Business Brief: Lessons from the loonie

Good morning. I’m Matt Lundy, economics editor. My team and I have had a close eye on trade, so we were quick to pivot when Canada got a one-month reprieve from U.S. President Donald Trump’s 25-per-cent tariffs.

It seems there was some wiggle room on the matter after a second phone call, with Prime Minister Justin Trudeau promising to invest $200-million more to fight organized crime and drugs and appoint a “fentanyl czar.”

But even with a delay, the threat of tariffs casts a dark cloud over the livelihoods of many Canadians and Americans. Even if the pause does provide Canadian businesses with a bit of breathing room to prepare for levies. Maybe Campbell Clark said it best: Oh how Trump loves to leave his neighbours hanging on his whim. More on all that, but first:

In non-tariff news

Evolve Funds Group Inc. plans Canada’s first leveraged crypto ETFs, hoping to draw back investor dollars from U.S. funds

Joriki Inc., the beverage maker linked to listeria outbreak, was struggling financially before recall, court filings show

StackAdapt Inc. will announce that the Ontario Teachers’ Pension Plan has led a US$235-million financing, backed by Intrepid Growth Partners and four other investors

On the radar

- Follow more trade news with our Canadian tariff war journal.

- U.S. data on job openings and factory orders for December will be released.

- Earnings include: Advanced Micro Devices Inc., Allied Properties REIT, Alphabet Inc., Amgen Inc., Chipotle Mexican Grill Inc., Finning International Inc., Merck & Co. Inc., PayPal Holdings Inc., Pepsico Inc., Pfizer Inc. and Spotify Technology SA

The Globe wants to know if your habits are changing in the face of U.S. tariffs. What products will you be substituting with a Canadian version? Are there any local brands you absolutely love? We’d love to hear about groceries, clothing, toys, home products and more – or even a general philosophy you employ when shopping in stores. Send an email to audience@globeandmail.com to share your thoughts.

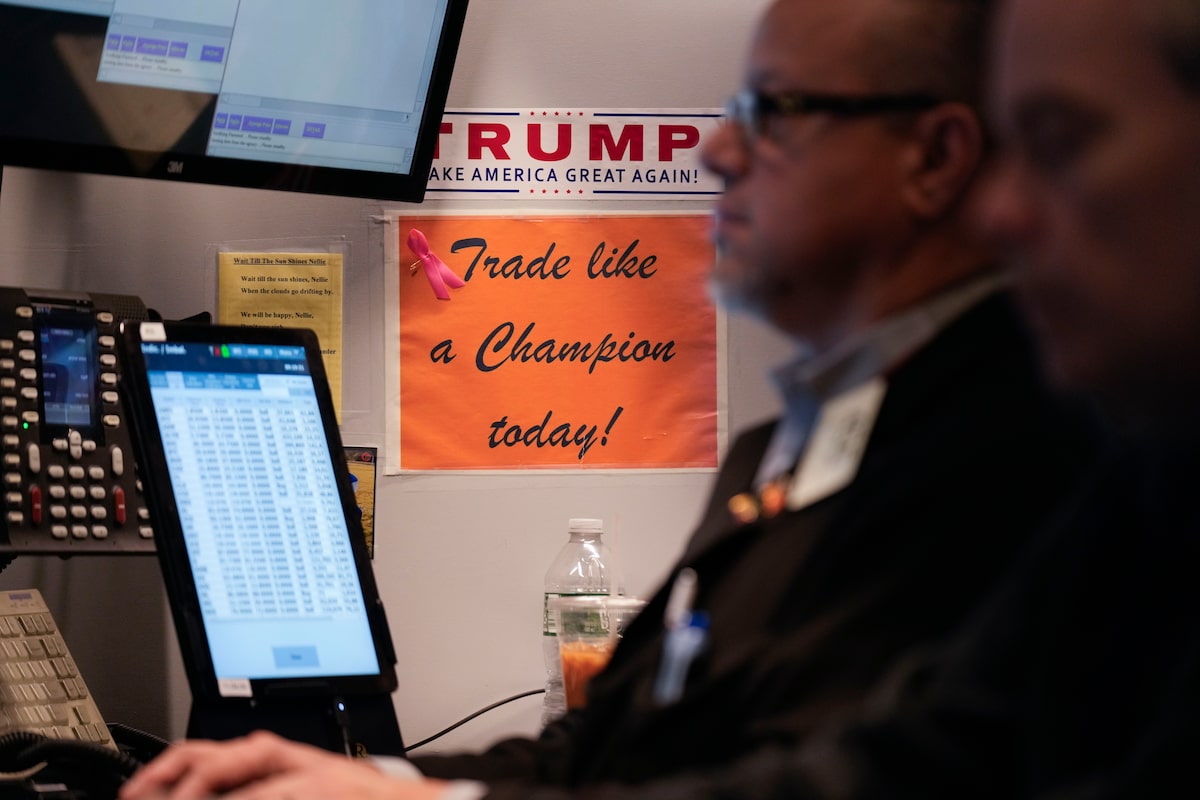

A sticker supporting President Donald Trump is displayed on the floor at the New York Stock Exchange in New York, Monday, Feb. 3, 2025.Seth Wenig/The Associated Press

In focus

Tariff tracker: The dollar speaks

For many Canadians, following the value of the Canadian dollar is akin to a national sport. And lately, it feels like we’re cheering on a hapless squad with no shot at making the playoffs (so, like the Toronto Raptors).

On Sunday, the Canadian dollar plunged below 68 US cents as investors absorbed Saturday’s news that U.S. President Donald Trump was pressing ahead with his tariff threats on Canada and Mexico.

Then on Monday afternoon, as news broke that tariffs on Canada would be delayed by a month, similar to what happened with Mexico earlier in the day, the Canadian dollar soared above 69 US cents.

Put another way, if you want to gauge how the country’s trade skirmish with the U.S. is going, there is no better indicator than the Canadian dollar.

Here’s a cheat sheet: If the loonie takes a dip, Trump said something threatening about Canada. When it rises, the prospect of a trade war diminishes.

Equity markets, by contrast, have been generally cheerful during weeks of Trump’s threats. Between the presidential election day and last weekend, the S&P 500 had risen 4.5 per cent, bolstered by Trump’s aims to lower taxes and regulations on business.

Yesterday played out differently. Canadian and U.S. stock indices opened sharply lower, before clawing back some ground. The S&P 500 and Dow Jones Industrial Average fell 0.8 per cent and 0.3 per cent, respectively, on the day – a timid response to a potential trade war. Canada’s benchmark stock index dropped 1.1 per cent.

It’s likely that stocks will rebound today. The news of the tariff pause was announced after market close.

Currency markets, however, are where the action is. And it’s been that way for a while.

There’s quite a lot working against the loonie of late: a U.S. dollar that’s dominating all major currencies, the sluggish Canadian economy, and the interest-rate policy divergence between the Bank of Canada and its U.S. counterpart, the Federal Reserve.

But tariff threats are a huge part of the loonie’s beleaguered status.

“The recent depreciation we’ve seen in the Canadian dollar has been more driven, in our view, by trade uncertainty, and particularly President Trump’s threats to impose 25-per-cent tariffs on Canadian exports,” Bank of Canada Governor Tiff Macklem explained at last week’s rate decision.

If tariffs went ahead in a month, the depreciation in the Canadian dollar would help to offset some of their impact, allowing domestic exporters to remain somewhat competitive in the U.S. market.

Conversely, the weaker loonie makes our imports from the U.S. more expensive. Get ready for pricier fruits and vegetables, which have a faster pass-through to consumers.

Before yesterday’s announcement, many economists and currency analysts forecast that the Canadian dollar could erode to roughly 66 US cents in a lengthy trade war.

Yes, the loonie is like a car crash that you can’t look away from.

But right now, it may be the easiest way to track Canada-U.S. relations.

Read more (and more and more)

- Do’s and don’ts for investors: Rob Carrick has a half-dozen ideas for your investments in these uncertain times

- What does “made in Canada” mean? How to read labels on products in stores

- For consumers: If tariffs do come for Canada, here’s what would get expensive first

- Retaliation: Some premiers pause plans for U.S. booze ban and Starlink

- Housing: A trade war will wreak havoc on a fragile homebuilding industry in Canada

- Resources: Canadian steel sector averts ‘doomsday’ scenario

- Labour: Tariffs would lead to job losses in auto and resource sectors, economists predict

- Abroad: Europe braces for tariffs as Trump signals expanded trade war

Views

Shopify’s Lütke and other appeasers miss Trump’s real agenda on tariffs

“The 30-day delay in rolling out tariffs announced on Monday doesn’t change the fact that Mr. Trump wants to replace decades of free trade between two countries with a one-sided business relationship where Washington sets the rules,” Andrew Willis writes.

Trump’s art-of-the-deal playbook is evident

“But just as the victors write the history of wars, the president of the strongest nation on the globe gets to define who is the winner and who is the loser. That, as much as the fluctuations of the financial markets and the rate of inflation, is the measure that in this conflict counts,” David Shribman writes.

Hopefully the U.S. and Canada can strike a deal on tariffs. But that doesn’t fix the real problem

“More importantly, this new trade war is a sobering wake-up call on the need for Canada to improve productivity, expand markets and re-establish the country as a place to invest in and grow companies – a sentiment that came through loud and clear in our discussions with Canadian business leaders,” writes Benjie Thomas, a senior partner and the chief executive officer of KPMG in Canada.

Charted

A closer look at the border

As part of the agreement to pause tariffs, Trump said Canada has agreed to appoint a “fentanyl czar.”

It was one of the reasons Trump claimed to want tariffs in the first place: to put Canada to task on border control. Particularly he mentioned the movement of fentanyl, which he claims is flowing freely from Canada into the U.S. While this type of drug trafficking does happen, it is not at the scale he claims.

Conservative Leader Pierre Poilievre said he wants Canadian soldiers sent to the border as part of a broader plan he says would both save Canada-U.S. trade and also serve Canada’s national-security interests.

Bookmarked

On our reading list

Boy, bye: A 22-year-old Canadian math whiz has been charged in connection with cryptocurrency hacking schemes that allegedly netted him US$65-million.

Sponsor, bye: The Giller Prize, Canada’s most lucrative literary prize for fiction, is looking for a new collaborator. The Giller Foundation and Bank of Nova Scotia have ended their decades-long partnership.

TikTok, hi: Donald Trump signed an executive order for the creation of a sovereign wealth fund within the next year, saying it could potentially buy the short-video app.

Morning update

Global stocks wobbled in cautious trading after Canada and Mexico struck deals for a 30-day reprieve from U.S. President Donald Trump’s 25-per-cent tariffs, with markets assessing the road ahead. Wall Street futures were mixed, while TSX futures followed sentiment lower as crude prices dipped.

Overseas, the pan-European STOXX 600 was flat in morning trading. Britain’s FTSE 100 fell 0.21 per cent, Germany’s DAX rose 0.05 per cent and France’s CAC 40 gained 0.25 per cent.

In Asia, Japan’s Nikkei closed 0.72 per cent lower, while Hong Kong’s Hang Seng advanced 2.83 per cent after markets were closed much of last week for lunar new year celebrations.

The Canadian dollar traded at 69.27 U.S. cents.