Article content

Written by Pamela Heaven on . Posted in Canada. Leave a Comment

Canada’s stock exchange has been outperforming the S&P 500, here’s why

Published Mar 25, 2025 • Last updated 1 hour ago • 4 minute read

Article content

Article content

Currency moves amid Donald Trump’s tariff war are aligning to actually boost Canada’s stock market, according to a CIBC analyst.

The U.S. dollar has been on a slide this year, partly because of the darkening outlook for the American economy but also, according to analyst Ian de Verteuil, because there is a sense that Trump wants to see a weaker U.S. dollar.

“This dovetails with speculation by incoming White House officials of a ‘Mar-a-Lago Accord’ to deliberately weaken U.S. exchange rates,” he wrote in a recent note.

Advertisement 2

Story continues below

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

Another twist is that the Canadian dollar is weak at the same time.

Canada’s main stock exchange has been outperforming the S&P/500 since the start of the year and “the net effect of currency changes has been, and should continue to be, beneficial for the S&P/TSX,” said de Verteuil.

Gold is a big reason why.

When the U.S. dollar falls, gold prices typically rise. In fact, this has happened 77 per cent of the time over the past 47 years, according to CIBC tracking.

The U.S. dollar slumped 2.3 per cent in the first week of March, and gold last week broke through US$3,000 an ounce for the first time.

“The reality is that the Canadian index has become the “home” for gold companies, whether they be explorers, producers or the royalty companies – and regardless of the location of their mines,” de Verteuil wrote, adding that gold stocks currently make up almost 10 per cent of the index’s market capitalization.

“A weaker U.S. dollar has helped support gold prices and a large proportion of the S&P/TSX market cap.”

Another reason is that the TSX as the main exchange of a trading nation is global in nature, with a fair proportion of revenues coming from outside the country. Only 48 per cent of revenues on the index come from Canadian operations, said CIBC.

Posthaste

Breaking business news, incisive views, must-reads and market signals. Weekdays by 9 a.m.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Posthaste will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“With most of the revenues for the S&P/TSX booked outside of Canada, this should provide earnings tailwinds throughout 2025,” said de Verteuil.

The big winners are companies with large non-Canadian revenues but which report in Canadian dollars — “not only do they benefit from being diversified outside of Canada, they also are likely to surprise positively on reported earnings in the first and second quarter of 2025,” he said.

Sign up here to get Posthaste delivered straight to your inbox.

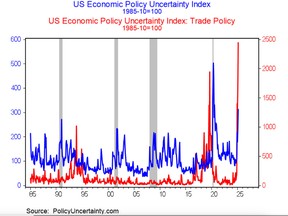

U.S. economic policy uncertainty has not been this high in 40 years, according to CBIC Capital Markets senior economist Sal Guatieri, who brings us today’s chart.

The spike in unpredictability presents special challenges for the Bank of Canada as it balances the harm uncertainty is doing to the economy with ensuring the “tariff problem doesn’t become an inflation problem.”

“The odds of an April pause have risen, though if tariffs do drag the economy into recession, the Bank may then need to cut rates “quickly when things crystallize,” said Guatieri.

Advertisement 4

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Older millennials, or younger ones who feel they need to put off saving, may be wondering: Is 40 too old to build generational wealth? Starting a wealth-building journey after 40 can seem like a challenge or feel like it is too late to get a significant nest egg together, but there are things you can do — and should not do. Find out more

Is the trade war having an effect on your finances? Are you making different decisions about your spending or saving habits? Is it changing your retirement math or portfolio construction? Do you see bigger plans like buying a house or starting a family slipping through your fingers? If yes, drop us a line at wealth@postmedia.com with your contact info and we’ll find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course).

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Advertisement 5

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Visit the Financial Post’s YouTube channel for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Article content

Share this article in your social network

Featured Local Savings

Comments