Why you’re miserable: We’ve grown too comfortable on the booming riches of ages past

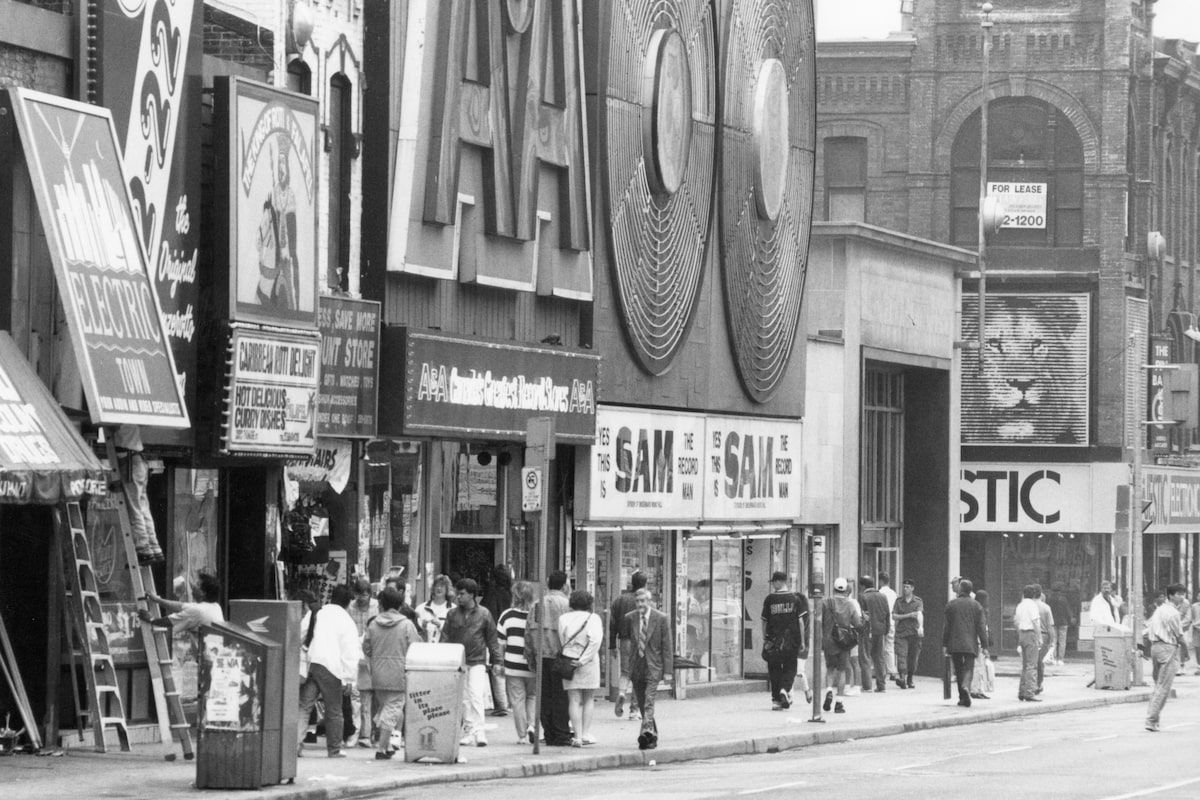

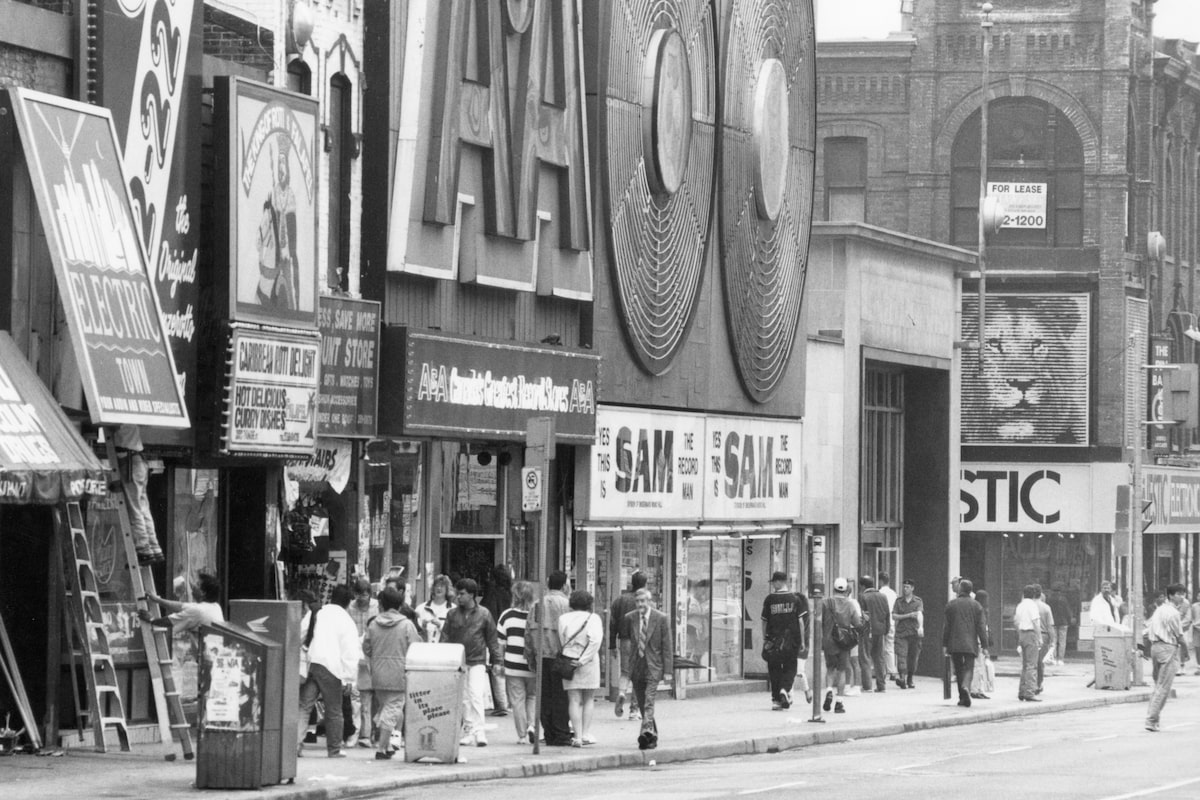

From about 1948, Western economies entered a long expansion that lasted until the early 1970s, during which time they grew at average annual rates in the 5-6 per cent range, John Rapley says.Peter Tym/The Globe and Mail

John Rapley is an author and academic who divides his time among London, Johannesburg and Ottawa. His books include Why Empires Fall (Yale University Press, 2023) and Twilight of the Money Gods (Simon and Schuster, 2017).

Pollsters report that we, and especially young Canadians, are gloomier than ever, with so many feeling so down about their economic future that they’re turning against democracy. Surveys reveal that increasingly, young people are showing greater openness to authoritarian leaders who threaten to break a system they already see as failing them. This echoes research in many developed democracies, revealing a growing radicalism and anti-system sentiment among young voters.

With the economic malaise all around, the cause might seem obvious. But our growing frustration also has deep roots, its origins lying in the postwar period now seen as the golden age of the West.

From about 1948, Western economies entered a long expansion that lasted until the early 1970s, during which time they grew at average annual rates in the range of 5 per cent to 6 per cent. Reflecting this buoyancy, asset values rose equally fast, with the index on the Toronto Stock Exchange growing at an annual average rate of more than 7 per cent.

All that added output and wealth not only generated higher incomes, it also filled the government’s coffers, enabling the expansion of higher education, public health care and the country’s pension system. But it also created a sense of limitless possibility. Believing that a new age of endless growth had begun, people and policy makers envisioned a world in which every generation would be richer than the previous one.

That allowed politicians to make pledges of future prosperity by projecting these growth rates and returns into the distant future. They thereby lengthened retirement with generous pensions and expanded social services. While this involved some pretty big long-term commitments, they were confident that future tax and investment returns would generate the money needed to fully fund them. Among ordinary people, what resulted was a culture of optimism and political harmony, in which a rising tide would lift all boats, making policy a win-win game.

This was, in the context of the time, a perfectly sensible belief. In a recent seminal paper, four economists found that people who grew up in a time of economic growth were less likely to take a zero-sum view of policy – in which benefits for some must involve cuts from elsewhere – than those who grew up amid stagnation or recession. Older Canadians who grew up in that golden age thus tend to be those who are most optimistic and trust the system to work to everyone’s benefit.

However, it is the zero-sum belief that wins out now. In the final quarter of the twentieth century, the economic growth rate began to slow, as is inevitable for advanced economies. Growth continued to slow and now, in some countries – Canada among them – it has gone into reverse (in per capita terms). One outcome of this is that policy has indeed turned into a zero-sum game, and it did so in two ways.

First, since tax revenues could no longer fund increasingly expensive commitments, governments began cutting their largesse, often first targeting programs that benefited young people. And so, university education stopped being free, or the contributions workers had to make to their pensions went up, reducing their net incomes.

Second, because promises of future largesse had been made on the expectation of steady rises in income that didn’t materialize, they made up the shortfall with policies that transferred income from workers to owners – among them the pension-funds, which relied on asset-income to support their beneficiaries. Thus, whereas economic growth slowed to a crawl and incomes barely kept pace with inflation, asset prices maintained their steady climb, with share prices on the TSX keeping to an annual average increase above 6 per cent – only modestly below that of the golden age.

One effect of this is that today, as a rule, the older you are in Canada, the more likely your income is higher than the previous generation’s at that age; and the younger you are, the more likely your income is lower than the previous generation’s at that age. Therefore, it’s just as reasonable for a young Canadian today to believe they’ll end up poorer than their parents’ generation as it is for their parents to believe they’re entitled to live better than their predecessors did.

That makes for an increasingly divided policy regime. If Canada were a business whose first few years saw rapid growth, leading it to make some big long-term spending decisions, it’s now facing the accountants, who are demanding it tighten its belt until its long-term income and expenditure realign.

At the same time, we probably all need to realign our expectations with the future. Owing to the expansion of higher education, the postwar period was a time of great upward mobility, as the children of construction workers became engineers and teachers. But with such a consequently larger middle class today, the pace of upward mobility is bound to slow.

It would be better if we found a model in which we all rose together – if at a more measured rate than we once took for granted.