Global stock markets plunge on Trump tariffs. Cryptocurrencies and oil prices fall

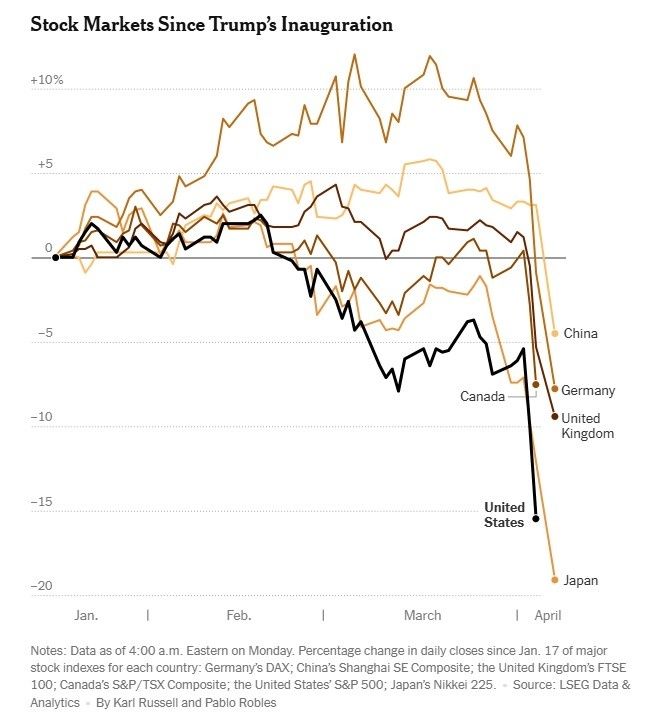

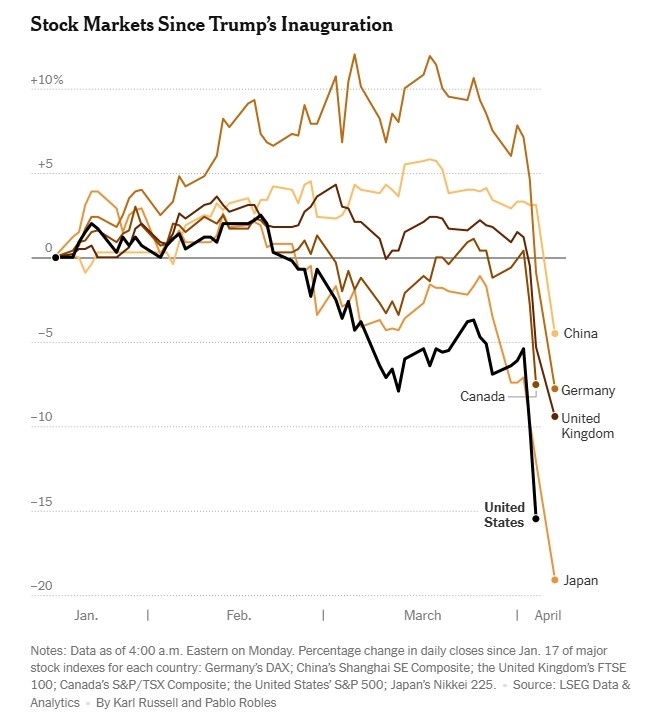

Financial markets around the world collapsed on April 7 as investors worried about the prospect of a severe economic downturn following new tariffs imposed by the administration of the US President Donald Trump.

This is reported by The New York Times and the Financial Times.

In Asia, trading was extremely volatile throughout the day. Hong Kong markets were the worst hit, with stocks falling 13%, and Taiwan, which saw a 10% drop (the biggest drop ever). Mainland Chinese stocks fell 7%.

Stocks in Europe also fell in price, with the main pan-European stock index Stoxx Europe falling by more than 5%.

The S&P 500 is expected to open sharply lower, down about 3%. If the decline continues throughout the New York trading day, the index could enter a “bear market” — a decline of 20% or more from its recent peak. On Friday, April 4, the index closed down 17.4% from its February peak.

“There are no signs yet that markets have bottomed out and are starting to stabilize,” Deutsche Bank analysts write.

South Koreaʼs benchmark indices fell about 5%, while Australiaʼs fell more than 4%. In Japan, the decline was so sharp that the countryʼs stock exchange operator briefly halted trading in Japanese stock futures on Monday morning. The Nikkei 225 index fell more than 7%.

Data as of 12:00 Kyiv time. Change in daily closing figures since January 17 for the main stock indices of each country: DAX (Germany), Shanghai SE Composite (China), FTSE 100 (UK), S&P/TSX Composite (Canada), S&P 500 (USA), Nikkei 225 (Japan).

Technology stocks across Asia also fell sharply. Shares of the worldʼs largest chipmaker, Taiwan Semiconductor Manufacturing Company, and Appleʼs main contract manufacturer, Foxconn, fell 10%. In Hong Kong, Chinese tech giants Alibaba, Tencent and Xiaomi all fell by double digits.

Japanese company Nintendo, which cited tariffs when it delayed pre-orders for the sequel to its best-selling Switch game console, fell more than 7%.

In Europe, no sector escaped the stock market crash. Banks were hit particularly hard as fears of a general economic downturn and a deal freeze materialized. Shares in Germanyʼs Deutsche Bank and Britainʼs Barclays fell more than 7%.

Defense stocks also fell sharply, no longer supported by recent pledges by European governments to increase military spending. Shares in Germanyʼs Rheinmetall fell 11% and Italyʼs Leonardo fell 9%.

Investors flocked to the relative safety of government bonds, pushing up prices and pushing down yields. Germanyʼs 10-year bond yield fell a tenth of a percentage point to 2.48%, a significant shift in the bond market. Japanʼs 10-year bond yield fell 0.07 percentage point to 1.11%.

Commodities suffered significant losses, with West Texas Intermediate crude down 3.6% to $59.74 a barrel, Brent crude down 3.5% to $63.30, and Russian Urals crude down 3.5% to $52.76.

Copper on the London Metal Exchange, often considered an indicator of economic growth because of its industrial uses, fell more than 7% to $8,690 a tonne.

Bitcoin fell 4% to $76,221, after trading above $80,000 for most of the year. Other cryptocurrencies suffered larger losses overnight. Ether and Solana-pegged tokens fell 8% and 6%, respectively.

Bitcoin’s decline has triggered a wave of long liquidations as traders who had been betting on its price to rise were forced to sell their assets to cover losses. Over the past 24 hours, Bitcoin has lost more than $247 million in long liquidations, according to CoinGlass. Over the same period, ether’s long liquidations totaled $217 million.

For more news and in-depth stories from Ukraine please follow us on X.