Article content

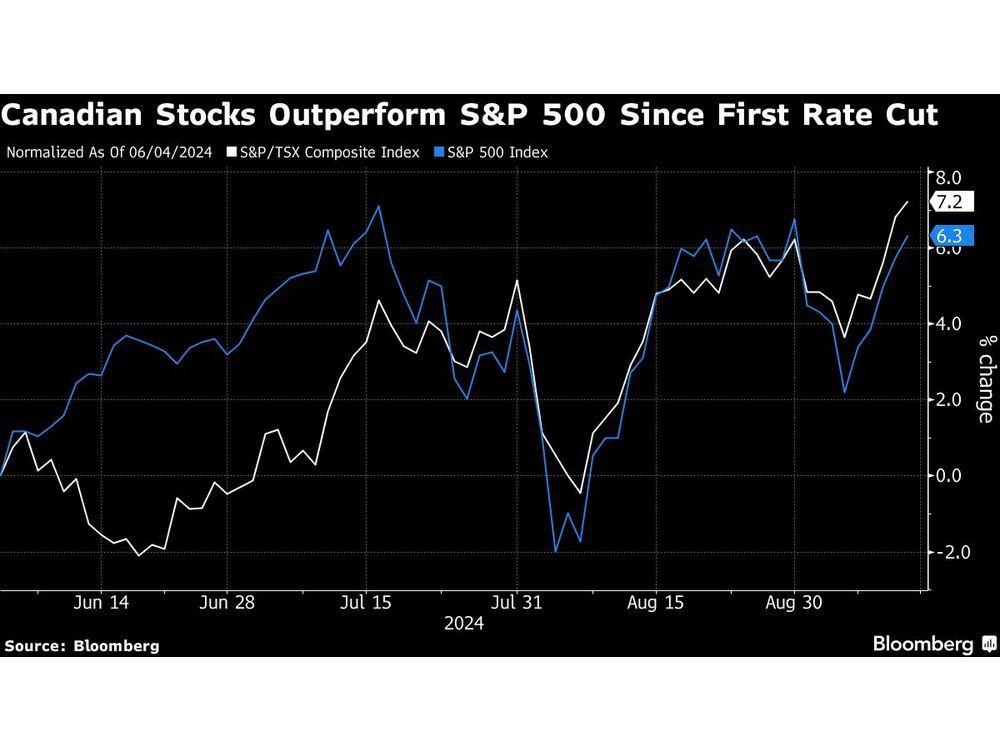

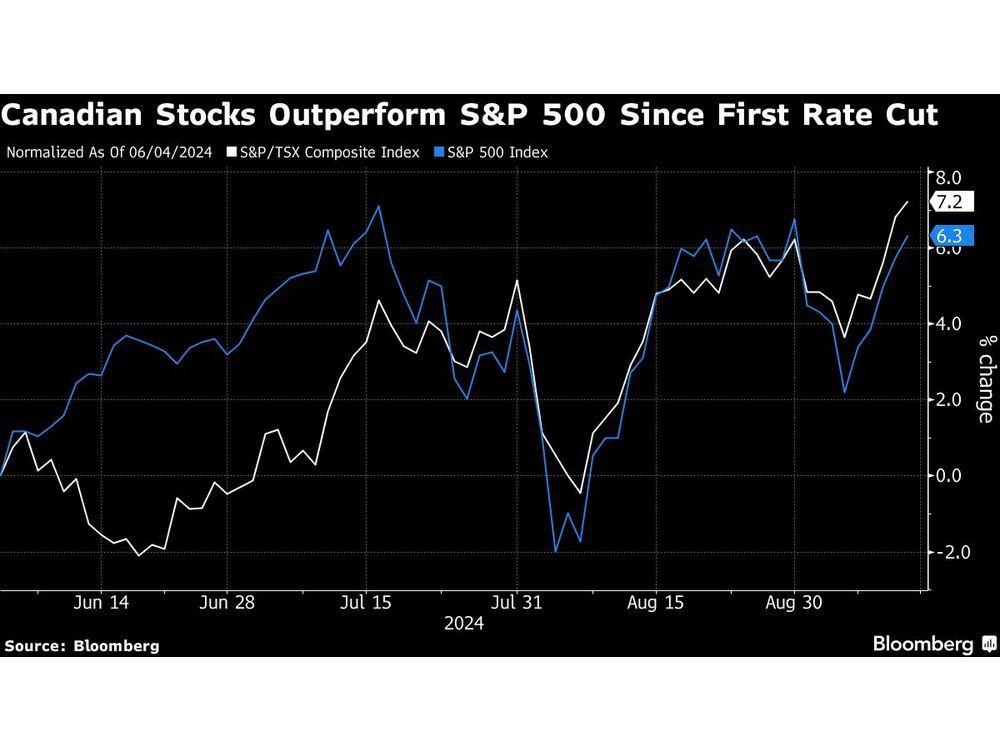

Canada’s main stock index has surged almost eight per cent since its central bank began cutting interest rates in June, outperforming the S&P 500. Some strategists say that’s an opportunity — they’re urging investors to sell down or even get out of Canadian stocks altogether.

The world’s 10th largest economy is flashing some warning signs. Unemployment is rising and private sector output is flagging. The Bank of Canada has lowered rates three times so far, and economists increasingly view economic growth as so weak that the central bank will have to start cutting faster.

Article content

“We’ve crossed the Rubicon and we’re in for a hard landing,” James Thorne, chief market strategist at Wellington Altus, said.

The unemployment rate is 6.6 per cent nationally and above seven per cent in Alberta and Ontario, two of the most economically important provinces. That “cannot be described as a soft landing,” Thorne said. “Get out of Canada. Don’t own in the TSX.”

Article content

Thorne has some company. “We do see and have seen a slowing of the Canadian economy,” said Philip Petursson, IGM Financial’s chief investment strategist.

The wealth management firm has an underweight in Canada and is encouraging investors in domestic equities to be selective, focusing on defensive names and rate-sensitive sectors such as real estate investment trusts. Indeed, real estate stocks are up 20 per cent since the first Bank of Canada rate cut, and financials have been on a tear too, gaining 12 per cent.

“Canada or the TSX could be more prone to greater downside risks” than the U.S., given the weakness of the Canadian consumer, Petursson said.

Economists at Canadian Imperial Bank of Commerce now expect the Bank of Canada to make a 25 basis-point cut in October and two 50 basis-point cuts in December and January in order to “stay out of a recession.” Citigroup economist Veronica Clark is forecasting a 50 basis point cut in October.

Article content

National Bank of Canada strategists led by Chief Economist Stefane Marion called rising unemployment levels “a red flag for equities,” saying that analysts are overly optimistic about earnings growth for Canadian companies. The bank recommends adding bonds and trimming equity exposure as it reinforces its defensive stance.

Rate cuts won’t fix the problem in the near term. “We believe equity investors are overly optimistic about the ability of central banks to quickly reignite economic growth and stabilize the labour market,” Marion wrote.

There are, to be sure, still some bulls. Brian Belski, chief investment strategist at BMO Capital Markets, wrote last week that he still sees the S&P/TSX Composite Index reaching 24,500 by year-end — about 3.5 per cent higher than its current level — thanks in part to lower rates.

Canadian stocks do have one powerful thing in their favour, and that’s the relative strength of the U.S. consumer.

“The old saying goes, ‘If America sneezes, Canada catches a cold,’” Craig Basinger, chief market strategist at Purpose Investments, said. “Well, if America remains healthy, that’s the equivalent to us getting a vaccine.” Even so, Basinger said Purpose is “a bit cautious” and underweight Canadian stocks given the recession concerns here.

Bloomberg.com

Share this article in your social network

Comments