Article content

This news release constitutes a “designated news release” for the purposes of CAPREIT’s prospectus supplement dated February 22, 2024, to its short form base shelf prospectus dated May 9, 2023.

Written by GlobeNewswire on . Posted in Canada. Leave a Comment

The content in this section is supplied by GlobeNewswire for the purposes of distributing press releases on behalf of its clients. Postmedia has not reviewed the content.

Author of the article:

GlobeNewswire

Published Dec 16, 2024 • 6 minute read

This news release constitutes a “designated news release” for the purposes of CAPREIT’s prospectus supplement dated February 22, 2024, to its short form base shelf prospectus dated May 9, 2023.

Article content

Article content

TORONTO, Dec. 16, 2024 (GLOBE NEWSWIRE) — Canadian Apartment Properties Real Estate Investment Trust (“CAPREIT”) (TSX:CAR.UN) announced today that is has completed, in part, its previously announced sale of its manufactured home community (“MHC”) portfolio, which now operates as Compass Communities. CAPREIT has completed the disposition of 11,605 residential lots for a gross purchase price of $715.0 million (all amounts disclosed herein exclude transaction costs and other customary adjustments). The purchase price was partially satisfied through an interest-only vendor take-back loan of $140.0 million, bearing interest at a rate of 3.0% per annum for a five-year term, with $575.0 million satisfied in cash. The sale of the remaining 533 lots is expected to be completed in the first quarter of 2025 for a gross purchase price of $25.0 million, to be satisfied in cash.

Advertisement 2

Story continues below

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

CAPREIT also announced that certain subsidiaries of European Residential Real Estate Investment Trust (TSX:ERE.UN) (“ERES”) completed its previously announced sale of 3,179 residential suites in the Netherlands for aggregate proceeds, net of certain adjustments, of approximately $1.1 billion (presented in Canadian dollars based on a Euro foreign exchange rate of 1.49 on December 13, 2024, applicable throughout this press release). ERES also declared a special cash distribution of an estimated $1.49 per ERES Unit and ERES Limited Partnership exchangeable Class B LP Unit (together, the “ERES Units”), payable to holders of the ERES Units of record at the close of business on December 23, 2024, with payment on December 31, 2024 (the “ERES

Special Distribution”). Based on CAPREIT’s effective interest in ERES of approximately 65%, CAPREIT expects to receive approximately $227 million from the ERES Special Distribution. Further details have been provided by ERES in its press release dated December 16, 2024.

CAPREIT intends to utilize the net proceeds from the sale of its MHC sites and the ERES Special Distribution: (1) to repay certain amounts drawn on its revolving credit facility; (2) to fund future acquisitions of on-strategy rental properties in Canada; and (3) for general business purposes, which may include capital expenditures, debt repayment and the repurchase of CAPREIT’s Trust Units under its normal course issuer bid.

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

CAPREIT Special Distribution

CAPREIT further announced that it has declared a special non-cash distribution of $1.18 per Unit, payable in Units of CAPREIT (the “Additional Units”) on December 31, 2024 to Unitholders of record at the close of business on December 31, 2024 (the “CAPREIT

Special Distribution”). The CAPREIT Special Distribution is principally being made to distribute to Unitholders a portion of the net capital gains of CAPREIT realized during the twelve-month period ending December 31, 2024, and will therefore be in the form of a capital gain to Unitholders for Canadian income tax purposes.

Taxable Canadian-resident Unitholders will generally be required to include their proportionate share of CAPREIT’s income and net taxable capital gain, as allocated and designated by CAPREIT, in computing their respective income for the tax year that includes the year end of CAPREIT (i.e., December 31, 2024).

The non-cash CAPREIT Special Distribution will be paid at the close of business on December 31, 2024 through the issuance of the Additional Units. The number of Additional Units to be issued will be based on the dollar amount of the CAPREIT Special Distribution divided by the closing price of the Units on the Toronto Stock Exchange on December 31, 2024.

Advertisement 4

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Immediately after the payment of the CAPREIT Special Distribution, the issued and outstanding Units of CAPREIT will be consolidated such that the aggregate number of issued and outstanding Units will be the same as immediately before the CAPREIT Special Distribution. For Unitholders who are residents of Canada for Canadian federal income tax purposes, the amount of the CAPREIT Special Distribution will increase the adjusted cost base of Unitholders’ consolidated Units. Unitholders who are not resident in Canada for Canadian federal income tax purposes may be subject to applicable withholding taxes in connection with the payment of the CAPREIT Special Distribution.

CAPREIT cautions that the foregoing comments are not intended to be, and should not be construed as, legal or tax advice to any Unitholder. CAPREIT recommends that Unitholders consult their own tax advisors regarding the income tax consequences to them of this anticipated CAPREIT Special Distribution and related Unit consolidation.

December 2024 Monthly Distribution

CAPREIT announced today its December 2024 monthly distribution in the amount of $0.125 per Unit (or $1.50 on an annualized basis). The December 2024 distribution will be payable on January 15, 2025 to Unitholders of record at the close of business on December 31, 2024.

Advertisement 5

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

ABOUT CAPREIT

CAPREIT is Canada’s largest publicly traded provider of quality rental housing. As at September 30, 2024, CAPREIT owns approximately 63,400 residential apartment suites, townhomes and manufactured home community sites, including approximately 15,400 suites and sites classified as assets held for sale, that are well-located across Canada and the Netherlands, with a total fair value of approximately $16.9 billion, including approximately $1.9 billion of assets held for sale. For more information about CAPREIT, its business and its investment highlights, please visit our website at www.capreit.ca and our public disclosure which can be found under our profile at www.sedarplus.ca.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this press release constitute forward-looking statements within the meaning of applicable Canadian securities laws which reflect CAPREIT’s current expectations and projections about future results. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “outlook”, “objective”, “may”, “will”, “expect”, “intent”, “estimate”, “anticipate”, “believe”, “consider”, “should”, “plans”, “predict”, “estimate”, “forward”, “potential”, “could”, “likely”, “approximately”, “scheduled”, “forecast”, “variation” or “continue”, or similar expressions suggesting future outcomes or events. The forward-looking statements made in this press release relate only to events or information as of the date on which the statements are made in this press release. Actual results and developments are likely to differ, and may differ materially, from those expressed or implied by the forward-looking statements contained in this press release. Any number of factors could cause actual results to differ materially from these forward-looking statements. Although CAPREIT believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurances that the expectations of any forward-looking statements will prove to be correct. Such forward-looking statements are based on a number of assumptions that may prove to be incorrect, including with regards to the expected completion and timing of the pending transactions, the intended use of proceeds from the transactions, the ERES Special Distribution and timing of payment, and the CAPREIT Special Distribution and timing of payment. Accordingly, readers should not place undue reliance on forward-looking statements.

Advertisement 6

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Forward looking statements in this press release are subject to certain risks and uncertainties, many of which are beyond CAPREIT’s control, which could result in actual results differing materially from these forward-looking statements. These risks and uncertainties include, but are not limited to, the risks and uncertainties described under the heading “Risks and Uncertainties” in CAPREIT’s 2023 Annual Report and under the heading “Risk Factors” in CAPREIT’s Annual Information Form for the year ended December 31, 2023, each of which is available under CAPREIT’s profile on SEDAR+ at www.sedarplus.ca.

Except as specifically required by applicable Canadian securities law, CAPREIT does not undertake any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. These forward-looking statements should not be relied upon as representing CAPREIT’s views as of any date subsequent to the date of this press release.

| For more information, please contact: | |

| CAPREIT | CAPREIT |

| Dr. Gina Parvaneh Cody | Mr. Mark Kenney |

| Chair of the Board of Trustees | President & Chief Executive Officer |

| (437) 219-1765 | (416) 861-9404 |

| CAPREIT | CAPREIT |

| Mr. Stephen Co | Mr. Julian Schonfeldt |

| Chief Financial Officer | Chief Investment Officer |

| (416) 306-3009 | (647) 535-2544 |

Article content

Share this article in your social network

Featured Local Savings

Written by GlobeNewswire on . Posted in Canada. Leave a Comment

The content in this section is supplied by GlobeNewswire for the purposes of distributing press releases on behalf of its clients. Postmedia has not reviewed the content.

Author of the article:

GlobeNewswire

Published Dec 16, 2024 • 4 minute read

TORONTO, Dec. 16, 2024 (GLOBE NEWSWIRE) — Electrovaya Inc. (“Electrovaya” or the “Company”) (NASDAQ: ELVA; TSX: ELVA), a leading lithium-ion battery technology and manufacturing company, is pleased to announce that the Company is commencing an underwritten public offering (the “Offering”) of its common shares (the “Common Shares”). All of the shares are being offered by the Company.

Article content

Article content

The shares will be offered in the United States pursuant to a shelf registration statement (including a prospectus supplement thereto) previously filed with and declared effective by the Securities and Exchange Commission (the “SEC”) on September 25, 2024 in accordance with the Multijurisdictional Disclosure System established between Canada and the United States, and will be qualified for distribution in the provinces and territories of Canada by way of a prospectus supplement to the Company’s base shelf prospectus dated September 17, 2024, provided that no securities will be sold in the Province of Québec.

Advertisement 2

Story continues below

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

Roth Capital Partners, Raymond James Ltd. and Craig-Hallum Capital Group LLC are acting as the co-lead book-running managers for the proposed Offering.

The Company intends to use the net proceeds from the Offering to satisfy the cash collateral conditions for the loan approved by the Export-Import Bank of the United States announced by the Company on November 14, 2024, repayment of amounts under the Company’s existing working capital facility in advance of proposed bank refinancing and for the costs of such financing, and satisfaction of certain outstanding amounts in connection with the purchase of the Company’s Jamestown, New York manufacturing facility.

The Offering is expected to be priced in the context of the market, with the final terms of the Offering to be determined at the time of pricing. There can be no assurance as to whether or when the Offering may be completed, or as to the actual size or terms of the Offering. The closing of the Offering will be subject to customary closing conditions, including the listing of the Common Shares on the Toronto Stock Exchange (“TSX”) and the Nasdaq Capital Market (“NASDAQ”) and any required approvals of TSX and NASDAQ.

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

A preliminary prospectus supplement and accompanying prospectus relating to the offering will be filed with the SEC and will be available for free on the SEC’s website at www.sec.gov and the prospectus supplement filed in Canada will be available on the Company’s profile on the SEDAR+ website at www.sedarplus.ca. Copies of the preliminary prospectus supplement and accompanying prospectus relating to the Offering, when available, may also be obtained by contacting Roth Capital Partners, LLC at 888 San Clemente Drive, Newport Beach CA 92660 by phone at (800)-678-9147 or e-mail at rothecm@roth.com. Prospective investors should read the preliminary prospectus supplement and accompanying prospectus relating to the Offering, and the base shelf prospectus and the other documents the Company has filed before making an investment decision.

This news release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any province, state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such province, state or jurisdiction.

Advertisement 4

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Investor and Media Contact:

Jason Roy

VP, Corporate Development and Investor Relations

Electrovaya Inc.

905-855-4618 / jroy@electrovaya.com

About Electrovaya Inc.

Electrovaya Inc. (NASDAQ:ELVA) (TSX:ELVA) is a pioneering leader in the global energy transformation, focused on contributing to the prevention of climate change by supplying safe and long-lasting lithium-ion batteries without compromising energy and power. The Company has extensive IP and designs, develops and manufactures proprietary lithium-ion batteries, battery systems, and battery-related products for energy storage, clean electric transportation, and other specialized applications. Electrovaya has two operating sites in Canada and a 52-acre site with a 135,000 square foot manufacturing facility in Jamestown New York state for its planned gigafactory. To learn more about how Electrovaya is powering mobility and energy storage, please explore www.electrovaya.com.

Forward-Looking Statements

This press release contains forward-looking statements, including statements regarding the intention to complete the Offering and the anticipated use of proceeds from the Offering. Forward-looking statements can generally, but not always, be identified by the use of words such as “may”, “will”, “could”, “should”, “would”, “likely”, “possible”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “plan”, “objective” and “continue” (or the negative thereof) and words and expressions of similar import. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, such statements are necessarily based on assumptions, and involve risks and uncertainties, therefore undue reliance should not be placed on such statements. Material assumptions on which forward-looking statements in this news release include assumptions about the ability to profitably market the Common Shares. Material risks and other factors that could cause actual results to differ from any forward-looking statement market conditions and other risks that may be found in the prospectus supplement and base shelf prospectus filed in connection with the Offering, including those risks described under the heading “Risk Factors”, and the documents incorporated by referenced therein. The Company does not undertake any obligation to update publicly or to revise any of the forward looking statements contained in this document, whether as a result of new information, future events or otherwise, except as required by law.

Article content

Share this article in your social network

Comments

Featured Local Savings

Written by GlobeNewswire on . Posted in Canada. Leave a Comment

The content in this section is supplied by GlobeNewswire for the purposes of distributing press releases on behalf of its clients. Postmedia has not reviewed the content.

Author of the article:

GlobeNewswire

Published Dec 16, 2024 • 10 minute read

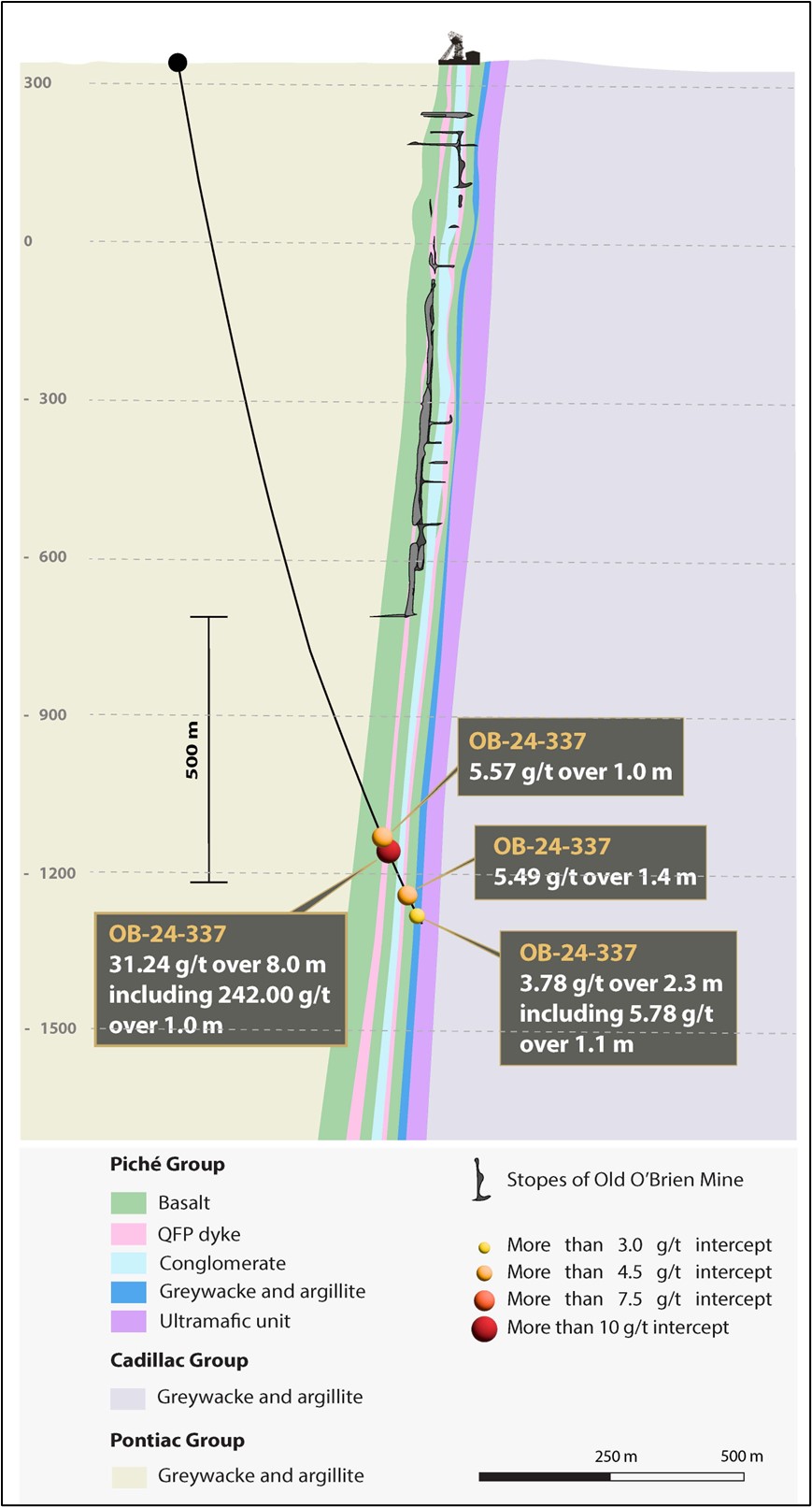

ROUYN-NORANDA, Quebec, Dec. 16, 2024 (GLOBE NEWSWIRE) — Radisson Mining Resources Inc. (TSX-V: RDS, OTCQB: RMRDF) (“Radisson” or the “Company”) is pleased to announce results from an important diamond drill hole at its 100%-owned O’Brien Gold Project (“O’Brien” or the “Project”) located in the Abitibi region of Québec.

Article content

Article content

OB-24-337 is an exploratory hole drilled to a depth of 1,700 metres, the deepest hole ever drilled at the Project and the first hole drilled directly below the historic O’Brien Mine workings. At approximately 1,500 metres vertical depth it intersected sheared and mineralized rocks of the Piché Group, the dominant host rocks for O’Brien gold mineralization, and returned 242.0 g/t gold (“Au”) over 1.0 metre within a mineralized interval that averaged 31.24 g/t Au over 8.0 metres.

Advertisement 2

Story continues below

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

Matt Manson, President and CEO, commented: “Following our “Jewellery Box” re-discovery news of December 9, 2024, we are taking the unusual step of releasing assays from another single drill hole today because of its particular significance to the future of the O’Brien Gold Project. Hole OB-24-337 was intended to be a pilot hole testing whether the Project’s host geology extended below the historic mine and to be a platform for future wedging and directional drilling. The fact that this hole intersected mineralization and visible gold at such a high grade greatly exceeded our expectations. Recall that approximately 75% of our existing Mineral Resource is defined at depths above 600 metres. On September 24th we announced that drill hole OB-24-324 had intersected 27.61 g/t Au over 6.0 metres at 1,100 metres vertical depth. Now, we have new gold mineralization in a classic O’Brien setting at 1,500 metres vertical depth, a full 500 metres below the deepest workings of the old mine. It is clear that O’Brien gold mineralization is extensive at depth, implying significant future upside potential for the Project.”

Advertisement 3

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Figure 1: Visible Gold in Drill Hole OB-24-337

Figure 2: Long Section in Oblique View of Gold Vein Mineralization and Mineral Resources at the O’Brien Gold Project, with Drill Hole OB-337 and Other Recent Deep Drill Holes Illustrated.

Table 1: Detailed Assay Results from Drill Hole OB-24-337

| DDH | Zone | From (m) | To (m) | Core Length (m) |

Au g/t – Uncut |

Host Lithology | |

| OB-24-337 | O’Brien Mine | 1,507.6 | 1,508.6 | 1.0 | 5.57 | POR-S | |

| 1,517.7 | 1,525.7 | 8.0 | 31.24 | POR-S | |||

| Including | 1,517.7 | 1,518.7 | 1.0 | 242.00 | POR-S | ||

| 1,550.5 | 1,552.0 | 1.5 | 2.38 | V3-CEN | |||

| 1,610.5 | 1,611.9 | 1.4 | 5.49 | V3-N | |||

| 1,660.5 | 1,662.7 | 2.3 | 3.78 | S3P |

Notes on Calculation of Drill Intercepts:

The O’Brien Gold Project March 2023 Mineral Resource Estimate (“MRE”) utilizes a 4.50 g/t Au bottom cutoff, a US$1600 gold price, a minimum mining width of 1.2 metres, and a 40 g/t Au upper cap on composites. Intercepts from drill hole OB-24-337 presented in Table 1 are calculated with a 1.00 g/t bottom cut-off over a minimum 1.0 metre core length so as to illustrate the frequency and continuity of mineralized intervals within which high-grade gold veins at O’Brien are developed. Intercepts presented in the deep drill hole compilation in Table 2 are calculated with a 3.00 g/t Au bottom cut-off, representing the lower limit of cut-off sensitivity presented in the March 2023 Mineral Resource Estimate. Sample grades are uncapped. True widths, based on depth of intercept and drill hole inclination, are estimated to be 30-70% of core length. Lithology Codes: PON-S3: Pontiac Sediments; V3-S, V3-N, V3-CEN: Basalt-South, North, Central; S1P, S3P: Conglomerate; POR-S, POR-N: Porphyry South, North; TX: Crystal Tuff; ZFLLC: Larder Lake-Cadillac Fault Zone

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 4

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Table 2: Compilation of All Deep Drill Holes Recently Published (see Radisson News Releases Dated September 24, 2024 and October 30, 2024. See “Notes on Calculation of Drill Intercepts”)

| DDH | Zone | From (m) | To (m) | Core Length (m) |

Au g/t – Uncut |

Host Lithology | |

| OB-24-322 | Trend #1 | 1,149.2 | 1,150.7 | 1.5 | 5.25 | PON-S3 | |

| 1,164.8 | 1,166.2 | 5.2 | 8.75 | V3-S | |||

| including | 1,164.8 | 1,167.6 | 1.4 | 27.20 | V3-S | ||

| 1,215.6 | 1,219.8 | 4.2 | 3.20 | V3-S | |||

| 1,234.9 | 1,236.4 | 1.5 | 5.16 | V3-S | |||

| OB-24-324 | Trend #1 | 1,178.8 | 1,184.8 | 6.0 | 27.61 | S1P | |

| including | 1,182.6 | 1,183.7 | 1.1 | 102.00 | S1P | ||

| 1,197.5 | 1,199.0 | 1.5 | 4.64 | S1P | |||

| 1,231.0 | 1,241.0 | 10.0 | 6.83 | POR-N/V3-N | |||

| including | 1,231.0 | 1,232.5 | 1.5 | 40.20 | POR-N | ||

| 1,249.0 | 1,250.4 | 1.4 | 3.78 | S3P | |||

| OB-23-324W1 | Trend #1 | 1,139.9 | 1,152.3 | 12.4 | 5.48 | POR-S | |

| Including | 1,141.4 | 1,145.8 | 4.4 | 12.10 | POR-S | ||

| 1,164.3 | 1,168.5 | 4.2 | 8.02 | S1P | |||

| 1,200.0 | 1,202.9 | 2.9 | 3.31 | POR-N | |||

| OB-24-323 | Trend #0 | 795.0 | 796.0 | 1.0 | 11.85 | PON-S3 | |

| 903.9 | 914.8 | 10.9 | 3.34 | V3-S | |||

| Including | 903.9 | 905.4 | 1.5 | 13.90 | V3-S | ||

| 933.5 | 934.7 | 1.2 | 6.21 | V3-CEN | |||

| 993.4 | 1,001.6 | 8.2 | 3.51 | V3-N/S3P | |||

| Including | 995.4 | 996.9 | 1.5 | 9.93 | V3-N | ||

| OB-24-337 | O’Brien Mine | 1,507.6 | 1,508.6 | 1.0 | 5.57 | POR-S | |

| 1,517.7 | 1,525.7 | 8.0 | 31.24 | POR-S | |||

| Including | 1,517.7 | 1,518.7 | 1.0 | 242.00 | POR-S | ||

| 1,610.5 | 1,611.9 | 1.4 | 5.49 | V3-N | |||

| 1,660.5 | 1,662.7 | 2.3 | 3.78 | S3P |

Advertisement 5

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Notes

Deep Drill Holes OB-24-321 and OB-24 324W2 did not return any intercepts >3 g/t Au

Figure 3: Cross Section of the Historic O’Brien Mine Locating Drill Hole OB-24-337

Recent Deep Drilling Results

Today’s results from deep drill hole OB-24-337 are from the third batch of drill results released since September that have shown high grade O’Brien gold mineralization within Piché Group rocks well below the base of the existing Mineral Resource Estimate (“MRE”). Seven deep drill holes or drill hole wedges have been completed since this time. Six of the seven returned instances of visible gold and five of the seven returned drill intercepts well above the Project’s grade cutoff in the March 2023 MRE. The holes were drilled at northerly declinations with initial inclinations of between -65 and -85 degrees, followed by angling to provide a high angle of incidence with the southerly dip of the Piché Group rocks and vein mineralization. Estimated true widths of drill intercepts at the point of contact with mineralization is estimated to be 30-70% of core length.

Deep drill results since September 2024, summarized in Table 2, have now included:

Advertisement 6

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

and now:

The frequency and grade of intercepts returned by these deep drill holes, as well as the observed host geology, its deformation, the style of alteration, and the mineralogical association of the gold mineralization, are all familiar from the historical O’Brien mine and consistent with the modern geological model developed at shallower depths. The implication is that characteristic O’Brien style gold mineralization is extensive at depth, well below the level of the historic mine workings and the current MRE.

Gold Mineralization at O’Brien

Gold mineralizing quartz-sulphide veins at O’Brien occur within a thin band of interlayered mafic volcanic rocks, conglomerates, and porphyric andesitic sills of the Piché Group occurring in contact with the east-west oriented Larder Lake-Cadillac Break (“LLCB”). Gold, along with pyrite and arsenopyrite, is typically associated with shearing and a pervasive biotite alteration, and developed within multiple Piché Group lithologies and, occasionally, the hanging-wall Pontiac and footwall Cadillac meta-sedimentary rocks.

Advertisement 7

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

As mapped at the historic O’Brien mine, and now replicated in the modern drilling, individual veins are generally narrow, ranging from several centimetres up to several metres in thickness. Multiple veins occur sub-parallel to each other, as well as sub-parallel to the Piché lithologies and the LLCB. Individual veins have well-established lateral continuity, with near-vertical, high-grade shoots developed over significant lengths. The historic O’Brien mine produced over half a million ounces of gold from such veins and shoots at an average grade exceeding 15 g/t and over a vertical extent of at least 1,000 metres.

Based on drilling complete to the end of 2022, the Project has estimated Indicated Mineral Resources of 0.50 million ounces (1.52 million tonnes at 10.26 g/t Au), with additional Inferred Mineral Resources of 0.45 million ounces (1.60 million tonnes at 8.66 g/t Au). Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Current exploration is focussed on delineating well developed vein mineralization to the east of the historic mine, with additional high-grade shoots becoming evident in the exploration data over what has been described as a series of repeating trends (“Trend #s 0 to 5”).

Advertisement 8

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Table 3: Drill Hole Collar Information for Holes contained in this News Release

| DDH | Zone | Easting | Northing | Azimuth | Dip | Hole Length (m) |

| OB-24-321 | Trend #1 | 693952 | 5345216 | 10.0 | -77 | 1065 |

| OB-24-322 | Trend #1 | 694197 | 5345102 | 0.0 | -85 | 1339 |

| OB-24-323 | Trend #0 | 693953 | 5345212 | 335.0 | -79 | 1014 |

| OB-24-324 | Trend #1 | 694219 | 5345107 | 343.0 | -80 | 1256 |

| OB-24-324W1 | Trend #1 | 694209 | 5345402 | 9.3 | -64 | 290 |

| OB-24-324W2 | Trend #1 | 694202 | 5345348 | 6.6 | -65 | 147 |

| OB-24-337 | O’Brien Mine | 693700 | 5345070 | 346.0 | -80 | 1695 |

QA/QC

All drill cores in this campaign are NQ in size. Assays were completed on sawn half-cores, with the second half kept for future reference. The samples were analyzed using standard fire assay procedures with Atomic Absorption (AA) finish at ALS Laboratory Ltd, in Val-d’Or, Quebec. Samples yielding a grade higher than 10 g/t Au were analyzed a second time by fire assay with gravimetric finish at the same laboratory. Mineralized zones containing visible gold were analyzed with metallic sieve procedure. Standard reference materials, blank samples and duplicates were inserted prior to shipment for quality assurance and quality control (QA/QC) program.

Advertisement 9

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Qualified Person

Disclosure of a scientific or technical nature in this news release was prepared under the supervision of Mr. Richard Nieminen, P.Geo, (QC), a geological consultant for Radisson and a Qualified Person for purposes of NI 43-101. Mr. Nieminen is independent of Radisson and the O’Brien Gold Project.

Radisson Mining Resources Inc.

Radisson is a gold exploration company focused on its 100% owned O’Brien Gold Project, located in the Bousquet-Cadillac mining camp along the world-renowned Larder-Lake-Cadillac Break in Abitibi, Québec. The Bousquet-Cadillac mining camp has produced over 25 million ounces of gold over the last 100 years. The Project hosts the former O’Brien Mine, considered to have been Québec’s highest-grade gold producer during its production. Indicated Mineral Resources are estimated at 0.50 million ounces (1.52 million tonnes at 10.26 g/t Au), with additional Inferred Mineral Resources estimated at 0.45 million ounces (1.60 million tonnes at 8.66 g/t Au). Please see the NI 43-101 “Technical Report on the O’Brien Project, Northwestern Québec, Canada” effective March 2, 2023, Radisson’s Annual Information Form for the year ended December 31, 2023 and other filings made with Canadian securities regulatory authorities available at www.sedar.com for further details and assumptions relating to the O’Brien Gold Project.

Advertisement 10

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

For more information on Radisson, visit our website at www.radissonmining.com or contact:

Matt Manson

President and CEO

416.618.5885

mmanson@radissonmining.com

Kristina Pillon

Manager, Investor Relations

604.908.1695

kpillon@radissonmining.com

Forward-Looking Statements

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections, and interpretations as at the date of this news release. Forward-looking statements including, but are not limited to, statements with respect to planned and ongoing drilling, the significance of drill results, the ability to continue drilling, the impact of drilling on the definition of any resource, the ability to incorporate new drilling in an updated technical report and resource modelling, the Company’s ability to grow the O’Brien project and the ability to convert inferred mineral resources to indicated mineral resources. Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. Except for statements of historical fact relating to the Company, certain information contained herein constitutes forward-looking statements Forward-looking information is based on estimates of management of the Company, at the time it was made, involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the companies to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, risks relating to the drill results at O’Brien; the significance of drill results; the ability of drill results to accurately predict mineralization; the ability of any material to be mined in a matter that is economic. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, the parties cannot assure shareholders and prospective purchasers of securities that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither the Company nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. The Company believes that this forward-looking information is based on reasonable assumptions, but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this press release should not be unduly relied upon. The Company does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law. These statements speak only as of the date of this news release.

Advertisement 11

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Three photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/0e6a2706-2f60-4445-ae2b-5dfbbcd3f8d7

https://www.globenewswire.com/NewsRoom/AttachmentNg/49406a2a-8bd9-453e-953c-377a7b7cf998

https://www.globenewswire.com/NewsRoom/AttachmentNg/17ed224a-1829-4499-8f05-f18a2de42b6f

Article content

Share this article in your social network

Comments

Featured Local Savings

Written by GlobeNewswire on . Posted in Canada. Leave a Comment

The content in this section is supplied by GlobeNewswire for the purposes of distributing press releases on behalf of its clients. Postmedia has not reviewed the content.

Author of the article:

GlobeNewswire

Published Dec 16, 2024 • 14 minute read

Reykjavik, Dec. 16, 2024 (GLOBE NEWSWIRE) — THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES, AUSTRALIA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH IT WOULD BE UNLAWFUL TO DO SO. PLEASE SEE THE IMPORTANT NOTICES SECTION WITHIN THIS ANNOUNCEMENT.

Article content

Article content

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY, AND DOES NOT CONSTITUTE OR FORM PART OF ANY OFFER OR INVITATION TO SELL OR ISSUE, OR ANY SOLICITATION OF AN OFFER TO PURCHASE OR SUBSCRIBE FOR, ANY SECURITIES OF AMAROQ MINERALS LTD.

Advertisement 2

Story continues below

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED UNDER THE MARKET ABUSE REGULATION NO 596/2014, WHICH IS PART OF ICELANDIC LAW BY VIRTUE OF THE ACT NO 60/2021 ON MEASURES AGAINST MARKET ABUSE AND ASSIMILATED REGULATION NO 596/ 2014 AS IT FORMS PART OF THE LAW OF THE UNITED KINGDOM BY VIRTUE OF THE EUROPEAN (WITHDRAWAL) ACT 2018, AS AMENDED. ON PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO BE IN THE PUBLIC DOMAIN.

Amaroq Minerals Ltd.

(“Amaroq” or the “Company”)

Update to Fundraising Settlement

TORONTO, ONTARIO – 16 December 2024 – Amaroq Minerals Ltd. (AIM, TSX-V, NASDAQ Iceland: AMRQ), an independent mining company with a substantial land package of gold and strategic mineral assets in Southern Greenland, today announces that due to a slight delay in the receipt of funds from one subscriber, the closing of its Fundraising, settlement and admission of the 32,034,664 common shares of the Company in relation to the UK Placing, Icelandic Placing and Canadian Subscription, as detailed in the announcements on the 3 and 4 December 2024, is now expected to occur on 17 December 2024.

Advertisement 3

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Capitalised terms not otherwise defined in the text of this announcement have the meanings given in the Company’s Fundraising announcement dated 3 December 2024.

Enquiries:

Amaroq Minerals Ltd.

Eldur Olafsson, Executive Director and CEO

eo@amaroqminerals.com

Eddie Wyvill, Corporate Development

+44 (0)7713 126727

ew@amaroqminerals.com

Panmure Liberum Limited (Nominated Adviser, Joint Bookrunner and Corporate Broker)

Scott Mathieson

Nikhil Varghese

Kieron Hodgson

Josh Moss

+44 (0) 20 7886 2500

Canaccord Genuity Limited (Joint Bookrunner and Corporate Broker)

James Asensio

Harry Rees

George Grainger

+44 (0) 20 7523 8000

Landsbankinn hf. (Joint Bookrunner and Underwriter)

Björn Hákonarson

Sigurður Kári Tryggvason

+354 410 4000

Acro verðbréf hf. (Joint Bookrunner)

Hannes Árdal

Þorbjörn Atli Sveinsson

+354 532 8000

Fossar Investment Bank hf. (Joint Bookrunner)

Steingrímur Arnar Finnsson

Kristín Alexandra Gísladóttir

+354 522 4000

Camarco (Financial PR)

Billy Clegg

Elfie Kent

Fergus Young

+44 (0) 20 3757 4980

IMPORTANT NOTICES

This Announcement does not constitute, or form part of, a prospectus relating to the Company, nor does it constitute or contain an invitation or offer to any person, or any public offer, to subscribe for, purchase or otherwise acquire any shares in the Company or advise persons to do so in any jurisdiction, nor shall it, or any part of it form the basis of or be relied on in connection with any contract or as an inducement to enter into any contract or commitment with the Company.

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 4

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

This Announcement is not for publication or distribution, directly or indirectly, in or into the United States of America, Australia, The Republic of South Africa (“South Africa”), Japan or any other jurisdiction in which such release, publication or distribution would be unlawful. This Announcement is for information purposes only and does not constitute an offer to sell or issue, or a solicitation of an offer to buy, subscribe for or otherwise acquire any securities in the United States (including its territories and possessions, any state of the United States and the District of Columbia (collectively, the “United States”)), Iceland, Australia, Canada, South Africa, Japan or any other jurisdiction in which such offer or solicitation would be unlawful or to any person to whom it is unlawful to make such offer or solicitation.

The securities referred to herein have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States, except pursuant to an applicable exemption from the registration requirements of the Securities Act and in compliance with any applicable securities laws of any state or other jurisdiction of the United States, or under the securities laws of Iceland, Australia, Canada, South Africa, Japan, or any state, province or territory thereof or any other jurisdiction outside the United Kingdom, except pursuant to an applicable exemption from the registration requirements and in compliance with any applicable securities laws of any state, province or other jurisdiction of Iceland, Australia, Canada, South Africa or Japan (as the case may be). No public offering of securities is being made in the United States, Iceland, Australia, Canada, South Africa, Japan or elsewhere.

Advertisement 5

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

No action has been taken by the Company, Panmure Liberum, Canaccord, Landsbankinn, Acro, Fossar or any of their respective affiliates, or any of its or their respective directors, officers, partners, employees, consultants, advisers and/or agents (collectively, “Representatives”) that would permit an offer of the Fundraising Shares or possession or distribution of this Announcement or any other publicity material relating to such Fundraising Shares in any jurisdiction where action for that purpose is required. Persons receiving this Announcement are required to inform themselves about and to observe any restrictions contained in this Announcement. Persons (including, without limitation, nominees and trustees) who have a contractual or other legal obligation to forward a copy of this Announcement should seek appropriate advice before taking any action. Persons distributing any part of this Announcement must satisfy themselves that it is lawful to do so.

This Announcement, as it relates to the UK Placing, is directed at and is only being distributed to: (a) if in a member state of the EEA, persons who are qualified investors (“EEA Qualified Investors”), being persons falling within the meaning of Article 2(e) of Regulation (EU) 2017/1129 (the “EU Prospectus Regulation”); or (b) if in the United Kingdom, persons who are qualified investors (“UK Qualified Investors”), being persons falling within the meaning of Article 2(e) of assimilated Regulation (EU) 2017/1129 as it forms part of the law of the United Kingdom by virtue of the European Union (Withdrawal) Act 2018, as amended (the “UK Prospectus Regulation”), and who are (i) persons falling within the definition of “investment professional” in Article 19(5) of the Financial Services And Markets Act 2000 (Financial Promotion) Order 2005, as amended (the “Order”) or (ii) persons who fall within Article 49(2)(a) to (d) (high net worth companies, unincorporated associations, etc.) of the Order, or (c) persons to whom it may otherwise be lawfully communicated (all such persons referred to in (a), (b) and (c) together being referred to as “Relevant Persons”).

Advertisement 6

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The Fundraising Shares have not been qualified for distribution by prospectus in Canada and may not be offered or sold in Canada except in reliance on exemptions from the requirements to provide the relevant purchaser with a prospectus and, as a consequence of acquiring securities pursuant to this exemption or exemptions, certain protections, rights and remedies provided by the applicable Canadian securities laws will not be available to the relevant purchaser. The Fundraising Shares will be subject to statutory resale (hold) restrictions for a period of four months and one day in Canada under the applicable Canadian securities laws and any resale of the Common Shares must be made in accordance with such resale restrictions or in reliance on an available exemption therefore. Such restrictions shall not apply to any Fundraising Shares acquired outside of Canada.

For the attention of residents of Australia: This Announcement is not a prospectus or product disclosure statement or otherwise a disclosure document for the purposes of Chapter 6D or Part 7.9 of the Australian Corporations Act 2001 (Cth) (“Corporations Act”) and does not constitute an offer, or an invitation to purchase or subscribe for the Fundraising Shares offered by this Announcement except to the extent that such an offer or invitation would be permitted under Chapter 6D or Part 7.9 of the Corporations Act without the need for a lodged prospectus or product disclosure statement. In addition, for a period of 12 months from the date of issue of the Fundraising Shares, no transfer of any interest in the Fundraising Shares may be made to any person in Australia except to “sophisticated investors” or “professional investors” within the meaning of sections 708(8) and (11) of the Corporations Act or otherwise in accordance with section 707(3) of the Corporations Act.

Advertisement 7

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

No other person should act on or rely on this Announcement as it relates to the UK Placing and persons distributing this Announcement must satisfy themselves that it is lawful to do so. By accepting the terms of this Announcement, you represent and agree that you are a Relevant Person. This Announcement must not be acted on or relied on by persons who are not Relevant Persons. Any investment or investment activity to which this Announcement or the Fundraising relates is available only to Relevant Persons and will be engaged in only with Relevant Persons.

No offering document or prospectus will be made available in any jurisdiction in connection with the matters contained or referred to in this Announcement or the UK Placing or the Fundraising, unless applicable in relation to admission to trading in Iceland and no such prospectus is required (in accordance with either the EU Prospectus Regulation for the purpose of the offer or sale of the Common Shares, the UK Prospectus Regulation or Canadian securities laws) to be published. The offering as it relates to the Icelandic Placing is subject to the exemptions from the obligation to publish a prospectus provided for in Articles 1(4)(a) and 1(4)(b) of the EU Prospectus Regulation.

Advertisement 8

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Panmure Liberum, which is authorised and regulated by the Financial Conduct Authority in the United Kingdom is acting exclusively for the Company and for no one else in connection with the UK Placing and will not regard any other person (whether or not a recipient of this Announcement) as a client in relation to the UK Placing and will not be responsible to anyone other than the Company in connection with the UK Placing or for providing the protections afforded to their clients or for giving advice in relation to the UK Placing, the Fundraising or any other matter referred to in this Announcement. The responsibilities of Panmure Liberum, as nominated adviser, are owed solely to the London Stock Exchange and are not owed to the Company or to any director or any other person and accordingly no duty of care is accepted in relation to them. No representation or warranty, express or implied, is made by Panmure Liberum as to, and no liability whatsoever is accepted by Panmure Liberum in respect of, any of the contents of this Announcement (without limiting the statutory rights of any person to whom this Announcement is issued).

Advertisement 9

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Canaccord, which is authorised and regulated by the Financial Conduct Authority in the United Kingdom is acting exclusively for the Company and for no one else in connection with the UK Placing and will not regard any other person (whether or not a recipient of this Announcement) as a client in relation to the UK Placing and will not be responsible to anyone other than the Company in connection with the UK Placing or for providing the protections afforded to their clients or for giving advice in relation to the UK Placing, the Fundraising or any other matter referred to in this Announcement.

Acro, which is authorised and regulated by the Financial Supervisory Authority of the Central Bank of Iceland, is acting exclusively for the Company and for no one else in connection with the Icelandic Placing and will not regard any other person (whether or not a recipient of this Announcement) as a client in relation to the Icelandic Placing and will not be responsible to anyone other than the Company in connection with the Icelandic Placing or for providing the protections afforded to their clients or for giving advice in relation to the Icelandic Placing, the Fundraising or any other matter referred to in this Announcement. Some Icelandic Placees may however be customers of Acro.

Advertisement 10

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Fossar, which is authorised and regulated by the Financial Supervisory Authority of the Central Bank of Iceland, is acting exclusively for the Company and for no one else in connection with the Icelandic Placing and will not regard any other person (whether or not a recipient of this Announcement) as a client in relation to the Icelandic Placing and will not be responsible to anyone other than the Company in connection with the Icelandic Placing or for providing the protections afforded to their clients or for giving advice in relation to the Icelandic Placing, the Fundraising or any other matter referred to in this Announcement. Some Icelandic Placees may however be customers of Fossar.

Landsbankinn, which is authorised and regulated by the Financial Supervisory Authority of the Central Bank of Iceland, is acting exclusively for the Company and for no one else in connection with the Icelandic Placing and will not regard any other person (whether or not a recipient of this Announcement) as a client in relation to the Icelandic Placing and will not be responsible to anyone other than the Company in connection with the Icelandic Placing or for providing the protections afforded to their clients or for giving advice in relation to the Icelandic Placing, the Fundraising or any other matter referred to in this Announcement. Some Icelandic Placees may however be customers of Landsbankinn.

Advertisement 11

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

This Announcement is being issued by and is the sole responsibility of the Company. No representation or warranty, express or implied, is or will be made as to, or in relation to, and no responsibility or liability is or will be accepted by or on behalf of Panmure Liberum, Canaccord, Landsbankinn, Acro and/or Fossar (apart from in the case of Panmure Liberum and Canaccord the responsibilities or liabilities that may be imposed by the Financial Services and Markets Act 2000, as amended (“FSMA”) or the regulatory regime established thereunder) and/or by any of their respective affiliates and/or any of their respective Representatives as to, or in relation to, the accuracy, adequacy, fairness or completeness of this Announcement or any other written or oral information made available to or publicly available to any interested party or their respective advisers or any other statement made or purported to be made by or on behalf of Panmure Liberum, Canaccord, Landsbankinn, Acro and/or Fossar and/or any of their respective affiliates and/or by any of their respective Representatives in connection with the Company, the UK Placing Shares, the UK Placing, the Common Shares or any part of the Fundraising and any responsibility and liability whether arising in tort, contract or otherwise therefor is expressly disclaimed. No representation or warranty, express or implied, is made by Panmure Liberum, Canaccord, Landsbankinn, Acro and/or Fossar and/or any of their respective affiliates and/or any of their respective Representatives as to the accuracy, fairness, verification, completeness or sufficiency of the information or opinions contained in this Announcement or any other written or oral information made available to or publicly available to any interested party or their respective advisers, and any liability therefor is expressly disclaimed.

Advertisement 12

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The information in this Announcement may not be forwarded or distributed to any other person and may not be reproduced in any manner whatsoever. Any forwarding, distribution, reproduction or disclosure of this Announcement, in whole or in part, is not authorised. Failure to comply with this directive may result in a violation of the Securities Act or the applicable laws of other jurisdictions.

This Announcement does not constitute a recommendation concerning any investor’s options with respect to the UK Placing or any part of the Fundraising. Recipients of this Announcement should conduct their own investigation, evaluation and analysis of the business, data and other information described in this Announcement. This Announcement does not identify or suggest, or purport to identify or suggest, the risks (direct or indirect) that may be associated with an investment in the UK Placing Shares or the Common Shares. The price and value of securities can go down as well as up and investors may not get back the full amount invested upon the disposal of the shares. Past performance is not a guide to future performance. The contents of this Announcement are not to be construed as legal, business, financial or tax advice. Each investor or prospective investor should consult his or her or its own legal adviser, business adviser, financial adviser or tax adviser for legal, business, financial or tax advice.

Advertisement 13

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Any indication in this Announcement of the price at which the Company’s shares have been bought or sold in the past cannot be relied upon as a guide to future performance. Persons needing advice should consult an independent financial adviser. No statement in this Announcement is intended to be a profit forecast or profit estimate for any period and no statement in this Announcement should be interpreted to mean that earnings, earnings per share or income, cash flow from operations or free cash flow for the Company for the current or future financial periods would necessarily match or exceed the historical published earnings, earnings per share or income, cash flow from operations or free cash flow for the Company.

All offers of the Fundraising Shares will be made pursuant to an exemption under the EU Prospectus Regulation and the UK Prospectus Regulation from the requirement to produce a prospectus. This Announcement is being distributed and communicated to persons in the United Kingdom only in circumstances in which section 21(1) of FSMA does not apply.

The Fundraising Shares to be issued pursuant to the Fundraising will not be admitted to trading on any stock exchange other than AIM, the TSX-V and the Icelandic Exchange.

Advertisement 14

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information

This Announcement includes statements that are, or may be deemed to be, “forward-looking statements”. In some cases, these forward-looking statements can be identified by the use of forward-looking terminology, including the terms “aims”, “anticipates”, “believes”, “could”, “envisages”, “estimates”, “expects”, “intends”, “may”, “plans”, “projects”, “should”, “targets” or “will” or, in each case, their negative or other variations or comparable terminology. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future and factors which are beyond the Company’s control. The actual results, performance or achievements of the Company or developments in the industry in which the Company operates may differ materially from the future results, performance or achievements or industry developments expressed or implied by the forward-looking statements contained in this Announcement. The forward-looking statements contained in this Announcement speak only as at the date of this Announcement. The Company undertakes no obligation to update or revise publicly the forward-looking statements contained in this Announcement, except as required in order to comply with its legal and regulatory obligations.

Article content

Share this article in your social network

Comments

Featured Local Savings

Written by GlobeNewswire on . Posted in Canada. Leave a Comment

The content in this section is supplied by GlobeNewswire for the purposes of distributing press releases on behalf of its clients. Postmedia has not reviewed the content.

Author of the article:

GlobeNewswire

Published Dec 13, 2024 • 9 minute read

VANCOUVER, British Columbia, Dec. 13, 2024 (GLOBE NEWSWIRE) — FIREWEED METALS CORP. (“Fireweed” or the “Company”) (TSXV: FWZ; OTCQX: FWEDF) is pleased to announce it has been awarded US$15.8 M (~C$22.5 M) from the U.S. Department of Defense and up to C$12.9 M from the Government of Canada in support of its critical minerals projects at Macmillan Pass, Yukon Territory.

Article content

Article content

Highlights

Advertisement 2

Story continues below

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

CEO Statement

Peter Hemstead, President and CEO, commented: “The coordinated investments by the United States and Canadian governments underscore the critical importance and strategic value of Fireweed’s mineral assets at Macmillan Pass. This joint announcement is a testament to the determination of both governments to unlock this new critical minerals district in Canada. In the coming months and years, our team will work to ensure our projects and the enabling infrastructure move forward in a way that respects rights-holders, provides benefits to communities in the region, and demonstrates how critical minerals can be developed responsibly.”

Adam Lundin Statement

Adam Lundin, Fireweed’s Strategic Advisor, stated: “The emerging critical minerals district at Macmillan Pass is a profound opportunity to address key supply chain vulnerabilities of the North American industrial base. These investments are significant milestones on the path to advancing both Macpass and Mactung projects toward development.”

Statement from the Honorable Jonathan Wilkinson, Canada’s Minister of Energy and Natural Resources

Advertisement 3

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The Honorable Jonathan Wilkinson, Canada’s Minister of Energy and Natural Resources, stated: “Canada is positioning itself as a global supplier of responsibly sourced critical minerals, which are increasingly in demand for the clean and digital economy as well as for defence applications. The Fireweed project will develop the necessary energy infrastructure to power multiple critical minerals mines and communities with clean energy. These investments by Canada and the United States build on our long history of friendship and collaboration, complement the region’s deep expertise in mining, create good jobs in the Yukon and advance economic growth, now and into the future.”

A Critical Minerals District at Macmillan Pass

Macmillan Pass is an emerging critical minerals district (the “Macpass District”), with two immediately-adjacent, best-in-class critical mineral projects being advanced by Fireweed. The Macpass Project (“Macpass”) is a district-scale collection of high-grade zinc deposits, forming one of the largest undeveloped zinc resources globally, while also containing the world’s largest known accumulation of germanium and gallium1,2. The Mactung Project (“Mactung”) is the world’s largest, high-grade tungsten deposit1,3, with sufficient mineral resources to potentially supply North America’s expected tungsten demand for decades.

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 4

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Macmillan Pass and the North Canol Road (the district’s primary overland access) are located within Kaska Nation Traditional Territory and the Traditional Territory of the First Nation of Na-Cho Nyӓk Dun. The Mactung access road passes through the Sahtú Settlement Area (Tulı́tʼa District in the Northwest Territories), which include both First Nations and Métis communities.

US Government Funding to Advance the Mactung Tungsten Project

Fireweed has been awarded US$15.8 M (~C$22.5 M) by the U.S. Department of Defense under DPA Title III to advance its 100%-owned Mactung tungsten project toward a final investment decision.

The objective of the DPA Title III funding is to progress Mactung to a final investment decision, a precursor to project construction and subsequent production of domestic tungsten concentrates for the North American industrial base. The award will support an expansive, Fireweed team-led program that includes mine design optimization, geotechnical investigations, and metallurgical test programs, culminating in the development of a new feasibility study. A range of environmental studies will be undertaken, supporting the pursuit of licenses and permits necessary to construct Mactung.

Advertisement 5

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The program builds on extensive past drilling at Mactung and an updated 2023 mineral resource estimate that supersedes a historical 2009 Feasibility Study. The project also benefits from a positive environmental assessment decision issued in 2014 by Yukon and Canadian Federal regulators.

The DPA Title III award is non-dilutive to Fireweed shareholders and no commercial covenants are included in the award conditions that would impair Fireweed’s current business nor its future sale of tungsten concentrates to the industrial base. Fireweed’s own management team will lead the work and periodically report progress to administrators of the award.

Canadian Government Funding to Advance the “North Canol Infrastructure Improvement Project”

Fireweed will also receive up to C$12.9 M, pending final due diligence, from the Government of Canada through the Critical Minerals Infrastructure Fund (“CMIF”) to lead planning efforts for infrastructure improvements that would serve the critical minerals district at Macmillan Pass.

The CMIF funding will support Fireweed’s implementation of the first phase (Phase I) of the “North Canol Infrastructure Improvement Project” (“NCIIP”), which includes developing preliminary designs for approximately 250 kilometers of road improvements, as well as upgrades to an existing transmission line between Faro and Ross River, and the construction of a new transmission line from Ross River to Macmillan Pass. The effort also includes seeking the consent of local Indigenous groups, completing necessary environmental assessment processes and facilitating multi-party project agreements necessary to advance NCIIP toward construction (Phase II).

Advertisement 6

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Fireweed anticipates NCIIP Phase II to be advanced through a collaboration of government, Indigenous groups and industry. Funding sources for NCIIP construction have yet to be determined but will likely involve ‘stacking’ a range of new and existing funding sources, potentially including previously announced Yukon Resource Gateway funding.

Qualified Person Statement

Technical information in this news release has been approved by Fireweed Metals VP Geology, Jack Milton, Ph.D., P.Geo. (BC), a ‘Qualified Person’ as defined under National Instrument 43-101. Dr. Milton is not independent of Fireweed for purposes of NI 43-101.

About Fireweed Metals Corp. (TSXV: FWZ; OTCQX: FWEDF; FSE:M0G): Fireweed Metals Corp. is an exploration company unlocking significant value in a new critical metals district located in the Yukon, Canada. Fireweed is 100% owner of the Macpass District, a large and highly prospective 977 km2 land package. The Macpass District includes the Macpass zinc-lead-silver (germanium-gallium) project and the Mactung tungsten project, both characterized by meaningful size, grade and opportunity. At Macpass, Fireweed owns one of the largest undeveloped zinc resources worldwide1,2, in a region with enormous exploration upside potential. The Mactung project is a strategic critical metals asset that hosts the world’s largest high-grade tungsten resource1,3 – a potential long-term supply of tungsten for North America. A Lundin Group company, Fireweed is strongly positioned to create meaningful value.

Advertisement 7

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

In Canada, Fireweed (TSXV: FWZ) trades on the TSX Venture Exchange. In the USA, Fireweed (OTCQX: FWEDF) trades on the OTCQX Best Market for early stage and developing U.S. and international companies and is DTC eligible for enhanced electronic clearing and settlement. Investors can find Real-Time quotes and market information for the Company on www.otcmarkets.com. In Europe, Fireweed (FSE: M0G) trades on the Frankfurt Stock Exchange.

Additional information about Fireweed and its projects can be found on the Company’s website at FireweedMetals.com and at www.sedarplus.com.

ON BEHALF OF FIREWEED METALS CORP.

“Peter Hemstead”

President & CEO, and Director

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements

Forward Looking Statements

This news release contains “forward-looking” statements and information (“forward-looking statements”). All statements, other than statements of historical facts, included herein, including, without limitation, statements relating to receipt of the DPA Title III award, use of proceeds of the DPA Title III award, receipt of CMIF award and the actual amount thereof, the use of proceeds of the CMIF award (including leading planning efforts relating to road improvements and transmission line construction and upgrades), pursuit of necessary licencing and permits and/or environmental assessment processes, seeking the consent of local Indigenous groups, the making of a final investment decision with respect to Mactung, interpretation of drill results, targets for exploration, potential extensions of mineralized zones, future work plans, and the potential of the Company’s projects, are forward looking statements. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “intends”, “estimates”, “potential”, “possible”, and similar expressions, or statements that events, conditions, or results “will”, “may”, “could”, or “should” occur or be achieved. Forward-looking statements are based on the beliefs of Company management, as well as assumptions made by and information currently available to Company management and reflect the beliefs, opinions, and projections on the date the statements are made. Forward-looking statements involve various risks and uncertainties and accordingly, readers are advised not to place undue reliance on forward-looking statements. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations include but are not limited to, exploration and development risks, unanticipated reclamation expenses, expenditure and financing requirements, general economic conditions, changes in financial markets, changes in the Company’s work programs, the ability to properly and efficiently staff the Company’s operations, the sufficiency of working capital and funding for continued operations, title matters, First Nations and local Indigenous group relations, operating hazards, political and economic factors, competitive factors, metal prices, relationships with vendors and strategic partners, governmental regulations and oversight, permitting, seasonality and weather, present and future infrastructure capacities, technological change, industry practices, uncertainties involved in the interpretation of drilling results and laboratory tests, and one-time events. The Company assumes no obligation to update forward‐looking statements or beliefs, opinions, projections or other factors, except as required by law.

Advertisement 8

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Footnotes and References

1 References to relative size, grade, and metal content of the Mactung resources and Macpass resources in comparison to other tungsten, zinc, gallium, and germanium deposits elsewhere in the world, respectively, are based on review of the Standard & Poor’s Global Market Intelligence Capital IQ database.

2 For Tom, Jason, End Zone, and Boundary Zone Mineral Resources, see the technical report filed on https://www.sedarplus.ca/ October 18, 2024, entitled “Technical Report for NI 43-101, Macpass Project, Yukon, Canada”. The effective date of the Mineral Resource is September 4, 2024. SLR Managing Principal Resource Geologist, Pierre Landry, P.Geo. (BC) is a ‘Qualified Person’ as defined under NI 43-101. Mr. Landry is considered to be “independent” of the Company for purposes of NI 43-101. Mr. Landry, of SLR, is responsible for the Macpass Mineral Resource Estimate.

3 For Mactung Mineral Resources, see Fireweed news release dated June 13, 2023 “Fireweed Metals Announces Mineral Resources for the Mactung Project: the Largest High-Grade Tungsten Deposit in the World” and the technical report entitled “NI 43-101 Technical Report, Mactung Project, Yukon Territory, Canada,” with effective date July 28, 2023 filed on https://www.sedarplus.ca/. Garth Kirkham, P.Geo. is considered independent of the Company, and a ‘Qualified Person’ as defined under NI 43-101. Garth Kirkham, of Kirkham Geosystems Limited., is responsible for the Mactung Mineral Resource Estimate.

Contact: Peter Hemstead

Phone: +1 (604) 689-7842

![]()

Email:

Article content

Share this article in your social network

Comments

Featured Local Savings

Written by GlobeNewswire on . Posted in Canada. Leave a Comment

The content in this section is supplied by GlobeNewswire for the purposes of distributing press releases on behalf of its clients. Postmedia has not reviewed the content.

Author of the article:

GlobeNewswire

Published Dec 13, 2024 • 3 minute read

TORONTO, Dec. 13, 2024 (GLOBE NEWSWIRE) — Troilus Gold Corp. (TSX: TLG; OTCQB: CHXMF) (“Troilus” or the “Company”) is pleased to report the results of its Annual General Meeting of Shareholders (the “Meeting”) held on December 12, 2024, in Toronto, Ontario.

Article content

Article content

In accordance with the policies of the Toronto Stock Exchange, all nominees listed in the Management Information Circular dated November 5, 2024, were elected as directors of the Company. Over 55% of the Company’s issued and outstanding shares were represented at the Meeting.

Advertisement 2

Story continues below

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content