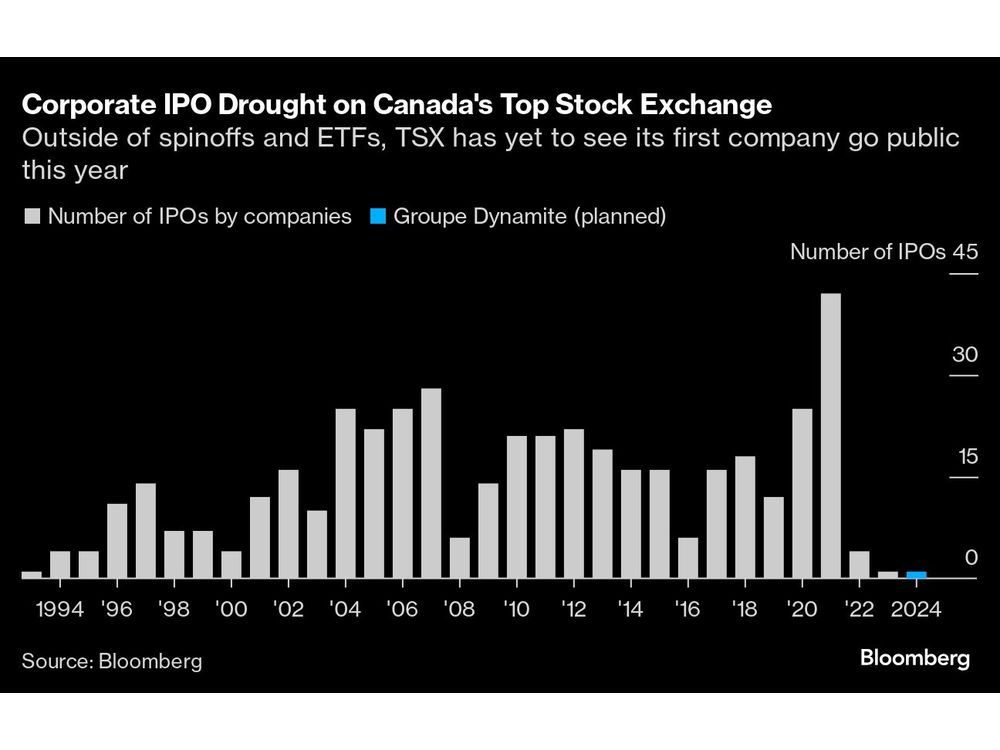

Its IPO would be the largest in Canada since Bausch + Lomb Corp. raised $889.3 million in January 2022. It’s expected to help the Toronto Stock Exchange, which hasn’t seen a corporate IPO since Lithium Royalty Corp. raised $150 million in February 2023.

“The timing of this IPO is actually quite canny,” said Grant Kernaghan, the chief executive of Citigroup Inc.’s global markets business in Canada.

Because other companies pushed through their IPOs ahead of the U.S. presidential election — on the prediction that there would be uncertainty about the results, which turned out to be incorrect — an air pocket of sorts has developed in which Dynamite isn’t facing competition for investor dollars.

“What you’ve got here is a very smart decision to try and hit the market in a very narrow period, when there’s unlikely to be a lot of competition out of the U.S. and that might lead to some incremental demand,” Kernaghan said in a phone interview.

That will help Groupe Dynamite, which is offering subordinate shares, to break the ice after “a very thin period for IPOs over the last couple of years,” he added.

Article content

Indeed, investors are watching the deal closely and more potential IPO candidates are waiting in the wings. Bloomberg reported that generic drug maker Apotex Inc. has hired bankers in preparation for an IPO. Bankers anticipate more action in 2025.

“I would expect there’ll be more deals,” said Daniel Nowlan, vice chairman and managing director of equity capital markets, corporate and investment banking at National Bank of Canada. “A lot of people are looking at this Dynamite deal to see how it goes.”

Investors have been asking to see “large, liquid names” coming to the market after a long stretch between IPOs in Canada, he said by phone. However, he does not expect any of those transactions to show up by the end of the year, due to holidays including Thanksgiving and Christmas.

“It’s just tough to squeeze things in,” he said.

A potential return for IPOs in Canada follows an uptick in secondary stock issuances this year. Through the end of October, Toronto Stock Exchange-listed firms raised $14.1 billion, up 9.4 per cent from $12.9 billion through the same period in 2023, almost entirely due to a rebound in secondaries and launches of exchange traded funds.

With assistance from Bailey Lipschultz

Bloomberg.com

Share this article in your social network

Comments