Cathie Wood’s Pours Another $4.95 Million Into Solana Staking ETF, Dumps Bitcoin ETF Again

On Thursday, Cathie Wood-led Ark Invest made significant trades, most notably offloading ARK 21Shares Bitcoin ETF ARKB and pouring funds into the newly listed 3iQ Solana Staking ETF (SOLQ.U).

The ARK 21Shares Bitcoin ETF Trade

Ark Invest sold a significant number of shares in the ARK 21Shares Bitcoin ETF. The ARK Next Generation Internet ETF ARKW fund offloaded 39,575 shares, representing 0.25% of the ETF. Based on the last closing price of $84.71, the value of the trade stands at approximately $3.35 million.

This move comes amidst signs of a potential bear market in Bitcoin BTC/USD. According to data from Glassnode, Bitcoin investors are facing unprecedented pressure with the largest unrealized losses on record, concentrated among new market participants.

Even so, Bitcoin showed impressive strength this week, bouncing from $74K to $84K despite a broader U.S.-focused risk-off environment where even safe-haven assets like Treasuries and the dollar faltered. With stocks down and uncertainty high, Bitcoin’s 20% gain over six months highlights its growing appeal as an alternative asset. Over 24-hours, Bitcoin traded 0.9% higher at $84,951.

The 3iQ Solana Staking ETF Trade

Simultaneously, Ark Invest made a significant purchase of the 3iQ Solana Staking ETF (SOLQ.U). Ark Fintech Innovation ETF ARKF and ARK Next Generation Internet ETF ARKW funds collectively bought 475,000 shares. The transaction was valued at $4.95 million. SOLQ.U ended the day in Toronto at $10.43.

This move aligns with Ark’s recent interest in 3iQ Solana Staking ETF, as detailed in a Benzinga report. On Wednesday, Ark scooped up 500,000 shares of SOLQ.U worth $5.2 million.

The ETF started trading on the Toronto Stock Exchange on Wednesday, with major unitholders including SkyBridge Capital, founded and managed by Anthony Scaramucci. It focuses on long-term Solana SOL/USD holdings acquired through over-the-counter counterparties and aims to offer investors “attractive staking rewards,” according to a statement from 3iQ, which describes itself as the world’s first Digital Assets Managed Account Platform. Solana spiked 2.3% higher at $134.96 over 24 hours.

Other Key Trades:

- Ark Invest’s ARKF fund sold 4,184 shares of Intuit Inc. (INTU).

- The ARKG fund sold 1,040 shares of Repare Therapeutics Inc. (RPTX).

- ARKX bought 4,284 shares of AeroVironment Inc. (AVAV) and sold 18,832 shares of Kratos Defense and Security Solutions Inc. (KTOS).

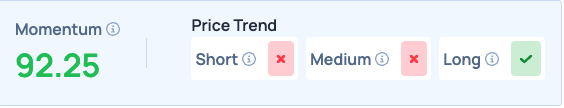

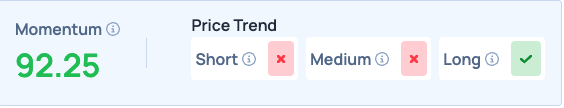

Benzinga Edge Stock Rankings indicate ARKB has Momentum in the 92nd percentile. How do other Bitcoin ETFs compare? Find out here.

Photo Courtesy: Ira Lichi on Shutterstock.com

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.