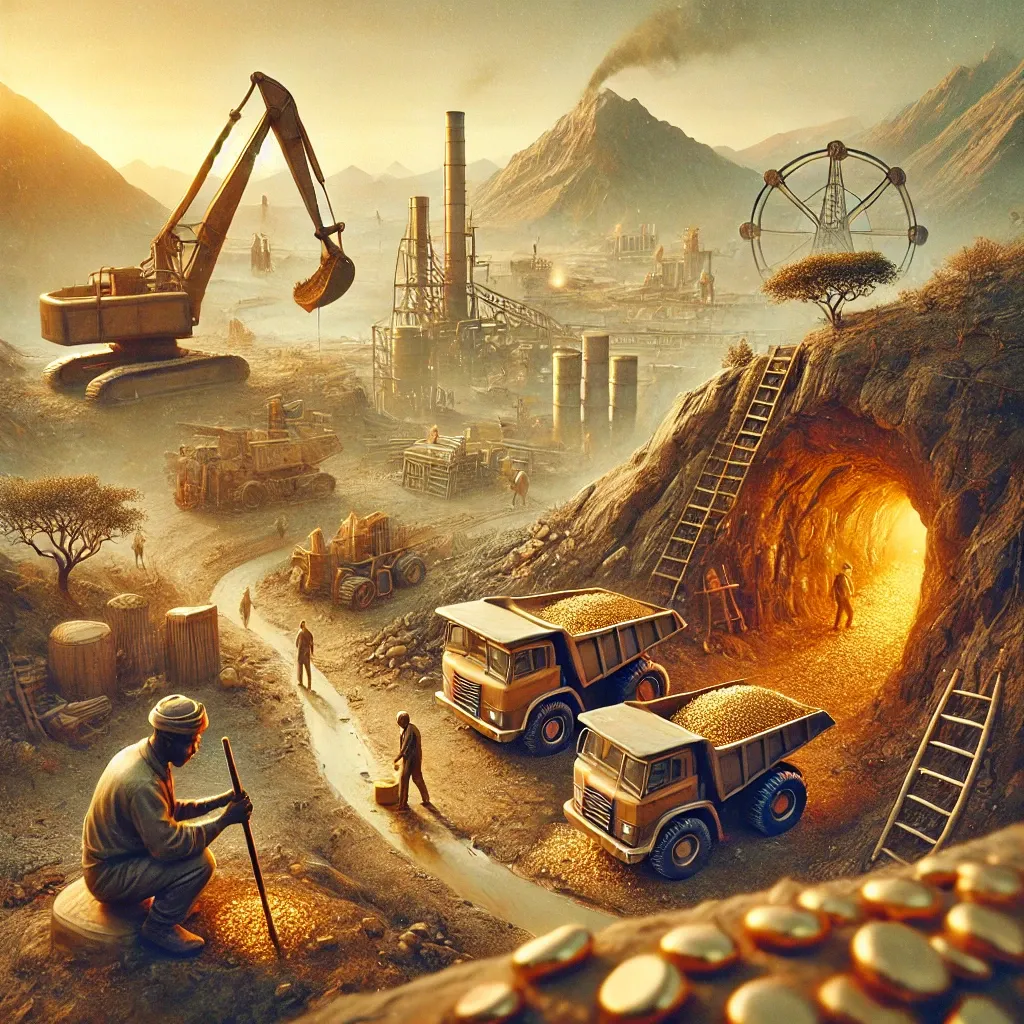

Pambili Natural Resources Secures Capital to Expand Zimbabwe Gold Projects

Pambili Natural Resources Corporation, a junior gold miner listed on the Toronto Stock Exchange (TSX), is poised to accelerate its exploration in Zimbabwe after securing a significant financial lifeline from its largest shareholder. The capital raise underscores mounting investor interest in Zimbabwe’s largely untapped gold reserves and positions Pambili at the forefront of a potential resurgence in the country’s mining sector.

Strategic Capital Raise to Support Expansion

Pambili announced it will raise C$500,000 (US$352,000) through a series of convertible loan notes, pending approval from the TSX Venture Exchange (TSX-V). The raise is anchored by Kavango Resources Plc, which has committed C$340,000 (US$239,000), further entrenching its role as Pambili’s cornerstone investor.

“The proceeds of the raise will provide Pambili with the working capital required to develop its Golden Valley A1 mining claim, as well as to conduct initial due diligence on the London Wall option,” said Jon Harris, Chief Executive Officer of Pambili. “We believe the London Wall mine has significant potential to be a company builder.”

The funds will be used to settle outstanding liabilities, sustain operations, and finance exploration across Pambili’s growing Zimbabwean asset base.

Related News

Spotlight on Zimbabwe’s Underexplored Gold Belts

The financing arrives at a pivotal time. Zimbabwe, long viewed as a high-risk mining jurisdiction, is experiencing a cautious reawakening as investors reassess its mineral potential. Pambili’s portfolio reflects a calculated bet on this opportunity.

Last year, the company entered a 12-month agreement with Long Strike Investments to acquire the London Wall group of 21 gold claims in Gwanda, Matabeleland South Province—an area traversed by three major gold-bearing geological structures. Among the claims are two previously producing mines: London Wall and New Jessie.

The acquisition is being marketed as transformational. If successful, it would significantly expand Pambili’s operating footprint, complementing its existing assets—the Golden Valley Mine and the Happy Valley Mine, both located near Bulawayo.

Deal Terms Reflect Junior Market Realities

The capital raise, structured as convertible loan notes, will be redeemed through the issuance of Units priced at C$0.05. Each Unit comprises one common share and one-half of a share purchase warrant. These warrants will entitle holders to buy additional shares at C$0.10 within 12 months.

Pambili will also issue finder’s fees of up to 7% in the form of shares and warrants—standard practice for small-cap resource companies where access to capital remains constrained.

All securities will be subject to a statutory hold period of four months and one day under Canadian law, reinforcing the speculative nature of the investment.

Backing from Kavango Signals Institutional Confidence

Kavango’s lead role in the raise is more than symbolic. It’s a signal to the market that institutional investors still see upside in Zimbabwe’s gold sector, despite the country’s longstanding policy and currency risks.

“Kavango is Pambili’s largest shareholder. Its participation in this raise demonstrates its continued support for our strategic approach to developing the vast modern mining and production potential on offer across Zimbabwe’s underexplored gold belts,” Harris noted.

The alignment is strategic: both companies share a focus on African resources and operate within similarly frontier jurisdictions.

A Calculated Bet on Zimbabwe’s Gold Revival

Pambili’s ambitions align with a broader shift underway in Zimbabwe’s mining industry. The government is pushing to formalize and attract foreign investment into artisanal and small-scale gold mining, which accounts for more than 60% of national output. This trend is opening the door to new entrants, provided they have the capital and risk appetite to operate in the country’s complex environment.

For Pambili, that means striking early while valuations are still depressed and regional consolidation is nascent.

“The potential here is substantial,” said a person familiar with the transaction. “But this is also about timing. Whoever establishes scale and operating credibility first could be very well-positioned.”

Pambili’s latest raise may seem modest in scale, but its implications are far-reaching. With Kavango doubling down and exploration set to begin at the London Wall group, the company is placing itself at the vanguard of Zimbabwe’s gold mining revival. The next 12 months will be critical—both for validating its asset base and for proving that small-cap resource plays can still unlock value in high-risk jurisdictions.

If the bet pays off, Pambili’s story could become a blueprint for navigating one of Africa’s most promising, yet precarious, gold frontiers.