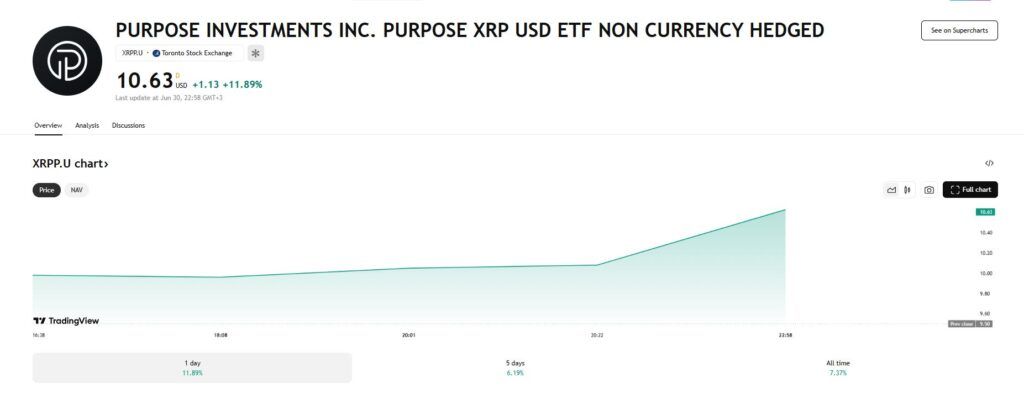

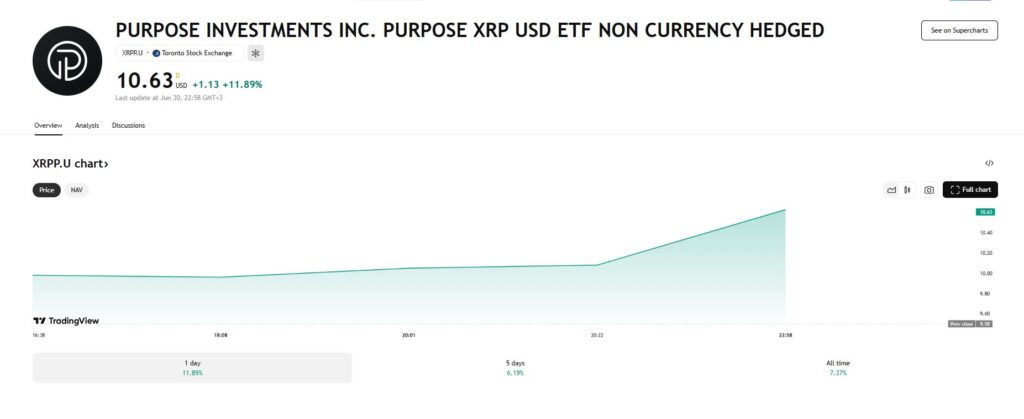

North America’s first spot XRP ETF is breaking out

Canada and North America’s first spot XRP exchange-traded fund (ETF), launched by Purpose Investments, is showing signs of strength following a choppy debut.

Trading on the Toronto Stock Exchange (TSX), the fund surged 11.89% on June 30, closing at $10.63. Over the past five days, the ETF has gained 6.19%, and since its inception on June 18, it is up 7.37%.

This resurgence comes despite the underlying XRP cryptocurrency struggling to break through key resistance levels. The ETF had initially mirrored the broader weakness in XRP, but appears to be decoupling somewhat in recent sessions.

The product is only the second spot XRP ETF globally, following Brazil’s Hashdex XRP offering. Purpose Investments charges a management fee of 0.69%, capped at 0.89%, with any cost savings passed on to investors.

Notably, Canadian residents can hold the ETF in tax-advantaged accounts such as TFSAs and RRSPs, making it an attractive vehicle for diversified crypto exposure.

U.S. next to approve XRP ETF?

While the Canadian and Brazilian launches have had limited impact on XRP’s global price so far, bigger developments could be on the horizon.

The U.S. Securities and Exchange Commission (SEC) recently requested public input on spot XRP and Solana ETF proposals from Franklin Templeton and WisdomTree.

If approved, these products would be listed on Cboe’s BZX Exchange, potentially unlocking significant institutional participation and liquidity, marking the first such offering just south of the Canadian border.

XRP price analysis

Meanwhile, XRP’s price action continues to lag. At press time, the token was trading at $2.20, up 1% in the past 24 hours, but only 0.8% higher over the week.

The key challenge remains a decisive break above the $2.25 resistance level, which could pave the way for a push toward $2.50.

Featured image via Shutterstock